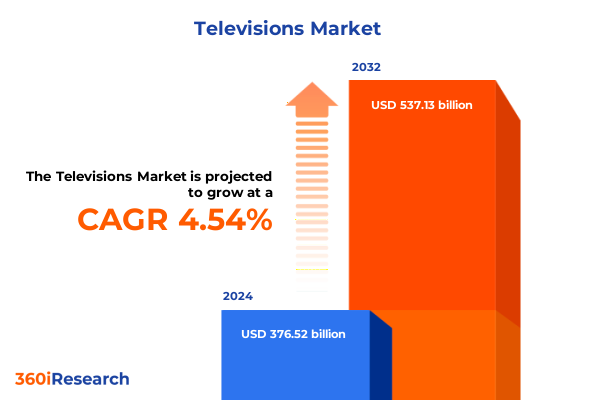

The Televisions Market size was estimated at USD 393.33 billion in 2025 and expected to reach USD 410.89 billion in 2026, at a CAGR of 4.55% to reach USD 537.13 billion by 2032.

Understanding Today’s Television Landscape Through Rapid Technological Evolution Content Consumption Patterns and Evolving Consumer Expectations

Television has evolved from a one-way broadcast medium into a central hub of entertainment information and connectivity. Fueled by rapid advancements in processing power display technologies and content delivery options it now serves as the cornerstone of modern living spaces. Audiences today demand not only high–quality visuals but also personalized viewing experiences instant access to streaming services and seamless integration with smart home ecosystems. This shifting consumer landscape underlines the convergence of content technology and user expectations that defines the current marketplace.

In recent years manufacturers have invested heavily to embed artificial intelligence machine learning and voice control capabilities directly into television sets enabling intuitive navigation content recommendations and real–time performance optimization. Simultaneously, the proliferation of over–the–top platforms and interactive applications has transformed the role of the television from passive viewing device into an interactive entertainment gateway. As consumer behaviors continue to diversify and new form factors emerge the industry stands at the threshold of another major transformation driven by innovation and competition.

Exploring the Transformative Shifts Reshaping Television from Broadcast Eras to Smart Ecosystems and AI Driven User Experiences

The television industry landscape has undergone some of the most dramatic transformations in recent memory as analog broadcasts gave way to digital signals and physical media ceded ground to streaming platforms. At the heart of this metamorphosis lies a relentless push toward hyperconnectivity smart ecosystems and content–driven differentiation. From the introduction of high–dynamic–range imaging to the integration of virtual assistants within the viewing interface televisions have been redefined to deliver cinematic experiences personalized assistance and interactive advertising capabilities.

Moreover the advent of next–generation connectivity standards has paved the way for ultra–low latency streaming and real–time multi–user gaming on television screens. This convergence of telecommunications and entertainment technologies has blurred the line between consoles set–top boxes and television panels themselves. Consequently manufacturers and content providers alike are collaborating on ecosystem plays that extend beyond hardware sales to include subscription services application marketplaces and ecosystem lock–in strategies. In this new era success hinges on the ability to foster deep engagement across hardware software and content ecosystems.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Television Supply Chains Manufacturing Costs and Global Sourcing Strategies

The imposition of new tariff measures by the United States in early 2025 introduced a pronounced ripple effect across television supply chains manufacturing processes and global sourcing arrangements. With duties applied to critical display panel components and finished television assemblies cost structures have been recalibrated throughout the value chain. Importers in North America have faced increased landed costs prompting renegotiations with suppliers and a reevaluation of assembly locations to mitigate margin pressures.

In response, many original design manufacturers have explored alternative sourcing hubs in Asia–Pacific while selectively advancing nearshoring initiatives closer to consumer markets. These strategic shifts were driven by the need to stabilize lead times manage currency volatility and shield end–consumer prices from further inflationary pressures. Although some costs have been passed along to retail price tags competition remains fierce as brands leverage product differentiation and bundled service offerings to preserve demand. As supply chains adapt regulatory changes in trade policy now coexist with technological innovation as primary forces shaping competitive positioning.

Illuminating Key Segmentation Insights Across Smart Capability Display Technology Resolution Price Tiers and Screen Size Preferences

Based on smart capability the market sees clear divergence between non–smart and smart television segments. While non–smart offerings retain relevance in cost–conscious segments smart models dominate in growth corridors owing to their integrated operating systems adaptive interfaces and app ecosystems. As consumers increasingly seek multifunctional devices that serve as entertainment control centers smart televisions have eclipsed legacy forms in both feature adoption and incremental revenue generation.

