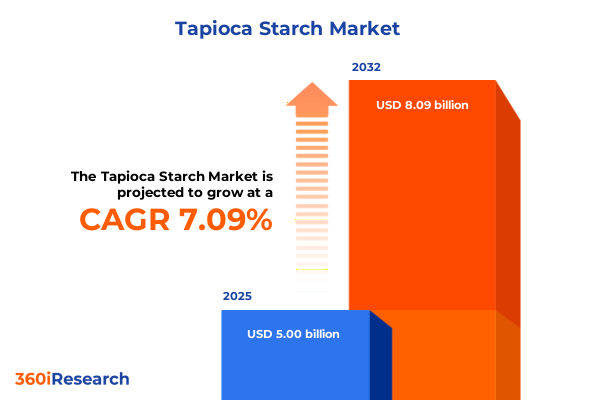

The Tapioca Starch Market size was estimated at USD 5.00 billion in 2025 and expected to reach USD 5.34 billion in 2026, at a CAGR of 7.09% to reach USD 8.09 billion by 2032.

Unveiling the Transformative Potential of Tapioca Starch Across Food, Pharmaceutical, and Industrial Sectors in a Rapidly Evolving Market Landscape

Tapioca starch, extracted from the tubers of the cassava plant, is a naturally gluten-free, flavor-neutral powder prized for its versatile functional properties in both culinary and industrial applications. Derived from Manihot esculenta, a hardy shrub native to Brazil’s tropical lowlands that now thrives in West Africa and Southeast Asia, tapioca starch has become a global ingredient staple used to thicken soups, stabilize sauces, and improve texture in gluten-free bakery products. Its unique capacity to create silky, elastic, or crispy textures has fostered widespread adoption across diverse sectors, from food and beverage to pharmaceutical and emerging packaging solutions.

The fine-grained powder provides exceptional binding, stabilizing, and gelling performance, making it indispensable for bubble tea pearls, dairy-alternative yogurts, and even biocompatible excipients in tablet manufacturing. Brazil, Thailand, and Nigeria stand as the world’s leading cassava producers, with Thailand alone accounting for roughly 60% of global exports. As major production hubs, these regions ensure a steady supply of high-quality cassava, while investments in mechanized processing have driven both yields and consistency.

Recent consumer preferences for gluten-free, plant-based, and clean-label products have accelerated demand for tapioca starch as a natural alternative to wheat and corn derivatives. Manufacturers are reformulating sauces, dressings, and baked goods to eliminate gums and synthetic thickeners, opting instead for minimally processed tapioca starch that aligns with transparent ingredient lists. Consequently, tapioca starch has solidified its status as a cornerstone ingredient in health-oriented and sustainability-focused formulations, setting the stage for its continued market expansion.

Examining the Radical Transformations Redefining the Global Tapioca Starch Landscape from Supply Chains to Consumer Preferences

The landscape of the tapioca starch industry has shifted dramatically as supply chains adapt to new sustainability mandates and consumer demands for clean-label ingredients. Energy-efficient extraction technologies now replace traditional wet-milling methods, reducing water usage and carbon footprints while preserving starch functionality. Producers are investing in continuous processing systems that enhance throughput and consistency, enabling tailor-made grades for high-value applications such as plant-based meat extenders and biodegradable packaging films.

Parallel to technological advances, formulation innovation is reshaping end-use opportunities. The surge in plant-based diets has catalyzed tapioca’s role in meat and dairy substitutes, where its neutral flavor and elastic texture deliver sensory characteristics akin to animal-derived proteins. Clean-label initiatives have also prompted manufacturers to replace modified corn and potato starches with native tapioca starch, leveraging its innate allergen-free profile and consumer appeal as a minimally processed ingredient.

Additionally, emerging markets are driving regional shifts in consumption patterns. In Latin America and Southeast Asia, rapid urbanization has spurred demand for convenient, ready-to-eat foods that rely on tapioca’s thickening and stabilizing properties. At the same time, stringent environmental regulations in Europe have encouraged starch producers to adopt circular-economy principles, integrating cassava peel valorization into their processes to minimize waste and generate co-products such as animal feed or bioenergy.

Assessing the Cumulative Outcomes of 2025 United States Tariff Measures on the Global Tapioca Starch Supply Chain and Trade Dynamics

In April 2025, the United States introduced a universal minimum tariff of 10% on all imported goods, including food ingredients, effective April 5, 2025. These levies are designed to stack on top of existing duties, resulting in combined rates of up to 54% on imports from countries with prior tariffs, such as China. Concurrently, “reciprocal” tariffs ranging from 10% to 49% have been imposed on more than 50 nations with which the U.S. holds significant trade imbalances.

Despite these sweeping measures, cassava and cassava-derived products have so far maintained a 0% tariff rate. Thailand, which exports approximately 100,000 tonnes of cassava products valued near US$60 million annually to the United States, has reported no immediate disruption to its export volumes. Nevertheless, downstream industries that rely on tapioca starch-such as bubble tea retailers-are monitoring potential cost increases. Smaller boba outlets have begun stockpiling inventory to hedge against price pressures, though many plan to absorb marginal cost hikes in the near term to preserve consumer loyalty.

