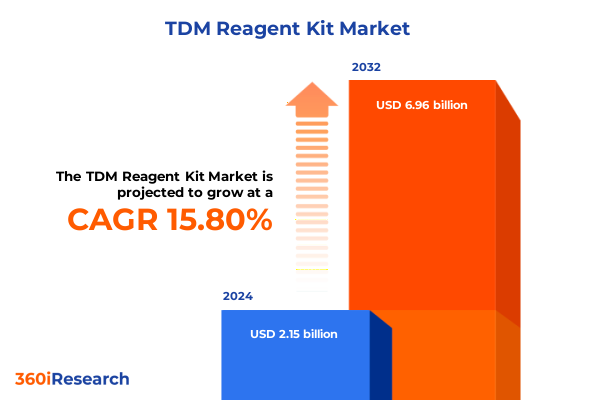

The TDM Reagent Kit Market size was estimated at USD 2.48 billion in 2025 and expected to reach USD 2.87 billion in 2026, at a CAGR of 15.84% to reach USD 6.96 billion by 2032.

Discover How Evolving Therapeutic Drug Monitoring Reagent Kits Are Shaping Precision Medicine and Clinical Decision-Making Worldwide

The landscape of clinical diagnostics is undergoing a profound transformation as healthcare systems worldwide embrace precision medicine. Therapeutic drug monitoring reagent kits have emerged as indispensable tools for optimizing pharmacotherapy by ensuring drug concentrations remain within therapeutic windows and minimizing adverse effects. Advances in analytical techniques such as chromatography, immunoassay, and mass spectrometry are enabling laboratories to deliver faster and more accurate results, driving improved patient outcomes. At the same time, an aging population coping with complex chronic conditions, including epilepsy, transplant rejection, and oncology therapies, underscores the critical need for reliable monitoring solutions.

Against this backdrop, this executive summary distills the core findings of an extensive market research initiative. The study synthesizes insights from leading industry participants, laboratory end users, and regulatory bodies to articulate the key forces shaping the therapeutic drug monitoring reagent kit sector. The report examines how technological breakthroughs, shifting trade policies, and evolving end-user requirements are converging to redefine market trajectories. By contextualizing these developments against a nuanced segmentation framework and a detailed regional analysis, this summary equips stakeholders with the strategic perspective needed to navigate dynamic market conditions and capitalize on emerging opportunities.

Exploring the Key Technological Breakthroughs and Market Dynamics Fueling the Next Generation of Therapeutic Drug Monitoring Reagents

In recent years, the therapeutic drug monitoring reagent landscape has been reshaped by a series of technological breakthroughs that are redefining analytical precision and operational efficiency. High-performance liquid chromatography platforms are now equipped with advanced detectors and streamlined sample preparation protocols, driving shorter turnaround times and enabling higher throughput in clinical laboratories. Meanwhile, gas chromatography kits have benefited from miniaturization and automated injection systems, reducing sample volume requirements and minimizing operator variability.

Concurrently, immunoassay platforms are moving beyond conventional enzyme-linked formats to embrace novel chemiluminescent and fluorescent detection modalities that improve sensitivity for low-abundance analytes. These innovations are fostering the development of competitive and noncompetitive assay formats capable of quantifying complex drug–protein interactions. In mass spectrometry, both GC–MS and LC–MS workflows are becoming more accessible through integrated software suites and plug-and-play reagent kits, lowering the barriers for adoption among hospital and research laboratories. Together, these advances are catalyzing a shift toward fully automated, data-rich monitoring solutions that support personalized dosing strategies and reinforce the role of therapeutic drug monitoring as a cornerstone of patient-centric care.

Analyzing the Compound Effects of Recent United States Tariff Policies on Reagent Manufacturing Costs Supply Chain Resilience and Market Accessibility

Throughout 2025, the United States has implemented a series of tariff adjustments affecting the import of critical reagents, solvents, and instrumentation components essential to TDM reagent kit manufacturing. Building on earlier Section 301 actions targeting chemical intermediates from select export markets, the cumulative effect has been a notable uptick in landed costs for chromatography columns, assay substrates, and mass spectrometry consumables. This escalation has placed pressure on reagent kit producers to reassess their supply chain strategies, driving increased onshoring of manufacturing capacity and forging new procurement partnerships with domestic chemical suppliers.

As laboratories contend with higher per-test expenses, many operators have responded by renegotiating vendor contracts, extending reagent shelf lives through enhanced stability studies, and selectively shifting testing volumes toward in-house platforms. These adaptations have helped mitigate the direct cost impact but have also underscored the importance of operational resilience. Moreover, the evolving tariff framework has incentivized reagent kit manufacturers to pursue vertical integration and strategic collaborations that can absorb tariff-related cost volatility. By fostering closer alignment between reagent developers and instrument OEMs, the industry is increasingly focused on co-innovation models that streamline logistics, reduce cumulative duties, and protect end-user affordability.

