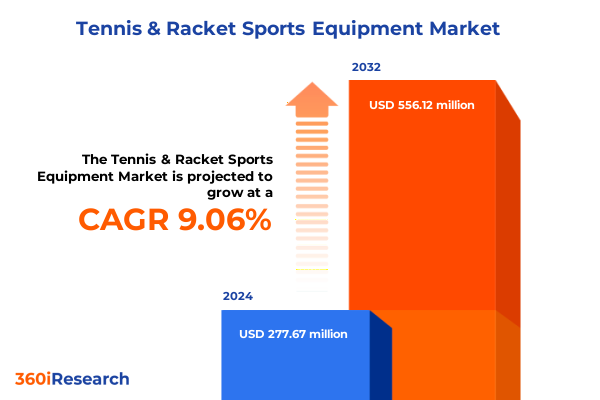

The Tennis & Racket Sports Equipment Market size was estimated at USD 302.68 million in 2025 and expected to reach USD 325.73 million in 2026, at a CAGR of 9.07% to reach USD 556.12 million by 2032.

Navigating the Rapidly Evolving Landscape of Tennis and Racket Sports Equipment Innovations, Consumer Trends, and Market Drivers

The tennis and racket sports equipment sector has undergone significant evolution in recent years, driven by rapid technological advancements and shifting consumer preferences. Innovation in materials science has yielded racquets that combine lightweight composites with vibration reduction technologies, while apparel and footwear design have increasingly prioritized performance-driven fabrics and biomechanical ergonomics. Consumer behaviors have trended toward multisport participation, with cross-training in pickleball, squash, and badminton fostering demand for versatile product lines. At the same time, digital integration-from connected sensors embedded in racquets to AI‐powered training platforms-has become a core differentiator for brands seeking to elevate the athlete experience and cultivate deeper customer engagement.

Amidst these forces, key market drivers include the proliferation of online retail channels that streamline product customization, the rise of youth participation programs that expand entry‐level demand, and heightened sustainability concerns prompting reevaluation of supply chain practices and material sourcing. This executive summary synthesizes the foundational factors shaping the landscape, outlines the transformative shifts underway, examines regulatory and trade-related headwinds, and delivers critical segmentation and regional insights. In doing so, it provides an essential framework for stakeholders to understand current market dynamics and identify high-impact opportunities for strategic growth.

Uncovering the Major Technological, Consumer Behavior, and Regulatory Transformations Reshaping the Tennis and Racket Sports Equipment Sector

Racket sports equipment has experienced several transformative shifts that extend beyond incremental product updates. First, the integration of digital technologies has redefined how players train and interact with their gear. Embedded sensors in racquets now capture real-time metrics such as swing speed, impact angle, and spin rate, enabling athletes and coaches to fine-tune technique based on data-driven feedback. Wearable technologies and mobile applications further personalize training regimens, fostering engagement and driving a seamless connection between on‐court performance and post-match analysis.

Simultaneously, sustainable innovation has gained momentum across the supply chain. Manufacturers are exploring bio-based polymer strings, recycled textile blends in apparel, and eco-friendly packaging solutions to meet growing consumer demand for environmentally responsible products. These efforts are complemented by circular business models that emphasize product lifecycle transparency and take-back initiatives. In parallel, the popularity surge of alternative racket sports-especially pickleball-has prompted brands to diversify their portfolios and leverage cross-category synergies. Furthermore, the digital retail revolution has accelerated personalized e-commerce experiences, immersive virtual showrooms, and AI-enhanced customer support. Together, these shifts are redefining competitive differentiation and setting the stage for the next paradigm of growth in the industry.

Analyzing the Ripple Effects of 2025 United States Tariff Adjustments on the Production, Pricing, and Trade Dynamics of Racket Sports Equipment

The implementation of updated United States tariffs in 2025 has had a pronounced cumulative impact on the racket sports equipment supply chain and pricing structure. Increased duties on imported raw materials such as specialized polymers, composite blends, and precision-engineered metals have elevated production costs for manufacturers with overseas sourcing strategies. In response, many companies have pursued partial reshoring of production to North America, balancing the tradeoff between higher labor costs and reduced tariff exposure. This shift has manifested in selective investments in regional manufacturing hubs that support just-in-time inventory models and streamline logistics.

Moreover, the tariff adjustments have influenced retail pricing strategies, as brands navigate margin compression while striving to maintain competitive price points. Some market players have introduced tiered product lines to preserve affordability at entry levels and protect premium offerings that command higher price elasticity. Concurrently, trade policy uncertainty has catalyzed more rigorous scenario planning and dynamic sourcing frameworks, with procurement teams evaluating alternative suppliers in Asia-Pacific and Latin America to optimize cost structures. These strategic responses reflect the industry’s adaptability and underscore the importance of supply chain resilience in mitigating external cost pressures.

