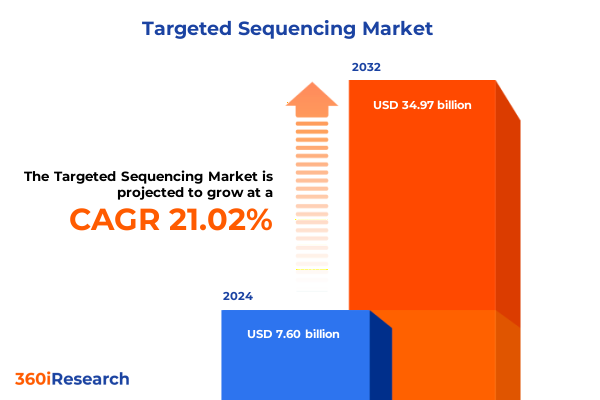

The Targeted Sequencing Market size was estimated at USD 9.18 billion in 2025 and expected to reach USD 11.10 billion in 2026, at a CAGR of 21.04% to reach USD 34.97 billion by 2032.

Unveiling the critical importance of targeted sequencing technologies in driving next-generation precision medicine and diagnostics

Targeted sequencing has emerged as a transformative force in genomics, enabling researchers and clinicians to focus on predefined genomic regions with unprecedented precision. By selectively interrogating gene panels associated with specific diseases, this approach streamlines data analysis, enhances throughput, and reduces cost per sample compared to whole-genome sequencing. In clinical diagnostics, targeted sequencing panels facilitate rapid identification of actionable mutations, guiding personalized treatment regimens and improving patient outcomes. Meanwhile, within basic research, the ability to enrich for genes of interest accelerates the discovery of novel biomarkers and elucidates complex biological pathways.

As the life sciences community embraces this technology, it is essential to recognize the converging factors that have propelled its adoption. Innovations in fluorophore chemistry, microfluidics, and optics have yielded next-generation instruments capable of processing thousands of targets simultaneously. At the same time, advances in library preparation and probe design have expanded the repertoire of compatible applications, from oncology to infectious disease surveillance. Regulatory agencies have also played a pivotal role, establishing guidelines for clinical validation that support the translation of targeted sequencing assays into routine diagnostics. Together, these developments have positioned targeted sequencing as a cornerstone technology in the pursuit of precision medicine.

Exploring landmark technological breakthroughs and strategic collaborations reshaping the targeted sequencing landscape to accelerate research outcomes

The targeted sequencing landscape has undergone profound shifts driven by both technological breakthroughs and evolving market dynamics. System miniaturization and modular instrument architectures have democratized access to high-throughput capabilities, enabling decentralized laboratories and point-of-care facilities to perform complex genomic assays. Simultaneously, the integration of unique molecular identifiers and error-correction algorithms has elevated data fidelity, empowering researchers to detect low-frequency variants with confidence. Beyond instrumentation, the rise of cloud-based bioinformatics platforms has transformed the downstream processing of sequencing data, offering scalable solutions for large-scale variant calling, annotation, and visualization.

On the commercial front, strategic partnerships between sequencing providers and pharmaceutical companies have accelerated the development of bespoke panels tailored to emerging therapeutic targets. Moreover, contract research organizations have expanded their service offerings to include turnkey targeted sequencing workflows, positioning themselves as critical enablers of translational research. These collaborative models have fostered an ecosystem in which tool manufacturers, software developers, and service providers co-create integrated solutions that address the full spectrum of customer needs. As a result, the targeted sequencing market has evolved from a collection of discrete products into a cohesive network of interoperable technologies and services.

Analyzing how United States tariff measures enacted in 2025 are restructuring supply chains cost structures and competitive positioning in targeted sequencing industry

In 2025, the United States implemented a series of tariff measures that have cumulatively influenced the targeted sequencing industry’s supply chain and cost structure. These policies encompass increased duties on imported reagents, consumables, and certain sequencing instruments, compelling manufacturers and distributors to reassess sourcing strategies. As a direct consequence, laboratories have experienced extended lead times for critical components, prompting a shift toward domestic production and inventory pre-stocking to mitigate disruptions. At the same time, elevated import costs have placed pressure on service providers to optimize operational efficiency and negotiate volume discounts to preserve margin integrity.

The broader impact of these tariff measures has also manifested in vendor partnerships and regional investment decisions. Facing higher duties, several global instrument suppliers have announced plans to establish regional assembly or manufacturing facilities, thereby localizing production to circumvent additional import expenses. Likewise, reagent producers are exploring joint ventures with U.S.-based contract manufacturers to ensure continuity of supply and maintain competitive pricing. While these strategic responses bolster supply chain resilience, they also introduce new complexities related to regulatory compliance and quality assurance across dispersed manufacturing sites. Consequently, industry stakeholders are navigating a nuanced environment where tariff-driven imperatives intersect with long-term growth objectives.

