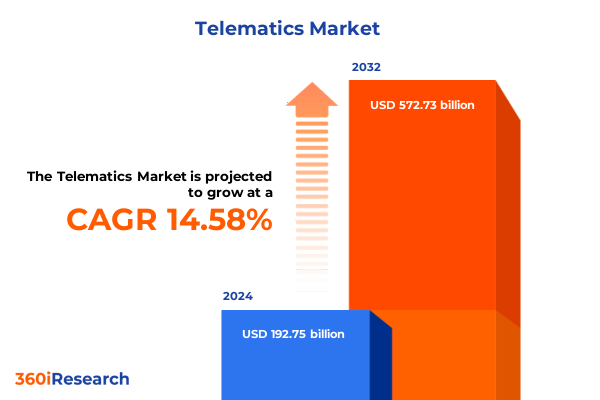

The Telematics Market size was estimated at USD 220.65 billion in 2025 and expected to reach USD 250.10 billion in 2026, at a CAGR of 14.59% to reach USD 572.73 billion by 2032.

Pioneering a New Era of Connected Mobility Through Data-Driven Telematics Solutions That Redefine Transportation Efficiency

Telematics represents the convergence of telecommunications and informatics, creating a bridge between vehicles and data ecosystems that power modern mobility. Over the past decade, this synthesis has evolved from basic GPS tracking to sophisticated platforms that capture, analyze, and act upon real-time information. As connected sensors, embedded hardware modules, and advanced software protocols continue to proliferate, organizations across industries are embedding telematics into their core operations to enhance safety, optimize performance, and deliver predictive maintenance capabilities.

Against this backdrop, the telematics landscape has witnessed rapid maturation driven by the proliferation of cloud infrastructures, the advent of high-speed wireless networks, and the strategic emphasis on data-driven decision making. Today, businesses evaluate telematics not merely as a cost center but as a strategic asset that unlocks operational efficiencies, reduces downtime, and fosters new revenue streams. This report delves into the foundational elements, emergent trends, and stakeholder imperatives that define the current phase of telematics innovation, setting the stage for a nuanced understanding of market dynamics and long-term value creation.

Harnessing Cutting-Edge Connectivity, AI-Driven Analytics, and Sustainable Infrastructure to Propel Telematics Beyond Traditional Boundaries

The telematics domain is undergoing transformative shifts driven by the integration of AI-powered analytics, resilient network architectures, and a growing emphasis on sustainable mobility. Moreover, the advent of fifth-generation cellular technologies is unlocking ultra-low latency communication, enabling vehicle-to-everything (V2X) interactions that were previously theoretical. In parallel, dedicated short range communication protocols and satellite connectivity are extending coverage into remote regions, broadening the scope of asset tracking and remote diagnostics beyond urban corridors.

In addition, telematics platforms are evolving from standalone instrumentation toward holistic ecosystems that weave together vehicle data, driver behavior insights, and external data feeds. Advanced analytics engines now ingest vast streams of sensor outputs to predict component failures, optimize routing in real time, and adapt to dynamic environmental conditions. Consequently, stakeholders are prioritizing modular architectures that support seamless integration with emerging fields such as autonomous driving and electric powertrains. This confluence of intelligent connectivity and data orchestration is redefining the boundaries of what telematics can achieve.

Evaluating the Far-Reaching Consequences of United States Tariff Measures on Telematics Hardware, Software, and Service Ecosystems in 2025

The imposition of new tariff measures in 2025 on imported telematics components has reverberated across the hardware, software, and services supply chains. Component costs for onboard diagnostic devices, sensor arrays, and telematics control units have experienced elevated pricing pressures, compelling manufacturers to reassess their sourcing models. While some organizations have absorbed incremental costs in the short term, others are exploring partnerships with domestic producers or nearshoring strategies to mitigate future exposure.