Delving into Product Type, Sport, End User, and Distribution Channel Segmentation to Reveal Nuanced Insights Driving Market Performance

A thorough examination of segmentation reveals compelling narratives across product offerings, sporting disciplines, end users, and distribution channels. Within the product type spectrum, strings and racquets dominate innovation cycles, while accessories such as grips and vibration dampeners gain traction through value-added positioning. Apparel-spanning kid’s, men’s, and women’s lines-remains essential for brand loyalty, and the evolution of footwear categories tailored to specific court surfaces underscores a drive toward performance customization. The ball segment also showcases differentiation, from pressureless tennis balls designed for durable recreational play to specialized single and double yellow dot squash balls that enhance training specificity.

Considering the sport-based segmentation, the meteoric rise of pickleball has captured the attention of established tennis and paddle brands, while badminton and squash maintain dedicated, performance-focused consumer bases. Table tennis growth, supported by tiered ball quality standards ranging from 1-star to 3-star classifications, continues to underpin a robust grassroots and competitive scene. Looking at end-user distinctions, recreational participants account for broad-based demand, professional circuits drive premium purchases, and clubs & academies serve as pivotal distribution partners through bulk procurement. Meanwhile, distribution channels have diversified: specialty stores offer curated in-store experiences, sporting goods retailers furnish broad assortments, hypermarkets and supermarkets provide mass reach, and online retail delivers hyper-personalized shopping journeys that blend virtual fitting tools and community-driven content.

This comprehensive research report categorizes the Tennis & Racket Sports Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sport

- End User

- Distribution Channel

Examining Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Highlight Distinct Market Opportunities and Challenges

Regional dynamics in the racket sports equipment market reflect contrasting growth trajectories and consumer behavior patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, tennis and emerging sports such as pickleball have witnessed widespread grassroots participation, bolstered by robust club networks and large-scale tournaments. This landscape encourages multi-channel distribution strategies that marry brick-and-mortar retail with digital commerce innovations. Sustainability themes resonate strongly with North American consumers, driving demand for eco-certified materials and traceable supply chain credentials.

Across Europe Middle East & Africa, diverse economic conditions and cultural preferences yield a mosaic of market opportunities. Western Europe continues to lead in premium equipment adoption, with professional academies and competitive leagues fueling demand for high-performance racquets and specialized apparel. Meanwhile, emerging markets in Eastern Europe and parts of the Middle East emphasize infrastructure development and youth engagement programs, creating pockets of rapid growth potential. In Africa, investment in community sports initiatives is expanding access but remains constrained by localized manufacturing challenges.

Turning to Asia-Pacific, the region stands out for its dynamic growth in both traditional sports like badminton and tennis and nascent categories such as padel tennis. Innovation clusters in East Asia have advanced materials research, while demographic trends in South Asia and Oceania underpin sustained recreational participation. E-commerce penetration is exceptionally high, prompting international brands to adapt omnichannel models that cater to both urban metropolises and emerging tier-two cities.

This comprehensive research report examines key regions that drive the evolution of the Tennis & Racket Sports Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers and Brands to Illuminate Competitive Strategies, Innovation Pipelines, and Collaborative Partnerships in the Industry

Leading companies in the racket sports equipment sphere exhibit differentiated strategies that combine technological innovation, brand storytelling, and channel diversification. Market stalwarts invest heavily in research partnerships with material science institutes, yielding proprietary composite formulations for enhanced power and control in racquet frames. Concurrently, these corporations leverage digital platforms to engage athlete communities through branded training apps, ambassadorship programs, and content-driven marketing campaigns.

Nimble challengers have disrupted traditional supply chains by adopting direct-to-consumer models, optimizing unit economics, and delivering highly personalized customization options for racquets and footwear. Some emerging players have also formed strategic alliances with sports federations and event organizers to amplify brand visibility and cultivate grassroots loyalty. Across the board, there is a palpable focus on sustainability, with companies piloting closed-loop recycling programs for worn-out equipment and exploring next-generation bio-based polymers to reduce environmental footprints.

As competitive intensity increases, alliances between established brands and technology startups are on the rise, fuelling cross-pollination of expertise in areas such as digital performance analytics, immersive retail experiences, and smart textile integration. These collaborative approaches position companies to respond rapidly to evolving athlete demands and to differentiate through holistic ecosystems that extend beyond traditional hardware offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tennis & Racket Sports Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Amer Sports

- ASICS Corporation

- Authentic Brands Group LLC

- BABOLAT VS S.A.S.

- Decathlon S.A.

- Diadem Sports

- Dunlop Sports Group Americas Inc.

- GAMMA Sports, Inc.

- Harrow Sports Inc.

- HEAD Sport GmbH

- Lacoste

- Li-Ning Company Limited

- Mizuno USA, Inc.

- New Balance Athletics, Inc.

- Nike, Inc.

- Pacific Racket Sports, Inc.

- ProKennex Sports, Inc.

