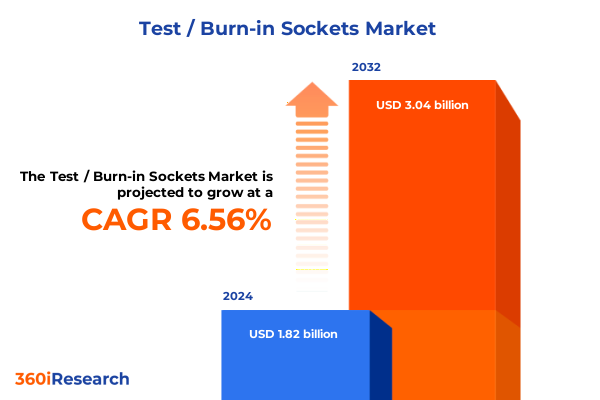

The Test / Burn-in Sockets Market size was estimated at USD 1.94 billion in 2025 and expected to reach USD 2.06 billion in 2026, at a CAGR of 6.61% to reach USD 3.04 billion by 2032.

A concise overview of how evolving packaging, reliability testing, and production throughput requirements are reshaping the test and burn-in socket ecosystem

The semiconductor test and burn-in socket ecosystem sits at the intersection of quality assurance, reliability engineering, and high-throughput production testing. Test sockets and burn-in sockets are essential fixtures in device validation and reliability screening workflows, enabling electrical connectivity, thermal control, and mechanical support during accelerated life testing and functional validation. Advances in packaging density, heterogeneous integration, and the spread of advanced node process technologies have amplified the technical demands on sockets, requiring greater thermal stability, finer mechanical tolerances, and improved contact reliability.

Across the value chain, equipment makers, test service providers, and OEMs are re-evaluating socket strategies to balance throughput, yield, and cost. Adoption of new packaging formats and increased system-level validation cycles have placed sockets under more frequent stress, prompting suppliers to prioritize material science innovations and modular design approaches. Meanwhile, sustainability considerations and the rising importance of circular practices are beginning to influence sourcing and end-of-life strategies for socket assemblies.

This executive summary synthesizes technological shifts, policy impacts, segmentation-level dynamics, regional performance differentials, competitive positioning, and actionable recommendations aimed at stakeholders who must navigate a rapidly evolving testing environment. The analysis emphasizes pragmatic implications for procurement, product engineering, and business strategy, offering a coherent foundation for decision-making in the near to medium term.

How advances in packaging density, thermal reliability requirements, automation, and supply chain resilience are fundamentally altering socket design and procurement dynamics

The landscape for sockets used in burn-in and test operations is undergoing transformative shifts driven by multiple, interdependent forces. First, packaging innovation has accelerated: finer pitch arrays, multilayer substrates and heterogeneous integration have increased contact density and complexity, which in turn demand sockets with higher precision alignment and improved electrical performance. As a result, suppliers are investing in microfabrication techniques and refined mechanical tolerances to maintain signal integrity at short interconnect lengths.

Simultaneously, thermal and reliability testing regimes have become more rigorous. Devices integrating power-hungry components and compound packages generate higher localized heat, pushing socket materials and cooling interfaces to perform reliably under elevated thermal cycling. This has elevated the role of material science, with ceramic-filled compounds and metal alloys gaining favor for thermal stability, while engineered plastics remain attractive for cost-sensitive applications. The confluence of these material choices with socket architecture is shaping lifecycle and maintenance practices for test floors.

Operationally, automation and data-driven test optimization are reducing manual handling and human error, while increasing test throughput expectations. Smart socket solutions, integrating sensors and diagnostic feedback, are emerging to support predictive maintenance and reduce unplanned downtime. At the same time, supply chain resilience concerns and regional policy shifts are prompting firms to diversify sourcing footprints and consider buffer inventory strategies for critical socket components. Taken together, these shifts are not incremental; they are reconfiguring supplier roadmaps, capital investment decisions, and the criteria by which buyers select socket partners.

The cascading operational and strategic consequences of recent United States tariff actions on sourcing, manufacturing footprint decisions, and total cost of ownership for socket suppliers and buyers

Recent tariff measures and trade policy adjustments in the United States have introduced new cost dynamics and sourcing imperatives for suppliers and buyers of test and burn-in sockets. Increased import duties on certain electronic components and raw materials have prompted manufacturers to reassess their supplier networks and to accelerate efforts to localize critical stages of production. This reshoring and nearshoring momentum has been most pronounced where tariffs interact with already existing logistics challenges and geopolitical risk considerations.

