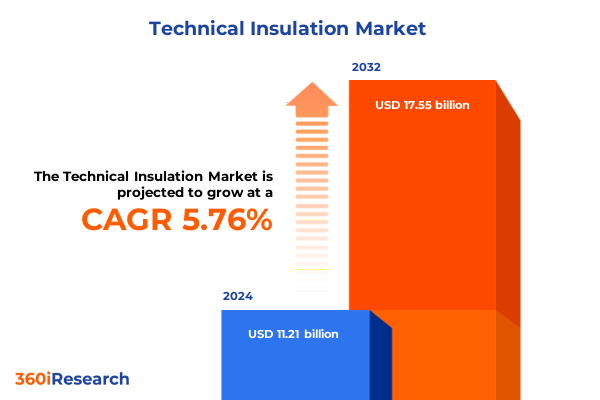

The Technical Insulation Market size was estimated at USD 11.87 billion in 2025 and expected to reach USD 12.58 billion in 2026, at a CAGR of 5.74% to reach USD 17.55 billion by 2032.

A Comprehensive Overview Unveiling the Critical Role of Technical Insulation in Enhancing Energy Efficiency and Industrial Sustainability Worldwide

The global technical insulation landscape is undergoing a period of profound transformation driven by increasing demands for energy efficiency, stricter environmental regulations, and the relentless pursuit of operational excellence across industries. As energy costs continue to escalate and sustainability becomes a boardroom priority, organizations are turning to advanced insulation materials and systems to optimize thermal management and reduce carbon footprints. Technical insulation no longer serves merely as a cost-reduction measure; it has emerged as a pivotal enabler of environmental compliance, process safety, and lifecycle cost optimization.

Against this backdrop, decision-makers require an authoritative overview that synthesizes the latest industry drivers, regulatory imperatives, and material innovations. This executive summary offers a concise yet comprehensive introduction to the forces shaping the technical insulation sector, setting the stage for deeper exploration of market shifts, tariff impacts, segmentation dynamics, regional variance, competitive landscapes, and strategic recommendations. By establishing this foundational understanding, stakeholders can confidently navigate the complexities of market entry, expansion, and product development strategies in the evolving technical insulation realm.

Exploring How Digital Integration Material Innovations and Supply Chain Resilience Are Redefining Technical Insulation Strategies

The technical insulation industry is experiencing transformative shifts propelled by digitalization, material science breakthroughs, and evolving customer expectations. Artificial intelligence and machine learning are increasingly applied to predictive maintenance programs, allowing enterprises to monitor insulation performance in real time and intervene proactively to prevent energy waste and process disruptions. Concurrently, the adoption of digital twins is facilitating virtual testing of insulation configurations, accelerating development cycles and reducing the risk associated with new installations.

In parallel, research into novel materials such as nano-structured aerogels and bio-based foams is unlocking new frontiers in thermal performance, fire safety, and environmental impact. These material advances are enabling the development of thinner, lighter, and more durable insulation systems that comply with stringent international standards. Moreover, end users are demanding solutions that integrate seamlessly with smart building and Industry 4.0 infrastructures, fostering closer collaboration between insulation manufacturers, technology providers, and EPC (engineering, procurement, and construction) firms.

Supply chain resilience has also become a defining theme, as recent disruptions have highlighted vulnerabilities in raw material sourcing and logistics. Organizations are diversifying supplier bases, localizing production, and investing in nearshoring strategies to ensure continuity of supply while mitigating exposure to geopolitical risks. These combined shifts underscore a landscape in which innovation, agility, and digital integration are the hallmarks of industry leaders.

Analyzing How Recent Cumulative United States Tariffs on Imported Insulation Materials Have Reshaped Procurement Dynamics and Sourcing Models

The United States instituted a series of tariffs in 2025 targeting imported insulation materials, reflecting broader trade policy objectives aimed at protecting domestic manufacturing and promoting local content. These measures encompass heightened duties on select foam glass, plastic foam boards, and mineral wool products, with a particular focus on imports originating from China and other low-cost manufacturing hubs. The cumulative effect has been a recalibration of procurement strategies among end users and distributors, as price sensitivities necessitate a closer examination of total cost of ownership beyond headline duties.

Many domestic buyers have responded by shifting volumes toward locally produced boards and blankets, while others have renegotiated long-term contracts to secure stable pricing and mitigate tariff-related volatility. The imposition of these duties has also stimulated investments in domestic production capacity expansion and technological upgrades, as manufacturers seek to capitalize on the reshored demand and differentiate their offerings through enhanced performance metrics and sustainability credentials.

Despite these shifts, certain specialized insulation types-such as high-performance aerogel blankets and cryogenic foam tapes-remain largely dependent on global supply chains due to limited domestic production. In these cases, end users are balancing tariff impacts against the operational risks of substituting with lower-performing alternatives. Overall, the 2025 tariffs have accelerated the industry’s move toward nearshoring and localization while underscoring the need for flexible sourcing models that can adapt to evolving trade policies.

