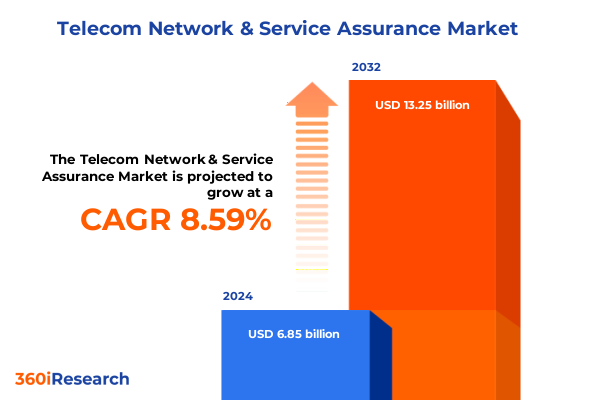

The Telecom Network & Service Assurance Market size was estimated at USD 7.32 billion in 2025 and expected to reach USD 7.97 billion in 2026, at a CAGR of 8.84% to reach USD 13.25 billion by 2032.

Understanding the Pivotal Role of Telecom Network and Service Assurance in Driving Operational Resilience and Unmatched Customer Satisfaction Across Industries

In the accelerating digital economy, telecom network and service assurance has become the bedrock for organizations striving to deliver uninterrupted connectivity and exceptional end-user experiences. As data volumes soar and service demands evolve, network operators and enterprises alike recognize that real-time visibility and proactive issue resolution are critical to sustaining business continuity. This introductory section lays the groundwork by exploring how assurance frameworks integrate monitoring, analytics, and automated remediation to maintain optimal performance across complex multi-vendor infrastructures.

Recent industry developments have underscored the need for holistic assurance approaches that transcend legacy silos. Carriers are adopting unified platforms to correlate performance metrics, fault events, and customer feedback, enabling faster root-cause analysis and service restoration. At the same time, regulated sectors such as government and utilities emphasize compliance and transparency, driving the adoption of end-to-end assurance solutions that support stringent service-level agreements. Understanding this pivotal role illuminates why networks cannot operate as passive conduits but must evolve into self-healing, intelligent ecosystems that proactively safeguard revenue and reputation.

By embedding advanced analytics, machine learning, and closed-loop automation, organizations can shift from reactive troubleshooting to predictive assurance. This transformation not only reduces mean-time-to-repair but also empowers stakeholders to make data-driven decisions that optimize capacity planning, enhance security posture, and elevate customer satisfaction. As the foundation for subsequent discussions, this section underscores the strategic importance of robust network and service assurance in an increasingly connected world.

Exploring the Most Transformative Technological Shifts and Market Disruptions Reshaping the Future of Telecom Network and Service Assurance Solutions Globally

Over the past decade, the telecom assurance landscape has been revolutionized by several intersecting trends that are reshaping how operators and enterprises manage network health. First, the proliferation of edge computing has introduced a distributed architecture where data processing occurs closer to end users, demanding assurance tools that can operate at the network edge with minimal latency. Concurrently, the convergence of 5G networks with IoT deployments has exponentially increased the number of connected devices, making end-to-end visibility and granular performance monitoring more essential than ever.

Meanwhile, the integration of artificial intelligence and machine learning into assurance platforms is enabling unprecedented levels of predictive insight. Rather than relying solely on threshold-based alarms, next-generation solutions leverage anomaly detection algorithms trained on historical operational data to forecast potential degradations before they impact services. This shift toward proactive assurance is further supported by intent-based networking, which automates policy enforcement and configuration management, reducing manual intervention and accelerating response times.

Finally, the rise of cloud-native architectures and containerized network functions has transformed solution deployment models, prompting assurance vendors to redesign their offerings for dynamic, microservices-driven environments. These transformative shifts-edge distribution, AI-driven analytics, intent-based automation, and cloud-native flexibility-collectively redefine expectations for network and service assurance, setting a new bar for reliability, scalability, and agility.

