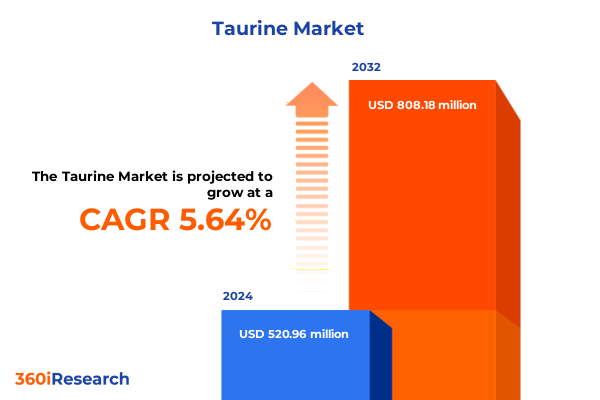

The Taurine Market size was estimated at USD 550.81 million in 2025 and expected to reach USD 583.42 million in 2026, at a CAGR of 6.22% to reach USD 840.79 million by 2032.

Setting the Stage for Taurine’s Renaissance as a Vital Bioactive Ingredient Reinventing Animal Feed, Pharmaceuticals, and Nutrition

Taurine’s journey from a humble discovery to a cornerstone ingredient in numerous industries exemplifies its remarkable versatility and enduring relevance. As a sulfur-containing amino acid, taurine was first isolated in the 19th century, but its full potential began to unfold only in the late 20th century. Through relentless research, scientists uncovered its critical physiological functions, from cell membrane stabilization to antioxidant properties, which laid the foundation for its adoption across a spectrum of applications. Today, taurine stands at the intersection of nutrition, health, and industrial innovation, offering a compelling value proposition to businesses aiming to meet diverse consumer and technical needs.

The modern landscape of taurine utilization reflects a convergence of scientific discovery and market demand. In the realm of dietary supplements, taurine’s ability to support cardiovascular health and neurological function has captured the attention of health-conscious consumers and formulators alike. Simultaneously, its functional properties have inspired breakthroughs in cosmetics, where its inclusion enhances product efficacy through improved cellular hydration and anti-aging benefits. In animal feed, taurine’s role in supporting growth, immune function, and reproduction has been widely validated, prompting its integration into specialized formulations for livestock and aquaculture species.

Beyond these core sectors, taurine’s influence extends to the pharmaceutical industry, where ongoing clinical investigations explore its potential in addressing metabolic disorders, vision health, and exercise-related recovery. Furthermore, emerging opportunities in food and beverage innovation highlight taurine’s versatility, as formulators experiment with functional beverages and fortified foods that cater to a new generation of proactive consumers. By tracing its evolution from laboratory benches to commercial shelves, this introduction underscores how taurine has transcended its origins to become an indispensable bioactive compound across global markets.

Mapping the Paradigm Shifts That Are Catalyzing Taurine’s Application Expansion in Nutrition, Cosmetics, and Beyond

The taurine landscape is undergoing transformative shifts driven by intersecting scientific advancements, evolving consumer preferences, and regulatory changes. Notably, breakthroughs in fermentation technologies have lowered production costs and improved scalability, enabling manufacturers to offer higher-purity grades that meet stringent pharmaceutical requirements. This technological maturation has unlocked broader applications, as formulators gain access to taurine with consistent quality and traceability. Moreover, the expansion of biotechnology platforms has ushered in next-generation processes that minimize environmental impact, reinforcing the industry’s commitment to sustainable growth.

In parallel, consumer demand for clean-label and multifunctional ingredients has reshaped the competitive dynamics of health and wellness markets. As individuals seek proactive solutions for aging, cognitive performance, and overall vitality, taurine’s multifaceted benefits have propelled it into premium formulations. This shift is further amplified by increasing awareness of synergistic ingredient blends, where taurine is paired with vitamins, adaptogens, and amino acids to enhance efficacy. Consequently, product developers are investing in research that elucidates optimal dosing strategies and delivery formats, reinforcing taurine’s reputation as a scientifically validated promoter of well-being.

Regulatory landscapes are also evolving, with health authorities around the world refining guidelines for taurine inclusion in food, beverage, and supplement products. These developments have heightened the importance of compliance frameworks and standardized testing protocols, compelling industry players to collaborate with accredited laboratories and certification bodies. As regulations become more harmonized, barriers to cross-border trade are diminishing, creating fertile ground for global expansion. Ultimately, these converging forces-technological innovation, consumer sophistication, and regulatory harmonization-are catalyzing a new era of growth and diversification within the taurine ecosystem.

