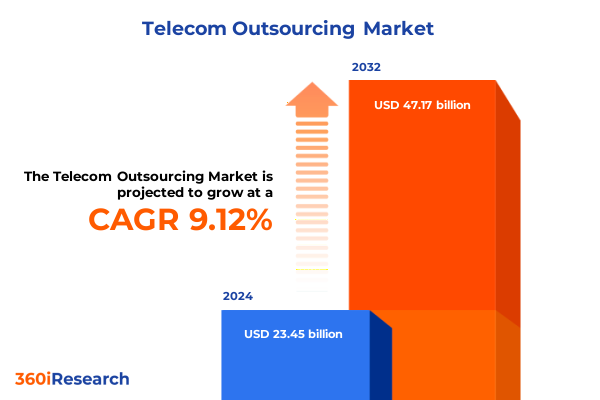

The Telecom Outsourcing Market size was estimated at USD 25.46 billion in 2025 and expected to reach USD 27.69 billion in 2026, at a CAGR of 9.21% to reach USD 47.17 billion by 2032.

Introduction to the transformative forces redefining the global telecom outsourcing landscape and the strategic priorities guiding industry leaders today toward innovation

The telecom outsourcing landscape has evolved from a cost-cutting tool to a strategic lever for innovation and growth. In recent years, service providers and enterprise buyers have increasingly recognized the potential of outsourcing to accelerate digital transformation, improve customer experience, and enhance operational resilience. This shift is shaped by a convergence of factors, including rapid advancements in network technologies, growing competitive pressures, and the need for scalable, flexible delivery models.

Moreover, as organizations strive to focus on core capabilities, the demand for specialized outsourcing partnerships has intensified. Providers now offer integrated solutions spanning software development, network design, customer support, and analytics. Consequently, decision-makers must navigate a complex ecosystem of vendors while aligning outsourcing initiatives with broader business objectives. This introduction sets the stage for understanding how transformative forces and strategic considerations are reshaping the future of telecom outsourcing.

Examining the disruptive technological, regulatory, and market shifts reshaping how organizations deploy and manage outsourced telecom services for competitive advantage

The telecom outsourcing market is undergoing a transformative renaissance driven by disruptive technologies, evolving regulatory frameworks, and changing customer expectations. Cloud-native architectures and platform-as-a-service offerings have become mainstream, enabling providers to deliver on-demand scalability and cost predictability. In addition, artificial intelligence and machine learning are embedded across network operations, empowering predictive maintenance, automated incident response, and enhanced customer insights.

Furthermore, regulatory shifts around data sovereignty and cross-border data flows are compelling enterprises to reassess their outsourcing structures and partner ecosystems. As a result, there is growing emphasis on compliance-led service delivery models and localized hosting strategies. Consequently, traditional cost-centric outsourcing paradigms are giving way to a value-centric approach that prioritizes service quality, agility, and regulatory alignment. This section delves into these dynamic shifts and their implications for both buyers and providers in the telecom outsourcing arena.

Analyzing the cumulative effects of United States 2025 tariffs on telecom outsourcing costs, supply chains, vendor relationships, and long term market dynamics

Beginning in early 2025, the United States implemented a series of tariffs targeting imported telecommunications equipment and components, reflecting broader geopolitical tensions and supply-chain security concerns. These measures have introduced a new cost dimension to outsourcing arrangements, as providers reevaluate vendor strategies and sourcing footprints. In particular, hardware-dependent services such as network maintenance and optimization have experienced direct cost escalations, prompting both buyers and sellers to explore alternative supply channels.

In addition to immediate price pressures, the tariff regime has accelerated diversification of supplier portfolios and reinforced the strategic importance of supplier risk management. Organizations are increasingly investing in dual-sourcing models and nearshoring options to mitigate exposure. Moreover, long-term market dynamics indicate a shift toward greater vertical integration by service providers, enabling them to internalize critical infrastructure components. This cumulative impact of 2025 tariffs underscores the necessity for agile sourcing strategies and continuous monitoring of trade policy developments.

Revealing nuanced insights across service types, revenue models, organization sizes, business models, and end user segments to inform targeted telecom outsourcing strategies

Segmentation by service type reveals distinct value pools across application management, business process outsourcing, customer support outsourcing, IT outsourcing, and network services. Within application management, the dichotomy of software development versus software maintenance underscores divergent priorities between innovation projects and legacy system optimizations. Simultaneously, business process outsourcing spans billing and revenue management, data management and analytics, and regulatory compliance and fraud management, each demanding specialized skill sets and regulatory expertise.

