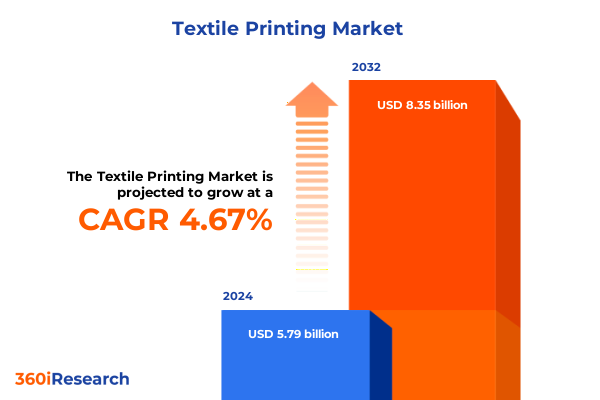

The Textile Printing Market size was estimated at USD 5.79 billion in 2024 and expected to reach USD 6.05 billion in 2025, at a CAGR of 4.67% to reach USD 8.35 billion by 2032.

Unveiling the Dynamic Landscape of Textile Printing for Manufacturers, Brands, and Service Providers: Key Drivers, Innovations, and Market Dynamics

The textile printing industry is at a pivotal moment, driven by an intersection of technological breakthroughs and shifting consumer demands. Over the past decade, advances in digital printing have revolutionized how manufacturers approach customization and small-batch production, enabling brands to respond more rapidly to evolving fashion trends. Meanwhile, legacy methods such as rotary and screen printing continue to maintain relevance, particularly for high-volume applications where cost efficiency remains a priority. From a materials perspective, the expansion of specialized inks and sustainable substrates has enhanced the creative possibilities, allowing designers and converters to explore new textures, color vibrancy, and performance characteristics. As market dynamics evolve, collaborative partnerships between equipment suppliers, ink manufacturers, and textile mills are becoming increasingly strategic, ensuring integrated solutions for faster time to market.

How Emerging Technologies, Sustainable Practices, and Consumer Preferences Are Redefining the Future of Textile Printing in Response to Market Disruption and Innovation

Emerging technologies are reshaping textile printing in profound ways. Digital direct-to-fabric and pigment inkjet systems now offer production speeds that rival analog methods while slashing water usage and chemical waste. In fact, according to Seiko Epson’s research, pigment-based digital printing can reduce water consumption by up to 97% compared to traditional rotary screen processes. This environmental advantage is further complemented by the ability to run shorter print jobs with minimal plate changes, allowing brands to embrace customization and on-demand production without incurring prohibitively high setup costs.

Moreover, industry voices highlight broader resource savings: shifting from six-color screen printing to digital workflows can yield water reductions exceeding 60%, alongside significant energy efficiencies. These gains are especially critical as sustainability mandates tighten in key markets such as California and the European Union, where Extended Producer Responsibility regulations now demand that manufacturers address lifecycle impacts. Together with advances in ink chemistry-spanning pigment, reactive, and disperse formulations-these shifts are enabling textile printers to deliver high-quality, low-impact products at scale. As a result, early adopters of these technologies are forging new supply chain models that emphasize local production, lean inventories, and rapid innovation cycles.

Assessing the Cumulative Impact of 2025 United States Tariffs on Textile Printing Ecosystems, Supply Chains, and Competitive Strategies

The cumulative effects of the latest U.S. tariff measures are reverberating throughout the textile printing sector, triggering strategic recalibrations in sourcing and pricing. Recent commentary suggests that a 15% tariff floor could push average import duties to levels not seen in more than a century, potentially driving a 2% overall rise in consumer prices in 2025. This increase is particularly acute for apparel and home textile imports, where steep duties on raw fabric and finished goods are likely to compress manufacturer margins and accelerate cost pass-through to end-users.

Notably, major brands are already feeling the impact. In late July 2025, Puma disclosed that precautionary imports to circumvent impending duties have resulted in an 18.3% jump in inventory and pressured second-quarter sales down 9.1% year-on-year in North America. The surplus stock has forced deep discounting and prompted supply chain restructuring. Furthermore, printing service providers reliant on imported inks and consumables face similar headwinds, with some reporting that a 25% levy on key inputs could fully erode profitability unless they either absorb the cost or shift operations onshore. Against this backdrop, government relief proposals and industry lobbying efforts are intensifying as stakeholders seek clarity on tariff extensions and phased adjustments.

Key Segmentation Insights Revealing How Printing Technology, Fabric Type, End Use, Ink Type, and Print Run Shape Market Opportunities and Strategies

Segmentation by printing technology reveals distinct pathways for growth and differentiation. Digital printing, encompassing both laser and inkjet modalities, continues to gain traction for its low-volume agility and design flexibility, while rotary and screen printing maintain strongholds in high-run applications. Hybrid models that combine digital pre-treatment with analog finishing are also emerging, offering a bridge between precision and throughput.

When considering fabric types, natural fibers like cotton and silk command premium positioning in apparel and technical textile niches, whereas synthetic and blended substrates-such as nylon and cotton-polyester blends-remain vital for industrial and home textile applications. This diversity in substrate selection drives demand for specialized ink chemistries that adhere consistently across varying fiber chemistries.