Evaluating How 2025 Tariff Adjustments Have Reshaped Taurine Sourcing Strategies, Cost Structures, and Domestic Capacity Expansion

The implementation of new United States tariffs in 2025 has introduced a complex dynamic affecting the supply chain and competitive positioning of taurine producers and end users. As import duties on key intermediates increased, raw material costs experienced an uptick, prompting manufacturers to reassess sourcing strategies. Supply chain managers have responded by diversifying procurement channels, with some shifting toward domestic fermentation capacity while others have pursued long-term supply agreements in tariff-exempt markets. These strategic adjustments have highlighted the importance of agile logistics planning and supplier risk assessment to maintain uninterrupted production.

In response to elevated landed costs, value chain participants have intensified efforts to optimize process efficiencies and mitigate margin erosion. Formulation teams have revisited product prototypes to identify opportunities for ingredient synergy, thereby preserving performance while managing input costs. Additionally, companies have leveraged technology-enabled inventory management systems to fine-tune raw material ordering patterns, ensuring buffer stocks without incurring excessive holding expenses. The swift industry-wide adaptation to tariff-induced pressures demonstrates the resilience and strategic acumen that underpin the taurine value chain.

Despite these headwinds, the tariffs have also spurred positive developments, particularly in domestic capacity building. U.S.-based manufacturers have accelerated investments in bioreactor installations and process automation, aiming to capture the value created by localized production. Furthermore, partnerships between technology providers and producers have intensified, focusing on continuous improvement initiatives that enhance yield and reduce waste. These collaborative endeavors are reshaping the competitive landscape, reinforcing the significance of innovation as a counterbalance to external economic challenges.

Unveiling Critical Insights into Taurine Adoption Across Applications, Delivery Formats, Distribution Pathways, and User Demographics

Distinctive patterns emerge when examining the taurine landscape through the lens of application categories. Animal feed remains a foundational segment, where taurine’s essentiality in feline nutrition and aquaculture has been well documented, driving formulators to integrate precise dosing methodologies. In the cosmetics arena, its hydrating and antioxidant properties have found favor in premium skincare lines, elevating brand storytelling around cellular health. Dietary supplements constitute a dynamic category that spans tablets, capsules, and powders; here, taurine is often co-formulated with other nutraceuticals to target cardiovascular support and cognitive clarity. Food and beverage developers are experimenting with taurine-infused functional beverages and energy formulations, while pharmaceutical scientists continue to pursue clinical evidence for novel therapeutic indications.

Form-driven preferences delineate how taurine is delivered to end users. Capsule and tablet formats benefit from ease of dosing and stability, underpinning many mainstream supplement launches. Powdered taurine, with its versatility in blending and flavor masking, has become a staple for sports nutrition and personalized wellness protocols. The liquid segment, although smaller, offers rapid absorption and convenient delivery in ready-to-drink applications. These form distinctions inform manufacturing investments and packaging innovations designed to align with evolving consumer usage patterns.

Distribution pathways also play a pivotal role in shaping market reach. Broadly, the trajectory moves from traditional channels like hypermarket and supermarket shelves to increasingly sophisticated online ecosystems. Specialized retailers, including pharmacy stores and niche health outlets, continue to curate taurine products for targeted demographics. Within the online sphere, a further breakdown reveals opportunities across e-commerce marketplaces, manufacturer-direct platforms, and third-party retail collaborations-each channel requiring bespoke marketing and logistics strategies to maximize customer engagement and conversion rates.

End-user segmentation highlights the demographic breadth of taurine adoption. Adult consumers seek taurine for general wellness and energy support, while athletes prioritize its role in exercise recovery and performance optimization. The growing elderly demographic leverages taurine’s potential neuroprotective benefits, and infant nutrition formulators utilize its developmental significance to enrich milk-based products. Beyond demographics, product developers distinguish between natural and synthetic taurine sources, catering to clean-label mandates and cost-driven applications respectively. Further scrutiny of purity levels uncovers a bifurcation between food-grade materials-favored for fortified foods and beverages-and pharmaceutical-grade extracts that meet exacting quality standards for therapeutic formulations.

This comprehensive research report categorizes the Taurine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Grade

- Production Method

- Application

- Distribution Channel

Examining Diverse Regional Dynamics Driving Taurine Innovation and Consumption Patterns Across Global Markets

The Americas continue to serve as a leading hub for taurine innovation, underpinned by robust R&D infrastructures, a large pool of contract manufacturers, and a culture of health-driven consumption. Regulatory clarity in North America has facilitated streamlined product launches, particularly in the dietary supplement and functional beverage spaces. Meanwhile, South American markets display promising uptake, with local producers exploring co-formulation strategies to cater to regional taste profiles and wellness trends.