- Puma SE

- Slazenger International Limited

- Solinco Sports

- Tecnifibre

- Wilson Sporting Goods Co.

- YONEX Co., Ltd.

Implementing Strategic Initiatives for Industry Leaders to Capitalize on Emerging Technologies, Consumer Trends, and Operational Efficiencies Effectively

To capitalize on the evolving landscape, industry leaders should prioritize a cohesive strategy that balances innovation investments with operational agility. First, enhancing digital ecosystems through partnerships with training technology providers will deepen customer engagement and create recurring revenue streams. Investing in connected platforms that integrate racquet sensors with analytics dashboards can facilitate premium subscription services and data‐driven coaching solutions.

In parallel, diversifying sourcing networks across multiple geographies will help mitigate tariff-related cost volatility. Establishing regional micro‐factories can reduce lead times and enable rapid customization, while reinforcing supply chain resilience through strategic stock buffers and dual‐sourcing agreements. Companies should also leverage advanced manufacturing techniques such as 3D printing to accelerate prototyping cycles and tailor product ergonomics for different athlete segments.

Finally, embedding sustainability throughout the value chain-from carbon-neutral production facilities to circular take‐back programs-will resonate with environmentally conscious consumers and strengthen brand equity. By aligning R&D roadmaps with eco‐material innovation and transparent reporting, businesses can differentiate their offerings, foster regulatory compliance, and cultivate long-term customer loyalty.

Detailing the Comprehensive Research Approach, Data Collection Techniques, and Analytical Frameworks That Underpin the Market Insights Presented

The research underpinning this report employs a rigorous, multi-method approach designed to ensure analytical robustness and actionable accuracy. Primary research included in-depth interviews with key stakeholders such as product development executives, procurement managers, professional athletes, and club operators. These qualitative insights were complemented by structured surveys distributed to a diverse cross-section of end users-encompassing recreational participants, academy coaches, and tour-level professionals-to capture real-world preferences and emerging adoption patterns.

Secondary research involved comprehensive analysis of industry publications, trade associations’ technical bulletins, and corporate sustainability disclosures to contextualize innovation trends and regulatory shifts. Data triangulation was applied by cross-referencing shipment statistics, patent filing databases, and e-commerce analytics to validate volume, channel, and pricing dynamics. An iterative validation process engaged external experts to review preliminary findings, ensuring the final insights align with on-the-ground realities and strategic imperatives. Together, these methodologies create a robust foundation for the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tennis & Racket Sports Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tennis & Racket Sports Equipment Market, by Product Type

- Tennis & Racket Sports Equipment Market, by Sport

- Tennis & Racket Sports Equipment Market, by End User

- Tennis & Racket Sports Equipment Market, by Distribution Channel

- Tennis & Racket Sports Equipment Market, by Region

- Tennis & Racket Sports Equipment Market, by Group

- Tennis & Racket Sports Equipment Market, by Country

- United States Tennis & Racket Sports Equipment Market

- China Tennis & Racket Sports Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing the Principal Findings on Market Evolution, Regulatory Impacts, and Strategic Imperatives to Outline the Future Trajectory of Racket Sports Equipment

In synthesizing the key takeaways, several overarching themes emerge. Technological integration continues to redefine product differentiation, with connected devices and data analytics transforming how athletes train and engage with equipment. At the same time, regulatory adjustments-particularly the 2025 tariff revisions-have galvanized supply chain realignment and pricing strategies, underscoring the importance of resilience and flexibility. Segmentation analysis reveals nuanced growth pockets, from the ascendancy of pickleball in North America to the premiumization of tennis racquets in Europe and Asia-Pacific.

Additionally, distribution channels are in flux, as digital platforms outpace traditional retail while specialty and sporting goods stores adapt with experiential offerings. Leading companies are responding through collaborative partnerships, sustainability initiatives, and omnichannel expansion. Taken together, these dynamics suggest that success in the near term will favor organizations that integrate technological agility, sustainable operations, and consumer-centric service models. As the market continues to evolve, the insights contained in this report will serve as a strategic compass for navigating competitive complexities and seizing emergent opportunities.

Engage with Ketan Rohom to Acquire Comprehensive Market Research Reports and Unlock Strategic Insights for Competitive Advantage in Racket Sports Equipment

For a comprehensive exploration of market dynamics, competitive landscapes, and strategic growth avenues in tennis and racket sports equipment, reach out to Ketan Rohom (Associate Director, Sales & Marketing). Engage directly to access the full research report tailored to your needs, featuring in-depth analyses, expert insights, and actionable intelligence that will empower your organization’s strategic decision-making and drive competitive differentiation. Leverage this opportunity to equip your leadership team with data-driven perspectives and future-proof your market strategies through proven methodologies and forward-looking recommendations.

- How big is the Tennis & Racket Sports Equipment Market?

- What is the Tennis & Racket Sports Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?