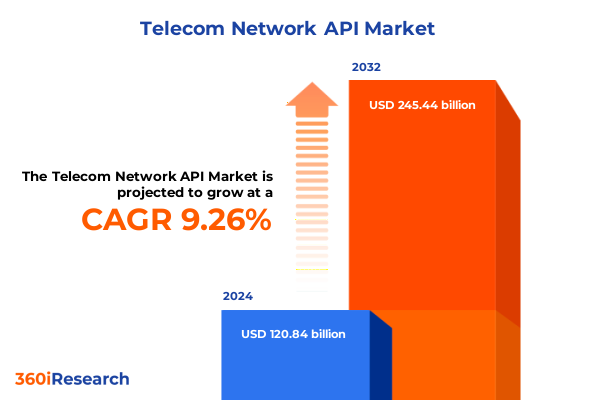

The Telecom Network API Market size was estimated at USD 131.84 billion in 2025 and expected to reach USD 142.24 billion in 2026, at a CAGR of 9.28% to reach USD 245.44 billion by 2032.

Unlocking the Future of Telecom Network APIs Through Seamless Connectivity and Strategic Innovation in a Rapidly Evolving Digital Landscape

The telecom network API landscape stands at the confluence of rapid digitization and soaring demands for seamless connectivity, prompting leaders to rethink legacy infrastructure and service models. As enterprises and developers seek to integrate voice, messaging, location, and authentication functions directly into applications, network operators and service providers are forging new pathways for collaboration. This shift marks a pivotal moment where telecom capabilities are no longer confined to hardware or siloed platforms, but rather exposed through programmable interfaces that democratize access to core network services.

This analysis begins by contextualizing the emergence of API-driven ecosystems as the backbone of modern communication services. It underscores how identity and authentication mechanisms now play a critical role in securing user interactions, while voice and WebRTC APIs deliver real-time engagement across digital channels. In parallel, payment and messaging APIs enable frictionless transactions and timely notifications, reinforcing the essential nature of these interfaces for mobile-first and cloud-native architectures.

Transitioning from foundational concepts, the introduction also highlights how agile development practices and microservices architectures have lowered integration barriers, empowering non-traditional players to embed telecom functionalities into a diverse array of vertical applications. From consumer-facing chatbots to enterprise-grade IoT platforms, the programmable network paradigm fosters innovation by bridging service providers with software ecosystems. Ultimately, this opening section sets the stage for a deeper examination of market shifts, policy influences, and segmentation nuances shaping the next era of telecom network APIs.

Navigating Transformative Shifts in the Telecom API Landscape Driven by Emerging Technologies and Changing Digital Service Demands

Over the past few years, the telecom network API ecosystem has undergone transformative shifts driven by the maturation of 5G, the proliferation of edge computing, and a heightened emphasis on security and automation. The rollout of 5G networks has significantly reduced latency and boosted bandwidth, enabling more sophisticated use cases that range from immersive virtual experiences to mission-critical IoT deployments. Concurrently, edge compute integration with network APIs brings processing closer to end devices, enhancing responsiveness for applications such as autonomous vehicles and remote health monitoring.

Moreover, developers now demand unified interfaces that abstract underlying network complexity, prompting API providers to standardize protocols and offer SDKs, plug-and-play integration modules, and low-code development environments. This trend has been further accelerated by the broad adoption of containerization and Kubernetes orchestration, which facilitate scalable, multi-cloud deployments. In this evolved landscape, the competitive battleground has shifted from network coverage alone to the agility and comprehensiveness of API portfolios.

Transitioning to regulatory influences, compliance requirements around data privacy and lawful interception have spurred the incorporation of advanced identity and authentication capabilities directly within core API platforms. As network operators adapt to stringent data sovereignty rules, they are embedding granular access controls and audit trails into their programmable interfaces, fostering trust among enterprise and government customers. These converging forces-5G expansion, edge integration, developer empowerment, and regulatory compliance-define the transformative undercurrents reshaping the telecom network API market today.