Uncovering the Diverse Insights That Drive Material and Application Preferences Across Multiple Segmentation Criteria in Technical Insulation

Insights from the latest segmentation analysis reveal nuanced variations in demand patterns across product types, materials, end-use industries, applications, forms, temperature ranges, and installation modes. Within product categories, blanket and felt solutions-particularly duct insulation blankets and preformed blankets-continue to dominate applications requiring rapid installation, whereas board and rigid formats are preferred in scenarios demanding precise thickness control and structural resilience. Foam tapes and spray-applied systems, on the other hand, have gained traction in niche applications such as cold storage retrofit and complex pipe network configurations.

Material choices are guided by performance priorities and regulatory requirements: aerogels are prized for their exceptional thermal conductivity in confined spaces, calcium silicate for its robustness at elevated temperatures, and foam glass for its compressive strength and moisture resistance in underground installations. Mineral wool variants, including glass wool and rock wool, maintain a strong presence in fire protection and acoustic attenuation roles, while plastic foams-ranging from EPS and XPS to polyurethane and polyisocyanurate-offer cost-effective solutions for thermal insulation in commercial and residential construction.

End-use industry analysis highlights differentiated growth trajectories. Chemical and petrochemical operations leverage specialized insulation for primary and secondary processing to safeguard process integrity, while automotive, electronics, and manufacturing segments prioritize lightweight, high-performance materials for thermal management. Oil and gas stakeholders optimize across upstream, midstream, and downstream facilities, and power generation users balance requirements between nuclear, renewable, and thermal installations. Across these industries, form factor choices-flexible, liquid, rigid, or spray-are determined by installation constraints and lifecycle maintenance considerations. Temperature-range segmentation further refines product application strategies, from ambient temperature solutions in residential buildings to cryogenic systems for liquefied natural gas handling. Finally, the choice between new-construction and retrofit insulation dictates project timelines, labor skill requirements, and total installation expenditures.

This comprehensive research report categorizes the Technical Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Form

- Temperature Range

- Installation Type

- End Use Industry

- Application

Examining How Regional Regulatory Drivers Infrastructure Investments and Industrial Expansion Shape Technical Insulation Demand Globally

Regional dynamics in the technical insulation sector are shaped by varying regulatory environments, infrastructure investment cycles, and industrial growth patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, heightened focus on energy conservation measures and tax incentives for sustainable building practices have fueled demand for high-efficiency foam boards and mineral wool blankets. North American refiners and petrochemical complexes continue to retrofit existing assets with advanced insulation to meet stricter emission standards and optimize process temperatures.

Across Europe, Middle East & Africa, regulatory frameworks such as the European Union’s Energy Performance of Buildings Directive and regional initiatives in the Gulf Cooperation Council have elevated thermal insulation standards, driving uptake of fire-rated boards and eco-friendly foam options. Meanwhile, Africa’s growing industrialization in sectors like power generation and petrochemicals is creating pockets of accelerated demand for both imported and locally produced insulation products.

In the Asia-Pacific region, rapid urbanization, expanding manufacturing hubs, and ambitious renewable energy deployments are key demand catalysts. Australia’s stringent building codes are driving adoption of high-performance aerogel blankets, while Southeast Asian shipyards and LNG facilities require specialized cryogenic insulation for maritime and energy applications. In China and India, government-led infrastructure programs continue to emphasize thermal efficiency and occupational safety, propelling growth across multiple insulation modalities.

This comprehensive research report examines key regions that drive the evolution of the Technical Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Leading Manufacturers Are Leveraging Innovation Partnerships and Strategic Expansion to Dominate the Technical Insulation Sector

Leading players in the technical insulation arena have distinguished themselves through targeted innovation, strategic partnerships, and geographic expansion. Established multinational manufacturers have been investing in advanced research centers to develop next-generation materials, focusing on improving thermal performance while reducing environmental impact. These R&D initiatives often involve collaboration with academic institutions and technology startups to accelerate the commercialization of breakthroughs like nano-porous aerogels and bio-derived foam composites.

At the same time, mid-sized regional firms are capturing market share by leveraging deep customer relationships, localized production facilities, and agile supply chains that can respond quickly to bespoke project specifications. These companies are differentiating through a consultative sales approach, offering integrated solutions that bundle insulation products with predictive maintenance services and digital monitoring platforms.

In addition, several entrants from the chemical and specialty polymers sectors have expanded their portfolios to include insulation materials, applying competencies in polymer science and manufacturing scale-up to introduce novel foam formulations. Across all tiers, strategic acquisitions and joint ventures have been prevalent as companies seek to balance global reach with local relevance, ensuring they can meet diverse application requirements across multiple geographies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Technical Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armacell International S.A.

- Compagnie de Saint-Gobain S.A.

- Huntsman International LLC

- Johns Manville Corporation

- Kingspan Group plc

- Knauf Insulation GmbH

- L’ISOLANTE K-FLEX S.p.A. (K-Flex)

- Morgan Advanced Materials plc

- Owens Corning

- Palziv Inc.