In Europe, Middle East & Africa, the landscape is marked by diversity in regulatory environments and consumer preferences. Western European countries have integrated taurine into high-end cosmetic and nutraceutical offerings, capitalizing on stringent quality expectations and premium brand positioning. In key Middle Eastern markets, taurine’s functional benefits align with the burgeoning sports nutrition segment, driven by escalating interest in fitness and performance. African territories, while nascent in structured market frameworks, reveal pockets of demand where taurine-enhanced animal feed formulations support livestock health and productivity.

The Asia-Pacific region stands out for its dual role as both a major production base and a rapidly expanding consumption market. China and India lead in manufacturing capabilities, with fermentation facilities supplying global customers, while local brands innovate with taurine-infused beverages and supplements tailored to regional flavor preferences. Japan and South Korea, renowned for skincare excellence, incorporate taurine into premium cosmetics, leveraging its cellular hydration effects. In Oceania, a health-conscious population drives demand for taurine-enriched functional foods and wellness products, supported by transparent labeling regulations.

This comprehensive research report examines key regions that drive the evolution of the Taurine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating How Leading Taurine Stakeholders Are Driving Quality Innovations, Collaborative Solutions, and Scalable Production Excellence

Leading players in the taurine arena are distinguished by their commitment to quality, innovation, and integrated supply chain capabilities. Global chemical producers have invested heavily in optimizing fermentation and synthesis processes to deliver consistent, high-purity taurine suited for pharmaceutical and dietary supplement applications. These companies often maintain extensive R&D partnerships with academic institutions and contract research organizations, ensuring continuous improvement in yield and sustainability.

In parallel, specialty ingredient firms have carved out competitive advantage by focusing on application-driven solutions. By collaborating closely with formulators in cosmetics and nutraceutical sectors, they co-develop proprietary blends that harness synergistic effects. Their agile product development teams respond rapidly to emerging consumer trends, translating clinical insights into market-ready formulations.

Contract manufacturing organizations (CMOs) play a crucial role in scaling both legacy and next-generation taurine derivatives. Equipped with flexible production lines and regulatory compliance expertise, they offer end-to-end solutions-from process validation to finished dosage form. These CMOs are leveraging process analytical technologies and continuous manufacturing approaches to reduce cycle times and enhance product consistency.

Through strategic alliances and targeted acquisitions, market participants are expanding their geographic footprint and diversifying their product portfolios. Such collaborations not only secure raw material sources but also unlock distribution channels in key end-use markets. Collectively, these initiatives underpin the competitive landscape, where technical excellence and customer-centric innovation are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Taurine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Mitsui Chemicals, Inc.

- Grand Pharmaceutical Group Limited

- Qianjiang Yongan Pharmaceutical Co., Ltd.

- Wacker Chemie AG

- Ajinomoto Co., Inc.

- Merck KGaA

- Stauber Performance Ingredients, Inc.

- CHEMCOPIA INGREDIENTS PRIVATE LIMITED

- Molekula Group

- Manus Aktteva Biopharma LLP

- Kenko Corporation

- Foodchem International Corporation

- Glentham Life Sciences Limited

- Jiangsu Yuanyang Pharmaceutical Co., Ltd.

- Jiangyin Huachang Food Additive Co., Ltd.

- Kyowa Hakko Bio Co., Ltd.

- NUTRIFOODS S.L.U

- Otto Chemie Pvt. Ltd.

- The Honjo Chemical Corporation

Strategic Recommendations for Amplifying Taurine Value Through Technological, Clinical, and Commercial Excellence

Industry leaders should prioritize investment in advanced fermentation platforms and downstream purification techniques to sustain cost-competitive high-purity taurine production while mitigating environmental impact. By adopting process intensification strategies, such as continuous bioprocessing, organizations can achieve greater throughput, lower energy consumption, and enhanced operational resilience. Moreover, forging joint ventures with biotech providers will accelerate access to proprietary strains and catalyst systems, reinforcing supply chain security.

Simultaneously, companies must deepen their engagement with end-user communities-ranging from athletes and aging consumers to pet nutrition formulators-by spearheading clinical studies that demonstrate taurine’s efficacy in targeted health outcomes. Establishing robust evidence through peer-reviewed publications and healthcare professional endorsements will elevate product credibility and drive premium positioning. In the cosmetic sector, partnering with dermatology research centers can yield innovative applications that capitalize on taurine’s cellular-level benefits.