Analyzing the Far-Reaching Cumulative Impact of United States Tariffs Implemented in 2025 on Telecom Network API Ecosystem and Supply Chains

The United States’ imposition of targeted tariffs in early 2025 on imported network components has reverberated across the telecom API ecosystem, reshaping cost structures and strategic sourcing decisions. These duties, applied to equipment and modules primarily sourced from key international markets, have elevated hardware expenses for both established carriers and new entrants. In response, many operators accelerated efforts to localize supply chains and invest in domestic manufacturing partnerships, mitigating tariff exposure while fostering regional resiliency.

Furthermore, API providers have encountered pass-through cost pressures, compelling them to reevaluate pricing models and contract terms with enterprise customers. Some innovative firms have offset these increases by optimizing software stacks, shifting from resource-intensive on-premises deployments to cloud-native, serverless architectures that reduce reliance on physical infrastructure. This strategic pivot underscores a broader industry move towards software-defined networking and infrastructure-as-code frameworks, enabling faster feature rollout and lower total cost of ownership.

Transitioning to ecosystem dynamics, the tariff environment has catalyzed partnerships between telecom operators and API platforms to co-invest in manufacturing research and development, particularly for next-generation radio access networks and edge devices. These collaborations are designed to unlock advanced capabilities-such as network slicing and private 5G deployments-while controlling component costs. Overall, the cumulative impact of the 2025 tariffs has prompted a rebalancing of capital allocation, accelerated innovation in software-centric solutions, and deepened cross-industry alliances that will influence market trajectories through the latter half of the decade.

Revealing Crucial Segmentation Insights That Illuminate Diverse Service Types Technologies Deployment Models Subscription Preferences and End User Verticals

An in-depth segmentation analysis uncovers how service type distinctions delineate distinct value propositions for identity and authentication versus messaging and voice APIs, each addressing unique developer requirements and compliance mandates. While identity and authentication interfaces underpin secure onboarding and fraud prevention, messaging and payment APIs facilitate customer engagement and digital commerce, with WebRTC services enabling rich real-time communications that blend voice, video, and data streams seamlessly within applications.

When examining technological layers, the evolution from 2G through 5G has unlocked new performance thresholds; earlier cellular generations supported basic voice and messaging, whereas the 5G era accelerates high-bandwidth, low-latency applications such as immersive AR/VR and industrial automation. This evolution influences API adoption patterns, as developers leverage advanced network capabilities through standardized endpoints rather than bespoke integrations. Deployment models further differentiate the market, with public cloud–hosted APIs offering rapid scalability and lower entry barriers, contrasted by private deployments that serve sensitive enterprise and government workloads requiring dedicated resources and strict data governance.

Subscription type also plays a critical role: postpaid arrangements often align with large-scale enterprise and government contracts that demand volume-based pricing and service level guarantees, while prepaid models cater to agile startups and consumer-facing platforms seeking predictable cost structures. Finally, end user verticals reveal divergent trajectories: consumer-centric applications drive demand for high-volume messaging and authentication, small enterprises favor turnkey voice and payment bundles, and large enterprises invest in bespoke API integrations to underpin digital transformation initiatives. Government use cases prioritize secure, auditable interfaces for public safety, civic services, and regulatory reporting. These segmentation insights collectively guide vendors in tailoring offerings to nuanced market segments and capturing emerging growth pockets.

This comprehensive research report categorizes the Telecom Network API market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Technology

- Deployment Model

- Subscription Type

- End User Vertical

Examining Key Regional Insights to Highlight Variations in API Adoption Infrastructure Investments and Regulatory Environments Across Major Geographies

Regional disparities in API adoption reflect varying stages of network maturity and regulatory environments across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, robust 5G rollouts combined with mature cloud infrastructures have accelerated enterprise investments in real-time messaging and voice APIs, particularly within fintech and e-commerce verticals. North American operators are increasingly partnering with hyperscale cloud providers to offer converged network and platform services, reducing time-to-market for API-driven applications.