Assessing the Cumulative Impact of United States Tariffs on the Telecom Network and Service Assurance Ecosystem Throughout 2025 and Future Investment Decisions

In 2025, United States import tariffs continue to exert significant influence on the telecom network and service assurance market, particularly through the sustained application of Section 301 duties on communications equipment and related components. These measures, initially enacted to address trade imbalances, have led to a persistent increase in hardware procurement costs, prompting vendors and operators to reassess sourcing strategies and supply chain resilience. The result has been a growing emphasis on regional manufacturing partnerships and alternative supplier networks to mitigate cost pressures and avoid potential disruptions.

Moreover, the tariffs have accelerated the adoption of software-centric assurance models, as organizations seek to offset higher capital expenditures on physical infrastructure by investing in advanced assurance software that can extend the lifecycle of existing assets. This pivot has bolstered demand for cloud-based and virtualized assurance solutions, which reduce deployment complexity and offer more predictable operational expense profiles. However, the transition also introduces integration challenges, requiring seamless interoperability between legacy appliances and modern platforms to ensure comprehensive monitoring and management coverage.

Looking ahead, the cumulative impact of these tariffs underscores the importance of strategic procurement planning and flexible assurance architectures. Companies that proactively reconcile cost considerations with performance requirements-while maintaining rigorous service-level objectives-will be best positioned to navigate an environment where tariff policies and geopolitical dynamics continue to evolve. Ultimately, this environment drives innovation in both product development and go-to-market strategies across the assurance ecosystem.

Deriving Actionable Insights from Comprehensive Segmentation Framework to Unlock Growth Opportunities in Telecom Network and Service Assurance Markets

A nuanced understanding of the telecom network and service assurance market emerges when examining multiple segmentation dimensions. Based on organization size, the landscape bifurcates into large enterprises-where complexity and scale drive demand for end-to-end, fully integrated assurance platforms-and small and medium enterprises, which often prioritize cost-effective, modular solutions that can be incrementally deployed. In terms of end users, commercial enterprises require customized assurance suites to support diverse vertical applications, government agencies demand compliance-focused frameworks with audit capabilities, and telecom operators seek carrier-grade performance monitoring across their expansive infrastructures.

Examining component segmentation reveals that services encompass both managed offerings-ranging from foundational consulting to implementation and integration projects-and professional services, which deliver specialized expertise for custom analytics and automation workflows. Solutions are further categorized into licensing of proprietary assurance software and ongoing maintenance and support agreements to ensure continuous updates and technical assistance. When considering deployment modes, on-premises implementations appeal to organizations with strict data sovereignty requirements, while cloud deployments-whether private clouds for greater control or public clouds for elasticity-enable rapid scaling and a shift to subscription-based consumption models.

Finally, solution types delineate customer experience assurance, which focuses on end-user quality metrics; network assurance, comprising fault management to detect and resolve alarms and performance monitoring to optimize throughput and latency; and service assurance, which spans configuration management for standardized network deployments and policy management to enforce governance across dynamic network topologies. Together, these segmentation insights form the foundation for targeted product development, tailored go-to-market strategies, and differentiated value propositions.

This comprehensive research report categorizes the Telecom Network & Service Assurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Organization Size

- Component

- Deployment Mode

- Solution Type

- End User

Unveiling Critical Regional Dynamics, Growth Drivers, and Market Nuances Shaping the Telecom Network and Service Assurance Landscape across Global Regions

The telecom network and service assurance market exhibits distinct regional characteristics that inform strategic priorities. In the Americas, investment is largely driven by telco operators modernizing legacy infrastructures to accommodate 5G rollouts and cloud-native network functions. The emphasis on distributed assurance tools reflects the geographic diversity and evolving regulatory requirements across North, Central, and South America, where service providers aim to maintain consistent quality while controlling operational costs.

