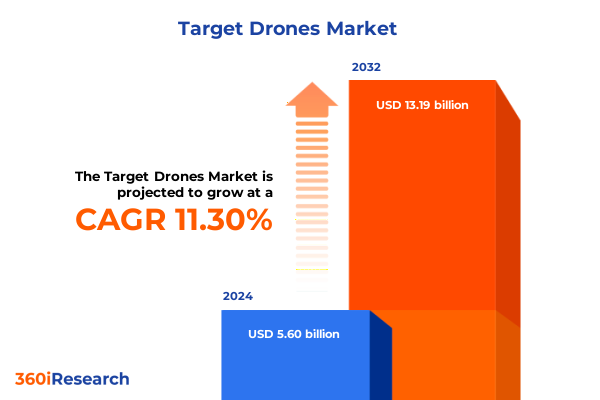

The Target Drones Market size was estimated at USD 6.18 billion in 2025 and expected to reach USD 6.82 billion in 2026, at a CAGR of 11.44% to reach USD 13.19 billion by 2032.

Exploring the Evolution and Strategic Significance of Target Drones in a Dynamic Landscape Highlighting Opportunities and Challenges for Enterprise and Defense

The landscape of target drones has undergone a profound transformation, evolving from niche tactical tools into versatile platforms that underpin a wide array of commercial and defense applications. This accelerating evolution is driven not only by leaps in aerodynamic design but also by the convergence of advanced propulsion systems, miniaturized sensors, and secure connectivity protocols. As organizations across the globe seek to leverage unmanned systems for missions ranging from reconnaissance and target practice to precision delivery, the importance of understanding these shifts in technology and market dynamics has never been more critical.

Moreover, the integration of artificial intelligence and machine learning algorithms has propelled target drones beyond simple remote-controlled aircraft to semi-autonomous and fully autonomous agents capable of real-time decision-making. These enhancements in onboard computing, image processing, and obstacle avoidance dramatically expand operational envelopes, enabling complex missions in congested or contested environments. At the same time, robust communication links powered by 5G, satellite constellations, and encrypted mesh networks ensure secure control and data transmission under challenging conditions.

Parallel to technological innovation, regulatory frameworks have evolved to accommodate emerging use cases. International aviation authorities and national regulators have introduced remote identification requirements, beyond-visual-line-of-sight waivers, and safety standards that pave the way for broader adoption while maintaining airspace integrity. This regulatory maturation has fostered collaboration among stakeholders-including government agencies, technology providers, and end users-to build interoperable solutions that balance innovation with safety and security considerations.

Taken together, these developments set the stage for a comprehensive exploration of the target drone market, encompassing transformative shifts in technology, the impact of trade policies, segmentation nuances, regional dynamics, competitive landscapes, and actionable strategies for industry leaders. Each subsequent section delves deeper into these critical dimensions, providing a roadmap for stakeholders to navigate a rapidly evolving ecosystem.

Advancements in Autonomy AI and Hybrid Propulsion Are Redefining Target Drone Capabilities and Operational Paradigms Across Industries

In recent years, the landscape of target drones has been reshaped by groundbreaking advancements in autonomy and artificial intelligence. Onboard processors empowered by machine learning enable drones to navigate complex environments without continuous human intervention, adapting to dynamic obstacles and mission parameters in real time. These AI-driven capabilities have ushered in beyond-visual-line-of-sight operations that were once considered futuristic, allowing for extended-range missions with minimal ground station oversight. Remote operations are further enhanced by the rollout of 5G networks and satellite-backed communication platforms, providing low-latency, high-bandwidth control channels that support high-definition video feeds and swarming coordination.

Simultaneously, hybrid propulsion systems have emerged as a bridge between the endurance of fixed-wing platforms and the vertical takeoff and landing flexibility of multirotor designs. These hybrid VTOL configurations combine efficient winged flight for long-range transit with powered lift for precise deployment in confined areas. This dual-mode architecture extends mission versatility, catering to applications as diverse as precision munitions training and remote payload delivery in humanitarian operations. Additionally, improvements in battery chemistry and lightweight composite materials have bolstered endurance and payload capacity, enabling drones to stay aloft longer while carrying more sophisticated sensor suites.