Across Europe, Middle East and Africa, a mosaic of regulatory frameworks around data privacy and telecom licensing has fostered a cautious yet innovative environment. Organizations in this region often leverage private deployments to satisfy stringent data sovereignty rules, while pan-regional API providers optimize their platforms to accommodate localization requirements. Meanwhile, Middle Eastern governments are championing digital infrastructure initiatives that promote public safety APIs and smart city solutions, supported by strategic partnerships with global technology leaders.

In the Asia-Pacific region, the rapid expansion of digital payments, mobile banking, and superapp ecosystems has underpinned surging demand for secure authentication and messaging APIs. The proliferation of prepaid subscription models among consumer segments has driven high-volume, low-cost API usage, while government programs aimed at digital inclusion have fueled investments in voice and location services to support emergency communications and rural connectivity. Overall, these regional insights underscore the importance of tailored go-to-market strategies that align with local infrastructure readiness, regulatory constraints, and customer preferences.

This comprehensive research report examines key regions that drive the evolution of the Telecom Network API market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Key Company Insights Highlighting Strategic Partnerships Innovations and Competitive Dynamics Among Leading Telecom API Providers

Leading telecom API providers have forged strategic partnerships with cloud hyperscalers, device manufacturers, and system integrators to enhance their service portfolios. Some vendors have integrated AI-driven fraud detection and analytics engines directly into their authentication and messaging platforms, delivering real-time risk scoring and deep behavioral insights. Others have expanded into adjacent verticals by embedding payment and commerce modules within unified developer portals, offering end-to-end transaction flows alongside communication capabilities.

Competitive dynamics reveal a bifurcation between incumbents who leverage expansive network footprints and emerging disruptors who champion agility and developer-centric tooling. The former often bundle APIs into comprehensive network suites, appealing to large enterprises with complex requirements, while the latter differentiate through intuitive documentation, code samples, and community support networks. A rising trend involves white-label API marketplaces that curate multi-vendor offerings under single contracts, enabling buyers to tailor functionality mix without engaging multiple suppliers.

Furthermore, some companies have invested heavily in open-source SDK contributions and standards bodies, driving interoperability across 3GPP specifications and emerging network architectures. These efforts aim to reduce vendor lock-in and foster ecosystem growth, particularly for cloud-native network functions and edge compute integration. Collectively, these company insights illustrate the strategic imperatives of innovation, partnership, and community engagement shaping the competitive landscape of telecom network APIs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Telecom Network API market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- América Móvil S.A.B. de C.V

- AT&T Inc

- Bharti Airtel Limited

- China Mobile Limited

- China Telecom Corp Ltd

- China Unicom Limited

- Cisco Systems Inc

- Deutsche Telekom AG

- Ericsson

- Google LLC

- Huawei Technologies Co Ltd

- Mavenir Systems Inc

- Microsoft Corporation

- Nokia Corporation

- Orange S.A.

- Reliance Jio Infocomm Limited

- Singtel Optus Pty Limited

- T-Mobile US Inc

- Telefónica S.A.

- Telnyx LLC

- Telstra Corporation Limited

- Twilio Inc

- Verizon Communications Inc

- Vodafone Group Plc

Formulating Actionable Recommendations That Empower Industry Leaders to Maximize Growth Security and Competitive Advantage in Telecom API Markets

Industry leaders should prioritize the development of modular API bundles that allow customers to incrementally adopt functionality based on specific use cases rather than monolithic suites. This approach accelerates initial deployments, reduces integration risk, and paves the way for upsell across adjacent services. By designing usage-based pricing frameworks with transparent metrics and predictable tiers, providers can align commercial models to customer needs, foster trust, and accelerate contract negotiations.

Moreover, integrating advanced analytics dashboards within API management platforms empowers enterprises to monitor performance, detect anomalies, and optimize resource allocation in real time. Such visibility becomes critical when supporting high-volume or mission-critical applications. In parallel, forging strategic alliances with cloud hyperscalers and edge compute specialists will enable the delivery of differentiated low-latency services and support hybrid deployment scenarios, catering to both global enterprises and regional operators.

