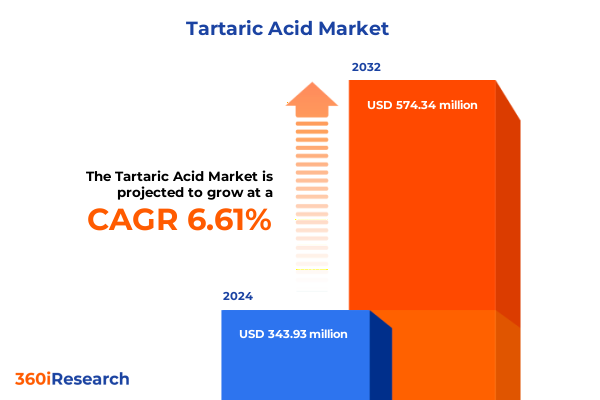

The Tartaric Acid Market size was estimated at USD 366.53 million in 2025 and expected to reach USD 388.85 million in 2026, at a CAGR of 6.62% to reach USD 574.34 million by 2032.

Exploring the Ubiquitous Influence of Tartaric Acid as a Multifunctional Ingredient Shaping Quality and Innovation Across Food, Pharma, Cosmetics, and Industry

Tartaric acid is a naturally occurring dicarboxylic acid found predominantly in grapes, tamarinds, bananas, and a variety of citrus fruits, where it forms as potassium bitartrate during fermentation and can be recovered through processes that date back to ancient winemaking practices. In its purified form, this white, crystalline compound serves as a versatile raw material in organic synthesis and is valued for its distinct sour taste and antioxidative properties. The foundational work of Louis Pasteur on the stereoisomeric forms of tartaric acid established the modern principles of chirality, underscoring its significance in both chemical research and industrial applications.

Within the food and beverage sector, tartaric acid’s role as an acidulant and pH regulator in carbonated drinks, gelatin desserts, and effervescent tablets enhances flavor profiles and extends shelf life, making it indispensable to product formulation and quality control. Meanwhile, its chelating capability underpins metal cleaning and polishing processes, while in pharmaceuticals, the compound contributes to effervescent drug delivery systems and acts as an excipient that balances solubility and stability. Moreover, in personal care, tartaric acid’s exfoliating and antioxidant attributes position it as a sought-after ingredient for formulations targeting skin renewal and complexion enhancement.

Rapid Global Shifts in Tartaric Acid Supply Chains, Regulatory Dynamics, and Technological Advances Driving Evolution in Production and Market Competition

Recent years have witnessed a profound realignment of tartaric acid supply chains driven by geopolitical tensions, trade policy shifts, and a heightened focus on supply resilience. Trade disruptions between the United States and China, coupled with pandemic-induced logistical challenges, have exposed vulnerabilities in traditional sourcing models, prompting buyers to pursue alternative suppliers in Europe, South America, and Asia-Pacific to secure uninterrupted feedstock flows. In parallel, regulatory scrutiny around environmental sustainability and manufacturing transparency has driven investment in cleaner production methods and localized capacity expansions to meet stringent purity and traceability requirements without compromising on cost competitiveness.

Concomitantly, technological advancements in both synthetic and biotechnological routes have reshaped production economics. Synthetic oxidation of maleic anhydride using molybdenum or tungsten catalysts has allowed manufacturers to diversify away from grape-derived argol, delivering consistent quality grades while reducing raw material dependency. Meanwhile, process intensification and fermentation-based recovery techniques have improved yields from wine lees, reinforcing the traditional extraction approach. These transformative shifts underscore a dynamic landscape where innovation and strategic agility drive differentiation and market leadership.

Analyzing the Broad Repercussions of 2025 U.S. Tariffs on Tartaric Acid Imports and Supply Chain Costs Reshaping Procurement and Pricing Strategies

In April 2025, the U.S. government’s implementation of reciprocal tariffs targeting key trading partners imposed a 125% duty on tartaric acid imports from China, while extending 20% and 24% tariffs on EU and Japanese sources respectively, thereby reshaping procurement strategies and cost structures. This policy move came amid broader trade tensions that saw other chemicals either spared or differently rated, emphasizing the strategic significance of chemical supply chain security. The tariffs have prompted U.S. importers to accelerate orders ahead of rate increases, triggering a temporary surge in ocean freight rates and container scarcity on transpacific routes as companies sought to circumvent the higher duties.

