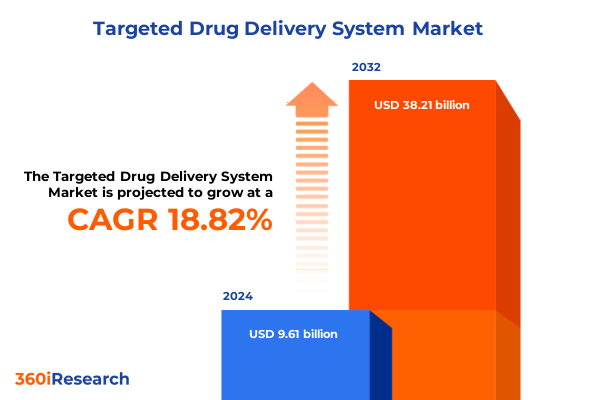

The Targeted Drug Delivery System Market size was estimated at USD 13.04 billion in 2025 and expected to reach USD 13.92 billion in 2026, at a CAGR of 7.26% to reach USD 21.32 billion by 2032.

Revolutionary Advances in Targeted Drug Delivery Are Redefining Therapeutic Precision and Patient Outcomes Across Complex Disease Landscapes

Targeted drug delivery systems represent a paradigm shift in the way therapies are designed, developed, and deployed to treat complex diseases. By focusing on the precise localization of active pharmaceutical ingredients, these systems enhance therapeutic efficacy while minimizing off-target effects and systemic toxicity. Innovations such as ligand-targeted nanoparticles, antibody-drug conjugates, and smart polymeric carriers have paved the way for a more personalized approach to treatment, thereby improving patient outcomes and quality of life in conditions ranging from autoimmune disorders to cancer.

Building on decades of foundational research, the current landscape integrates cutting-edge biomaterials, molecular targeting strategies, and advanced manufacturing techniques. This intersection of disciplines underscores the importance of multidisciplinary collaboration among pharmaceutical scientists, bioengineers, clinicians, and regulatory bodies. As the industry continues to embrace precision medicine principles, targeted delivery platforms are poised to become the cornerstone of next-generation therapeutics, reshaping treatment paradigms and unlocking new possibilities for disease management.

Emerging Paradigms in Precision Medicine and Nanotechnology That Are Transforming the Targeted Drug Delivery Ecosystem Globally

The targeted drug delivery ecosystem has experienced transformative shifts driven by breakthroughs in nanotechnology, engineering, and molecular biology. Nanocarriers engineered at the molecular level now exploit unique physicochemical properties to achieve controlled release, enhanced permeability, and active targeting to disease sites. Concurrently, the rise of personalized medicine has catalyzed the development of diagnostic biomarkers that guide the selection of optimal delivery vehicles and payloads for individual patients.

In parallel with technological strides, regulatory frameworks are evolving to accommodate novel delivery modalities. Agencies have introduced adaptive pathways and streamlined review processes that facilitate accelerated clinical evaluation while maintaining rigorous safety standards. This regulatory agility has invited a surge of early-stage investment and collaboration, enabling small-scale innovators to partner with established biopharma companies to co-develop sophisticated formulations.

Furthermore, digital health integration-including real-time monitoring and data analytics-enhances the precision and adaptability of targeted therapies. Wearable sensors and telemedicine platforms can now track patient responses and pharmacokinetic profiles, allowing for dynamic dose adjustments and improved adherence. Together, these paradigm shifts are forging an ecosystem where scientific ingenuity, regulatory insight, and digital tools converge to redefine the future of targeted drug delivery.

Navigating the Complexities of New United States 2025 Tariff Structures Impacting Advanced Targeted Drug Delivery Supply Chains and Costs

The implementation of revised tariff structures by the United States in 2025 has introduced significant variables into the supply chains of specialized drug delivery components and raw materials. Tariffs on imported active pharmaceutical ingredients and key raw polymers have altered cost dynamics, prompting manufacturers to reassess sourcing strategies. As a result, some biopharma innovators are reshoring critical production steps or seeking alternative suppliers in tariff-free zones to mitigate cost volatility.

These trade policy adjustments have also impacted the logistics of advanced carriers such as antibody-drug conjugate linkers and lipid nanoparticles. Increased duties on certain chemical precursors and lab consumables have driven operational costs higher, compelling organizations to optimize batch sizes, negotiate long-term contracts, and leverage duty drawback programs. While these tactics can alleviate some burden, sustained tariff pressures underscore the need for supply chain resilience and greater visibility across partner networks.

In response, leading players are adopting dual manufacturing footprints and integrating real-time trade compliance analytics. By mapping tariff exposures alongside production timelines, companies can pivot swiftly to logistical alternatives and buffer against sudden policy shifts. This strategic agility not only buffers margin erosion but also ensures uninterrupted advancement through clinical and commercial phases, securing timely patient access to next-generation targeted therapies.