To address evolving security and compliance demands, stakeholders should embed zero-trust principles directly into API gateways, incorporating multifactor authentication, end-to-end encryption, and contextual access policies. These measures not only protect sensitive data but also simplify audit readiness for regulated industries. Finally, investing in developer enablement through robust documentation, sandbox environments, and dedicated support channels will cultivate loyal communities and drive organic growth. Collectively, these actionable recommendations equip industry leaders with a clear roadmap to elevate their telecom network API strategies.

Detailing a Robust Research Methodology Integrating Primary and Secondary Data Validation to Ensure Comprehensive and Reliable Market Insights

This research employed a hybrid methodology that combined primary interviews with senior executives at service providers, API platform vendors, and system integrators, alongside secondary data pulled from regulatory filings, industry whitepapers, and public financial disclosures. Primary engagement involved structured interviews and workshops designed to capture qualitative insights into strategic priorities, technology roadmaps, and tariff impact assessments. Secondary sources provided quantitative context around network deployments, API usage trends, and investment patterns across global regions.

Data triangulation ensured the validity of findings by cross-referencing interview observations with financial performance metrics and publicly available industry benchmarks. Key performance indicators such as API call volumes, average revenue per user, and security incident rates were analyzed to identify patterns and anomalies. In addition, scenario analysis was conducted to evaluate the potential effects of tariff adjustments, regulatory shifts, and technology rollouts on market dynamics over a multi-year horizon.

To enhance transparency and reproducibility, all data collection processes, from sample selection to interview protocols, followed rigorous documentation standards. The research team also engaged subject-matter experts in edge computing, 5G architecture, and cybersecurity to review draft findings and validate technical accuracy. This comprehensive methodology underscores the robustness of the insights presented and ensures that the conclusions drawn reflect a balanced, empirically grounded understanding of the telecom network API market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Telecom Network API market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Telecom Network API Market, by Service Type

- Telecom Network API Market, by Technology

- Telecom Network API Market, by Deployment Model

- Telecom Network API Market, by Subscription Type

- Telecom Network API Market, by End User Vertical

- Telecom Network API Market, by Region

- Telecom Network API Market, by Group

- Telecom Network API Market, by Country

- United States Telecom Network API Market

- China Telecom Network API Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Insights That Synthesize Market Dynamics Strategic Drivers and Emerging Opportunities in the Evolving Telecom Network API Landscape

In conclusion, the telecom network API market is experiencing a period of accelerated innovation driven by the convergence of advanced network technologies, shifting regulatory landscapes, and evolving developer expectations. The integration of identity and authentication, messaging, voice, payment, location, and WebRTC interfaces within unified platforms is redefining how applications leverage network capabilities, while segmentation across service types, technologies, deployment models, subscription types, and end user verticals informs tailored market strategies.

Additionally, the cumulative impact of the 2025 tariffs has prompted a recalibration of supplier relationships, spurred investments in software-centric solutions, and deepened cross-industry collaborations that will shape future value chains. Regional variations underscore the importance of customizing go-to-market approaches to align with local infrastructure maturity and regulatory requirements. Meanwhile, company-level innovations in AI-driven security, developer enablement, and open standards participation are intensifying competitive dynamics and expanding the addressable market.

As industry stakeholders chart their paths forward, they must balance the imperatives of agility, security, and scalability. Providers who adopt modular bundling strategies, embrace zero-trust frameworks, and forge strategic cloud and edge partnerships will position themselves for sustained growth. Ultimately, the evolving telecom network API ecosystem offers a wealth of opportunities for those who can seamlessly integrate programmable network services into the next generation of digital experiences and enterprise solutions.

Compelling Call to Action Inviting Decision Makers to Engage with Associate Director Sales and Marketing to Acquire the Complete Market Research Report

To explore the comprehensive findings and strategic opportunities outlined in this market research report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through the tailored insights and actionable intelligence that can transform your growth trajectory in the telecom network API space. Engage today to secure your organization’s competitive edge by accessing the full suite of detailed analyses, in-depth case studies, and customized data frameworks designed to empower your decision-making and accelerate revenue performance.

- How big is the Telecom Network API Market?

- What is the Telecom Network API Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?