In response to tariff-driven cost pressures, several firms have adjusted their product strategies by optimizing material bills of materials, adopting alternative component suppliers, or redesigning socket assemblies to reduce exposure to affected inputs. Some suppliers have invested in regional manufacturing hubs to mitigate duty exposure and shorten lead times, while others have pursued contractual hedges and cost-passing mechanisms with customers. These tactical responses often have secondary effects, including altered supplier margins, changed warranty and service models, and revised inventory strategies to buffer against policy volatility.

Beyond immediate cost impacts, tariffs are influencing long-term strategic decisions. Firms are evaluating the total cost of ownership that incorporates duty exposure, transit time, and service proximity, which is reshaping procurement frameworks. This re-evaluation is catalyzing partnerships with local contract manufacturers and opening opportunities for suppliers that can provide flexible production capacity and quick-turn prototyping. For buyers and manufacturers alike, adapting to this tariff environment requires a stronger emphasis on supply chain modeling, scenario planning, and collaborative supplier development to preserve continuity of testing operations and product roadmaps.

A granular segmentation-driven perspective explaining how product architectures, packaging families, material compositions, end-user demands, and channels jointly determine socket selection and sourcing behavior

Segment-level dynamics reveal differentiated drivers and buying behaviors across product, packaging, material, end-user, and distribution dimensions. Based on product, the market is studied across Burn-In Sockets and Test Sockets; the Burn-In Sockets category further segments into Clamshell, Continuous Flow, and Open Top architectures that each address specific thermal, throughput and handling requirements, while Test Sockets divide into Pogo Pin and Probe Pin configurations that trade off contact reliability and repeatability. Based on packaging type, the market is studied across Ball Grid Array, Land Grid Array, Pin Grid Array, Quad Flat No-lead, Small Outline Integrated Circuit, and Thin Small Outline Package, with each package family presenting unique alignment and contact density challenges that influence socket selection and lifecycle costs.

Based on material type, the market is studied across Ceramic-Filled, Metal, and Plastic options; ceramic-filled materials excel in thermal stability, metal parts deliver mechanical robustness and high conductivity, and plastics provide cost-effective flexibility where thermal and mechanical demands are moderate. Based on end user, the market is studied across Aerospace & Defense, Automotive, Consumer Electronics, Healthcare, and Telecommunications; aerospace and defense prioritize qualification and traceability, automotive emphasizes long-term reliability under harsh environments, consumer electronics demand cost-efficient high-volume solutions, healthcare focuses on precision and contamination control, and telecommunications values signal integrity and thermal management for network equipment validation. Based on distribution channel, the market is studied across Offline and Online channels, with offline channels remaining critical for complex, customized socket solutions that require engineering collaboration, while online channels increasingly serve standardized, repeat-purchase components and aftermarket needs.

These segmentation insights collectively show that decisions about socket design, material selection, and procurement channels are not isolated; they are conditioned by interactions between package type, end-use reliability requirements, and production scale. As such, targeted product roadmaps and go-to-market approaches that map explicitly to these segment cross-sections will deliver better alignment with buyer expectations and operational constraints.

This comprehensive research report categorizes the Test / Burn-in Sockets market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Material Type

- Mounting Method

- Contact Technology

- Device Type

- End User Industry

- Distribution Channel

How distinct regional manufacturing clusters, regulatory expectations, and customer demands across the Americas, Europe Middle East and Africa, and Asia Pacific dictate differentiated socket strategies and investments

Regional dynamics play a pivotal role in shaping technology adoption, supply chain strategies, and commercial priorities for socket manufacturers and buyers. In the Americas, manufacturing leadership, strong domestic demand in automotive and aerospace sectors, and investment in advanced packaging R&D have fostered an environment where proximity to end customers and strong service capabilities are strategic differentiators. This region also sees growing emphasis on near-term reshoring and investments in local assembly to minimize exposure to trade disruptions.

Europe, Middle East & Africa combines stringent regulatory and qualification standards with diverse market requirements across industrial automation, telecommunications, and healthcare segments. High reliability expectations and a premium on environmental and occupational safety compliance drive demand for well-documented, traceable socket solutions. Within this region, strategic partnerships with regional test houses and calibration service providers are a common route to market for both established and emerging socket suppliers.

