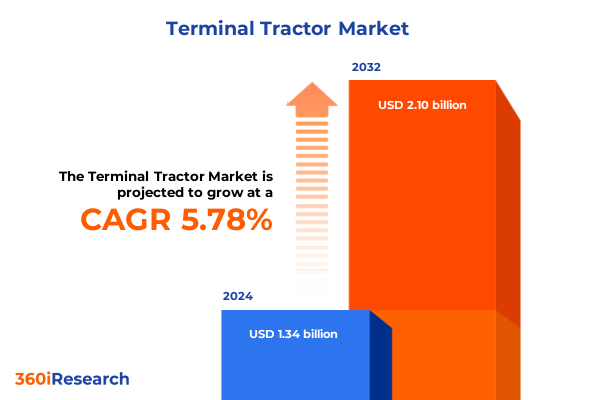

The Terminal Tractor Market size was estimated at USD 1.41 billion in 2025 and expected to reach USD 1.49 billion in 2026, at a CAGR of 5.81% to reach USD 2.10 billion by 2032.

Unveiling the Terminal Tractor Market Dynamics Through Strategic Insights on Evolving Technologies, Regulatory Pressures, and Operational Imperatives

Navigating the terminal tractor market requires a nuanced understanding of how fleets are transitioning from traditional diesel power to cleaner, electric alternatives amid evolving regulatory and cost pressures. While diesel technology continues to anchor most fleets due to its high torque output and established fueling infrastructure, zero-emission yard tractors are gaining traction as operators recognize significant reductions in maintenance and fuel spend. According to CalStart, electric terminal tractors account for approximately 2.8% of the 62,000-unit U.S. yard tractor fleet, having grown 30% year-on-year between 2023 and 2024 as operators seek lower total cost of ownership and emissions compliance. At the same time, diesel machines retained over 63% of the global fleet in 2024, underscoring that dual-propulsion scenarios will define the coming half-decade as grid reliability and charging infrastructure mature.

Moreover, terminal tractor manufacturers are embedding digital capabilities and exploring autonomy to enhance operational efficiency and safety. Market leaders bundle battery warranties, telematics packages, and proactive maintenance contracts to mitigate lifetime cost uncertainty. Autonomous models, leveraging Lidar or vision-based systems, are projecting a 22% compound annual growth rate as yards pursue labor savings and extended duty cycles that human-operated units cannot economically sustain. In parallel, every established diesel yard truck manufacturer has introduced or is developing an electric alternative, reflecting a universal pivot toward electrification to meet customer demand and regulatory mandates.

Regulatory frameworks and environmental targets have accelerated this technological shift, particularly in North America where EPA’s stringent emissions standards and state-level zero-emission vehicle mandates drive electrification investments at major intermodal hubs. In California alone, the Advanced Clean Trucks Rule compels terminal operators to phase out diesel tractors in favor of zero-emission models, catalyzing infrastructure upgrades and public-private partnerships for on-site charging deployment. As these factors converge, industry stakeholders must reassess procurement strategies, fleet electrification roadmaps, and service-based revenue models to remain competitive in an increasingly green and connected terminal landscape.

Transformative Shifts in the Terminal Tractor Ecosystem Driven by Electrification, Automation, and Sustainability Imperatives Across Global Operations

Electrification has emerged as the most profound driver reshaping the terminal tractor ecosystem globally. Electric medium- and heavy-duty truck sales surged by nearly 80% in 2024 to exceed 90,000 units worldwide, propelled by China’s aggressive incentives and tighter emission standards issued in July 2023. These measures not only bolstered China’s market share-accounting for over four-fifths of global electric truck deliveries in 2024-but also signaled to OEMs that battery-electric propulsion is a strategic priority across all regions.

In the United States, operational pilots and fleet rollouts substantiate that electric terminal tractors can achieve up to 50% lower maintenance and repair costs compared to diesel incumbents, driven by simplified powertrains and regenerative braking systems. Lazer Logistics’ deployment of more than 125 battery-electric yard tractors illustrates that continuous duty-cycle applications, such as port container movements and warehouse transfers, can fully leverage opportunity charging during scheduled breaks without disrupting throughput.

Autonomous technology is concurrently transforming yard operations, with self-driving models leveraging Lidar or computer vision to navigate complex container terminals and industrial yards. These systems reduce labor dependencies, enhance safety in mixed-traffic scenarios, and enable 24/7 operations. While manual units still dominate the market-with a 75.2% share in 2024-autonomous tractors are expected to grow rapidly as regulatory frameworks around unmanned industrial vehicles evolve.