The new tariff framework also faces legal challenges. On May 28, 2025, the United States Court of International Trade in V.O.S. Selections, Inc. v. United States ruled that broad tariff orders issued under the International Emergency Economic Powers Act exceeded constitutional authority, enjoining further enforcement. The appellate process remains ongoing, introducing potential volatility into trade policies that will directly affect the global tapioca starch supply chain and import costs.

Decoding Key Market Segmentation Insights Revealing Product Types, Forms, Applications, End Users, and Distribution Channel Dynamics

The global analysis of the tapioca starch market examines the interplay between product type and processing preferences, detailing how dried and fresh forms meet different operational demands. Dried tapioca starch offers stability and extended shelf life, catering to large-scale food processors seeking predictable consistency, while fresh starch appeals to artisanal and small-batch producers who prioritize natural attributes and boutique branding.

Within the form segment, distinctions surface based on particle size and functionality. Fine powders deliver immediate solubility for sauces and desserts, whereas flakes and granules are engineered for controlled hydration in bakery applications. Pearls and pellets provide textural imaging in bubble tea and confections, and liquid syrups enable rapid incorporation in beverage systems and pharmaceutical suspensions.

Application insights reveal that binding agents harness tapioca’s cohesive properties, ensuring uniform texture in meat analogues and confectionery. As a stabilizing agent, it maintains emulsion integrity in dressings and dairy alternatives, and its thickening capacity enhances viscosity in processed foods and personal care formulations. End-user segmentation highlights how industries as varied as construction rely on starch-based adhesives, cosmetics lean on hypoallergenic thickeners, food and beverage companies drive volume demand, and mining, pharmaceutical, and textile sectors utilize its functional versatility. Distribution dynamics span traditional supermarkets and specialty stores to burgeoning online platforms, reflecting the ingredient’s dual role as both an industrial staple and a consumer pantry item.

This comprehensive research report categorizes the Tapioca Starch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End User

- Distribution Channels

Unraveling Regional Market Dynamics within the Americas, Europe Middle East & Africa, and Asia-Pacific Shaping Tapioca Starch Demand

In the Americas, the North American market is fueled by shifting consumer diets, particularly the embrace of gluten-free and plant-based lifestyles. Certified clean-label ingredients reign supreme on retail shelves, prompting food manufacturers to integrate tapioca starch across bakery, snack, and ready-meal categories. Bubble tea’s continued expansion has also cemented tapioca pearls as a mainstream retail item beyond niche cafes, reinforcing volume consumption in the United States and Canada.

Europe, Middle East & Africa markets are characterized by stringent regulatory frameworks emphasizing natural ingredients and environmental stewardship. European producers and brands are capitalizing on tapioca starch’s clean-label credentials to replace synthetic thickeners in sauces and confectionery, while sustainable sourcing practices align with the region’s circular-economy mandates. In markets like Germany and France, research grants and subsidy programs support cassava-derived starches for use in bioplastics and pharmaceutical excipients, diversifying demand beyond food.

Across Asia-Pacific, the region remains the linchpin for raw material supply and traditional consumption. Thailand and Vietnam, commanding the majority of global exports, continue to invest in upgraded processing facilities to boost extraction yields and purity. Government initiatives, such as trade missions and international conferences, are broadening market access in the Middle East, South Korea, and New Zealand. Simultaneously, domestic demand in China and Southeast Asia for ready-to-eat confections and bubble tea creates a robust local market, ensuring that Asia-Pacific serves as both a production powerhouse and a dynamic consumption frontier.

This comprehensive research report examines key regions that drive the evolution of the Tapioca Starch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Shaping the Global Tapioca Starch Industry through Innovation, Strategic Partnerships, and Sustainable Sourcing

Global corporate strategies in the tapioca starch sector are typified by product innovation and value-chain integration. Ingredion Incorporated, with a 14–18% share of the specialty starch market, recently launched an organic tapioca starch tailored for high-premium clean-label applications, signaling its intent to lead in non-GMO ingredient solutions. This move complements its broader portfolio of sweeteners and plant-based texturizers, reinforcing its commitment to meeting complex formulation needs.

Cargill, commanding 12–16% of the tapioca derivatives segment, has expanded its texturizing solutions for the dairy and bakery segments, focusing on sustainability through traceable sourcing from smallholder farms in Thailand and Indonesia. By leveraging robust R&D capabilities, the company has developed proprietary processes that enhance starch functionality for plant-based meat alternatives and biodegradable packaging films.

Specialty players like Emsland Group have introduced sustainable tapioca starch ranges engineered specifically for plant-based protein and gluten-free markets, positioning themselves at the intersection of health trends and environmental priorities. Meanwhile, TATE & LYLE PLC distinguishes itself with advanced clean-label modification technologies, enabling a portfolio that addresses both food-grade and industrial starch requirements across global distribution networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tapioca Starch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Andritz AG

- Archer Daniels Midland Company

- Bangkok Starch Industrial Co., Ltd.