Unveiling Critical Segmentation Perspectives Across Product Types End Users Applications Sample Types and Sales Channels to Guide Strategic Positioning in the Therapeutic Drug Monitoring Reagent Market

A nuanced segmentation framework reveals distinct strategic imperatives across product, end user, application, sample type, and sales channel dimensions. From a product perspective, chromatography reagent kits bifurcate into gas chromatography and high-performance liquid chromatography systems, each supported by dedicated consumables, while immunoassay kits span competitive and noncompetitive assay formats that cater to targeted drug classes. Mass spectrometry offerings further divide into GC–MS and LC–MS configurations, emphasizing sensitivity for multiplexed analyte panels.

Laboratory end users display varied preferences: diagnostic centers-both high-throughput hubs and point-of-care facilities-prioritize rapid assay kits with simplified workflows, whereas hospital laboratories balance reagent robustness with broad test menus across private and public networks. Research laboratories, encompassing academic and commercial institutions, demand flexible reagent portfolios that accommodate pharmacokinetic absorption and metabolism studies alongside toxicology screening protocols for clinical and forensic applications.

Sample type segmentation highlights the importance of tailored reagent chemistries for blood matrices-serum and whole blood-alongside salivary fluid platforms for noninvasive monitoring, and urine assays optimized for both random and 24-hour collections. Meanwhile, sales channel analysis illustrates how field-based direct sales organizations, global distribution partnerships, and online platforms each play critical roles in ensuring reagent accessibility, with digital ordering portals and national sales forces increasingly shaping customer engagement.

This comprehensive research report categorizes the TDM Reagent Kit market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sample Type

- Sales Channel

- Application

- End User

Illuminating Regional Nuances Shaping the Therapeutic Drug Monitoring Reagent Landscape Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics are reshaping market trajectories as regional stakeholders navigate distinct healthcare infrastructures, reimbursement policies, and technological adoption rates. In the Americas, robust investment in clinical laboratory modernization across the United States and Canada is driving uptake of high-throughput chromatography and mass spectrometry reagent kits, while Latin American markets are gradually enhancing their capacity for advanced immunoassay applications amid rising public health budgets.

Within Europe, the Middle East, and Africa, Western European countries benefit from established regulatory frameworks that accelerate reagent kit approvals and reimbursements. Emerging markets in the Gulf Cooperation Council region are channeling funds into state-of-the-art diagnostic centers, stimulating demand for turnkey assay solutions. Conversely, several African nations are still building foundational laboratory networks, prompting reagent developers to introduce cost-effective immunoassay platforms with simplified instrumentation requirements.

Asia-Pacific demonstrates a heterogeneous landscape, where mature markets such as Japan and Australia exhibit strong preferences for integrated GC–MS and LC–MS workflows, and China and India are investing heavily in domestic reagent production capabilities to reduce dependence on imports. Southeast Asian countries are expanding hospital laboratory infrastructure, creating incremental opportunities for saliva-based and urine-based assay kits designed for decentralized testing environments.

This comprehensive research report examines key regions that drive the evolution of the TDM Reagent Kit market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Driving Competitive Differentiation and Collaborative Growth in the Therapeutic Drug Monitoring Reagent Industry

Industry leaders are executing differentiated strategies to capture growth and sustain competitive advantage. Established global players have leveraged acquisitions to bolster reagent portfolios and enhance geographic reach, while also integrating proprietary software solutions to deliver seamless instrument–reagent interoperability. In parallel, niche innovators are carving out specialized segments, focusing on high-sensitivity immunoassays for narrow therapeutic index drugs and developing reagent kits optimized for emerging mass spectrometry platforms.

Strategic alliances between reagent manufacturers and instrumentation OEMs are becoming more prevalent, facilitating co-marketing initiatives and joint product development roadmaps. Several companies are expanding their field service capabilities and investing in digital training modules to support decentralized test adoption and to accelerate time to competency for laboratory personnel. Moreover, a growing emphasis on sustainability has prompted leaders to explore eco-friendly reagent formulations and recyclable packaging solutions, aligning with broader corporate responsibility agendas.

By combining robust research and development pipelines with agile supply chain models, top-tier vendors are positioning themselves to respond nimbly to regulatory shifts and end-user requirements. Their proactive engagement with key opinion leaders and participation in clinical validation studies underpin strategic product launches, ensuring that their reagent offerings remain at the forefront of therapeutic drug monitoring innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the TDM Reagent Kit market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Chromsystems Instruments & Chemicals GmbH

- Danaher Corporation

- DiaSorin S.p.A.

- F. Hoffmann-La Roche AG

- Helena Laboratories

- Instrumentation Laboratory

- QuidelOrtho Corporation

- R-Biopharm AG

- Randox Laboratories Ltd.

- SEKISUI CHEMICAL CO., LTD.

- Shimadzu Corporation

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

Strategic Imperatives for Industry Leaders to Enhance Market Presence and Operational Agility in the Therapeutic Drug Monitoring Reagent Sector

Leaders aiming to consolidate market share and enhance operational resilience should prioritize diversification of supply chains by establishing dual-source agreements with both domestic and international reagent producers. Concurrently, investing in local manufacturing facilities can buffer tariff-induced cost pressures while supporting accelerated time to market. Cultivating partnerships with instrument original equipment manufacturers will foster co-developed reagent–instrument bundles that deliver seamless experiences and reinforce customer loyalty.