Based on display technology the competition unfolds across a spectrum including LED, OLED, Plasma and QLED panels. LED continues to underpin entry–level and midrange propositions with reliable performance and cost efficiency. In contrast OLED is celebrated for its deep contrast and pixel–level illumination, driving premium adoption among cinephiles. Plasma, though largely phased out, maintains a niche following, while QLED’s brightness and color volume innovations position it as a leading contender in high–end mainstream tiers.

Based on resolution televisions span 4K UHD, 8K UHD, Full HD, and HD standards. With 4K UHD now mainstream, manufacturers have shifted focus toward computational upscaling and diverse content partnerships to enrich the viewing ecosystem. Meanwhile 8K UHD has carved out an experimental high–end niche, relying on improved bandwidth infrastructures and early adopters of next–generation gaming and broadcast formats. Full HD and HD continue to anchor budget segments particularly in secondary rooms and regions with constrained infrastructure.

Based on price range the landscape is divided into high, low, mid and premium price tiers. High–priced models emphasize advanced processing, large screens and bespoke sound systems. Conversely low–price alternatives cater to value–orientated buyers prioritizing basic viewing functionality. Mid–priced televisions balance these extremes by embedding popular smart features and modern panel technologies at accessible price points. Premium–price models encapsulate the pinnacle of innovation often bundled with exclusive software services and luxury design elements.

Based on screen size consumer preferences stretch from less than 32 inches through 32 to 42 inches, 43 to 55 inches, 56 to 65 inches, and greater than 65 inches. Smaller screens remain popular for kitchens, bedrooms and dormitories whereas the 43 to 55 inch range represents the sweet spot for living room setups blending immersion with room versatility. Larger formats exceeding 65 inches continue to gain traction among enthusiasts willing to invest in home theater–grade experiences.

This comprehensive research report categorizes the Televisions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Technology

- Resolution

- Price Range

- Screen Size

- Sales Channel

Unveiling Regional Dynamics Shaping Television Demand in the Americas Europe Middle East Africa and Asia Pacific Markets

The television market in the Americas is characterized by mature consumer demand, robust retail ecosystems and high penetration rates of smart, connected TVs. Distribution channels range from big–box retailers to digital marketplaces and direct–to–consumer platforms. As content providers expand exclusive streaming catalogs and channel bundles, competition for viewership remains intense. This environment fosters rapid feature adoption and justifies steady replacement cycles in metropolitan and suburban regions alike.

In Europe, Middle East & Africa diverse economic conditions and infrastructure disparities result in variegated demand patterns. Western European markets display strong appetite for premium and high–performance models, often coupled with value–added services such as extended warranties and installation packages. Conversely regions in Eastern Europe and parts of Africa exhibit greater sensitivity to price controls and tend toward mid and low–price segments. Meanwhile the Middle East’s affluent submarkets embrace ultra–large screen formats and bespoke home theater integrations.

The Asia-Pacific region continues to serve as both a manufacturing hub and an innovator of television technologies. Rapid urbanization in Southeast Asia bolsters growth in mid–range smart TVs while North Asia leads in adoption of cutting–edge panel technologies and next–generation resolutions. Distribution strategies here leverage e-commerce expansions and micro–distribution networks to reach tier–two and tier–three cities. Simultaneously, local content partnerships and language–specific interfaces play crucial roles in driving penetration across diverse cultural markets.

This comprehensive research report examines key regions that drive the evolution of the Televisions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Television Manufacturers Strategic Innovations Market Positioning and Competitive Differentiators

Leading industry players have distinguished themselves through sustained investments in research partnerships and vertical integration strategies. Global conglomerates have reinforced their positions by aligning proprietary display technologies with exclusive content alliances whereas regional champions deploy agile localized approaches to capture emerging consumer segments. Innovation in design and user interface remains a critical differentiator, prompting manufacturers to onboard consumer feedback loops early in the development cycle to fine–tune ergonomics, remote control experiences and voice interaction capabilities.

Strategic mergers and joint ventures have further consolidated technological capabilities and supply chain economies. Some enterprises have invested in semiconductor startups to secure premium processor access, while others have established in–house software divisions to control the full stack of user interface development. Collaboration with streaming platforms and gaming studios has become increasingly common as companies seek to deliver ecosystems that lock in consumers through integrated hardware–software–content value propositions. As competition intensifies, profitability increasingly hinges on operational efficiency, intellectual property portfolios and the ability to anticipate consumer lifestyle trends ahead of the curve.

This comprehensive research report delivers an in-depth overview of the principal market players in the Televisions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Hisense Group Co., Ltd.