- Banpong Tapioca Flour Industrial Co., Ltd.

- C.P. Intertrade Co., Ltd.

- Cargill, Inc.

- Chol Charoen Group Company Limited

- Ettlinger Corporation

- FOCOCEV Vietnam Joint Stock Company

- Fuji Nihon Corporation

- General Starch Limited

- Grain Processing Corporation

- Ingredion Incorporated

- Meelunie B.V.

- Neo Nam Viet Co., Ltd.

- PT Budi Starch & Sweetener Tbk

- ROI ET Group

- Roquette Frères

- Royal Avebe U.A.

- Sanguan Wongse Industries Co., Ltd.

- SCG International Corporation

- SMS Corporation Co., Ltd.

- Tate & Lyle PLC

- Thai Flour Industry Co., Ltd.

- Thai Wah Public Company Limited

- Ubon Sunflower Co., Ltd.

- Vedan International (Holdings) Limited

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in the Tapioca Starch Sector

Industry leaders should prioritize investment in modular processing technologies that enable rapid scaling and customization of starch grades to meet diverse customer requirements, from food-grade clarity to pharmaceutical purity. Strengthening upstream partnerships with cassava farmers through contract farming or cooperatives can secure raw material quality and foster sustainable agricultural practices that resonate with corporate social responsibility goals.

Navigating evolving trade policies requires proactive engagement with regulatory stakeholders, ensuring that tariff risks are hedged through diversified sourcing and alternative regional supply hubs. Additionally, companies can unlock new revenue streams by developing high-margin specialty derivatives-such as resistant starches and modified grades tailored for functional food and medical nutrition segments-leveraging innovation pipelines to differentiate offerings.

Embracing digital traceability platforms will enhance transparency across the value chain, from farm to end user, building consumer trust and supporting compliance with stringent global food safety and sustainability standards. Lastly, targeted market education campaigns that highlight tapioca starch’s functional and clean-label advantages can further accelerate adoption in emerging applications like biodegradable films and green packaging solutions.

Comprehensive Research Methodology Underpinning the Analysis of the Tapioca Starch Market’s Insights, Trends, and Data Collection Approach

This analysis integrates insights from comprehensive primary and secondary research. Primary data collection included structured interviews with industry executives, cassava farmers, and formulation specialists, providing firsthand perspectives on supply chain dynamics and emerging application requirements. Secondary research drew on credible trade publications, academic journals, and regulatory databases to triangulate market drivers, technological advances, and tariff developments.

Quantitative assessments leveraged import-export statistics from customs agencies and production volume data reported by leading cassava-producing nations. Qualitative evaluation encompassed case studies of strategic partnerships, technology adoption trends, and policy impacts. Data validation employed cross-verification across multiple sources to ensure consistency and reliability.

Analytical frameworks applied include Porter’s Five Forces for competitive dynamics, SWOT analysis for company positioning, and PESTEL review for macro-environmental influences. Segmentation analyses were developed based on market structure, product forms, application categories, end-user industries, and distribution channels, offering a nuanced perspective on demand drivers and growth opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tapioca Starch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tapioca Starch Market, by Type

- Tapioca Starch Market, by Form

- Tapioca Starch Market, by Application

- Tapioca Starch Market, by End User

- Tapioca Starch Market, by Distribution Channels

- Tapioca Starch Market, by Region

- Tapioca Starch Market, by Group

- Tapioca Starch Market, by Country

- United States Tapioca Starch Market

- China Tapioca Starch Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Reflections on the Future Trajectory of the Tapioca Starch Market Driven by Innovation, Sustainability, and Evolving Consumer Demand

The global tapioca starch industry stands at the cusp of transformative growth, driven by health-forward consumer preferences, technological enhancements in processing, and the pursuit of sustainable practices. As clean-label and gluten-free demands intersect with burgeoning plant-based trends, tapioca starch’s versatility positions it as a foundational ingredient across food, pharmaceutical, and industrial sectors.

Trade policy shifts and potential tariff volatility underscore the importance of resilient supply-chain strategies and proactive regulatory engagement. Concurrently, innovation in specialty starches and derivative applications promises to expand revenue avenues, from resistant starches for functional foods to starch-based biopolymers for eco-friendly packaging.

Regional markets each contribute unique dynamics: the Americas drive volume through retail and foodservice innovations; EMEA prioritizes regulatory compliance and sustainability; and Asia-Pacific anchors global production while fostering traditional and modern consumption. Collectively, these forces chart a trajectory of continued diversification, with tapioca starch at the forefront of ingredient innovation and sustainable growth.

Take the Next Step with Associate Director Ketan Rohom to Secure Your Comprehensive Tapioca Starch Market Research Report for Strategic Advantage

Don’t miss the opportunity to deepen your market intelligence and stay ahead of emerging trends in the rapidly evolving tapioca starch industry. Reach out today to Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive market research report and empower your strategic decision-making with detailed insights and expert analysis

- How big is the Tapioca Starch Market?

- What is the Tapioca Starch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?