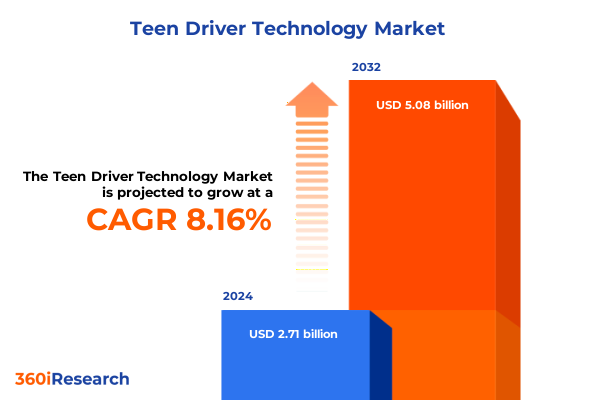

The Teen Driver Technology Market size was estimated at USD 882.68 million in 2025 and expected to reach USD 965.37 million in 2026, at a CAGR of 10.22% to reach USD 1,745.19 million by 2032.

Unveiling the Critical Landscape of Teen Driver Technology: Addressing Rising Safety Concerns and Emerging Digital Innovations Shaping the Future

The prevalence of motor vehicle crashes among adolescent drivers remains a critical public safety concern in the United States. According to the National Highway Traffic Safety Administration, 2,611 teen drivers aged 15 to 18 lost their lives in traffic collisions in 2023, and more than half of those fatalities involved occupants who were not using seat belts at the time of the crash. This alarming trend underscores the vulnerability of new drivers as they encounter complex traffic environments for the first time. In addition, seasonal patterns exacerbate these risks: nearly one-third of teen driving deaths occurred during the summer “100 Deadliest Days,” when increased driving frequency and peer passenger presence heighten crash probabilities.

Policymakers have responded by strengthening Graduated Driver Licensing (GDL) frameworks, imposing restrictions on nighttime driving, passenger limits, and mandatory supervised practice. These measures aim to reduce dangerous behaviors such as speeding, distracted driving, and impaired operation. Enforcement initiatives, coupled with driver education programs, have improved hazard recognition and decision-making skills among novice drivers. However, the evolving nature of mobile technology and social dynamics demands innovative approaches to further mitigate these risks and reinforce safe driving habits.

Technology has emerged as a powerful ally in addressing the teenage crash epidemic. From built-in vehicle features like speed limiters to smartphone apps offering real-time feedback, the industry is deploying solutions that leverage telematics, geolocation data, and artificial intelligence. Early studies demonstrate promising outcomes; for instance, usage-based driving apps providing weekly performance reports have been shown to reduce speeding incidents by 13 percent and hard braking events by 21 percent over a single month of use. By transforming raw driving data into actionable coaching, these platforms are setting a new standard for proactive safety management.

Charting the Dramatic Technological and Behavioral Transformations Reshaping Teen Driver Safety Through Telematics, AI Coaching, and Connected Ecosystems

The trajectory of teen driver technology traces back to 2009, when automakers like Ford and Lincoln introduced MyKey, a system that empowers parents to enforce speed restrictions and limit audio volume for young drivers. Subsequent introductions-Hyundai and Kia’s Blue Link geofencing alerts in 2012, General Motors’ integrated Teen Driver report cards in 2016, and Toyota’s Entune mobile connectivity evolving in the late 2010s-demonstrate a continuous evolution of in-vehicle safety mechanisms. More recently, Honda and Acura’s Driver Coaching App leverages real-time Apple CarPlay integration to assess braking, acceleration, and steering inputs, offering contextual guidance and end-of-drive performance summaries to encourage incremental skill development.

Concurrently, smartphone apps from both insurers and third-party developers have harnessed mobile sensors to extend monitoring beyond factory-installed hardware. A landmark AAA Foundation study found that participants equipped with telematics-enabled apps exhibited sustained reductions in risky behaviors even after feedback ceased, illustrating the potential for mobile platforms to instill lasting safe driving habits. These applications monitor metrics ranging from phone handling events to night-time driving patterns, reinforcing positive behaviors through gamified scoring and personalized reminders.

Looking ahead, integration with advanced driver assistance systems (ADAS) and artificial intelligence is poised to deepen the analytical insights available to both insurers and families. AI algorithms can differentiate driver from passenger actions, identify signs of fatigue through micro-movement analysis, and predict hazardous scenarios before they unfold. Augmented reality overlays and virtual reality simulators are also gaining traction as immersive education tools, allowing teens to practice complex maneuvers in controlled, repeatable environments that build muscle memory and cognitive readiness.