Meanwhile, customer support outsourcing bifurcates into traditional call center support and emerging remote assistance models that leverage virtual agents and augmented-reality tools. IT outsourcing services are anchored in CRM and customer analytics alongside IT infrastructure management, reflecting the dual mandate of customer experience enhancement and operational continuity. Network services extend across design and engineering, ongoing maintenance, optimization efforts, and security management, illustrating a holistic approach to network lifecycle operations. Furthermore, differentiating by revenue model, buyer organizations weigh pay-per-use against subscription-based models, with the latter divided into annual and monthly subscriptions to accommodate budgetary preferences and scalability needs.

In terms of organization size, large enterprises often seek end-to-end integrated outsourcing partnerships, whereas small and medium-sized enterprises tend to favor modular engagements. The choice between business-to-business and business-to-consumer business models also influences service requirements, with B2B arrangements emphasizing SLA-driven performance and B2C focusing on customer experience metrics. Lastly, end-user industry segments such as banking, financial services, and insurance; government and public sector; healthcare; IT and telecommunications; and media and entertainment each exhibit unique regulatory and operational imperatives. These segmentation insights highlight the necessity of tailored outsourcing strategies to align services with buyer objectives.

This comprehensive research report categorizes the Telecom Outsourcing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Revenue Model

- Organization Size

- Business Model

- End User

Uncovering critical regional variations in telecom outsourcing adoption trends and strategic priorities across the Americas, EMEA, and Asia Pacific markets

Regional dynamics continue to shape where and how telecom outsourcing services are delivered. In the Americas, robust digital infrastructure in the United States and Canada pairs with rising adoption in Latin American markets, where outsourcing is driven by cost optimization and access to skilled labor. Strategic partnerships with local providers and bilingual support capabilities are key differentiators in this region, enabling global vendors to penetrate emerging markets while maintaining service quality.

Across Europe, the Middle East, and Africa, a diverse regulatory tapestry and varying levels of digital maturity demand flexible delivery models and compliance-driven service architectures. In Western Europe, stringent data protection requirements prompt on-shore hosting and localized control, whereas Middle Eastern markets favor cloud-enabled network services to support rapid 5G rollouts. In Africa, mobile-first consumer habits and public sector digital transformation initiatives are catalysts for outsourcing uptake.

Meanwhile, Asia Pacific stands out for its blend of established markets like Japan and Australia alongside high-growth economies such as India and Southeast Asia. Enterprises in these markets leverage outsourcing to accelerate digital transformation, particularly within mobile networks and edge computing deployments. Localization of service delivery, language support, and adherence to region-specific data regulations are pivotal for success. These key regional insights illustrate the importance of localized strategies and partner ecosystems aligned with regional drivers and constraints.

This comprehensive research report examines key regions that drive the evolution of the Telecom Outsourcing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading telecom outsourcers and technology vendors to highlight competitive positioning, service innovation, partnership models, and growth trajectories

Key players in the telecom outsourcing ecosystem continue to expand their service portfolios and forge strategic alliances to capture new opportunities. Leading global system integrators and consultancy firms are increasingly bundling network services with advanced analytics and managed security offerings, creating differentiated value propositions. At the same time, specialized vendors focused on application management and support services are leveraging automation platforms to streamline operations and enhance service levels.

Strategic partnerships between hardware manufacturers and service providers have become more prevalent, blurring the lines between traditional equipment vendors and outsourcing companies. This trend enables seamless integration of network infrastructure solutions with end-to-end managed services. Furthermore, alliances with cloud hyperscalers and emerging technology startups are driving co-innovation initiatives that accelerate the development of AI-driven network optimization and remote assistance capabilities.

Competitive positioning is increasingly defined by a provider’s ability to deliver integrated, outcome-based offerings that span design, deployment, and day-to-day operations. As market leaders invest in proprietary platforms and industry-specific solutions, the competitive landscape is characterized by both consolidation and specialization. These insights into key company strategies underscore the importance of continuous innovation and collaborative ecosystems to maintain market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Telecom Outsourcing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- AT&T Inc.

- Capgemini Services SAS

- CGI Inc.

- Cognizant Technology Solutions Corporation

- Concentrix Corporation

- DXC Technology Company

- Ericsson Group

- Fujitsu Limited

- Genpact

- HCL Technologies Limited

- Hewlett Packard Enterprise Development LP

- Infosys Limited

- International Business Machines Corporation

- Lumen Technologies

- NEC Corporation

- NTT DATA, Inc.

- Sutherland Global Services, Inc.

- TATA Consultancy Services Limited

- Tech Mahindra Limited

- Teleperformance SE

- Transworld Systems Inc.

