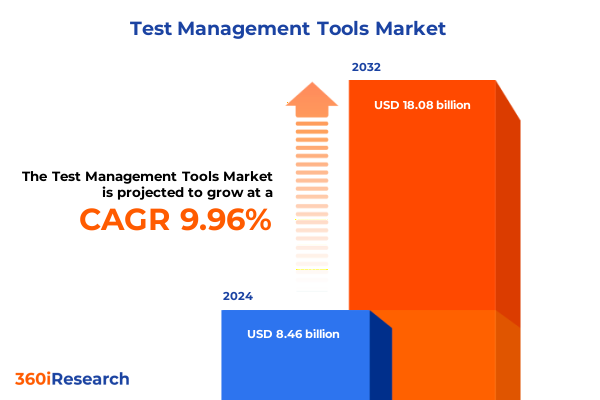

The Test Management Tools Market size was estimated at USD 9.29 billion in 2025 and expected to reach USD 10.17 billion in 2026, at a CAGR of 9.98% to reach USD 18.08 billion by 2032.

Introducing the Strategic Imperatives and Operational Foundations of Test Management Tools in Today’s Rapidly Evolving Software Delivery Environment

In today’s software delivery ecosystem, the swift cadence of iterative releases and the expanding complexity of applications place unparalleled demands on quality assurance processes. Test management tools have evolved from simple defect repositories into sophisticated platforms that orchestrate the entire testing lifecycle, encompassing planning, execution, and traceability. As development teams adopt Agile, DevOps, and continuous integration methodologies at scale, these solutions serve as the operational backbone that enforces consistency, governance, and accountability across functional and technical stakeholders.

Moreover, seamless integration with requirement definitions, defect triage workflows, and real time analytics elevates test management from a support function to a strategic enabler. Modern tool suites enable teams to define comprehensive test plans aligned with user stories, manage extensive case libraries, and evaluate execution outcomes against key performance metrics. Furthermore, by consolidating disparate data sources into unified dashboards, they empower decision makers to identify quality risks early, allocate resources effectively, and maintain release calendars without compromising compliance or performance.

Uncovering the Transformative Shifts Redefining Test Management Strategies Through Automation, Open Source Proliferation, Seamless DevOps Collaboration Dynamics

Legacy approaches to test management have ceded ground to transformative shifts driven by automation, community collaboration, and seamless pipeline integration. Whereas manual test case creation and execution once dominated, the proliferation of automated testing frameworks now enables organizations to execute thousands of validations per cycle, accelerating feedback loops and reducing human error. This shift has recalibrated quality assurance roles, empowering teams to focus on test strategy and exploratory validation rather than repetitive tasks.

Concurrently, open source test management projects have gained significant traction, offering extensible architectures and thriving contributor ecosystems. These platforms often deliver core functionality at minimal cost, yet they drive community driven innovation in areas such as scriptless automation, containerized test environments, and plugin ecosystems. As a result, enterprises increasingly evaluate hybrid adoption models that combine commercial support with the agility of open communities.

Most notably, the seamless integration of test management within DevOps pipelines has redefined cross functional collaboration. Continuous integration and delivery workflows now incorporate automated validation gates, defect logging hooks, and release analytics, ensuring that quality assurance is embedded at every stage. In turn, this enables organizations to scale testing efforts in parallel with development velocity, meeting the demands of digital transformation without sacrificing reliability.

Assessing the Multifaceted Cumulative Impact of Recent United States Tariff Measures on Global Test Management Tool Deployment and Adoption Patterns

In 2025, a series of tariff measures enacted by the United States government under trade statutes targeting software subscriptions and imported IT hardware have had a compound effect on test management tool adoption. Duties imposed on software licensing fees, alongside Section 232 levies on servers and development hardware, have elevated the total cost of ownership for on premise solutions. Consequently, procurement teams are facing higher upfront expenditures and ongoing maintenance charges, prompting reevaluation of deployment strategies.

As organizations assess the cumulative impact, many are pivoting toward cloud based software as a service models to mitigate tariff exposure and capitalize on pay as you go billing. Meanwhile, regional subsidiaries with localized compliance requirements are exploring domestic vendor alternatives to avoid cross border duties. This recalibration has not only reshaped vendor negotiations but also intensified interest in license models that insulate enterprises from unpredictable tariff fluctuations.

Furthermore, the shifting landscape has driven renewed attention to open source test management frameworks, which are inherently immune to import duties. Companies that previously maintained a blended portfolio of commercial and community tools are now accelerating their open source adoption roadmaps, reinvesting savings into automation and analytics. This tariff induced metamorphosis underscores the strategic importance of cost resilience in tool selection and vendor partnerships.