Uncovering critical insights across product typologies platforms end user segments and applications to illuminate the nuanced dimensions of targeted sequencing

A nuanced examination of product type, platform, end user, and application segments reveals the multifaceted nature of targeted sequencing. Within the realm of product type, instrument offerings span benchtop sequencers designed for mid-volume laboratories and high-throughput systems optimized for large-scale genomic operations. Complementing these hardware solutions, reagent and kit portfolios encompass amplicon-based, hybridization-based, and molecular inversion probe kits, each tailored to distinct library preparation methodologies. Bioinformatics services and data analysis software further extend this spectrum by providing the computational frameworks necessary to translate raw reads into actionable insights.

Platform segmentation underscores methodological diversity, as the market supports amplicon sequencing approaches-ranging from multiplex PCR panels to UMI-based libraries-as well as hybrid capture workflows subdivided into baits-based and probe-based methodologies. Molecular inversion probes add a third dimension, enabling robust copy number variation and single-nucleotide polymorphism detection through highly specific probe designs. On the end-user front, academic and research institutions, whether private or public laboratories, leverage targeted sequencing for exploratory studies and biomarker validation. Hospitals and diagnostic centers deploy these assays in both point-of-care and reference lab contexts to inform patient management. Meanwhile, pharmaceutical and biotechnology organizations-from clinical research organizations to drug discovery units-integrate targeted panels into preclinical and clinical trial workflows to streamline candidate selection.

Application-driven segmentation highlights the breadth of use cases fueling adoption. Biomarker discovery efforts, spanning pharmacogenomic and predictive markers, rely on targeted panels to connect genetic variants with therapeutic response. Genetic disease diagnostics, including prenatal testing and rare disease investigation, capitalize on focused gene sets to deliver rapid, clinically actionable results. Infectious disease applications-such as antibiotic resistance profiling and pathogen detection-leverage scalable assays to inform public health interventions. In oncology, targeted sequencing underpins diagnostic, prognostic, and theranostic strategies, offering a granular view of tumor heterogeneity and enabling personalized treatment pathways.

This comprehensive research report categorizes the Targeted Sequencing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Platform

- End User

- Application

Delving into region specific dynamics and growth drivers across Americas Europe Middle East & Africa and Asia-Pacific that shape the targeted sequencing domain

Regional dynamics exert a profound influence on how targeted sequencing technologies are adopted and integrated into healthcare and research ecosystems. In the Americas, the United States remains the epicenter of innovation, supported by robust funding for precision oncology initiatives and an established network of academic centers driving assay development. Canada’s research institutions have similarly embraced targeted panels for genetic disease studies, while Latin American markets are gradually strengthening infrastructure to accommodate expanding clinical sequencing demands. Regulatory clarity in these jurisdictions facilitates clinical validation pathways, enabling the rollout of new assays with confidence.

Across Europe, the Middle East, and Africa, the implementation of the European In Vitro Diagnostic Regulation has ushered in more stringent quality and performance requirements, prompting manufacturers to enhance validation protocols for targeted panels. Simultaneously, emerging markets in the Gulf Cooperation Council leverage public-private partnerships to establish genomics centers of excellence. In Sub-Saharan Africa, targeted sequencing supports pathogen surveillance and outbreak response, though capacity building remains a central priority. Turning to the Asia-Pacific region, government-led genomics programs in China and Japan drive large-scale targeted sequencing initiatives, while India’s molecular diagnostic sector increasingly adopts localized reagent production to balance cost and quality. Southeast Asian countries are investing in workforce training and laboratory accreditation, ensuring that targeted sequencing technologies can be effectively leveraged for both research and clinical diagnostics.

This comprehensive research report examines key regions that drive the evolution of the Targeted Sequencing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic maneuvers collaborative ventures and innovative technology portfolios of leading companies steering the evolution of targeted sequencing solutions

The competitive landscape of targeted sequencing is shaped by established life science conglomerates alongside agile innovators that push the boundaries of assay performance and analytical capabilities. Leading instrument manufacturers have expanded their portfolios with next-generation benchtop and high-throughput systems, integrating advanced optics, microfluidics, and UMI-enabled chemistry to enhance sensitivity. These players have forged alliances with bioinformatics firms to bundle software solutions that streamline variant calling and annotation workflows, enabling end users to deploy turnkey sequencing pipelines.

Parallel to these developments, specialty reagent and kit providers continue to differentiate through novel library preparation methodologies, including optimized probe designs and automated sample handling. Contract research organizations have also emerged as key enablers, delivering end-to-end sequencing services that appeal to pharmaceutical companies focused on clinical trial acceleration. Partnerships between kit developers and clinical laboratories facilitate rapid assay adoption, while strategic acquisitions bolster capabilities in complementary areas such as single-cell analysis and spatial transcriptomics. Collectively, these competitive moves underscore a market in which collaboration and integration are as vital as standalone product innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Targeted Sequencing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10x Genomics, Inc.

- A-Alpha Bio, Inc.

- Agilent Technologies, Inc.

- Azenta Life Sciences

- BGI Genomics Co., Ltd.

- Bio-Rad Laboratories, Inc.

- CD Genomics

- DH Life Sciences, LLC

- Element Biosciences

- F. Hoffmann-La Roche Ltd.