Unveiling Deep Segmentation Insights Highlighting Therapeutic Applications Delivery Routes Technologies Drug Types End Users and Sales Channels

A nuanced understanding of market segmentation illuminates where targeted delivery innovations hold the greatest promise. When viewed through the lens of therapeutic application, there is a clear distinction between autoimmune treatments, cardiovascular agents, central nervous system modulators, oncology therapies-further refined into breast cancer, colorectal cancer, and lung cancer portfolios-and orthopedic delivery systems. Each of these segments demands unique carrier characteristics, whether it is sustained release in joint tissues or selective receptor targeting within tumor microenvironments.

Delivery route segmentation further specifies formulation requirements. Inhalation approaches must account for device compatibility, encompassing dry powder inhalers, metered dose inhalers, and nebulizer systems, while intraocular and local injection routes prioritize precise volumetric control. Intravenous platforms emphasizes sterility and controlled infusion profiles, oral vehicles rely on pH-responsive coatings and permeability enhancers, and transdermal patches integrate adhesive matrices with diffusion-optimized technologies to achieve consistent systemic delivery.

Technology-centric segmentation identifies antibody-drug conjugates that combine monoclonal specificity with cytotoxic payloads, dendrimers engineered for multivalent drug attachment, liposomes offering biocompatible encapsulation, microspheres designed for depot release, and nanoparticles tailored for size-dependent tissue penetration. When overlaid with drug type distinctions-biologics requiring cold-chain logistics, nucleic acids demanding protection from nuclease degradation, peptides needing enzymatic stabilization, and small molecules often suited to conventional encapsulation-the result is a comprehensive matrix for formulation strategy. Finally, end users such as ambulatory surgical centers, clinics, hospitals, and research institutes shape demand patterns and influence adoption timelines, while sales channels including direct tenders, hospital pharmacies, online distributors, and retail pharmacies determine commercial access pathways.

This comprehensive research report categorizes the Targeted Drug Delivery System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Delivery Route

- Technology

- Therapeutic Application

- End User

- Sales Channel

Regional Dynamics Shaping the Future of Targeted Drug Delivery with Distinct Drivers in the Americas EMEA and Asia-Pacific Markets

Geographic analysis reveals differentiated growth accelerators and challenges across three principal regions. In the Americas, research hubs in North America lead clinical innovation, with strategic investment flowing into particle engineering and biologic conjugation research. Regulatory clarity around breakthrough therapy designations has encouraged rapid proof-of-concept studies, and commercial rollouts benefit from established specialty pharmacy networks that ensure targeted therapies reach niche patient cohorts.

Europe, Middle East & Africa present heterogeneous dynamics. Western Europe’s stringent regulatory environment coexists with collaborative research consortia that pool resources for nanotechnology scale-up. In contrast, emerging markets in the Middle East and Africa show increasing interest in localized manufacturing hubs and public-private partnerships to enhance access to advanced treatments. Supply chain adaptation must account for varying import regulations and cold-chain infrastructure gaps in these diverse jurisdictions.

Asia-Pacific is characterized by rapid biotech capacity expansion and government incentives for domestic biopharma R&D. Countries such as China, Japan, and South Korea are scaling up mRNA and nanoparticle production facilities, while India’s contract development and manufacturing organizations are poised to capture fill-finish operations. This region’s emphasis on cost-effective manufacturing and evolving regulatory frameworks positions it as both a production powerhouse and a burgeoning end-market with significant unmet therapeutic demand.

This comprehensive research report examines key regions that drive the evolution of the Targeted Drug Delivery System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Industry Leaders Demonstrating Innovation Collaborations Product Pipelines and Competitive Positioning within Targeted Drug Delivery

Leading life sciences companies are strategically shaping the targeted delivery landscape through diversified pipelines, collaborative partnerships, and technological acquisitions. Global pharmaceutical giants have prioritized antibody-drug conjugate programs that leverage established oncology franchises, while specialty biotech firms focus on next-generation lipid nanoparticle platforms optimized for gene therapies. Collaborations between academic spin-outs and established players accelerate the translation of dendrimer and microsphere innovations into clinical trials.

Several leading corporations have established dedicated centers of excellence for nanocarrier research, drawing on interdisciplinary teams of chemists, biologists, and process engineers. These research hubs work in tandem with contract research organizations and academic laboratories, forming a network that spans early discovery through late-stage clinical development. Strategic licensing agreements and joint ventures enable rapid scale-up and market entry, reducing time to value.

Innovation is further bolstered by acquisitions of specialized technology providers, ensuring in-house capabilities for complex conjugate synthesis, particle engineering, and regulatory documentation. This integrated approach not only strengthens competitive positioning but also enhances the ability to address emerging therapeutic areas such as targeted central nervous system delivery and site-specific orthopedic applications. By maintaining both broad therapeutic reach and deep formulation expertise, these companies are setting new benchmarks for targeted drug delivery excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Targeted Drug Delivery System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- AstraZeneca PLC

- F. Hoffmann-La Roche Ltd

- GSK plc

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

Actionable Strategic Recommendations Empowering Stakeholders to Leverage Technological Insights and Regulatory Foresight in Targeted Drug Delivery

Industry leaders seeking to capitalize on targeted drug delivery opportunities must adopt an agile innovation framework that integrates scientific, regulatory, and commercial considerations. First, organizations should invest in modular formulation platforms that can be rapidly adapted to different therapeutic payloads. This approach accelerates entry into new indications and improves internal resource utilization, minimizing development cycle times.

