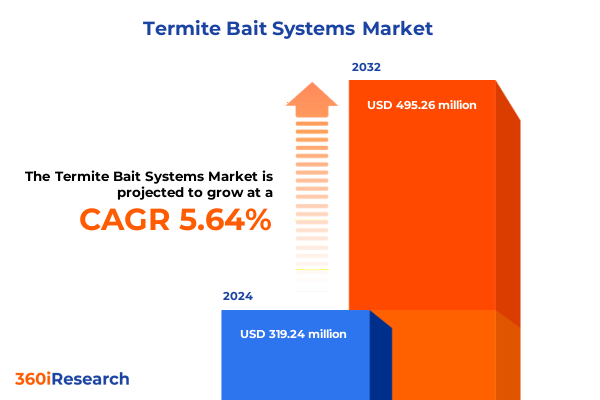

The Termite Bait Systems Market size was estimated at USD 337.47 million in 2025 and expected to reach USD 357.92 million in 2026, at a CAGR of 6.23% to reach USD 515.26 million by 2032.

Unveiling the Strategic Significance of Termite Bait Systems as a Cornerstone in Protecting Built Environments and Enhancing Integrated Pest Management

Termite bait systems have emerged as a critical linchpin in modern pest management strategies, providing a targeted and minimally invasive alternative to traditional chemical treatments. By leveraging the natural foraging behavior of termite colonies, these systems introduce chitin synthesis inhibitors and growth regulators that are discreetly integrated into protective stations. This focused approach not only curtails collateral environmental impacts but also elevates safety profiles for residential, commercial, and industrial settings. As awareness of integrated pest management grows, stakeholders increasingly recognize the value of baiting techniques in delivering long-term colony suppression without resorting to widespread soil drenching or structural fumigation.

Over the past decade, heightened scrutiny over chemical usage and a surge in green building certifications have further propelled the adoption of termite bait systems. Property owners and facility managers are demanding solutions that align with sustainability objectives while maintaining robust structural protection. In parallel, service providers are refining their offerings to incorporate remote monitoring capabilities and data-driven interventions, thereby enhancing treatment precision and reducing labor intensity. This introduction underscores the sector’s evolution from rudimentary soil treatments to sophisticated baiting frameworks that harmonize efficacy, environmental stewardship, and operational efficiency.

Rapid Technological Innovations and Regulatory Evolution Reshaping the Termite Bait Systems Landscape with Precision Monitoring and Ecofriendly Solutions

The termite bait systems landscape is undergoing transformative shifts driven by technological breakthroughs and evolving regulatory expectations. Innovations in sensor miniaturization and wireless connectivity have given rise to intelligent stations capable of transmitting real-time colony activity data to centralized platforms. This transition towards proactive pest management enables service providers to preempt termite incursions, optimize route scheduling, and demonstrate treatment efficacy through demonstrable metrics. Concurrently, advancements in bait formulation-such as biodegradable carriers and slow-release matrices-are facilitating controlled active ingredient dispersal, thereby maximizing pest lethality while minimizing non-target exposures.

Regulatory bodies are also reshaping the market dynamics by tightening restrictions on broad-spectrum termiticides and endorsing integrated pest management protocols. Heightened emphasis on environmental protection, worker safety, and public health has accelerated the approval of non-repellent baits and natural compounds. These policy changes are incentivizing manufacturers to invest in research and development of eco-friendly active ingredients and to engage in collaborative studies validating long-term environmental impacts. Together, technological and regulatory vectors are redefining competitive advantage, with operators who adopt a data-centric and sustainability-oriented stance positioned to lead the next wave of market expansion.

Assessing the Cumulative Effects of United States Tariff Measures in Twenty Twenty Five on Supply Chain Viability and Production Costs for Termite Bait Systems

In twenty twenty five, expanded tariff measures enacted by the United States government on specific imported materials have imparted significant stress on the termite bait systems supply chain. Raw components, including high-density polymers and specialized sensor modules largely sourced from overseas suppliers, now incur elevated import costs that cascade through production budgets. As manufacturers reconcile these additional duties, margins are under pressure, prompting an industry-wide reassessment of procurement strategies and vendor diversification efforts.

These cumulative tariff impacts have also accelerated the shift toward near-shoring and the establishment of domestic assembly facilities. By localizing critical manufacturing operations, companies can mitigate the volatility of cross-border duties and benefit from shorter lead times. However, this strategic pivot entails substantial capital expenditure and logistical coordination. In response, several leading players are forging partnerships with regional injection molders and electronics assemblers to distribute risk and secure alternative sources of supply. While the transition introduces complexity in scale-up management, it ultimately strengthens resilience against future policy fluctuations and reinforces continuity of supply for end-users.