Insurance providers have recognized the value of telematics data in underwriting and customer engagement. Usage-based insurance (UBI) has risen from niche pilot programs to mainstream offerings, representing over one-third of new personal auto policies in the United States by early 2025. This shift not only rewards safe teen drivers with premium discounts but also fosters a data-driven ecosystem where driver performance informs continuous product innovation and risk management.

Assessing the Multi-Billion-Dollar Impact of 2025 U.S. Automotive Tariffs on Teen Driver Technology Supply Chains, Pricing, and Innovation

The United States unveiled a phased tariff schedule commencing on April 2, 2025, imposing a 25 percent duty on imported passenger vehicles and light trucks under Section 232 of the Trade Expansion Act of 1962. Subsequent implementation on May 3 extended a 25 percent tariff to critical auto components-including engines, transmissions and electrical systems-while temporarily exempting USMCA-compliant parts pending verification protocols. These measures represent a broad escalation in trade barriers that directly affect the cost structure of automotive manufacturing and aftermarket device assembly.

Tariffs on steel, aluminum and specialized vehicle parts disrupt deeply integrated supply chains that span borders multiple times before final assembly. Analysis by legal and trade experts highlights that escalating duties on cross-border components will either have to be absorbed by producers or passed through to consumers, inevitably raising the cost of telematics modules, sensor arrays and embedded connectivity platforms used in teen driver safety solutions. The resulting price pressures may extend bill of materials costs by upwards of 10 to 15 percent for hardware reliant on imported materials.

Automakers have thus far mitigated immediate consumer price increases by absorbing roughly $1.1 billion in tariff costs during the second quarter of 2025, signaling a squeeze on profit margins and reduced flexibility for product investments. At the same time, concerns persist that prolonged cost burdens will compel manufacturers to adjust MSRPs upward and defer the deployment of next-generation safety technologies in entry-level vehicles popular among first-time teen drivers.

Trade uncertainties also incentivize the redistribution of component sourcing strategies, with some suppliers exploring nearshoring options or capacity expansions within the United States. However, the logistical complexity of re-engineering multi-tier supply networks and the time required to establish compliant domestic manufacturing facilities present significant constraints. This environment underscores the importance of agile partnership models and localized assembly capabilities for device vendors and OEMs seeking to maintain cost competitiveness amid tariff volatility.

Unlocking Strategic Insights from Application, Technology, Connectivity, Deployment, and Distribution Segmentation for Teen Driver Technology

The Application Type segmentation offers a detailed lens into how teen driver technology meets distinct safety objectives. Within Driving Behavior Analysis, solutions focus on detecting acceleration patterns and hard braking events, providing actionable feedback to curb aggressive maneuvers. Emergency Response applications ensure rapid connection to first responders in the event of a collision, while Safety & Security features such as geofencing alerts, real-time tracking and speed alert systems enhance parental oversight. Usage-Based Insurance applications then translate real-time driving data into actuarial insights, with Pay-As-You-Drive models charging premiums per mile and Pay-How-You-Drive schemes adjusting rates based on driving discipline and consistency.

Technology Type segmentation reveals the diverse hardware and software architectures underpinning teen driver safety systems. Bluetooth peripherals enable short-range connectivity for driver monitoring kits, whereas GPS solutions-available in both smartphone-based and standalone form factors-provide precise location and route analytics. Mobile applications on Android and iOS platforms serve as user interfaces for alerting and coaching, complemented by RFID for secure driver authentication. More sophisticated telematics platforms appear as either Aftermarket Telematics devices that can be retrofitted to older vehicles or Embedded Telematics systems factory-installed to support seamless data capture and over-the-air upgrades.

Connectivity Type segmentation underscores the critical role of network infrastructure. Bluetooth remains essential for in-vehicle sensor networks, cellular connectivity powers cloud-based data aggregation and remote monitoring, satellite links ensure coverage in isolated regions, and Wi-Fi facilitates high-speed data transfers during charging or idle periods. Each connectivity modality offers a trade-off between bandwidth, reliability and power consumption, influencing device design and user experience.

Deployment Mode segmentation categorizes solutions based on integration depth. Embedded systems offer the most seamless operation and minimal end-user intervention, yet require OEM collaboration. Plug-In devices offer a balance of portability and functionality, connecting to standard OBD-II ports without permanent modification. Fully Portable units, often smartphone centralized, deliver maximum flexibility across multiple vehicles. The Distribution Channel segmentation then highlights routes to market: Aftermarket channels enable rapid customer acquisition through retailers and installers, Direct-To-Consumer strategies leverage online and app-store presence for software engagements, and OEM partnerships integrate solutions at the point of vehicle manufacture to maximize scale and consistency.