Second, companies should cultivate regulatory foresight by engaging with agencies early through scientific advice meetings and breakthrough therapy consultations. Proactive dialogue ensures clarity around clinical endpoints, safety requirements, and chemistry, manufacturing, and controls expectations. By aligning development plans with regulatory milestones, teams can anticipate submission challenges and avoid costly delays.

Third, forging cross-sector partnerships enhances access to specialized expertise and shared infrastructure. Collaborations with device manufacturers, diagnostic innovators, and digital health companies strengthen the end-to-end value proposition, enabling integrated solutions that combine targeted delivery with real-time monitoring. Together, these strategic imperatives will empower stakeholders to navigate evolving policy environments and technological landscapes, ultimately delivering superior therapeutic solutions to patients.

Rigorous Multimethod Research Framework Combining Primary Expert Interviews Secondary Literature Reviews and Data Triangulation for Robust Analysis

Our research methodology blends primary qualitative insights with rigorous secondary analysis to ensure a robust understanding of the targeted drug delivery landscape. Initially, in-depth interviews with C-level executives, formulation scientists, and regulatory experts provided firsthand perspectives on strategic priorities, technical bottlenecks, and policy trends. These dialogues were complemented by a structured telephone survey of R&D leaders to quantify sentiment on emerging technologies and regional priorities.

Secondary research encompassed a comprehensive review of peer-reviewed journals, patent filings, clinical trial registries, and public regulatory announcements. This stage identified key innovation trajectories, technology maturation curves, and policy shifts affecting tariff structures and approval pathways. Data triangulation techniques were employed to reconcile discrepancies between primary and secondary findings, ensuring both rigor and relevance.

All quantitative inputs underwent quality validation through cross-referencing with proprietary databases and statistical consistency checks. An expert advisory panel then reviewed preliminary insights, providing domain-specific feedback that refined analytical frameworks and enhanced interpretive accuracy. This multimethod framework delivers a high-fidelity analysis of current dynamics and future directions in targeted drug delivery.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Targeted Drug Delivery System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Targeted Drug Delivery System Market, by Drug Type

- Targeted Drug Delivery System Market, by Delivery Route

- Targeted Drug Delivery System Market, by Technology

- Targeted Drug Delivery System Market, by Therapeutic Application

- Targeted Drug Delivery System Market, by End User

- Targeted Drug Delivery System Market, by Sales Channel

- Targeted Drug Delivery System Market, by Region

- Targeted Drug Delivery System Market, by Group

- Targeted Drug Delivery System Market, by Country

- United States Targeted Drug Delivery System Market

- China Targeted Drug Delivery System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Conclusive Perspectives Integrating Market Dynamics Technological Evolution and Policy Drivers to Illuminate the Strategic Imperatives Ahead

Bringing together technological advances, regulatory evolution, and market dynamics, the targeted drug delivery field stands at a critical inflection point. Nanocarrier innovations, from liposomes and microspheres to next-gen dendrimers and antibody-drug conjugates, are unlocking treatment possibilities previously constrained by systemic toxicity and delivery inefficiencies. At the same time, adaptive regulatory pathways and clearer breakthrough designations accelerate the translation of these platforms.

Supply chain resilience remains pivotal in light of recent tariff changes, and strategic segmentation continues to guide resource allocation across therapeutic applications, delivery routes, and formulation technologies. Regional variations further underscore the importance of localized strategies that respect regulatory nuances and infrastructure capabilities. Engagement models that span academic, biopharma, and manufacturing sectors will be essential to scale production and navigate market access hurdles.

In conclusion, organizations equipped with comprehensive insights on segmentation, regional dynamics, and competitive activity will possess the strategic agility to drive innovation and capture emerging opportunities. As the industry advances, targeted drug delivery is set to redefine therapeutic standards, improving both clinical outcomes and operational efficiency across the drug development continuum.

Take the Next Step Toward Informed Decision Making and Unlock Comprehensive Insights by Engaging Ketan Rohom for the Full Targeted Drug Delivery Report

Are you prepared to elevate your strategic planning with comprehensive intelligence on targeted drug delivery innovations and market drivers? By engaging Ketan Rohom as your primary resource, you gain exclusive access to a full-scale report that delves into technological breakthroughs, regulatory developments, and competitive benchmarks. You will benefit from a customized consultation tailored to your specific therapeutic interests and supply chain challenges, ensuring that you can translate insights into action rapidly and effectively.

Secure the definitive guide designed for decision-makers who demand precision and depth. Contact Ketan Rohom (Associate Director, Sales & Marketing) to schedule a detailed overview and unlock the complete market research report. Your next competitive advantage is a conversation away.

- How big is the Targeted Drug Delivery System Market?

- What is the Targeted Drug Delivery System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?