Moreover, the proliferation of unmanned traffic management (UTM) solutions has become essential to integrate drones safely into shared airspace. Collaborative platforms between air navigation service providers and drone operators facilitate automated flight approvals, real-time airspace deconfliction, and secure data exchange. As these systems mature, they will serve as the backbone for large-scale operations such as commercial package delivery and coordinated defense exercises.

Altogether, these technological and operational shifts are redefining the performance benchmarks and mission profiles of target drones. The convergence of AI autonomy, hybrid propulsion, enhanced connectivity, and airspace management solutions establishes a new paradigm for unmanned systems, unlocking unprecedented capabilities across civilian and defense domains.

Assessing the 170% Cumulative Tariff Burden on Chinese-Made Drones and Its Far-Reaching Impact on Supply Chains R&D and Pricing

The cumulative impact of United States tariffs on Chinese-made drones has reached unprecedented levels, profoundly affecting the economics of drone procurement and development. Building upon an initial tariff introduction under Section 301 of the Trade Act, successive policy actions in early 2025 added incremental duties, culminating in a total tariff burden of 170%. This steep levy applies to both finished UAV platforms and critical subsystems, compelling importers to reassess their sourcing strategies and cost structures.

Beyond direct pricing effects, the tariff regime has triggered volatility throughout the drone component supply chain. Original equipment manufacturers and defense primes have faced delayed deliveries of lithium-ion batteries, electronic speed controllers, and high-precision optics-components historically sourced from China. With import costs more than doubling, procurement teams have been forced to identify alternative suppliers in Southeast Asia, North America, and Europe, often at the expense of unit economics and project timelines.

In addition, research and development budgets have been partially diverted from innovation to compliance and procurement of domestically certified parts. The requirement to meet “Buy American” guidelines under national security frameworks has necessitated audits, origin traceability, and supplier qualification processes that further strain R&D cycles. As a result, some drone manufacturers have postponed or restructured advanced projects in autonomy and sensor fusion to accommodate new sourcing mandates.

These layered effects illustrate how cumulative tariffs can reshape industry dynamics, influencing not only price points but also supply chain resilience, innovation trajectories, and cross-border partnerships. Industry participants must now navigate a more complex trade environment as they strive to maintain competitiveness and technological leadership.

Unveiling Precise Market Segmentation Reveals How Drone Types Applications and End Use Scenarios Drive Diverse Industry Requirements and Innovations

A nuanced understanding of market segmentation illuminates the diverse requirements and growth drivers within the target drone ecosystem. When considering the array of fixed-wing, hybrid VTOL, multirotor, and single-rotor platforms, it becomes clear that each configuration serves distinct mission profiles. Conventional fixed-wing variants deliver endurance and speed for wide-area reconnaissance, while high-altitude long-endurance platforms excel in persistent surveillance. In contrast, multirotor solutions-including quadcopters, hexacopters, and octocopters-offer vertical takeoff and pinpoint maneuverability that are ideal for infrastructure inspection and close-quarters targeting scenarios. Single-rotor systems, with their helicopter-like lift, occupy a specialized niche where heavy payloads and extended loiter times are required.

Equally important is the classification of operational use cases, which encompass aerial photography and videography for cinematic and industrial inspections, agriculture monitoring to optimize crop health, delivery services streamlining logistics, mapping and surveying that generate high-fidelity terrain models, as well as surveillance and security missions that demand real-time situational awareness. These applications each impose unique payload, endurance, and regulatory compliance considerations, driving platform design and service offerings.

Finally, end-use segmentation spans commercial, consumer, and defense sectors. Commercial operators prioritize reliability, maintainability, and integration with enterprise resource planning systems, whereas consumer users seek ease of use, portability, and multimedia capabilities. Defense users, by contrast, place the highest emphasis on ruggedization, secure communications, and rapid deployment in contested environments. Recognizing these differentiated needs allows technology providers and service integrators to tailor their solutions effectively and capture emerging opportunities across each segment.