The immediate result has been a noticeable cost pass-through, with chemical distributors reporting landed price increases in the range of 3% to 7% for tartaric acid, reflecting early-stage adjustment by market participants. Food and beverage formulators have begun evaluating alternative acidulants or blended acid systems to mitigate budgetary impact, while industrial users are exploring domestic production partnerships and backward integration. As these measures unfold, the U.S. tartaric acid landscape is entering a period of strategic realignment where supply diversification and value chain optimization will be essential to sustaining competitive advantage.

Deep Dive into Market Segmentation Revealing Critical Insights on Purity, Form, Production Process, Application Verticals, and Distribution Channels for Tartaric Acid

Market segmentation based on purity grade reveals differentiated user requirements across food grade, technical grade, and USP grade, each designed to adhere to specific regulatory standards and functional specifications. Within the crystalline and powder forms dimension, end-users select the morphology that best aligns with processing characteristics, such as dissolution rate and blending uniformity. The natural extraction process continues to command a premium in markets focused on clean-label credentials, whereas the synthetic route offers scalability and cost stability, catering to price-sensitive industrial segments. Application segmentation spans cosmetics, food and beverage, industrial, and pharmaceutical sectors, with sub-verticals such as bakery and confectionery, dairy, soft drinks, and wine driving nuanced demand patterns, while metal processing and textile processing applications demand rigorous chelation performance. Distribution channels oscillate between traditional offline networks, which ensure localized service and technical support, and expanding online platforms that prioritize efficiency, transparency, and rapid fulfillment.

This comprehensive research report categorizes the Tartaric Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Grade

- Form

- Production Process

- Application

- Distribution Channel

Strategic Regional Perspectives Highlighting Demand Patterns, Production Hubs, and Growth Drivers in the Americas, EMEA, and Asia-Pacific Tartaric Acid Markets

In the Americas, robust demand from food and beverage manufacturers, particularly in the United States and Brazil, underscores the importance of tartaric acid as a key acidulant in confections, beverages, and pharmaceutical formulations. Local producers and importers are responding to shifting tariffs by strengthening regional logistics and forging partnerships to ensure feedstock availability. Across Europe, the Middle East, and Africa, traditional wine-producing nations in France, Italy, and Spain leverage their extensive viticulture infrastructure to supply both domestic and export markets, while emerging hubs in the Middle East are investing in downstream processing facilities to capture value locally. Regulatory frameworks in the EMEA region, which emphasize food safety and cosmetic compliance, drive continuous improvements in quality control and traceability.

The Asia-Pacific region remains the largest producer globally, with China dominating natural extraction output and India expanding synthetic capacity to meet surging domestic consumption. Recent supply chain constraints, including port congestion and shipping rate volatility, have prompted industry leaders in the region to explore inland rail routes and expanded warehousing to mitigate risks. Strategic alignment between regional producers and multinational end-users is fostering collaborative innovation in process optimization and product customization, reflecting the region’s ascent as both a manufacturing powerhouse and a critical consumption market.

This comprehensive research report examines key regions that drive the evolution of the Tartaric Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Tartaric Acid Producers and Innovators Shaping Market Leadership through Strategic Partnerships, Capacity Investments, and Sustainability Initiatives

Leading participants in the global tartaric acid arena include ATPGroup, a longstanding supplier to wine and food processors renowned for its extensive distribution network across North America; Noah Technologies Corporation, which has carved a niche in high-purity, ISO-certified specialty grades for research and pharmaceutical use; and Caviro Extra SpA, leveraging its Italian wine heritage to drive product authenticity and scale. Other notable companies such as The Tartaric Chemicals Corporation and Changmao Biochemical Engineering Company Limited emphasize integrated supply chains that blend natural extraction with synthetic capabilities, enabling them to serve diverse end-markets efficiently. Collectively, these players invest in capacity enhancements, quality assurance frameworks, and sustainability initiatives to align with evolving regulatory demands and customer expectations.

Partnerships between upstream producers and research institutions are fostering novel process innovations, while acquisitions and joint ventures are reshaping regional footprints. As consolidation intensifies, the ability to deliver specialized grade variants, coupled with reliable technical support and consistent quality, remains paramount for market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tartaric Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alvin Chemicals

- American Tartaric Products Inc.

- Argentinean Tartaric Company S.A.

- Cavitoro Distillerie S.r.l.

- Changmao Biochemical Engineering Co., Ltd.