Software and service providers have also felt the ripple effects, as higher hardware prices translate into elevated total cost of ownership for end users. To remain competitive, many are adopting subscription-based models and tiered support structures that spread costs over extended service lifecycles. Concurrently, the tariff environment has catalyzed innovation in design for manufacturability, with an emphasis on component consolidation and the use of standardized modules to dilute the impact of differential import duties. Ultimately, these measures are driving a recalibration of global supply chains, fostering resilience through diversification and strategic collaboration.

Uncovering Critical Market Segmentation Dimensions That Illuminate Diverse Telematics Solutions Across Hardware, Services, Software, and End-User Applications

Insight into market segmentation reveals that telematics solutions extend across a spectrum of offerings. Within the solution category, the hardware domain encompasses onboard diagnostic devices, a variety of sensors, and telematics control units, each delivering specialized data capture capabilities. Complementing these tangible assets, service portfolios span from comprehensive managed programs to professional consultancy engagements and ongoing support frameworks. Meanwhile, software modules encompass analytics and reporting platforms alongside fleet management interfaces and navigation suites, forming the digital backbone of connected operations.

Connectivity types further delineate market opportunities, with cellular networks dissected by generation alongside dedicated short range communication standards and satellite links that ensure pervasive coverage. The cellular segment itself stratifies into fifth-generation, fourth-generation, and legacy second and third-generation networks. Vehicle typologies ranging from commercial fleets and electric vehicles to passenger cars and two-wheelers underscore the breadth of application contexts. Deployment models oscillate between cloud-native environments and on-premises infrastructures, while application areas include fleet orchestration, stolen vehicle recovery, usage-based insurance, and basic vehicle tracking. Finally, end-user sectors span automotive OEMs, consumer electronics vendors, insurance firms, and transportation and logistics providers, each leveraging telematics in unique ways to drive productivity and competitive differentiation.

This comprehensive research report categorizes the Telematics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Connectivity Type

- Vehicle Type

- Deployment Type

- Application

- End User

Mapping Distinct Regional Dynamics and Growth Drivers That Define Telematics Adoption Across the Americas, EMEA, and Asia-Pacific

Regional dynamics in the telematics space reflect contrasting adoption curves and regulatory frameworks. In the Americas, emphasis on fleet optimization and compliance with safety mandates has accelerated uptake of advanced tracking and behavioral analytics tools. Leading logistics operators are partnering with telematics specialists to reduce idle times, streamline last-mile delivery, and enhance driver coaching programs.

Across Europe, the Middle East, and Africa, regulatory initiatives-such as mandatory installation of e-call devices and stringent emissions standards-have catalyzed demand for integrated telematics offerings that blend navigation, environmental monitoring, and emergency response features. Differing levels of infrastructure maturity and spectrum allocation policies have also shaped diverse market trajectories within EMEA.

In the Asia-Pacific sphere, rapid urbanization and the electrification of public and private transport fleets are forging new avenues for telematics innovation. Investments in smart city projects and public-private partnerships are fostering real-time traffic management solutions that reduce congestion and emissions. Collectively, these regional narratives underscore the need for adaptable strategies that account for local regulatory, technological, and economic conditions.

This comprehensive research report examines key regions that drive the evolution of the Telematics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves by Top Telematics Hardware Manufacturers, Software Innovators, and Service Providers Shaping Industry Leadership

Leading participants in the telematics arena are advancing through strategic alliances, targeted acquisitions, and sustained R&D investment. Key hardware suppliers are enhancing their sensor portfolios and telematics control units to support edge processing and over-the-air updates. Software vendors are integrating advanced analytics with user-centric dashboards to deliver actionable insights on vehicle health, driver performance, and route optimization.

Service providers, meanwhile, are differentiating through tiered support offerings and managed service frameworks that enable clients to outsource end-to-end telematics operations. Partnerships between network operators and platform vendors are delivering seamless connectivity bundles, while semiconductor manufacturers are prioritizing low-power, cost-effective modules optimized for telematics workloads. Collectively, these efforts are deepening the value chain and elevating the competitive bar for both incumbents and new entrants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Telematics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aplicom Oy

- AT&T Inc.

- Cisco Systems Inc.

- Continental AG

- Geotab Inc.