Digitalization remains a critical enabler of both electrification and autonomy. OEMs increasingly offer integrated fleet management platforms that aggregate telematics, diagnostics, and predictive maintenance analytics. By leveraging real-time data, operators can optimize charging schedules, monitor battery health, and minimize unplanned downtime. This convergence of hardware and software is essential for unlocking maximum uptime and extending asset lifecycles in high-utilization environments.

Finally, sustainability and ESG mandates are heightening pressure on ports and logistics centers to reduce carbon footprints. European ports, for instance, are implementing carbon neutrality roadmaps under the EU Green Deal, accelerating adoption of electric and hydrogen-ready terminal tractors. Across all regions, carbon targets and air quality regulations are compelling stakeholders to adopt cleaner technologies and partner with equipment providers that can deliver demonstrable emissions reductions and transparent reporting.

Assessing the Cumulative Impact of United States 2025 Tariff Measures on Terminal Tractor Supply Chains, Manufacturing Costs, and Strategic Sourcing Decisions

Beginning April 2025, the U.S. reinstated a 25% tariff on imported passenger vehicles and light trucks, aiming to bolster domestic manufacturing but risking higher acquisition costs for terminal tractor OEMs and their customers. At the same time, steel and aluminum tariffs remain at 50% for Canadian imports and 25% for most other trading partners, directly affecting chassis, frames, and component sourcing for yard trucks. These duties compound existing Section 232 levies on steel and aluminum enacted in 2018 and Section 301 tariffs on Chinese machinery, creating layered cost pressures on global supply chains.

Analysts at S&P Global Mobility estimate that new tariffs could raise the net purchase price of commercial vehicles by approximately 9%, taking into account currency adjustments and import mix dynamics. Should these measures persist through year-end, new heavy commercial vehicle demand could drop by as much as 17% in 2025 compared to prior expectations, negating previously forecasted growth and leading to inventory build-ups that strain OEM production planning.

Additionally, the United States Trade Representative’s Section 301 tariffs on strategic imports, including electric vehicle battery parts and semiconductors, impose up to 100% duties on certain non-lithium-ion batteries and 50% on semiconductors effective January 1, 2025. Though an exclusion process under Annex E offers temporary relief for industrial machinery through May 31, 2025, the overall landscape compels OEMs to revisit sourcing strategies and secure long-term supplier agreements to mitigate tariff volatility.

In response, many manufacturers are accelerating nearshoring initiatives, relocating key subassembly lines to U.S. facilities or adjacent markets with favorable trade terms. Others are negotiating cost-pass-through clauses in supplier contracts or adopting dual-sourcing models to preserve delivery timelines. As capital expenditures rise and component lead times extend, fleet operators must plan budget allocations more conservatively and explore government incentive programs to offset incremental costs.

Deriving Key Insights from Powertrain, Horsepower, Operation Mode, Speed, and Application Segmentation Revealing Market Nuances

Powertrain segmentation reveals a dual-propulsion market where diesel maintains a leading share in regions with mature fueling networks, while electric variants-subdivided into lead-acid and lithium-ion battery chemistries-gain ground in low-speed, return-to-base operations where charging infrastructure exists. Hybrid and LNG options continue to occupy niche applications, offering transitional solutions in markets where grid reliability or energy costs preclude full electrification.

Horsepower range is another critical determinant of deployment suitability. Tractors with outputs at or below 100 horsepower serve lighter duty cycles in enclosed warehouses and indoor distribution centers, while the 101–150 horsepower segment addresses standard intermodal operations. Units exceeding 150 horsepower are designed for heavy-weight container terminals and port environments requiring maximum tractive effort, yet these high-power machines also present opportunities for electric propulsion where battery capacity and opportunity-charging strategies support extended cycles.

Operational mode segmentation underscores a shift toward increased automation and hands-off capabilities. Manual control remains prevalent in mixed-traffic settings, but autonomous models are emerging for predictable yard paths and container stacking. Within the autonomous subset, Lidar-based systems offer precise spatial mapping, while vision-based solutions leverage advanced cameras and AI to interpret dynamic environments, each approach balancing capital intensity with operational complexity.

Speed segmentation further refines application fit, as most terminal tractors operate at less than 20 kilometers per hour in tightly controlled yards, with select units rated up to 25 km/h for expedited container transfers along designated corridors. Speeds above 25 km/h, though rare, indicate cross-yard shuttles or linkages with on-dock rail operations where quick repositioning is critical.

Finally, application segmentation spans airports, manufacturing plants, ports and terminals, and warehouses or distribution centers. Each end-use imposes distinct duty cycles, maintenance regimes, and emissions requirements that shape product specifications, service models, and total cost of ownership considerations.