Decoding Product Types Pest Species Applications and Diverse Distribution Channels to Reveal Strategic Insights for Termite Bait System Stakeholders

Understanding the termite bait systems market requires a multilayered analysis of how product types, pest species, application contexts, and distribution channels intersect to create demand patterns. Above ground bait systems have gained traction in high-visibility environments such as historic buildings and interior spaces, where minimal soil disturbance is imperative, whereas in ground bait systems remain the foundation for subterranean termite control in soil-rich perimeters. This dichotomy influences procurement choices by service providers who must align station design with colony behavior and structural sensitivity.

The diversity of target species further nuances deployment strategies. Dampwood termites, prevalent in high-moisture coastal regions, often necessitate station relocation and moisture-resistant formulations, while drywood termites in arid zones require strategically placed monitors within wooden substrates. Subterranean termites, which account for the majority of structural damage incidents, prompt the widespread installation of ground-integrated stations that leverage the colony’s foraging networks. Application segments-commercial, industrial, and residential-exhibit distinct service level demands, with commercial and industrial clients prioritizing continuous monitoring and rapid response capabilities, while homeowners often seek cost-effective periodic inspections.

Distribution channels are equally pivotal in shaping market access and service delivery models. National distributors capitalize on large-scale rollouts for governmental and corporate accounts, while regional distributors offer tailored technical support to local operators. E-commerce platforms, including manufacturer websites and major online marketplaces, are eroding traditional barriers by providing direct access to standardized stations and consumables. Retailers, with their extensive footprints, cater to do-it-yourself consumers who prefer turnkey baiting kits. These channel dynamics underscore the importance of an omnichannel approach that balances centralized logistics with localized expertise.

This comprehensive research report categorizes the Termite Bait Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pest Species

- Application

- Distribution Channel

Delineating the Unique Characteristics and Growth Drivers Across Americas EMEA and Asia Pacific Regions for Targeted Termite Bait System Deployment

Regional variations in economic activity, building practices, and termite prevalence drive distinct termite bait system adoption rates across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, aging residential and commercial infrastructure coupled with stringent insurance requirements has elevated demand for proven subterranean termite remediation. The United States, in particular, demonstrates robust uptake of integrated monitoring platforms, while Latin American markets show growing interest in low-cost in ground systems adapted for warm, humid climates.

Across Europe Middle East & Africa, regulatory frameworks emphasize eco-friendly treatments that comply with stringent chemical restrictions and sustainability targets. Western European markets lead in the adoption of non-repellent baiting solutions, supported by incentives for green building certifications. Meanwhile, Middle Eastern construction booms have spurred initial service deployments, and select African urban centers are evolving pilot programs to address escalating termite incidents in rapidly expanding cities.

The Asia Pacific region remains the epicenter of termite biodiversity, motivating widespread utilization of both above ground and in ground bait systems. Urbanization in China and India has intensified the need for integrated pest management, with governments sponsoring awareness campaigns and technical training for service providers. In Southeast Asia and Oceania, favorable humidity conditions accelerate termite life cycles, creating year-round treatment requirements and fostering innovation in moisture-adaptive formulations.

This comprehensive research report examines key regions that drive the evolution of the Termite Bait Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders Embracing Advanced Technologies Strategic Collaborations and Sustainable Practices in the Termite Bait System Market

Leading companies in the termite bait systems domain are distinguishing themselves through innovation in sensor integration, sustainable active ingredients, and collaborative service models. Major agricultural chemical corporations have expanded their portfolios by acquiring specialized biotech firms developing chitin synthesis inhibitors, thereby securing proprietary bait formulations. Concurrently, technology enterprises have introduced cloud-based monitoring platforms that aggregate colony data, enabling predictive analytics and cross-site benchmarking for large facility management.

Strategic alliances between formulation developers and equipment manufacturers are also reshaping competitive dynamics. By co-developing moisture-resistant carriers and smart station enclosures, partners can offer end-to-end solutions that appeal to high-value commercial contracts and government tenders. Some organizations are further differentiating through comprehensive training programs and certification for technicians, underscoring a service-oriented value proposition. These combined efforts illustrate how an integrated approach-encompassing research, product innovation, and practitioner support-can drive both market penetration and customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Termite Bait Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anticimex Holding AB

- Bayer AG

- Corteva Agriscience Inc.

- D-Tec Pest Solutions

- Ecolab Inc.