- Harman International Industries Inc.

- Huawei Technologies Co. Ltd.

- Inseego Corporation

- LG Electronics Inc.

- Microlise Group PLC

- MiX Telematics Ltd

- Octo Group S.p.A.

- Robert Bosch GmbH

- Samsara Inc.

- Sierra Wireless Inc.

- TomTom N.V.

- Trimble Inc.

- Valeo SA

- Verizon Communications Inc.

- ZF Friedrichshafen AG

Implementing Modular Architectures, Diversified Supply Chains, and Data-Driven Partnerships to Secure Competitive Advantage in Telematics

To maintain a leadership position in this dynamic market, executives should prioritize modular product architectures that facilitate rapid feature deployment and customization. Furthermore, cultivating partnerships with cellular and satellite operators will ensure uninterrupted coverage and support for emerging V2X applications. Investment in data analytics capabilities-particularly predictive and prescriptive models-will yield faster time to insight and greater operational resilience.

In parallel, firms must develop diversified supply chain strategies to buffer against tariff volatility, including the evaluation of local contract manufacturers and multi-source procurement frameworks. Engaging proactively with regulatory bodies and industry consortia will also help shape standards for data privacy, cybersecurity, and interoperability. Finally, embracing a customer-centric approach by offering flexible consumption models and value-added services will drive higher retention and enable upsell opportunities into adjacent markets such as autonomous systems and mobility services.

Detailed Methodological Framework Integrating Expert Interviews, Proprietary Data Analysis, and Multi-Source Validation to Ensure Analytical Rigor

This report is underpinned by a rigorous methodology that blends primary and secondary research to ensure comprehensive coverage and analytical integrity. Primary inputs were gathered through in-depth interviews with senior executives across the value chain, including OEMs, tier 1 suppliers, telematics service operators, and regulatory officials. These qualitative insights were complemented by quantitative data extracted from proprietary industry databases, regional trade statistics, and corporate filings.

Secondary research involved a systematic review of publicly available materials such as white papers, technical standards, government regulations, and industry benchmarks. Data triangulation techniques were applied to reconcile disparate sources and validate key findings. Finally, the report’s conclusions and recommendations were subjected to internal expert reviews and scenario stress-testing to confirm their robustness under varying market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Telematics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Telematics Market, by Solution Type

- Telematics Market, by Connectivity Type

- Telematics Market, by Vehicle Type

- Telematics Market, by Deployment Type

- Telematics Market, by Application

- Telematics Market, by End User

- Telematics Market, by Region

- Telematics Market, by Group

- Telematics Market, by Country

- United States Telematics Market

- China Telematics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Reflections on Balancing Innovation, Resilience, and Strategic Partnership to Unlock the Full Potential of Telematics Solutions

The telematics sector stands at an inflection point, driven by the convergence of high-speed connectivity, artificial intelligence, and regulatory imperatives. While tariff headwinds introduce near-term pricing challenges, they also catalyze innovation in supply chain design and value proposition development. As regional markets evolve at different paces, successful participants will tailor their strategies to local needs without compromising on global integration.

Ultimately, telematics will continue to transform the transportation landscape by delivering actionable insights, enhancing safety protocols, and enabling new business models. Organizations that adopt a proactive stance-embracing modularity, forging strategic alliances, and investing in advanced analytics-will be best positioned to harness the full potential of connected mobility. The path forward lies in balancing agility with resilience and in viewing telematics not just as a cost center, but as a platform for sustainable growth and differentiation.

Secure Exclusive Access to In-Depth Telematics Market Intelligence by Engaging with Our Lead Sales and Marketing Executive

To explore comprehensive market insights and strategic intelligence, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through customized research packages, detailed dataset access, and value-added advisory services tailored to your organizational objectives. Engaging directly with Ketan will ensure you receive prompt support, clarity on scope, and flexible delivery options that accelerate your decision-making processes. Connect today to secure your copy of the full telematics market report and begin leveraging forward-looking intelligence that drives competitive advantage.

- How big is the Telematics Market?

- What is the Telematics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?