This comprehensive research report categorizes the Terminal Tractor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Powertrain

- Horsepower Range

- Operation Mode

- Speed

- Application

Uncovering Regional Dynamics and Growth Drivers across the Americas, Europe-Middle East-Africa, and Asia-Pacific Terminal Tractor Markets

The Americas region, led by the United States and Canada, dominates terminal tractor electrification thanks to supportive regulatory frameworks and infrastructure investments. Federal and state incentives-most notably California’s Advanced Clean Fleets regulation and Canada’s Clean Fuel Standard-have driven pilot programs and large-scale deployments. Major ports such as Los Angeles-Long Beach, New York/New Jersey, and Vancouver have instituted clean air action plans requiring zero-emission yard trucks, fueling demand for electric terminal tractors and related charging networks.

Europe, the Middle East, and Africa present a heterogeneous landscape shaped by stringent EU emissions regulations, ambitious carbon neutrality roadmaps, and burgeoning renewable energy investments. In Northern Europe, ports such as Rotterdam and Antwerp are integrating electric and hydrogen-ready terminal tractors to meet low-emission targets, while Mediterranean hubs evaluate hybrid solutions to balance grid constraints with decarbonization goals. In the Middle East, state-sponsored smart port initiatives are exploring autonomous and electric units for new terminals, though adoption remains nascent amid fluctuating energy pricing. Africa’s market is still emerging, driven by infrastructure modernization at key transshipment centers and donor-funded green logistics projects that introduce electric yard equipment in select free trade zones.

Asia-Pacific is characterized by rapid growth in China, where scrappage schemes and purchase incentives have more than doubled electric medium- and heavy-duty truck sales between 2023 and 2024, representing over 80% of global volumes in that period. Major Chinese ports have established emission control areas mandating zero-emission operations, and domestic OEMs benefit from deep manufacturing ecosystems that enable cost-competitive battery production. Elsewhere in APAC, Singapore and Hong Kong pilots focus on electric terminal tractors in smart port corridors, while India and Australia weigh incentives and infrastructure readiness to determine the pace of transition.

This comprehensive research report examines key regions that drive the evolution of the Terminal Tractor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Shaping the Terminal Tractor Landscape with Innovation, Partnerships, and Market Leadership Strategies

Kalmar, a division of Cargotec, remains the global market leader in terminal tractor solutions, with an estimated 20–25% share driven by a diversified portfolio covering diesel, hybrid, and electric models. Its 2023 acquisition of Lonestar Specialty Vehicles’ electric terminal tractor line exemplifies its strategy to integrate proven technologies and scale production through contract manufacturing partnerships.

Terberg Group BV holds approximately 15–20% of the market, leveraging its expertise in hybrid and emerging hydrogen propulsion systems. Strategic collaborations with high-volume ports in Rotterdam and Singapore underpin its competitive edge, while stringent EU emission mandates continue to validate its green product roadmap.

BYD Company Ltd. has rapidly expanded its presence beyond China, holding a projected 12–18% share by supplying cost-effective electric yard tractors powered by lithium iron phosphate batteries. Its domestic manufacturing scale confers price advantages that resonate in emerging markets where acquisition costs are a primary constraint.

Volvo AB, capturing roughly 10–15% of the market, is pioneering hydrogen-fuel cell models aimed at long-duty, high-power applications where battery-electric range limitations persist. Concurrently, Orange EV distinguishes itself in North America with a turnkey approach-deploying electric trucks alongside chargers and service support-and has surpassed deployments to over 300 fleets, logging more than 21.5 million miles in service, the highest penetration among heavy-duty electric truck manufacturers.

Other notable participants such as Taylor Machine Works, Mitsubishi Logisnext, and Hyster-Yale continue to innovate in hybrid architectures and advanced telematics, reinforcing a competitive environment where new entrants and traditional truck OEMs compete on efficiency, reliability, and total cost of ownership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Terminal Tractor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AUTOCAR, LLC

- BYD Company Limited

- Capacity Trucks

- CVS Ferrari

- Dongfeng Motor Corporation

- FERNRIDE GmbH

- Hoist Material Handling

- Hyster‑Yale Materials Handling

- Kalmar Corporation

- Konecranes

- Linde Material Handling by KION Group

- MAFI Transport-Systeme

- MOL Trucks

- Orange EV

- Outrider Technologies

- REV Group

- Saic-Iveco Hongyan

- Sany Group

- Shacman

- Sinotruk

- Terberg Group

- TICO Tractors

- Volvo AG

Actionable Strategic Recommendations for Terminal Tractor Industry Leaders to Capitalize on Emerging Technological and Regulatory Trends

To thrive in the evolving terminal tractor market, industry leaders must prioritize electrification roadmaps that align with regulatory timelines and ESG targets. This entails investing in battery-electric and hydrogen-fuel cell development, securing long-term supply agreements for critical minerals, and collaborating with charging infrastructure providers to deploy reliable on-site solutions. Given that opportunity charging during breaks can sustain yard operations without downtime, as noted by leading fleets, seamless integration of hardware and charging schedules is essential.