Turning to Europe, Middle East & Africa, the landscape is shaped by strict data protection standards and the digital sovereignty initiatives of national governments. Operators and enterprises in this region increasingly adopt hybrid assurance architectures that balance on-premises control with cloud-hosted analytics, ensuring compliance without sacrificing agility. Growth in Africa is propelled by expanding mobile broadband penetration and the need for robust fault management in remote and high-growth markets.

In the Asia-Pacific region, rapid urbanization and the proliferation of smart city projects fuel demand for granular performance monitoring and automated policy enforcement. Leading economies such as China, India, and Japan are pioneering large-scale deployments of AI-powered assurance platforms to support IoT ecosystems and mission-critical applications. Across Asia-Pacific, the interplay of local vendor ecosystems and global technology providers creates a competitive environment where scalable, cost-efficient assurance solutions gain traction.

This comprehensive research report examines key regions that drive the evolution of the Telecom Network & Service Assurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements and Competitive Positioning of Leading Companies in the Telecom Network and Service Assurance Domain and Ecosystem Evolution

Leading technology vendors and service providers are executing strategic initiatives to solidify their positions within the telecom network and service assurance domain. One major player has extended its portfolio through acquisitions of niche analytics firms, integrating advanced machine learning capabilities to augment real-time fault prediction. Another competitor has formed alliances with cloud hyperscalers to deliver turnkey assurance platforms that support hybrid deployment models, addressing the needs of both regulated industries and agile enterprises.

Meanwhile, infrastructure specialists are collaborating with telecom operators on proof-of-concept projects for edge assurance, demonstrating the value of decentralized monitoring in latency-sensitive applications. These pilots serve as testbeds for containerized assurance components that can be dynamically deployed alongside virtualized network functions. Simultaneously, a cohort of software-centric challengers is differentiating through open-source integration frameworks and flexible licensing models, appealing to organizations seeking to leverage community-driven innovation while minimizing vendor lock-in.

Competitive positioning also hinges on comprehensive support ecosystems. Several incumbents have expanded their global service footprints, offering 24/7 technical assistance, consulting services, and co-innovation labs where customers can co-create customized assurance workflows. This emphasis on client proximity and continuous improvement underscores how key companies are redefining value by blending technological prowess with consultative engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Telecom Network & Service Assurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Amdocs Limited

- Broadcom Inc.

- Cisco Systems, Inc.

- Comarch S.A.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Infovista S.A.

- International Business Machines Corporation

- NEC Corporation

- NETSCOUT Systems, Inc.

- Nokia Corporation

- Spirent Communications plc

- Tata Consultancy Services Limited

- Telefonaktiebolaget LM Ericsson

- TEOCO Corporation

- Viavi Solutions Inc.

Formulating Actionable Recommendations for Industry Leaders to Accelerate Innovation and Operational Excellence in Telecom Network and Service Assurance

Industry leaders must adopt a multifaceted approach to achieve and sustain market leadership in network and service assurance. First, organizations should invest in AI-driven analytics engines that can learn from operational telemetry and automatically prioritize critical incidents. By doing so, they will reduce mean-time-to-detect and mean-time-to-repair, directly impacting service quality and customer loyalty. Furthermore, integrating assurance tools with intent-based networking frameworks enables closed-loop orchestration, eliminating manual configuration errors and accelerating remediation.

Second, companies are advised to embrace hybrid deployment strategies that combine on-premises control for sensitive workloads with the scalability of public cloud environments. Such flexibility not only enhances resilience but also supports the adoption of subscription-based consumption models, aligning CapEx and OpEx to evolving business objectives. Third, forging partnerships with edge computing providers can extend assurance capabilities to remote sites and IoT endpoints, ensuring that performance and reliability standards are consistently applied across all network segments.

Finally, executives should prioritize continuous skills development and cross-functional collaboration between operations, security, and business teams. By establishing joint KPI frameworks and investing in upskilling programs, organizations can foster a culture of proactive assurance, where stakeholder buy-in and shared accountability drive continuous improvement. Implementing these recommendations will empower industry leaders to navigate complexity and emerge as trusted guardians of network performance.