This comprehensive research report categorizes the Teen Driver Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Connectivity Type

- Deployment Mode

- Application Type

- Distribution Channel

Exploring Regional Dynamics and Adoption Patterns Across Americas, EMEA, and Asia-Pacific for Teen Driver Technology Solutions

In the Americas, the United States leads global adoption of teen driver technology through a combination of regulatory mandates and insurance-driven incentives. Major carriers such as Progressive report that one-in-four parents use usage-based apps to monitor their teen’s driving behavior, leveraging speed alerts, hard braking warnings and location tracking to reinforce safe habits. Canada’s insurer partnerships mirror this trend, with telematics-enabled learner policies emerging in provinces with stricter graduated licensing requirements. Regional advocacy initiatives continue to drive awareness, with state and provincial authorities collaborating on public education campaigns and incentive programs.

In Europe, adoption rates vary widely across markets. Italy has emerged as a frontrunner, with approximately a quarter of personal auto policies incorporating telematics, while the U.K. and France see double-digit penetration driven by high liability costs among young drivers and strong regulatory support for digital safety tools. Germany’s telematics integration is accelerating from a lower base, as major insurers introduce behavioral models and mobile-first programs. Privacy and data protection under the GDPR framework remain paramount, shaping feature sets and user consent workflows across all EMEA jurisdictions.

The Asia-Pacific region presents a mosaic of opportunities. Japan’s mature insurance market has embraced telematics through partnerships like Toyota Insurance Services, which offers pay-how-you-drive policies integrated with onboard vehicle sensors. South Korea has followed suit, promoting usage-based pricing as part of government road safety drives. China’s vast population and rapid smartphone penetration are fueling experimentation by local insurers such as Ping An, which piloted AI-driven driving behavior scoring in major urban centers. While regulatory frameworks are still evolving, the region’s appetite for mobile-centric solutions positions it as a high-growth frontier for both OEMs and tech innovators.

This comprehensive research report examines key regions that drive the evolution of the Teen Driver Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators and Impactful Players in the Teen Driver Technology Ecosystem Driving Market Evolution

Several legacy automotive manufacturers have seized first-mover advantages in the teen safety domain. Ford’s MyKey, a pioneer of programmable key technology, laid the groundwork for parental control features that prevent disabling critical safety systems and enforce speed thresholds. General Motors extended this lineage with its Teen Driver system, providing in-vehicle report cards detailing maximum speed, distance driven and safety feature engagement. Hyundai and Kia’s Blue Link brought geofencing alerts to the mainstream, notifying guardians when pre-defined boundaries are crossed. Toyota’s Entune and Lexus suite integrated remote vehicle control and telematics within mobile apps, while Honda and Acura’s Driver Coaching App now leverages Apple CarPlay to deliver real-time performance coaching and end-trip scoring.

Beyond OEM offerings, a new wave of technology companies has emerged to fill aftermarket and mobile-first niches. OCTO Telematics, originally based in Europe, has introduced smartphone crash detection that converts phone accelerometers into active safety sensors, automatically alerting emergency services upon severe impact. Life360’s popular family safety app incorporates collision detection, SOS dispatch and detailed driving reports to bolster peace of mind. Bouncie’s plug-in OBD-II device delivers location updates every 15 seconds and comprehensive driving analytics, catering to parents seeking turnkey monitoring solutions. Each of these players is forging partnerships with insurers to embed telematics insights into usage-based premiums, driving broader acceptance and continuous innovation across the ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Teen Driver Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Azuga Inc.

- CalAmp Corporation

- Continental AG

- Denso Corporation

- Geotab, Inc.

- Lytx, Inc.

- Magna International Inc.

- Mobileye Global Inc.

- Nauto Inc.

- Panasonic Corporation

- Robert Bosch GmbH

- Samsara Inc.

- Seeing Machines Limited

- Smart Eye AB

- SmartDrive Systems, Inc.

- Trimble Inc.

- TrueMotion, Inc.

- Valeo S.A.

- Verizon Connect, Inc.

Actionable Strategic Recommendations for Industry Leaders to Seize Opportunities and Mitigate Emerging Teen Driver Technology Risks

Industry leaders should prioritize the development of advanced analytics capabilities that harness artificial intelligence and machine learning to derive predictive insights from driving data. By integrating cognitive models that detect subtle risk indicators-such as microsleep patterns or erratic steering inputs-companies can transition from reactive event reporting to anticipatory risk mitigation, offering parents and insurers prescriptive guidance before critical incidents occur.

To fortify competitive positioning, organizations must accelerate collaborations with OEMs to embed safety solutions directly within vehicle architectures. Deep integration of telematics hardware and software at the factory level reduces system latency, enhances data fidelity and supports seamless over-the-air updates. Such partnerships can also hedge against tariff-induced cost fluctuations by localizing component assembly and simplifying certification pathways for new technologies.

