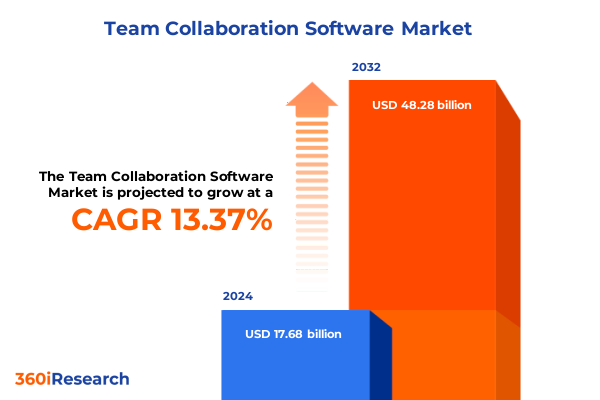

The Team Collaboration Software Market size was estimated at USD 35.36 billion in 2025 and expected to reach USD 37.60 billion in 2026, at a CAGR of 6.86% to reach USD 56.26 billion by 2032.

Exploring the Evolution of Team Collaboration Tools and the Strategic Imperatives Influencing Communication and Productivity Across Modern Enterprises

The landscape of collaborative work environments is undergoing a seismic shift as enterprises around the world embrace new paradigms in communication and productivity. Traditional silos are dissolving under the pressure of remote and hybrid work models, prompting organizations to deploy unified platforms that integrate messaging, file sharing, video conferencing, and project management. This convergence of capabilities not only streamlines workflows but also cultivates a culture of transparency and real-time interaction. Concurrently, the proliferation of mobile devices and geographically dispersed teams has elevated the urgency for secure, scalable solutions that adapt seamlessly to varied network conditions and compliance requirements.

Against this backdrop, decision-makers are confronting a complex matrix of considerations ranging from deployment models to functional priorities. Cloud-based offerings have become synonymous with flexibility and rapid innovation, whereas on-premises solutions continue to appeal to highly regulated industries seeking data sovereignty and granular control. As the interplay between technology and organizational strategy intensifies, it becomes critical to chart a clear path through this dynamic ecosystem. This executive summary sets the stage by articulating the forces reshaping collaboration platforms and identifying the key parameters that will guide future investments.

Mapping the Catalysts Transforming Collaboration Software Ecosystems Amidst Cloud Innovation Mobile Integration and AI-Driven Workflows

In recent years, the catalyst for transformation within the collaboration software sector has been multifaceted, encompassing cloud-native architectures, mobile-first design principles, and the infusion of artificial intelligence. Cloud infrastructure has unlocked a level of elasticity that enables organizations to scale capacity on demand, dramatically reducing time to deployment and total cost of ownership. Mobile integration ensures that team members remain connected regardless of location, fostering agility and responsiveness in today’s fast-paced business environment. Meanwhile, AI-driven enhancements-ranging from intelligent meeting summaries to predictive task prioritization-are redefining user experiences by automating routine tasks and surface insights that inform better decision-making.

Security and compliance frameworks have also evolved in tandem, with end-to-end encryption, zero trust controls, and advanced data loss prevention mechanisms becoming standard expectations. The growing emphasis on platform interoperability has further encouraged collaboration vendors to offer robust APIs, enabling seamless integration with CRM, ERP, and custom-developed applications. These transformative shifts are not isolated trends but rather interlocking forces that collectively accelerate digital collaboration and drive competitive differentiation for forward-looking enterprises.

Analyzing the Cumulative Ramifications of United States Trade Tariffs in 2025 on Collaboration Technology Adoption Total Cost of Ownership and Supplier Dynamics

The U.S. government’s tariff measures enacted in 2025, primarily targeting hardware imports from key manufacturing hubs, have yielded nuanced repercussions for the collaboration technology landscape. While digital subscription services and cloud-based platforms remain largely unaffected by duty impositions, on-premises deployments have encountered elevated costs as organizations contend with higher prices for servers, networking equipment, and specialized conferencing hardware. These increased capital expenditures have prompted many enterprises to reassess their total cost of ownership models and accelerate migrations toward software-as-a-service offerings that sidestep tariff-related fees.

Supplier dynamics have likewise shifted as hardware vendors seek to diversify production footprints, establishing new assembly lines in duty-exempt regions or incentivizing local manufacturing partnerships. This realignment of supply chains has introduced temporary lead-time volatility, compelling technology buyers to account for extended procurement cycles and buffer stock strategies. The cumulative impact of tariffs has, paradoxically, catalyzed greater reliance on cloud-native collaboration suites, underscoring a broader industry pivot away from capital-intensive infrastructure toward subscription-driven, agile consumption models that mitigate geopolitical risk.