Simultaneously, embracing autonomy and digital services enhances operational productivity and safety. OEMs and fleet operators should pilot Lidar- and vision-based autonomous models in controlled environments to validate use cases and build regulatory confidence. Bundling telematics-driven predictive maintenance with service contracts can shift revenue models toward outcomes-based engagements, reducing unplanned downtime and strengthening customer relationships.

Supply chain resilience must be bolstered through dual-sourcing strategies and nearshoring of critical component manufacturing. The recent tariff environment underscores the need for diversified supplier networks and agile procurement processes that can adapt to shifting trade policies. Engaging in public-private partnerships to secure tariff exemptions and infrastructure grants can further mitigate cost pressures and ensure continuity of parts supply.

Lastly, workforce upskilling is pivotal. As electric and autonomous technologies proliferate, maintenance teams and operators require training on high-voltage safety protocols, battery management, and software diagnostics. Leading ports have demonstrated successful collaboration with unions and training institutions to facilitate this transition, setting a precedent for industry-wide adoption.

Comprehensive Research Methodology Encompassing Primary Interviews, Secondary Data Analysis, and Robust Market Validation Techniques

This research harnessed a hybrid methodology combining primary interviews with 20+ terminal tractor OEM executives, fleet managers, and logistics facility operators alongside extensive secondary data analysis drawn from industry publications, regulatory filings, and trade association reports. Primary engagements focused on gauging adoption barriers, total cost of ownership drivers, and technology roadmaps, ensuring stakeholder perspectives informed market narratives and strategic priorities.

Secondary sources encompassed official emissions standards documentation, tariff schedules from the U.S. Trade Representative, and market trend analyses from independent energy agencies. Data triangulation techniques were employed to validate propulsion segmentation, regional deployment rates, and adoption forecasts, while quality control protocols ensured consistency across diverse data sets.

Market sizing and segmentation frameworks were constructed through bottom-up and top-down approaches, reconciling manufacturer shipment data, fleet renewal rates, and end-user demand signals. Rigorous cross verification with third-party fleet registration databases and port authority equipment inventories underpinned the accuracy of regional demand breakdowns.

Finally, internal workshops and peer reviews by subject-matter experts refined key findings, ensuring that strategic recommendations and cost-impact analyses reflect realistic implementation scenarios. This comprehensive methodology delivers robust, actionable insights tailored for decision-makers in the terminal tractor ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Terminal Tractor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Terminal Tractor Market, by Powertrain

- Terminal Tractor Market, by Horsepower Range

- Terminal Tractor Market, by Operation Mode

- Terminal Tractor Market, by Speed

- Terminal Tractor Market, by Application

- Terminal Tractor Market, by Region

- Terminal Tractor Market, by Group

- Terminal Tractor Market, by Country

- United States Terminal Tractor Market

- China Terminal Tractor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Conclusion Synthesizing Critical Market Insights, Strategic Imperatives, and the Path Forward for the Terminal Tractor Sector

The terminal tractor market stands at a pivotal juncture where decarbonization, automation, and digitalization converge to redefine yard operations and logistics workflows. While diesel propulsion and manual control will coexist with emerging electric and autonomous solutions for several years, the balance is shifting decisively toward cleaner, smarter equipment that meets rigorous emissions and efficiency mandates.

Regional dynamics underscore that North America leads in electrification and infrastructure investment, Europe-Middle East-Africa charts a complex path shaped by stringent regulations and smart port initiatives, and Asia-Pacific registers explosive growth driven by policy incentives and domestic manufacturing scale. Simultaneously, multiple layers of U.S. tariffs impose new cost structures that compel supply chain diversification and nearshoring strategies.

In this rapidly evolving landscape, market leaders must embrace integrated approaches-combining advanced powertrain development, telematics-enabled services, and workforce upskilling-to maintain competitive advantage. Collaborative partnerships across the ecosystem, including port authorities, utilities, and technology providers, will be instrumental in achieving seamless transitions to zero-emission and autonomous operations.

Ultimately, agility in procurement, innovation in product portfolios, and strategic alignment with sustainability imperatives will determine which stakeholders emerge as winners in the terminal tractor sector. This executive summary provides a roadmap for navigating these transformative shifts and capitalizing on the opportunities they present.

Connect with Ketan Rohom to Access the Full Terminal Tractor Market Research Report and Empower Your Strategic Decision-Making Efforts

For a deeper dive into market dynamics, competitive positioning, and tailored growth opportunities in the terminal tractor sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to unlock the full value of this comprehensive industry report and empower your strategic decision making with data-driven insights.

- How big is the Terminal Tractor Market?

- What is the Terminal Tractor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?