- Illumina, Inc.

- LGC Limited

- Macrogen, Inc.

- MGI Tech Co., Ltd.

- Oxford Nanopore Technologies PLC

- Pacific Biosciences of California, Inc.

- Paragon Genomics, Inc.

- PerkinElmer, Inc.

- Psomagen, Inc.

- QIAGEN N.V.

- Singular Genomics Systems, Inc.

- Takara Bio Inc.

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- Twist Bioscience Corporation

Formulating actionable recommendations and tactical roadmaps for industry leaders to harness the full potential of emerging opportunities in targeted sequencing markets

To navigate the rapidly evolving targeted sequencing landscape, industry leaders should prioritize investments in flexible platform architectures that accommodate both mid- and high-throughput demands. Developing modular instruments that can be upgraded with minimal hardware changes will mitigate obsolescence risks and align capital expenditures with evolving research needs. Diversifying reagent supply chains through a mix of regional manufacturing partnerships and multi-sourcing strategies will enhance resilience against tariff-induced disruptions and ensure continuity of operations.

Furthermore, forming strategic alliances with bioinformatics providers can accelerate the delivery of integrated solutions that seamlessly connect wet-lab workflows to downstream data analysis. This holistic approach will address customer demand for simplified procurement and implementation while fostering stickiness through recurring software and service contracts. Engaging with regulatory authorities early in the assay development process will streamline clinical validation timelines and facilitate market entry. Lastly, leveraging real-world evidence generated from early adopters to demonstrate clinical utility will bolster adoption among conservative end-user segments such as hospitals and reference laboratories.

Detailing the rigorous research design data acquisition protocols and analytical frameworks that establish the foundation of this targeted sequencing market analysis

This analysis draws upon a mixed-methods research framework designed to ensure rigor, relevance, and reliability. Primary research activities included in-depth interviews with key opinion leaders from academic institutions, diagnostic laboratories, and pharmaceutical companies, providing qualitative insights into technology adoption, workflow preferences, and strategic priorities. Secondary research sources comprised peer-reviewed journals, regulatory publications, and patent filings, which informed the historical context and technology evolution. Trade association reports and white papers supplemented this foundation, offering perspectives on policy developments and reimbursement landscapes.

Analytical rigor was maintained through data triangulation, where qualitative interview findings were cross-verified with secondary data to confirm consistency and mitigate bias. Thematic analysis facilitated the identification of core trends across product, platform, end-use, and application segments. Regional dynamics were assessed through comparative regulatory reviews and infrastructure evaluations. Competitive intelligence was gathered via company press releases, financial disclosures, and M&A announcements, enabling a comprehensive view of strategic moves. Throughout the process, strict adherence to ethical guidelines and confidentiality agreements ensured the integrity of proprietary information shared by participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Targeted Sequencing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Targeted Sequencing Market, by Product Type

- Targeted Sequencing Market, by Platform

- Targeted Sequencing Market, by End User

- Targeted Sequencing Market, by Application

- Targeted Sequencing Market, by Region

- Targeted Sequencing Market, by Group

- Targeted Sequencing Market, by Country

- United States Targeted Sequencing Market

- China Targeted Sequencing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing core findings to emphasize strategic imperatives and future pathways that will drive leadership and innovation in the targeted sequencing ecosystem

Collectively, the core insights underscore that targeted sequencing stands at the nexus of technological innovation, clinical demand, and strategic collaboration. Instrument and reagent advancements continue to lower barriers to entry, while enhanced bioinformatics solutions translate complex datasets into actionable outcomes. Yet external forces, such as tariff measures, underscore the need for supply chain agility and regionalized manufacturing approaches. Segmentation analysis reveals a tapestry of submarkets-each with unique technical requirements and end-user expectations-demanding tailored product and service strategies.

Regional disparities highlight that while mature markets advance through regulatory harmonization and research funding, emerging economies focus on capacity building and localized solutions. Competitive dynamics emphasize that partnerships and integrated offerings have become as critical as standalone innovations. Together, these findings point toward strategic imperatives: fostering modularity, fortifying supply resilience, aligning with regulatory frameworks, and delivering comprehensive solutions that span wet-lab to data interpretation. By embracing these imperatives, stakeholders can position themselves for sustained leadership in the dynamic targeted sequencing ecosystem.

Connect directly with our Associate Director to secure exclusive in-depth insights that elevate your targeted sequencing strategies to new heights of innovation

To secure a comprehensive view of the strategic, technological, and regulatory dimensions shaping targeted sequencing, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Through this personalized consultation, your organization can obtain an in-depth market research report that delivers unparalleled insights into supply chain dynamics, segmentation nuances, regional growth drivers, and actionable recommendations. Engaging with Ketan ensures access to exclusive data analyses and expert interpretations that equip decision-makers with the clarity to refine strategies, optimize investments, and maintain a competitive edge in the rapidly evolving targeted sequencing landscape.

- How big is the Targeted Sequencing Market?

- What is the Targeted Sequencing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?