Unlocking Strategic Segmentation Perspectives to Tailor Collaboration Platform Offerings by Deployment Method Organization Scale and Functional Requirements

A nuanced understanding of market segmentation offers strategic clarity for stakeholders aiming to tailor their collaboration platforms effectively. Deployment modalities diverge between Cloud and On Premises alternatives, wherein the Cloud archetype subdivides into PaaS and SaaS offerings suited for rapid provisioning and continuous updates, and the On Premises counterpart branches into Managed and Self Hosted configurations that deliver heightened control and compliance assurances. When evaluating organizational size, the market bifurcates into Large Enterprises and Small and Medium Enterprises, with global multinationals and nationally focused firms on one axis, and micro enterprises alongside growing small enterprises on the other, each presenting distinct buying behaviors and support requirements.

Diving into platform functionality reveals a spectrum encompassing File Sharing, Messaging, Team Workspaces, and Video Conferencing. File Sharing further differentiates into Cloud Storage and Document Management solutions designed for seamless content lifecycle management, while Messaging spans Group Chat and Instant Messaging channels that foster both structured and ad hoc communication. Team Workspaces integrate Document Collaboration and Project Management capabilities to synchronize tasks and content, and Video Conferencing offerings range from high-definition meeting experiences to large-scale webinars. Finally, integration pathways are delineated by API, Custom Integrations, and Third Party Apps, with GraphQL and REST APIs driving real-time data exchange, bot frameworks and scripting interfaces enabling bespoke workflows, and CRM or ERP connecters extending collaboration into broader enterprise systems.

This comprehensive research report categorizes the Team Collaboration Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Type

- Organization Size

- Functionality

- Industry Vertical

- Integration Type

Examining Regional Dynamics and Adoption Trends in Collaborative Software Solutions Across Americas Europe Middle East Africa and Asia Pacific Markets

Regional nuances play a pivotal role in shaping the adoption and maturation of collaboration software ecosystems. In the Americas, North America leads with mature cloud infrastructures, supportive regulatory frameworks, and a culture of early technology adoption, driving pervasive use of unified communication suites across sectors such as finance, healthcare, and technology. Latin America is experiencing accelerated digital transformation as broadband penetration improves, though buyers often prioritize scalable SaaS models to offset infrastructure constraints.

Europe, the Middle East, and Africa present a tapestry of regulatory environments and market maturity levels. Data protection mandates like GDPR have elevated privacy considerations, compelling vendors to establish regional data centers and localized compliance protocols. Western European enterprises exhibit high interoperability demands and a preference for integrated analytics, while Middle Eastern and African markets are characterized by rapid mobile adoption and growing interest in cost-efficient collaboration bundles.

Asia-Pacific stands out as the fastest-growing region, fueled by large-scale government digitalization initiatives, a surge in remote work practices, and strong demand from small and medium enterprises embracing cloud-first strategies. In markets such as India and Southeast Asia, providers are optimizing for mobile-centric use cases and multilingual support, whereas in developed economies like Japan and Australia, there is heightened focus on AI-enhanced automation and enterprise-grade security features.

This comprehensive research report examines key regions that drive the evolution of the Team Collaboration Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Shaping the Future of Collaborative Platforms Through Innovation Strategic Partnerships and Ecosystem Integration

The competitive landscape of collaboration platforms is defined by a set of industry frontrunners distinguished by their innovation roadmaps, partnership networks, and ecosystem integrations. Established software giants continue to leverage broad product portfolios and deep enterprise relationships to introduce advanced AI capabilities, such as automated note-taking, sentiment analysis in group discussions, and task-prioritization engines. Meanwhile, specialized vendors and emerging challengers are carving out niche positions by focusing on vertical-specific compliance, low-latency video experiences, or ultra-lightweight mobile clients designed for high-volume user bases.

Strategic alliances and ecosystem plays have become central to competitive differentiation. Vendors are forming partnerships with security providers to embed zero trust frameworks directly into their collaboration suites, while integration with leading CRM and ERP systems ensures seamless data flow between front-line teams and back-office operations. Mergers, acquisitions, and open-source contributions further amplify the rate of innovation, enabling platforms to deliver unified experiences across messaging, conferencing, and content management under a single pane of glass. As the market evolves, success will hinge on the ability to blend comprehensive feature sets with intuitive user journeys and scalable architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Team Collaboration Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alphabet Inc.

- Atlassian Corporation Plc

- Box, Inc.

- Cisco Systems, Inc.

- Dropbox, Inc.

- Microsoft Corporation

- RingCentral, Inc.

- Slack Technologies, LLC

- Smartsheet Inc.