This comprehensive research report categorizes the Target Drones market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End Use

Examining Regional Dynamics of Drone Adoption Across the Americas EMEA and Asia-Pacific to Illuminate Market Drivers and Strategic Growth Pathways

Regional dynamics play a pivotal role in shaping the trajectory of target drone adoption. In the Americas, progressive policy initiatives and significant investment in unmanned systems have established a robust ecosystem that spans North America’s regulated airspace to emerging markets in Latin America. Collaboration between federal aviation authorities and private stakeholders has yielded streamlined pathways for beyond-visual-line-of-sight operations, setting the stage for commercial delivery networks and public safety deployments.

In Europe, the Middle East, and Africa, regulatory harmonization efforts under regional aviation agencies have facilitated the cross-border interoperability of drone services. The European Union’s unified U-space framework, for instance, promotes secure airspace integration, while several Gulf Cooperation Council countries are investing in drone corridors for infrastructure inspection and logistics. Concurrently, African nations are exploring drone applications for healthcare delivery and environmental monitoring, leveraging partnerships with global NGOs and public-private consortia.

Across the Asia-Pacific region, government-led technology initiatives and favorable manufacturing ecosystems underscore a rapid pace of innovation. Countries such as Japan and South Korea are piloting advanced UTM systems and integrating drones into smart city projects. Meanwhile, Southeast Asian nations are emerging as manufacturing hubs for cost-sensitive components, offering an alternative to traditional supply chains. These regional distinctions highlight the importance of tailoring market strategies to local regulatory, technological, and economic conditions.

Together, the Americas, EMEA, and Asia-Pacific regions form a mosaic of regulatory environments and investment climates that drive differentiated adoption curves. Understanding these regional characteristics is essential for stakeholders aiming to deploy scalable drone solutions and optimize their global footprint.

This comprehensive research report examines key regions that drive the evolution of the Target Drones market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Drone Manufacturers from Consumer Titans to Specialized Innovators Who Shape Competitive Landscapes and Technological Advancement

The competitive landscape of target drones spans dominant incumbents, agile innovators, and specialized service providers. Leading consumer-oriented manufacturers retain their preeminence through extensive product portfolios and global distribution networks. By contrast, domestic challengers leverage advanced autonomy and security certifications to capture enterprise and government contracts, particularly in markets with stringent “Buy American” or data sovereignty requirements.

Among the pioneers of AI-driven autonomy, select companies have achieved notable milestones. One firm’s origin story as a spin-off from a prominent technology institute highlights how computer vision breakthroughs can translate into self-navigating multirotor platforms. Its adoption by U.S. federal agencies for reconnaissance missions underscores the strategic value of homegrown solutions and secure flight control architectures.

Meanwhile, providers specializing in medical and logistical delivery have demonstrated the operational feasibility of drone networks in densely populated areas. Partnerships with major retail and healthcare organizations have expanded these delivery corridors, showcasing rapid order fulfillment times and high reliability under real-world conditions.

On the defense front, established aerospace contractors continue to supply advanced unmanned systems equipped with long-endurance capabilities, multi-sensor payloads, and hardened communications. These solutions often integrate seamlessly with existing command-and-control frameworks, offering certified performance in contested or GPS-denied environments. Collectively, these diverse market leaders drive innovation by setting performance benchmarks and shaping ecosystem collaboration models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Target Drones market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroTargets International LLC

- Air Affairs Australia Pty Ltd

- Airbus S.A.S.

- Aitech Systems, Inc.

- BAE Systems plc

- BQM Systems, Inc.

- Composite Engineering, Inc.

- Denel SOC Ltd

- Griffon Aerospace, Inc.

- Hindustan Aeronautics Limited

- Kadet Defence Systems Pty Ltd

- Kratos Defense & Security Solutions, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MBDA Systems

- Northrop Grumman Corporation

- QinetiQ Group plc

- QinetiQ Target Systems Limited

- Rheinmetall AG

- Saab AB

- Systems de Control Remoto (SCR) S.A.

- Thales Group

- The Boeing Company

- Turkish Aerospace Industries, Inc.