Outlining Rigorous Research Methodology and Data Validation Processes Underpinning Insights into Telecom Network and Service Assurance Market Trends

This research is grounded in a rigorous methodology that combines primary engagements with industry stakeholders and secondary analysis of reputable public and private sources. In the primary phase, structured interviews were conducted with senior executives from telecom operators, enterprise ICT leaders, and government regulators to capture firsthand perspectives on emerging assurance requirements and technology adoption roadmaps. These qualitative insights were complemented by quantitative surveys administered to network operations and customer experience professionals, providing statistically relevant data on challenges, priorities, and tool preferences.

Secondary research included a comprehensive review of regulatory filings, standards documentation, vendor white papers, and peer-reviewed journals. This ensured a balanced understanding of evolving compliance mandates, technical specifications, and performance benchmarks. To validate findings, cross-reference checks were performed against publicly disclosed financial reports, patent filings, and real-world deployment case studies. Throughout the process, a multi-tiered data triangulation approach was employed to reconcile discrepancies and reinforce the reliability of conclusions.

Analytical frameworks such as SWOT analysis and Porter’s Five Forces were applied to assess competitive dynamics, while technology adoption curves and maturity models guided the evaluation of solution readiness. By integrating these methods, the research delivers a holistic, evidence-based view of the telecom network and service assurance market, equipping stakeholders with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Telecom Network & Service Assurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Telecom Network & Service Assurance Market, by Organization Size

- Telecom Network & Service Assurance Market, by Component

- Telecom Network & Service Assurance Market, by Deployment Mode

- Telecom Network & Service Assurance Market, by Solution Type

- Telecom Network & Service Assurance Market, by End User

- Telecom Network & Service Assurance Market, by Region

- Telecom Network & Service Assurance Market, by Group

- Telecom Network & Service Assurance Market, by Country

- United States Telecom Network & Service Assurance Market

- China Telecom Network & Service Assurance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings to Provide a Cohesive Perspective on the Future of Telecom Network and Service Assurance Strategies and Investments

The synthesis of core findings illuminates a market at the intersection of rapid technological evolution and shifting regulatory landscapes. Pervasive automation, driven by AI and intent-based networking, is redefining assurance paradigms, while hybrid deployment models offer a pragmatic path to scalability and control. The enduring effects of United States tariffs have underscored the importance of flexible procurement strategies and software-centric innovation to mitigate supply chain constraints.

Segmentation analysis reveals that distinct end-user requirements-from enterprise digital transformation to government compliance mandates and carrier-grade quality standards-necessitate tailored assurance portfolios. Regional insights highlight the diversity of growth drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific, each with unique regulatory and technological catalysts. Leading companies are differentiating through strategic partnerships, acquisitions, and expanded support ecosystems that deliver both technology and domain expertise.

Collectively, these findings point to a future where proactive, predictive assurance becomes the standard, and where network reliability and customer experience are inseparable metrics of success. Organizations that align investment, architecture, and operational competencies in accordance with these insights will be poised to capture new revenue streams, mitigate risk, and foster sustained competitive advantage.

Take the Next Step toward Optimizing Your Telecom Network and Service Assurance Strategy by Securing the Comprehensive Market Research Report Today

Are you ready to elevate your strategic planning and uncover the competitive edge needed to excel in telecom network and service assurance? Engage with Ketan Rohom, Associate Director of Sales & Marketing, to learn how this in-depth report can equip your organization with the foresight and tactical guidance required to navigate emerging challenges and seize new market opportunities. Secure your copy today to gain instant access to exclusive analysis, expert recommendations, and actionable roadmaps tailored to support your growth objectives and operational excellence initiatives.

Contact Ketan Rohom now to transform insights into impact and drive tangible results in your network assurance strategy.

- How big is the Telecom Network & Service Assurance Market?

- What is the Telecom Network & Service Assurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?