Revealing the Critical Insights Emerging from Component, Testing Type, License Model, Industry Vertical, and Deployment Model Segmentation Dimensions

A detailed component analysis reveals that organizations prioritize modules such as defect tracking, reporting and analytics, requirement integration, test case management, and test planning in distinct ways depending on their operational maturity and compliance mandates. For instance, firms with stringent audit requirements gravitate toward unified dashboards that correlate test outcomes with regulatory checklists, whereas digital native enterprises emphasize automated test case libraries and planning features to support continuous delivery.

When viewed through the lens of testing type, the divide between manual and automated approaches becomes pronounced. Manual testing retains its role in exploratory scenarios and user acceptance cycles, yet automated testing now underpins the majority of regression validations. Within automated testing, commercial tools often deliver out of the box integrations with mainstream development platforms, while open source projects attract teams seeking customizable pipelines and community driven enhancements.

The choice between commercial and open source license models further shapes procurement frameworks. Commercial offerings typically bundle enterprise support, security certifications, and roadmap guarantees, whereas open source alternatives provide flexibility, community collaboration, and reduced license fees. Vertical specific demands also influence these decisions: highly regulated industries such as BFSI and healthcare demand vendor accountability and compliance assurances, while IT and telecommunications organizations prioritize agility and scalability. At the same time, manufacturing and retail and ecommerce sectors require integrated workflows that tie test planning to supply chain and sales cycle milestones.

Deployment strategies, spanning cloud and on premise models, reflect a spectrum of risk profiles and infrastructure readiness. Cloud based deployments are surging for teams that value elastic resource allocation and minimal operational overhead, whereas on premise solutions remain relevant for enterprises with strict data residency constraints or legacy system dependencies.

This comprehensive research report categorizes the Test Management Tools market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Testing Type

- License Model

- Industry Vertical

- Deployment Model

Elucidating the Distinct Regional Dynamics Shaping Test Management Tool Adoption Across the Americas, EMEA, and Asia Pacific Technology Ecosystems

In the Americas, North American organizations leverage mature digital transformation programs to advance cloud based test management adoption, aligning closely with their enterprise scale and security requirements. Latin American enterprises, by contrast, focus on cost effective open source frameworks and hybrid deployments that accommodate bandwidth variability and regional data protection mandates.

Across Europe, Middle East, and Africa, a heterogeneous regulatory landscape shapes adoption dynamics. European firms often seek solutions that support GDPR compliance and robust access controls, whereas entities in the Middle East and Africa prioritize rapid implementation and vendor partnerships that guarantee localized support. Transitional strategies in EMEA frequently involve hybrid on premise infrastructures supplemented by cloud sandboxes for development and testing.

In Asia Pacific, the region’s innovation hubs-particularly Australia, Japan, and South Korea-are early adopters of AI enabled test management capabilities, integrating machine learning driven risk analysis into their pipelines. Meanwhile, emerging markets throughout Southeast Asia exhibit a pragmatic approach, balancing budgetary constraints with scalability imperatives by piloting cloud modules before committing to enterprise wide rollouts.

This comprehensive research report examines key regions that drive the evolution of the Test Management Tools market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positioning, Competitive Strengths, and Innovation Trajectories of Leading Test Management Tool Providers in a Diversified Marketplace

Leading legacy vendors continue to fortify their platforms by integrating end to end modules that encompass requirements management, test orchestration, and advanced analytics. Their deep enterprise relationships and established support frameworks solidify their presence in large scale, mission critical environments. These providers frequently introduce incremental innovations focused on compliance automation and cross functional traceability.

Specialized test management solution providers differentiate through nimble roadmaps and targeted feature sets such as AI driven test optimization, scriptless automation interfaces, and pre built connectors to popular CI/CD pipelines. By fostering robust partner ecosystems, these vendors accelerate time to value for customers seeking domain specific capabilities without vendor lock in.

Open source communities have evolved into vibrant ecosystems where developers collaborate on core frameworks, plugins, and integrations. This community driven approach accelerates innovation cycles and democratizes access, although enterprises often seek commercial support agreements or professional services to mitigate implementation and maintenance risks. Hybrid models that combine community innovation with paid support offerings are emerging as a compelling strategic choice for risk conscious organizations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Test Management Tools market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlassian Corporation Plc

- IBM Corporation

- Katalon, Inc.

- LambdaTest Inc.

- Micro Focus International plc

- Microsoft Corporation

- OpenText Corporation

- Parasoft Corporation

- Perforce Software, Inc.

- Polarion Software GmbH

- PractiTest

- QA Systems GmbH

- qTest

- Qualitia Software Technologies Pvt. Ltd.