- Wipro Limited

- ZTE Corporation

Presenting strategic recommendations for industry leaders to optimize performance, enhance resilience, and capitalize on emerging opportunities in telecom outsourcing

To navigate the evolving telecom outsourcing landscape, industry leaders must adopt proactive strategies that blend innovation with operational rigor. First, embedding artificial intelligence and automation across network and support functions can unlock efficiencies and enhance service reliability. Investing in proprietary automation frameworks will enable providers to standardize processes and accelerate response times.

In addition, diversifying supplier ecosystems through dual-sourcing and near-shoring initiatives reduces exposure to geopolitical and tariff-related risks. Establishing partnerships in multiple geographies can also improve service resilience and enable localized support models. Furthermore, embracing hybrid delivery architectures that combine on-shore, near-shore, and offshore resources allows organizations to balance cost and control effectively.

Moreover, prioritizing cybersecurity and regulatory compliance in outsourcing engagements is critical as data privacy requirements intensify. Implementing robust governance frameworks and continuous monitoring capabilities ensures alignment with evolving standards. Finally, fostering collaborative relationships with technology vendors and startups through co-innovation labs can catalyze the development of next-generation services. These actionable recommendations provide a roadmap for leaders to strengthen their outsourcing strategies and capture emerging market opportunities.

Detailing the rigorous research framework, data collection techniques, and analytical approaches underpinning the comprehensive telecom outsourcing market study

This research leverages a multi-layered approach combining primary and secondary data sources to deliver rigorous and reliable insights. Initially, extensive interviews were conducted with senior executives from service providers, enterprise buyers, and technology vendors to capture firsthand perspectives on market dynamics, strategic priorities, and investment plans. These qualitative inputs were complemented by surveys of global telecom outsourcing stakeholders, ensuring broad representation across industry segments and regions.

Secondary data collection involved analyzing public company reports, regulatory filings, trade association publications, and industry white papers to validate and enrich primary findings. Proprietary databases and in-house analytical tools were employed to segment the market and identify emerging service categories. Data triangulation techniques were applied throughout, cross-referencing multiple information streams to enhance accuracy and consistency.

Finally, an expert review panel comprising telecom industry veterans and outsourced services specialists evaluated preliminary findings, providing validation and contextual nuance. This layered methodology ensures that the insights and recommendations presented are grounded in empirical evidence and industry expertise, delivering a comprehensive view of the telecom outsourcing market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Telecom Outsourcing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Telecom Outsourcing Market, by Service Type

- Telecom Outsourcing Market, by Revenue Model

- Telecom Outsourcing Market, by Organization Size

- Telecom Outsourcing Market, by Business Model

- Telecom Outsourcing Market, by End User

- Telecom Outsourcing Market, by Region

- Telecom Outsourcing Market, by Group

- Telecom Outsourcing Market, by Country

- United States Telecom Outsourcing Market

- China Telecom Outsourcing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing key findings and reflecting on the strategic implications of industry trends shaping the future of telecom outsourcing ecosystems

In conclusion, the telecom outsourcing market is at an inflection point where technological innovations, policy shifts, and evolving buyer expectations converge to redefine the nature of service delivery. Organizations that embrace automation, diversify sourcing strategies, and cultivate collaborative ecosystems will be best positioned to harness emerging opportunities while mitigating risks associated with geopolitical uncertainties and regulatory complexities.

The segmentation analysis underscores the necessity of tailoring outsourcing models to specific service types, revenue preferences, organizational scales, and industry verticals. Regional insights further highlight the importance of localized approaches aligned with market maturity levels and regulatory landscapes. As leading providers continue to innovate through strategic alliances and platform investments, the competitive playing field will reward those who can integrate agile delivery models with outcome-focused service offerings.

Ultimately, the successful navigation of this dynamic environment requires a blend of strategic foresight, operational excellence, and continuous learning. By leveraging the insights and recommendations detailed in this executive summary, decision-makers can confidently chart a course that delivers both immediate efficiencies and long-term competitive advantage.

Engage with our expert Associate Director to acquire the full comprehensive telecom outsourcing report and unlock actionable strategic insights today

We invite you to connect with Ketan Rohom, our Associate Director of Sales and Marketing and a seasoned industry expert, to secure immediate access to the comprehensive telecom outsourcing market research report.

By engaging with Ketan, you will gain personalized guidance on how the insights presented can be tailored to your organization’s strategic priorities. His in-depth understanding of market drivers, regional nuances, and competitive dynamics will ensure that you extract maximum value from the report findings.

Embrace this opportunity to equip your leadership team with data-driven recommendations and forecast-informed strategies essential for thriving in today’s complex outsourcing environment. Reach out today to transform your decision-making and unlock the full potential of outsourced telecom services.

- How big is the Telecom Outsourcing Market?

- What is the Telecom Outsourcing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?