- Ensystex, Inc.

- FMC Corporation

- Rentokil Initial plc

- Rollins, Inc.

- ServiceMaster Global Holdings, Inc.

- TermiKill Pty Ltd.

- Truly Nolen Consolidated, Inc.

- Zip Pest Solutions

Strategic Imperatives and Practical Guidance for Industry Leaders Aiming to Enhance Market Positioning and Operational Resilience in Termite Bait Systems

To capitalize on emerging opportunities and navigate the challenges of evolving supply chains, industry leaders should prioritize the integration of digital monitoring solutions with advanced analytics. Establishing a unified platform for station data collection and performance reporting enables rapid identification of infestation hotspots and resource allocation at scale. Simultaneously, diversifying procurement channels by engaging both domestic and international suppliers can buffer against potential tariff escalations and logistical disruptions. Securing agreements with regional OEMs for injection molding and electronics assembly will further distribute risk and reinforce continuity of supply.

Sustainable innovation must remain at the forefront of product development pipelines. Investing in research to enhance bait palatability through novel attractants and to engineer biodegradable station components aligns with regulatory trends and customer expectations. In parallel, expanding training initiatives and certification programs for technicians elevates service quality and fosters differentiation. Finally, strengthening omnichannel distribution strategies-spanning national and regional distributors, direct-to-customer e-commerce, and retail partnerships-will maximize market reach while preserving localized technical support.

Employing a Rigorous Mixed Methods Framework Integrating Primary Expert Consultations and Secondary Data Analysis for Validated Market Insights

This research employs a robust mixed methods framework to deliver validated market insights. Primary data was gathered through in-depth interviews with key stakeholders, including formulation scientists, equipment engineers, pest management executives, and regulatory advisors. These qualitative insights were complemented by secondary data collected from government registries, patent databases, and published environmental assessments to ensure comprehensive coverage of technology, policy, and commercial dynamics.

To reinforce data reliability, triangulation techniques were applied by cross-referencing interview findings with third-party technical reports and academic publications. Quantitative analysis incorporated global and regional pest incidence statistics, tariff schedules, and distribution channel performance metrics. The combined methodological approach ensured that conclusions are grounded in empirical evidence and enriched by expert validation, providing a rigorous foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Termite Bait Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Termite Bait Systems Market, by Product Type

- Termite Bait Systems Market, by Pest Species

- Termite Bait Systems Market, by Application

- Termite Bait Systems Market, by Distribution Channel

- Termite Bait Systems Market, by Region

- Termite Bait Systems Market, by Group

- Termite Bait Systems Market, by Country

- United States Termite Bait Systems Market

- China Termite Bait Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Market Drivers Emerging Challenges and Lucrative Opportunities to Reinforce the Critical Role of Termite Bait Systems

The termite bait systems market is characterized by converging drivers that underscore its strategic importance: escalating sustainability mandates, technological digitization, and an imperative for precise, targeted pest control. However, challenges such as supply chain volatility, regulatory complexity, and the evolving behavior of termite populations require adaptive strategies. Stakeholders able to harmonize innovation in bait formulation with intelligent monitoring platforms are best positioned to achieve durable colony suppression and operational efficiency.

Looking ahead, the intersection of eco-friendly active ingredients, AI-enabled data analytics, and modular hardware design will define the next frontier in termite management. Industry participants who embrace a holistic approach-spanning research, manufacturing, service delivery, and continuous training-will capture disproportionate value. Ultimately, the integration of these multifaceted capabilities will reinforce the role of termite bait systems as indispensable tools in preserving structural integrity and safeguarding environments.

Connect with Associate Director Ketan Rohom to Unlock Comprehensive Termite Bait Systems Market Research and Drive Actionable Strategic Decisions

To delve deeper into comprehensive insights and actionable intelligence on termite bait systems, engage directly with Associate Director Ketan Rohom. His extensive expertise and strategic acumen in sales and marketing can guide your organization in translating market data into effective business strategies. By connecting with Ketan, you gain personalized support in interpreting trends, identifying high-value opportunities, and crafting go-to-market plans that address regulatory challenges and evolving customer demands.

Take the next step toward securing your competitive edge in the termite bait systems arena. Reach out to Ketan Rohom to learn how our full market research report can empower your decision-making process, optimize resource allocation, and drive sustainable growth. Collaborate with a dedicated partner focused on delivering tailored recommendations, granular segmentation insights, and region-specific strategies that align with your organizational objectives.

- How big is the Termite Bait Systems Market?

- What is the Termite Bait Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?