To expand market penetration, organizations should tailor marketing and training programs to the specific needs of diagnostic centers, hospital laboratories, and research institutions, emphasizing workflow optimization and cost per test advantages. Embracing digital platforms for ordering, technical support, and data analytics will improve customer satisfaction and provide actionable insights into reagent utilization patterns. Furthermore, pursuing eco-conscious reagent formulations and packaging formats will resonate with sustainability-focused stakeholders and differentiate brands in a crowded landscape.

Finally, developing targeted reimbursement engagement strategies and participating in policy advocacy efforts can accelerate reagent kit adoption across both developed and emerging regions. By aligning product roadmaps with regional regulatory frameworks and payer requirements, industry leaders can secure favorable market access conditions and drive long-term growth.

Comprehensive Research Framework and Data Validation Processes Underpinning the Therapeutic Drug Monitoring Reagent Market Insights

This research initiative combined comprehensive secondary research with rigorous primary data collection to ensure the highest level of accuracy and relevance. Secondary inputs were gathered from scientific publications, regulatory filings, patent databases, and publicly available financial disclosures to create an initial market framework. These insights were further validated through structured interviews with senior executives at reagent manufacturers, laboratory directors across diagnostic, hospital, and research settings, and supply chain experts in target regions.

Quantitative data on reagent adoption trends, pricing dynamics, and tariff schedules were synthesized using statistical modeling and cross-validated against multiple industry sources. In parallel, qualitative inputs from key opinion leaders and end users provided contextual depth on purchasing criteria, workflow challenges, and future technology requirements. Data triangulation techniques, including convergence analysis and outlier validation, were employed to mitigate biases and reconcile discrepancies among sources.

The final report structure reflects a multi-tiered segmentation approach, detailed regional assessments, and competitive profiling. All data points were subjected to peer review by a dedicated in-house team of analysts to confirm logical consistency and to ensure compliance with the highest standards of research ethics and methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our TDM Reagent Kit market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- TDM Reagent Kit Market, by Product Type

- TDM Reagent Kit Market, by Sample Type

- TDM Reagent Kit Market, by Sales Channel

- TDM Reagent Kit Market, by Application

- TDM Reagent Kit Market, by End User

- TDM Reagent Kit Market, by Region

- TDM Reagent Kit Market, by Group

- TDM Reagent Kit Market, by Country

- United States TDM Reagent Kit Market

- China TDM Reagent Kit Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesis of Core Findings and Strategic Implications for Stakeholders in the Expanding Therapeutic Drug Monitoring Reagent Ecosystem

The therapeutic drug monitoring reagent market is characterized by rapid technological evolution, complex supply chain dynamics, and diverse end-user requirements. Our analysis underscores the criticality of segmentation strategies that address distinct product modalities, laboratory settings, therapeutic applications, and sample matrix considerations. Regional nuances-from the advanced regulatory landscapes of North America and Western Europe to the emerging capacities in Asia-Pacific and Latin America-highlight the importance of tailored market approaches.

The 2025 tariff environment has introduced new cost considerations, prompting an industry-wide pivot toward operational resilience and collaborative innovation with both suppliers and instrument partners. Leading organizations are leveraging vertical integration, strategic alliances, and sustainable product development to mitigate external challenges and to create differentiated value propositions. As laboratories continue to prioritize precision and throughput, the combined advances in chromatography, immunoassay, and mass spectrometry technologies will drive the next wave of assay capabilities.

Stakeholders who embrace supply chain diversification, invest in digital engagement platforms, and align product roadmaps with evolving clinical and regulatory requirements will be best positioned to capture sustained growth. By synthesizing these insights, industry participants can craft informed strategies that navigate trade complexities, capitalize on market segmentation opportunities, and reinforce their leadership in the expanding therapeutic drug monitoring reagent ecosystem.

Engage Directly with Associate Director Ketan Rohom to Leverage In-Depth Market Intelligence and Secure Your Therapeutic Drug Monitoring Reagent Report Today

To gain a comprehensive and authoritative understanding of the therapeutic drug monitoring reagent market’s competitive landscape, regulatory environment, and growth drivers, reach out to Associate Director Ketan Rohom. Leveraging his expertise in sales and marketing strategy development, Ketan Rohom will guide your team through the highlights of the research, answer detailed questions on methodology, and tailor insights to your organizational priorities. Engage in a one-on-one consultation to explore how this report can enhance your product positioning, inform investment decisions, and shape go-to-market approaches to drive sustained performance.

Secure immediate access to the full report and associated data tables by scheduling a discussion today. Elevate your strategic planning efforts with data-driven projections, actionable recommendations, and deep segmentation analyses backed by rigorous primary and secondary research. Connect with Ketan Rohom to unlock bespoke insights, negotiate custom licensing options, and ensure your organization is positioned at the forefront of therapeutic drug monitoring innovation.

- How big is the TDM Reagent Kit Market?

- What is the TDM Reagent Kit Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?