- LG Electronics Inc.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Sceptre Inc.

- Sharp Corporation

- Sichuan Changhong Electric Co., Ltd.

- Skyworth Group Co., Ltd.

- Sony Group Corporation

- TCL Electronics Holdings Ltd.

- Technicolor SA

- TPV Technology Limited

- Xiaomi Corporation

Actionable Strategic Recommendations for Industry Leaders to Navigate Disruption Optimize Portfolios and Enhance Customer Engagement

Industry leaders should prioritize end–to–end ecosystem development by forging deeper partnerships with streaming services gaming platforms and smart home solution providers. Establishing white labeled content hubs optimized for proprietary interfaces can unlock recurring revenue streams and bolster consumer loyalty. Concurrently, manufacturers should explore modular hardware architectures that allow incremental feature upgrades, thereby extending product lifecycles and reducing e–waste.

Equally critical is the strengthening of resilient supply chains through diversified component sourcing and flexible production footprints. Investing in predictive supply chain analytics can help mitigate tariff impacts and lead–time fluctuations while nearshore assembly options bolster responsiveness to market developments. On the marketing front, cultivating localized customer experiences through language customization and region–specific software integrations will be essential to driving penetration in heterogeneous markets.

Finally, sustainability initiatives must be ingrained into product roadmaps to meet evolving regulatory requirements and ethical consumer expectations. Brands that champion energy efficiency material recyclability and responsible manufacturing practices will not only attract environmentally conscious buyers but also position themselves advantageously for forthcoming policy shifts and corporate ESG mandates.

Outlining the Comprehensive Research Methodology Combining Primary Interviews Secondary Data Analysis and Rigorous Validation Techniques

This report synthesizes insights from both primary and secondary research methodologies to ensure robust validation of market trends and strategic imperatives. Primary research involved in–depth interviews with key stakeholders including original equipment manufacturers component suppliers channel partners and technology experts. These conversations provided firsthand perspectives on innovation roadmaps, supply chain realignments and consumer adoption patterns.

Secondary sources encompassed corporate filings, patent databases and technology whitepapers, supplemented by analysis of industry conferences and regulatory announcements. Data triangulation techniques were applied to reconcile disparate data points and eliminate biases. Quantitative analysis leveraged time series data on production volumes inventory levels and trade flows to identify structural shifts. Qualitative assessments incorporated scenario modeling and expert panel reviews to stress–test strategic hypotheses under multiple market conditions.

Rigorous validation procedures such as cross–referencing proprietary data sets with public resources and leveraging multi–stage review cycles underpin the report’s findings. This combined methodological approach ensures that conclusions are not only grounded in empirical evidence but also attuned to the nuanced realities facing manufacturers content providers and retailers alike.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Televisions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Televisions Market, by Display Technology

- Televisions Market, by Resolution

- Televisions Market, by Price Range

- Televisions Market, by Screen Size

- Televisions Market, by Sales Channel

- Televisions Market, by Region

- Televisions Market, by Group

- Televisions Market, by Country

- United States Televisions Market

- China Televisions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Insights Highlighting Television Industry Evolution Strategic Imperatives and Pathways for Sustainable Growth

The television industry stands at a pivotal junction where technological innovation evolving consumer behaviors and shifting policy landscapes converge to shape the road ahead. The maturation of smart capabilities and the integration of ecosystem services underscore the necessity for players to adopt holistic strategies that transcend traditional hardware–centric models. At the same time cost pressures from trade regulations and supply chain disruptions demand agile operational frameworks.

As segmentation insights highlight the diversity of consumer preferences across capabilities budgets and screen sizes, and regional dynamics illustrate varying growth trajectories, decision makers must balance global scale with localized execution. Leading companies will be those that can seamlessly weave together advanced display technologies targeted content offerings and sustainable business practices. By staying attuned to emerging trends and proactively adjusting strategies this industry is poised to enter a new era of interactive entertainment and connected living.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your In-Depth Television Market Research Report Today

If you are seeking a detailed analysis of the global television market to support informed strategic planning and competitive positioning, reach out to Ketan Rohom (Associate Director, Sales & Marketing) today to purchase the comprehensive report tailored to your needs. The report provides actionable intelligence on emerging technologies market dynamics regional performance and competitive landscapes that will empower you to make confident decisions and capitalize on growth opportunities. Engage directly with Ketan Rohom to discuss customization options special pricing and delivery timelines to ensure your organization gains the full advantage of this authoritative resource

- How big is the Televisions Market?

- What is the Televisions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?