- Zoom Video Communications, Inc.

Formulating Targeted Strategies and Actionable Roadmaps to Enhance Collaboration Software Adoption Operational Efficiency and User Engagement Across Enterprises

To capitalize on the momentum in collaboration software adoption, industry leaders must develop targeted strategies that emphasize flexibility, security, and user experience. Prioritizing modular architectures allows organizations to incrementally integrate new capabilities-such as AI-powered assistants or advanced analytics dashboards-without disrupting core workflows. Embedding robust security protocols at every layer, from device authentication to data encryption, will safeguard sensitive communications and bolster compliance with evolving regulations.

User engagement is another vital dimension, and investments in intuitive interfaces, contextual workflows, and embedded help resources can drive adoption and reduce training overhead. Cultivating a developer ecosystem around open APIs and bot frameworks stimulates innovation, enabling internal teams and third-party partners to extend platform capabilities rapidly. Finally, adopting a data-driven governance model-leveraging usage metrics and sentiment analysis-provides continuous feedback loops to optimize configurations, retire underutilized features, and align technology investments with business outcomes.

Detailing Rigorous Research Methodologies Leveraging Primary and Secondary Data to Ensure Comprehensive Insights into the Collaboration Technology Ecosystem

This report’s insights are grounded in a rigorous research methodology that synthesizes primary and secondary sources to deliver a comprehensive view of the collaboration technology ecosystem. Primary research encompassed in-depth interviews with C-level executives, IT decision-makers, and end-users, supplemented by structured surveys designed to quantify deployment preferences, feature priorities, and investment drivers. Secondary research involved a thorough review of regulatory filings, technology whitepapers, company literature, and public financial disclosures to contextualize market developments and innovation trajectories.

Analytical frameworks were applied to triangulate data, validate segmentation models, and ensure consistency across multiple data streams. Quality assurance processes included cross-referencing findings with strategic partnerships, vendor roadmaps, and case study benchmarks. This multi-pronged approach not only strengthens the reliability of insights but also illuminates emerging opportunities and potential risks, equipping stakeholders with the nuanced understanding necessary to navigate a rapidly evolving collaboration landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Team Collaboration Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Team Collaboration Software Market, by Deployment Type

- Team Collaboration Software Market, by Organization Size

- Team Collaboration Software Market, by Functionality

- Team Collaboration Software Market, by Industry Vertical

- Team Collaboration Software Market, by Integration Type

- Team Collaboration Software Market, by Region

- Team Collaboration Software Market, by Group

- Team Collaboration Software Market, by Country

- United States Team Collaboration Software Market

- China Team Collaboration Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Synthesizing Core Findings and Strategic Takeaways to Illuminate the Present State and Emerging Trends in Collaborative Software Adoption

The convergence of cloud elasticity, mobile ubiquity, and AI augmentation underscores an inflection point in collaborative software evolution. Cloud-first and subscription-driven consumption models have become the default, creating competitive pressures on on-premises solutions and spurring hybrid approaches to accommodate regulatory and security demands. Segmentation analysis reveals that organizations of all sizes are increasingly valuing end-to-end collaboration suites that integrate messaging, file sharing, workspaces, and video conferencing under unified interfaces. Regional distinctions highlight mature North American and Western European markets favoring sophisticated analytics and integrations, while Asia-Pacific and emerging economies prioritize affordability, scalability, and mobile optimization.

As industry leaders pursue increased agility and resilience, the strategic interplay between technology adoption, supplier selection, and governance frameworks will determine market winners. Vendors that continue to innovate through AI-enabled features, open ecosystem partnerships, and flexible deployment options are best positioned to capture the next wave of growth. Simultaneously, organizations that adopt a data-driven approach to platform governance and user engagement will unlock sustained productivity gains and achieve higher returns on their collaboration investments.

Engage with Associate Director of Sales and Marketing to Secure Tailored Collaboration Market Intelligence Driving Better Decisions and Competitive Advantage

For organizations seeking an edge in decision-making and strategic planning, securing tailored market intelligence is essential. Collaborating directly with the Associate Director of Sales and Marketing brings unparalleled access to expert guidance and exclusive insights. Through a personalized consultation, you can clarify business objectives, highlight areas of unmet need, and receive recommendations on the most relevant modules, data sets, and analytical frameworks for your organization. This engagement ensures that when you invest in the full market research report, you are equipped with precise, actionable data aligned to your unique priorities. Reach out today to explore customized packages, special advisory options, and ongoing support to propel your collaboration strategy forward and maintain a competitive advantage in an increasingly dynamic environment.

- How big is the Team Collaboration Software Market?

- What is the Team Collaboration Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?