- Paroc Group

- Recticel NV/SA

- ROCKWOOL International A/S

- Zotefoams plc

Advising How Sustainable Material Innovations Digital Monitoring and Agile Sourcing Strategies Can Secure Long-Term Success for Industry Leaders

Industry leaders should prioritize a dual focus on sustainable material development and digital integration to maintain competitive advantage in the evolving technical insulation market. By accelerating investment in eco-friendly formulations and pursuing certifications that validate environmental performance, organizations can address increasing regulatory scrutiny and capitalize on growing demand for green building solutions. Equally important is the deployment of sensor-based monitoring systems and data analytics platforms that provide real-time insights into insulation efficacy, enabling predictive maintenance that reduces downtime and energy waste.

To navigate tariff-related uncertainties and supply chain disruptions, companies must establish diversified procurement strategies that blend local sourcing with strategic partnerships in low-cost jurisdictions. This approach should be complemented by scenario planning and risk modeling to forecast potential trade policy changes and material shortages. Moreover, developing flexible manufacturing capabilities-such as modular production lines and agile workforce training-will allow for rapid scale-up or reconfiguration in response to shifting market conditions.

Finally, partnering closely with end users and EPC contractors to co-develop tailored solutions can unlock new revenue streams and reinforce customer loyalty. By offering value-added services-such as on-site installation training and lifecycle performance audits-manufacturers can differentiate their offerings, drive deeper engagement, and foster long-term, collaborative relationships.

Detailing the Rigorous Qualitative and Quantitative Research Framework Underpinning This Comprehensive Technical Insulation Analysis

This research was conducted using a blended methodology that integrates qualitative insights from in-depth interviews with key stakeholders-including insulation manufacturers, EPC contractors, and end users-with quantitative data analysis of procurement patterns and trade flows. The interview phase involved structured discussions across North America, Europe, Middle East & Africa, and Asia-Pacific to capture regional nuances in regulatory landscapes, application requirements, and material preferences.

Quantitative data were sourced from publicly available trade databases, industry association reports, and corporate disclosures, ensuring transparency and reproducibility. Advanced statistical techniques were applied to identify correlations between trade policy shifts and procurement behaviors, while cross-validation against case studies provided additional confidence in the analytic approach. Segmentation models were developed by mapping product, material, application, form, temperature, and installation-type dimensions against actual project specifications drawn from a representative sample of infrastructure and industrial projects.

To further enhance the robustness of findings, secondary research encompassed a comprehensive review of technical standards, patent filings, and academic publications, enabling triangulation of innovation trends and material performance metrics. Quality assurance protocols were applied throughout the research process, including peer review by subject matter experts and validation workshops with industry practitioners.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Technical Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Technical Insulation Market, by Product Type

- Technical Insulation Market, by Material

- Technical Insulation Market, by Form

- Technical Insulation Market, by Temperature Range

- Technical Insulation Market, by Installation Type

- Technical Insulation Market, by End Use Industry

- Technical Insulation Market, by Application

- Technical Insulation Market, by Region

- Technical Insulation Market, by Group

- Technical Insulation Market, by Country

- United States Technical Insulation Market

- China Technical Insulation Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Summarizing the Strategic Imperatives and Innovation Trends That Will Drive Future Success in the Technical Insulation Industry

In an era defined by energy efficiency mandates, environmental accountability, and rapidly evolving trade policies, technical insulation has emerged as a strategic asset for organizations seeking to optimize operational performance and reduce carbon footprints. The analysis presented here underscores the multifaceted nature of the market, shaped by material innovations, regulatory imperatives, segmentation diversity, and regional dynamics.

Key takeaways include the critical importance of sustainable material development, the growing role of digital monitoring for predictive maintenance, and the need for flexible sourcing strategies to mitigate tariff impacts and supply chain disruptions. By understanding segmentation specifics-from product formats and material chemistries to application requirements and installation modes-stakeholders can tailor their approaches to meet precise performance and cost objectives.

As the industry continues to evolve, companies that can integrate advanced materials, digital capabilities, and agile operational models will be best positioned to capture emerging opportunities and navigate future challenges. The insights and recommendations detailed throughout this report serve as a roadmap for decision-makers striving to achieve both technical excellence and business resilience in the dynamic technical insulation landscape.

Discover How In-Depth Technical Insulation Market Intelligence Can Propel Your Growth by Connecting with Ketan Rohom for Complete Report Access

I invite you to explore the comprehensive insights and strategic perspectives detailed throughout this report to empower your organizational growth and decision-making. To gain full access to the in-depth analysis, detailed segmentation breakdowns, regional dynamics exploration, and customized recommendations, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engage with Ketan to discuss how this actionable intelligence can be tailored to your specific needs and secure your copy of the definitive technical insulation market research report today

- How big is the Technical Insulation Market?

- What is the Technical Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?