On the commercial front, a multi-channel distribution strategy is imperative. Businesses should refine their omni-channel presence, balancing brick-and-mortar partnerships with data-driven e-commerce initiatives. Tailored digital marketing campaigns, informed by consumer behavior analytics, will enhance brand loyalty and conversion rates. Furthermore, investing in traceability solutions-blockchain-enabled or otherwise-will address growing demands for transparency and clean-label assurance, particularly in food, beverage, and supplement categories.

Finally, to navigate evolving tariff landscapes and regulatory frameworks, organizations should implement agile sourcing policies that combine geographic diversification with long-term strategic contracting. Maintaining collaborative dialogues with trade associations and policy makers will ensure proactive compliance and influence future regulation. In doing so, taurine stakeholders can not only weather macroeconomic headwinds but also position themselves to capitalize on emerging global opportunities.

Elaborating the Rigorous Multi-Source Research Design That Validates Taurine Industry Insights with Scientific and Expert Perspectives

The research underpinning this report integrates both primary and secondary methodologies to ensure a comprehensive and balanced perspective. Initially, secondary sources-including peer-reviewed journals, industry white papers, and regulatory guidances-were analyzed to establish technical baselines for taurine production, functional mechanisms, and regulatory classifications. Special emphasis was placed on sourcing information from leading scientific publications and accredited agencies to guarantee data integrity.

Complementing this desk research, primary engagements were conducted with key opinion leaders across biotechnology firms, nutritional scientists, and formulators in the cosmetics and feed industries. Structured interviews and roundtable discussions provided qualitative insights into emerging application trends, supply chain challenges, and investment priorities. These dialogues were instrumental in validating hypotheses around consumer demand, technological adoption, and tariff-driven supply adjustments.

Further, a systematic data triangulation process was employed to reconcile diverse inputs and minimize bias. Quantitative datasets-such as production capacity figures and purity grade distributions-were cross-validated against proprietary survey findings and expert feedback. Consistency checks and sensitivity analyses ensured the robustness of thematic conclusions without delving into specific market sizes or forecasts.

Finally, the findings were synthesized through a collaborative review with experienced industry analysts and advisory board members. This iterative validation cycle affirmed the report’s strategic recommendations and reinforced the credibility of its insights. The methodology’s rigor guarantees that the conclusions drawn reflect the latest developments and stakeholder perspectives shaping the taurine landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Taurine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Taurine Market, by Type

- Taurine Market, by Form

- Taurine Market, by Grade

- Taurine Market, by Production Method

- Taurine Market, by Application

- Taurine Market, by Distribution Channel

- Taurine Market, by Region

- Taurine Market, by Group

- Taurine Market, by Country

- United States Taurine Market

- China Taurine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing the Resilience, Innovation, and Growth Catalysts That Define the Modern Taurine Ecosystem

Taurine’s evolution from a niche biochemical curiosity to a multifunctional ingredient of global significance demonstrates the enduring power of science-driven innovation. Across applications-from animal nutrition and pharmaceuticals to cosmetics and functional foods-taurine continues to redefine performance expectations and create new avenues for differentiation. The industry’s capacity to adapt to tariff shifts, embrace sustainable production methods, and navigate complex regulatory landscapes underscores its resilience and strategic foresight.

Segmentation analysis reveals a multifaceted market shaped by application-specific demands, diverse delivery formats, and evolving distribution channels. Regional dynamics highlight both established hubs and emerging frontiers, while competitive insights underscore the importance of integrated value chains and collaborative partnerships. Collectively, these findings paint a comprehensive portrait of an industry on the cusp of further transformation, propelled by technological advancements, clinical validation efforts, and consumer-driven innovation.

As companies chart their strategic pathways, the interplay of cost management, quality assurance, and go-to-market agility will determine leadership positions. Those that harness robust research methodologies, forge cross-industry alliances, and proactively engage regulatory ecosystems will unlock the full potential of taurine’s versatile capabilities. In summary, the taurine sector stands poised for sustained growth and innovation, offering a wealth of opportunities for forward-thinking organizations.

Drive Strategic Growth and Competitive Edge with Expert-Guided Access to the Comprehensive Taurine Market Intelligence Report

Ready to harness the insights outlined in this executive summary and propel your organization to the forefront of the taurine landscape? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore the full depth of our comprehensive report and customize deliverables that empower your strategic vision. His expertise in translating complex research into actionable solutions will guide your team in making informed decisions, unlocking new growth opportunities, and solidifying your position as a market leader. Contact Ketan today to secure your copy of the full report and begin unlocking the competitive advantages that rigorous market intelligence delivers.

- How big is the Taurine Market?

- What is the Taurine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?