- Ranorex GmbH

- SmartBear Software Inc.

- TestRail

- Tricentis GmbH

- Zephyr Corporation

Presenting Actionable Strategic Recommendations to Empower Industry Leaders in Leveraging Test Management Tools for Optimal Quality and Delivery Velocity Gains

Industry leaders should begin by prioritizing tool interoperability through the establishment of standardized APIs and integration frameworks. This approach eliminates workflow silos, ensures seamless data flow between defect tracking, test planning, and CI/CD pipelines, and accelerates feedback loops that drive quality improvements.

Next, decision makers ought to evaluate the optimal balance between commercial and open source license models. By conducting a risk assessment that considers factors such as support requirements, compliance mandates, and customization needs, organizations can leverage community innovations while securing enterprise grade features where they matter most.

A phased cloud deployment strategy is recommended to validate security controls, performance metrics, and cost management practices before scaling across global teams. Starting with noncritical modules reduces risk and builds internal confidence, paving the way for comprehensive adoption across the testing portfolio.

Finally, securing executive sponsorship for continuous process improvement initiatives ensures that quality remains a strategic priority. By embedding real time analytics dashboards into governance checkpoints and aligning metrics with business objectives, organizations foster a culture of accountability and drive continuous delivery excellence.

Detailing the Rigorous Multi Methodology Research Approach, Data Sources, and Validation Processes Underpinning the Test Management Tools Market Study

This research employs a robust multi methodology approach, beginning with an exhaustive secondary analysis of public domain information, technical white papers, and industry publications. This foundational step maps the landscape of test management solutions, identifying key functional modules, license models, and deployment architectures.

Primary insights were gathered through targeted interviews with senior quality assurance managers, DevOps engineers, and IT executives. These engagements surfaced firsthand perspectives on adoption drivers, integration challenges, and the impact of external factors such as regulatory changes and tariff measures.

Vendor profiling was conducted to capture product roadmaps, release cadences, and innovation pipelines, supplemented by an analysis of developer community forums, technology conference proceedings, and certification databases. This triangulation ensures that vendor claims are contextualized against actual user experiences and independent performance benchmarks.

All data streams undergo rigorous validation through cross referencing, statistical reconciliation, and expert panel review. This meticulous validation process underpins the credibility and strategic relevance of the findings, providing stakeholders with confidence in the research outcomes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Test Management Tools market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Test Management Tools Market, by Component

- Test Management Tools Market, by Testing Type

- Test Management Tools Market, by License Model

- Test Management Tools Market, by Industry Vertical

- Test Management Tools Market, by Deployment Model

- Test Management Tools Market, by Region

- Test Management Tools Market, by Group

- Test Management Tools Market, by Country

- United States Test Management Tools Market

- China Test Management Tools Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding the Strategic Executive Summary with Key Takeaways, Overarching Insights, and Imperatives for Effective Test Management Tool Adoption and Evolution

In conclusion, robust test management tooling is central to navigating the pressures of accelerated release cadences, evolving compliance landscapes, and the relentless drive for innovation. As the industry continues to embrace automation, open source collaboration, and cloud native deployments, the ability to orchestrate complex test workflows will define competitive differentiation.

Despite the allure of commercial enterprise suites, open source frameworks are gaining prominence as organizations seek to optimize costs and capitalize on community innovation. Decision makers must therefore strike a balance between comprehensive vendor support and the flexibility afforded by open ecosystems.

The cumulative impact of tariff policies and regional regulatory regimes further complicates procurement strategies, underscoring the need for adaptable license and deployment models. Segmentation analysis highlights the importance of component modularity, vertical specific functionality, and phased adoption paths in delivering sustainable value.

Ultimately, organizations that prioritize interoperability, data driven governance, and incremental cloud migrations will position themselves to achieve continuous quality improvements, accelerate time to market, and sustain innovation leadership in a rapidly evolving software delivery terrain.

Engaging with Ketan Rohom to Unlock Exclusive Access to the Comprehensive Market Research Report on Test Management Tools and Amplify Your Strategic Insights

To gain in depth visibility into the latest trends and competitive dynamics shaping the test management tools sector, we encourage you to engage with Ketan Rohom, Associate Director of Sales and Marketing.

Ketan offers personalized consultations tailored to your organizational goals, providing demonstrations of key findings, segmentation deep dives, and regional analyses.

Reach out to arrange a briefing that will equip your leadership team with actionable intelligence and strategic recommendations, ensuring you can confidently align your technology investments with evolving market imperatives.

Secure your copy of the full market research report today to drive data informed decisions, accelerate innovation, and deliver exceptional software quality across every release cycle.

- How big is the Test Management Tools Market?

- What is the Test Management Tools Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?