Operational agility in supply chain management is essential to navigate the uncertainties of the 2025 tariff environment. Companies should diversify procurement sources, evaluate near-shoring opportunities for critical components, and leverage free trade agreement provisions to minimize duty exposure. Advanced planning and strategic stockholding can mitigate short-term disruptions, while long-term investments in domestic manufacturing capacity will deliver cost resilience and supply continuity.

Finally, stakeholders are encouraged to forge closer alliances with insurance firms to co-create tailored usage-based insurance products that align with teen driver risk profiles. By designing joint value propositions-combining telematics data, behavioral incentives and educational content-companies can unlock bundled offerings that drive adoption, improve retention and reinforce safer driving cultures among young licensees.

Detailing Rigorous Research Methodologies and Data Collection Approaches Underpinning the Teen Driver Technology Market Analysis

This analysis integrates primary research conducted through in-depth interviews with industry executives spanning OEMs, telematics device manufacturers and insurance providers, capturing firsthand perspectives on technology roadmaps, pricing strategies and regulatory compliance. Complementing these interviews, a quantitative survey of over 200 parents of teen drivers probed usage patterns, feature preferences and purchase drivers to ensure consumer relevance and behavioral validity.

Secondary research encompassed a systematic review of government databases, including NHTSA crash and licensing statistics, cross-referenced with state GDL frameworks to map legislative influences on technology adoption trends. Additionally, industry journals, academic publications and white papers on mobile telematics, AI in transportation safety and ADAS interoperability provided technical context and validated emerging use cases.

Data triangulation methodologies were applied to reconcile discrepancies between public sources and proprietary insights, ensuring analytical rigor and reducing bias. A detailed segmentation matrix was then constructed to align product features, deployment models and distribution channels with user requirements and stakeholder objectives. This robust methodological framework underpins the reliability and strategic guidance offered throughout this executive summary.

Quality assurance procedures included peer review by subject matter experts in automotive technology and road safety, as well as validation workshops with select parent focus groups and insurer partners. The iterative feedback process refined interpretive models and reinforced the practical applicability of findings to real-world decision-making scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Teen Driver Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Teen Driver Technology Market, by Technology Type

- Teen Driver Technology Market, by Connectivity Type

- Teen Driver Technology Market, by Deployment Mode

- Teen Driver Technology Market, by Application Type

- Teen Driver Technology Market, by Distribution Channel

- Teen Driver Technology Market, by Region

- Teen Driver Technology Market, by Group

- Teen Driver Technology Market, by Country

- United States Teen Driver Technology Market

- China Teen Driver Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Insights on How Teen Driver Technology Innovations Are Paving the Way for Safer Roads While Navigating Regulatory and Trade Challenges

Teen driver technology is revolutionizing the way young drivers learn, practice and internalize safe driving behaviors. As integrated telematics modules and mobile-first platforms become ubiquitous, families gain unprecedented visibility into driving performance, enabling targeted interventions and reinforcing adherence to traffic regulations. The confluence of smartphone penetration, AI-driven insights and embedded vehicle systems points toward a future where continuous coaching and automated safety responses significantly reduce crash rates among novice drivers.

Yet the industry must navigate a complex landscape of trade policy, supply chain realignment and divergent regional regulations. The 2025 tariff programs pose cost and logistical challenges that require agile procurement strategies and collaborative sourcing models. Meanwhile, data privacy and GDPR compliance in EMEA, along with consumer comfort levels in North America, demand transparent user consent frameworks and robust cybersecurity architectures.

Strategic segmentation-from application types such as usage-based insurance to deployment modes spanning embedded to portable devices-enables firms to tailor offerings for distinct user personas and regional market conditions. By leveraging key insights on connectivity preferences, regional adoption rates and partner ecosystems, organizations can capitalize on growth corridors and mitigate friction points.

Ultimately, sustained innovation and cross-sector collaboration hold the key to unlocking the full potential of teen driver technology. The insights presented in this summary offer a roadmap for stakeholders to prioritize investments, align with emerging policy imperatives and deliver impactful safety solutions that resonate with families, regulators and insurers alike.

Partner with Ketan Rohom to Access Exclusive Teen Driver Technology Market Insights and Secure Your Competitive Edge Today in an Evolving Safety Landscape

To explore how this comprehensive analysis can inform your strategic decision-making and support your growth initiatives, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan can provide tailored insights, exclusive data excerpts, and flexible engagement options to ensure your organization fully leverages the latest developments in teen driver technology. Contact Ketan Rohom to secure your copy of the full market research report and take decisive action in an evolving safety innovation landscape

- How big is the Teen Driver Technology Market?

- What is the Teen Driver Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?