Asia-Pacific remains a critical hub for high-volume manufacturing, advanced packaging innovation, and dense supplier ecosystems. A strong cluster of wafer fabrication, OSATs, and test houses creates a deep demand base for both burn-in and test sockets, while rapid adoption of new consumer electronics form factors continuously elevates technical requirements. However, this region also presents competitive pricing pressures and a complex regulatory tapestry that necessitates nimble supply chain strategies. Taken together, regional differences underscore the importance of aligning manufacturing footprints, service models, and product portfolios to local customer expectations and regulatory realities.

This comprehensive research report examines key regions that drive the evolution of the Test / Burn-in Sockets market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive positioning and capability plays that separate suppliers who win on engineered performance, rapid customization, and comprehensive after-sales service from those competing primarily on cost

Leading firms in the socket ecosystem demonstrate varied approaches to competing on performance, customization, and service. Some companies concentrate on deep engineering partnerships with key OEMs and test houses to co-develop socket assemblies tailored for high-reliability applications, leveraging proprietary materials and precision machining capabilities. Other players focus on modular, cost-optimized platforms that reduce lead times and support rapid design-to-production cycles for high-volume consumer and telecom applications.

Across the competitive landscape, differentiation often emerges from after-sales capabilities: rapid field support, spare component availability, and diagnostic tooling that shortens mean time to repair. Strategic investments in automation and smart diagnostics are becoming a meaningful differentiator, enabling predictive maintenance of sockets and reducing test floor downtime. Collaborations between socket suppliers and thermal management vendors are also increasing, reflecting a growing need to pair mechanical contact solutions with effective cooling strategies.

Mergers, strategic alliances, and targeted acquisitions continue to be tools for capability expansion, enabling companies to add materials expertise, expand regional manufacturing footprints, or integrate complementary testing accessories. Firms that can balance product innovation with reproducible manufacturing quality and responsive service models are best positioned to meet the diverse and evolving demands of device makers and test service providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Test / Burn-in Sockets market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abrel Products Limited

- Advanced Interconnections Corp.

- ADVANTEST CORPORATION

- Ardent Concepts, Inc.

- Aries Electronics Inc.

- Azimuth Electronics LLC

- Boyd Corporation

- Codico GmbH

- Cohu, Inc.

- E-tec Interconnect Ltd.

- Enplas Corporation

- Exatron, Inc.

- Johnstech International

- Loranger International Corporation

- Micronics Japan Co., Ltd.

- Mouser Electronics, Inc.

- Pomona Electronics

- Qualmax Inc.

- Quanta Computer Inc.

- Robson Technologies, Inc.

- Sensata Technologies, Inc.

- Smiths Interconnect, Inc.

- TopLine Corporation

- WinWay Tech. Co., Ltd.

- Yamaichi Electronics Co., Ltd.

- Yokowo Co., Ltd.

- Zierick Manufacturing Corporation

Actionable strategic measures for suppliers and buyers to drive modular design, material innovation, regional resilience, embedded diagnostics, and collaborative co-development to secure long-term competitiveness

Industry leaders should pursue a coordinated set of actions to secure technical leadership and supply resilience while addressing cost pressures. First, prioritize modularity in socket design to enable faster customization with lower engineering overhead. Modular platforms reduce time-to-deployment and enable economies of scale across product families, while maintaining the ability to meet specialized thermal and mechanical requirements.

Second, accelerate material and process innovation focused on thermal stability and contact reliability. Investing in hybrid material systems and thin-film contact technologies can deliver longevity and electrical performance improvements that reduce failure rates and aftermarket support costs. Third, develop regional manufacturing and service nodes to reduce exposure to trade policy shocks and compress lead times; these nodes should be sized to provide rapid prototyping, small-batch production and localized repair capabilities.

Fourth, embed diagnostics and IoT-enabled monitoring in higher-value socket products to support predictive maintenance and remote troubleshooting. These capabilities lower total test-floor downtime and create recurring value streams through service contracts. Fifth, cultivate collaborative relationships with packaging and test-house partners to anticipate design trends and co-validate new socket architectures early in the product lifecycle. By aligning R&D roadmaps with key customers, suppliers can influence specification evolution and secure early adoption windows.

Finally, adopt a supplier risk management program that combines multi-sourcing, strategic inventory buffers for critical inputs, and contractual flexibility to navigate tariff volatility. Executed together, these measures position industry leaders to deliver differentiated products with resilient operational models that meet increasingly exacting reliability and throughput expectations.