- COFCO BiocheMtry (Anhui) Co., Ltd.

- Distillerie Italiane S.r.l.

- Distillerie Mazzari S.p.A.

- Grap'Sud Industrie

- Hangzhou Reb Technology Co., Ltd.

- Industrial Tartaric S.A.I.C.

- Jayant Agro-Organics Limited

- M & M Industries Inc.

- MCP Food Ingredients GmbH

- Powdered Tartaric Products Inc.

- Tartaric Chemicals Corporation

- Tartaros Gonzalo Castello S.L.

- Tarterie Meridionali S.r.l.

- Thirumalai Chemicals Limited

- Vinicola Altochiampos S.r.l.

Actionable Strategies for Industry Leaders to Optimize Supply Resilience, Enhance Production Efficiency, and Drive Value across Tartaric Acid Value Chains

Industry leaders should consider diversifying raw material sources by establishing strategic alliances with both natural extraction hubs in EMEA and synthetic producers in Asia-Pacific to balance purity credentials with cost stability. Investing in advanced process technologies, such as continuous crystallization and membrane separation, can enhance yield efficiencies and reduce energy consumption, thereby strengthening margins. Companies are encouraged to develop flexible product portfolios that cater to niche applications in pharmaceuticals and premium cosmetics, where high-purity grades command value premiums and support brand differentiation.

In light of tariff-induced cost pressures, organizations should explore backward integration opportunities or toll-manufacturing partnerships within the Americas to secure domestic supply. Leveraging digital platforms for demand forecasting and inventory optimization will mitigate the impact of freight volatility and enable responsive replenishment. Finally, proactive engagement with regulatory bodies and participation in industry consortia will facilitate alignment on quality standards and sustainability benchmarks, reinforcing corporate reputation and customer trust.

Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Expert Validation to Deliver Reliable Market Insights

This research employs a comprehensive blend of primary and secondary methodologies to ensure robustness and validity. Primary insights were gathered through in-depth interviews with key stakeholders, including production managers, procurement officers, and R&D specialists, supplemented by structured surveys targeting major end-users in food, pharmaceutical, cosmetic, and industrial segments. Secondary data was compiled from authoritative sources, including trade journals, technical publications, and government tariff schedules, to construct a holistic view of market dynamics.

Quantitative analysis involved the systematic review of trade flow data, tariff rate schedules, and production capacity statistics, while qualitative assessment focused on competitive benchmarking and technology trend mapping. Data triangulation was applied to reconcile discrepancies, and scenario modeling was used to evaluate the implications of tariff adjustments and regulatory changes. Finally, expert validation with industry veterans ensured that findings reflect both current realities and emerging developments in the tartaric acid landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tartaric Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tartaric Acid Market, by Purity Grade

- Tartaric Acid Market, by Form

- Tartaric Acid Market, by Production Process

- Tartaric Acid Market, by Application

- Tartaric Acid Market, by Distribution Channel

- Tartaric Acid Market, by Region

- Tartaric Acid Market, by Group

- Tartaric Acid Market, by Country

- United States Tartaric Acid Market

- China Tartaric Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Market Drivers and Strategic Imperatives Pointing to Collaborative Innovation and Agility as Keys to Future Success in the Tartaric Acid Sector

The convergence of supply chain realignment, regulatory shifts, and technological advancements is redefining the contours of the tartaric acid market. Firms that proactively adapt to the evolving tariff environment, diversify sourcing strategies, and invest in production innovation stand to capitalize on emerging opportunities across food and beverage, pharmaceutical, industrial, and cosmetic applications. Meanwhile, a nuanced appreciation of regional dynamics-from Americas demand resilience to Europe’s winemaking heritage and Asia-Pacific’s production scale-will inform targeted market entry and expansion strategies.

As the industry navigates heightened cost pressures and quality imperatives, sustained collaboration among producers, research institutions, and end-users will be crucial to drive product enhancement and supply chain agility. Ultimately, those organizations that blend operational excellence with strategic foresight will be best positioned to lead in the dynamic and growth-oriented tartaric acid sector.

Connect with Our Expert Associate Director to Unlock the Complete Tartaric Acid Market Research Report and Propel Your Business Growth

To explore how this comprehensive analysis can empower your strategic planning and supply chain decisions, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure access to the full market research report and gain a competitive edge in the evolving tartaric acid landscape

- How big is the Tartaric Acid Market?

- What is the Tartaric Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?