Strategic Recommendations to Navigate Regulatory Complexities Embrace Technological Innovation and Optimize Supply Chains for Sustainable Drone Market Leadership

Industry leaders must adopt a multifaceted strategy to thrive in the evolving target drone market. First, cultivating resilient supply chains through diversified sourcing and strategic partnerships can mitigate the impact of trade uncertainties and component shortages. By prequalifying alternative suppliers across multiple regions, organizations can ensure continuity in production and accelerate time-to-market for new platforms.

Concurrently, investing in modular design architectures enables rapid integration of emerging technologies such as AI-based perception modules and compact electronic warfare systems. This approach reduces development cycles and fosters a plug-and-play ecosystem that accommodates evolving mission requirements. It also supports incremental upgrades in the field, preserving the longevity of deployed assets.

Engagement with regulatory bodies and standardization forums is equally vital. Proactive collaboration on policy development ensures that industry perspectives inform the creation of realistic guidelines for autonomy, security, and airspace integration. Early participation in pilot programs for unmanned traffic management and remote identification can yield valuable operational insights and accelerate certification pathways.

Lastly, fostering talent development through specialized training initiatives and cross-disciplinary partnerships enhances organizational agility. Empowered teams with expertise in avionics, data analytics, and cybersecurity can more effectively address emerging operational challenges, delivering safe and reliable drone services at scale.

Comprehensive Methodology Combining Primary Insights Secondary Data Verification and Advanced Analytics to Deliver Rigorous and Transparent Drone Market Research

This research integrates primary interviews with industry executives and defense procurement officers alongside a comprehensive review of peer-reviewed publications, government whitepapers, and patent filings. Qualitative insights obtained from frontline operators and service integrators provide real-world validation of emerging technologies and operational requirements. Secondary research sources include regulatory documentation, trade association reports, and academic journals that offer rigorous analysis of technological trends and policy developments.

Advanced analytics techniques, such as sentiment analysis of public filings and clustering of patent citation networks, underscore the evolving innovation landscape. Cross-referencing this intelligence with supply chain datasets and trade flow records reveals patterns of component sourcing and potential disruption nodes. A structured framework was applied to evaluate competitive positioning based on factors such as autonomy capability, payload flexibility, and integration maturity.

Data integrity is ensured through triangulation across multiple sources and iterative validation with subject matter experts. All findings are presented with transparency regarding data provenance and methodological assumptions, enabling stakeholders to trace conclusions back to original evidence. This rigorous approach underpins the credibility of the insights and supports informed decision-making in a rapidly evolving market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Target Drones market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Target Drones Market, by Type

- Target Drones Market, by Application

- Target Drones Market, by End Use

- Target Drones Market, by Region

- Target Drones Market, by Group

- Target Drones Market, by Country

- United States Target Drones Market

- China Target Drones Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Key Insights and Future Outlook to Empower Stakeholders with Clarity on the Transformative Trajectory of the Drone Industry

As target drone technologies continue to mature, the interplay of autonomy, regulatory evolution, and supply chain resilience will define the competitive arena. Stakeholders who embrace modular architectures and collaborative policy engagement are positioned to capitalize on new mission opportunities, from precision defense training to urban logistics.

Simultaneously, regional variations in airspace regulation and manufacturing capabilities necessitate tailored market entry strategies. Organizations that harmonize global best practices with local adaptation will cultivate robust operational frameworks and sustainable growth trajectories.

Ultimately, the ability to anticipate policy shifts, integrate emergent technologies, and build agile supply networks will differentiate market leaders from followers. By synthesizing insights across technological, commercial, and regulatory dimensions, industry participants can chart a course toward sustained innovation and strategic advantage in the dynamic target drone ecosystem.

Connect with Ketan Rohom to Secure Comprehensive Drone Market Insights and Elevate Strategic Decision-Making with a Detailed Research Report

Take the next strategic step to gain an unparalleled edge in your decision-making by securing the comprehensive drone market research report. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to tailor a solution that aligns with your organization’s unique needs and unlocks actionable insights that drive growth and innovation

- How big is the Target Drones Market?

- What is the Target Drones Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?