A transparent mixed-methods research approach combining primary interviews with engineering and procurement leaders and secondary technical literature to ensure robust, validated insights

This report synthesizes primary interviews with engineering and procurement leaders across device makers, test houses, and socket manufacturers, supplemented by secondary research from technical literature, industry standards, and regional policy announcements. Primary engagement consisted of structured conversations exploring product performance priorities, sourcing strategies, and service expectations, ensuring that technical nuance and real-world operational considerations informed the analysis.

Secondary inputs included peer-reviewed materials science publications, standards documentation for package interfaces, and publicly available company disclosures that detail manufacturing investments and product roadmaps. The analytical approach used qualitative triangulation of interview insights with documented technical trends to develop segmentation narratives, competitive profiles, and scenario-based implications for tariffs and regional supply shifts. Wherever possible, technical claims were validated against multiple independent sources to enhance reliability.

Limitations of the methodology are acknowledged and addressed through sensitivity analysis and cross-validation. Stakeholder perspectives were selected to represent a balanced cross-section of end-user segments and geographic footprints, while recognizing that proprietary operational data from individual firms may not be fully disclosed. The research framework emphasizes reproducibility and transparency in assumptions, enabling readers to adapt the insights to their specific operational contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Test / Burn-in Sockets market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Test / Burn-in Sockets Market, by Product Type

- Test / Burn-in Sockets Market, by Packaging Type

- Test / Burn-in Sockets Market, by Material Type

- Test / Burn-in Sockets Market, by Mounting Method

- Test / Burn-in Sockets Market, by Contact Technology

- Test / Burn-in Sockets Market, by Device Type

- Test / Burn-in Sockets Market, by End User Industry

- Test / Burn-in Sockets Market, by Distribution Channel

- Test / Burn-in Sockets Market, by Region

- Test / Burn-in Sockets Market, by Group

- Test / Burn-in Sockets Market, by Country

- United States Test / Burn-in Sockets Market

- China Test / Burn-in Sockets Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2385 ]

Synthesis of strategic imperatives showing why engineering excellence, service responsiveness, regional resilience, and collaborative procurement are essential for future success

As device complexity increases and reliability expectations rise, sockets will continue to be a critical enabler of functional validation and lifecycle qualification. Suppliers that combine rigorous materials engineering, modular design philosophies, and localized operational capabilities will be best positioned to meet escalating customer demands while managing tariff and supply chain uncertainties. Buyers, in turn, should reframe procurement criteria to value service responsiveness, embedded diagnostics, and long-term reliability investments alongside unit price considerations.

The interplay between packaging innovation, thermal management challenges, and end-user reliability requirements will sustain demand for differentiated socket solutions, yet it will also raise the bar for supplier competency. Strategic investments in co-development partnerships, regional manufacturing footprints, and predictive maintenance capabilities will yield outsized returns in uptime and qualification velocity. In an environment marked by policy shifts and rapid technological change, disciplined scenario planning and closer supplier collaboration are necessary to protect testing continuity and accelerate product validation cycles.

Ultimately, the firms that act decisively to align engineering roadmaps with customer validation needs and that build resilience into their supply and service operations will capture the most durable advantages in this evolving market landscape.

Immediate purchase pathway and tailored briefing options with the Associate Director of Sales and Marketing to secure the full market report and supplemental deliverables

For procurement leaders and technical buyers seeking the full, actionable intelligence in this executive summary, contact Ketan Rohom, Associate Director, Sales & Marketing, to arrange purchase and secure immediate access to the complete market research report and supporting datasets. The research package includes a comprehensive PDF, methodological appendices, raw data tables, and customizable slide decks to support executive briefings and strategic planning needs.

Engage directly to request tailored deliverables such as focused competitor benchmarking, regional drilldowns, or a bespoke implications memo aligned to a specific product line or end-user segment. The team will facilitate secure delivery and a short walkthrough to highlight key findings, assumptions, and how to operationalize the insights for product development, sourcing, and go-to-market strategies.

Prompt engagement will also unlock advisory sessions to translate research findings into near-term tactical actions and a prioritized roadmap. Reach out to arrange a briefing that aligns the research outcomes to your commercial objectives and procurement timelines, ensuring you derive immediate value from the report and supporting analytics.

- How big is the Test / Burn-in Sockets Market?

- What is the Test / Burn-in Sockets Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?