End-use segmentation underscores the breadth of textile printing applications. From casual and sportswear in the apparel sector to complex filtration media in industrial uses, the requirements span fast-changing style cycles to rigorous performance criteria. Meanwhile, ink types-ranging from reactive formulations for cotton to acid dyes for nylon-shape printer configurations and process controls.

Finally, distinctions between long and short run print strategies continue to influence equipment and workflow investments. While long runs offer economies of scale, short-run production appeals to brands targeting rapid design iteration, seasonal collections, and personalized offerings.

This comprehensive research report categorizes the Textile Printing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Printing Technology

- Ink Type

- Substrate Material

- Production Volume

- Application

Regional Market Perspectives Deep Dive into the Americas Europe Middle East & Africa and Asia-Pacific Dynamics Shaping Textile Printing Growth and Challenges

Regional dynamics in textile printing reflect a tapestry of growth drivers and challenges. In the Americas, North American manufacturers are doubling down on nearshoring initiatives, bolstered by government incentives and a desire to mitigate tariff-induced cost volatility. Mexico’s established textile clusters are pivoting toward digital adoption, while the U.S. is witnessing expanded investments in high-speed inkjet lines to serve both domestic and export markets.

Across Europe, Middle East & Africa, sustainability mandates and labor considerations are reshaping competitive positioning. The European Union’s stringent environmental regulations are compelling facilities to upgrade to waterless inkjet processes and implement circular textile programs. In parallel, emerging markets in North Africa are building integrated supply chains, leveraging free trade agreements to funnel yarn and fabric into regional printing hubs.

In Asia-Pacific, rapid digitalization is converging with entrenched manufacturing scale. China and India continue to dominate volume printing, but they face mounting pressures to reduce water usage and chemical effluent. Southeast Asian nations are capitalizing on agility and cost advantages, attracting smaller brands seeking flexible short-run production. Meanwhile, Australia and Japan are leading premium segments, focusing on performance textiles and high-definition prints for technical applications.

This comprehensive research report examines key regions that drive the evolution of the Textile Printing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Spotlight Strategic Moves Innovation Highlights and Collaboration Trends Among Leading Textile Printing Companies

The competitive landscape is characterized by a mix of established equipment manufacturers, specialized ink suppliers, and integrators offering end-to-end solutions. Industry stalwarts such as Epson and Kornit Digital are pushing the boundaries of print head technology and sustainable ink formulations, while players like Durst and Mimaki differentiate through modular system architectures that accommodate multiple substrates.

Ink companies including DyStar and Sun Chemical have ramped up research into low-impact chemistries, collaborating closely with OEMs to certify pigment and disperse ink lines for high-performance applications. Meanwhile, software providers are advancing workflow automation, color management, and cloud-based order handling to streamline the path from digital file to finished textile.

Service bureaus and converters are also evolving their business models, emphasizing value-added services such as perpetual print-on-demand platforms, virtual sample approvals, and localized distribution networks. In this ecosystem, partnerships and channel alliances are increasingly strategic. For example, joint ventures between machine builders and fabric mills aim to optimize process integration and accelerate time to market for bespoke collections.

As these players vie for market share, differentiation hinges on a blend of technology leadership, sustainability credentials, and the ability to deliver seamless digital-to-fabric workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Textile Printing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeoon Technologies GmbH

- Agfa-Gevaert N.V.

- AM Printex Solutions

- Archroma Management GmbH

- ATPColor Srl

- Brother Industries, Ltd.

- Canon Inc.

- Colorjet Group

- Digital Graphics Incorporation

- Dover Corporation

- Durst Group AG

- Hangzhou Honghua Digital Technology Stock Co., Ltd

- Hangzhou Yisheng Digital Technology Co., Ltd.

- Hollanders Printing Solutions

- HP Inc.

- JV Digital Printing

- KERAjet S.A.

- Konica Minolta, Inc.

- Kornit Digital Ltd.

- Kyocera Corporation

- Mimaki Engineering Co., Ltd.

- Mutoh Holdings Co. Ltd.

- Ricoh Company, Ltd.

- Roland DG Corporation

- Seiko Epson Corporation

- Shanghai Color Digital Supplier Co., Ltd.

- Shenzhen Hanglory Digital Printing Group Co., Ltd

- SPGPrints B.V.

- Tex India Enterprises Pvt Ltd.

- The M&R Companies

Strategic Imperatives for Industry Leaders to Navigate Disruption Capitalize on Innovation and Achieve Sustainable Growth in Textile Printing

Industry leaders must prioritize strategic investments that balance operational efficiency with innovation agility. Allocating capital toward modular printing platforms enables seamless scaling between short and long run orders, while maintaining the flexibility to adopt emerging inks and process enhancements. In parallel, forging deeper alliances across the value chain-spanning fiber producers, ink specialists, and logistics providers-will reinforce supply chain resilience against tariff fluctuations and geopolitical risks.

To capitalize on sustainability imperatives, companies should accelerate transitions to low-water digital processes and integrate closed-loop recycling systems. Embedding environmental performance metrics into product development cycles not only ensures compliance with tightening regulations but also meets rising consumer expectations for eco-friendly apparel and home textiles. Furthermore, implementing digital order management and analytics will unlock insights into demand patterns, reducing excess inventory and shortening lead times.

In pursuing growth, executives should explore new verticals such as technical textiles for medical, automotive, and protective applications, where print functionality can be augmented by performance coatings and smart materials. Finally, cultivating a skilled workforce through targeted training in digital workflows, color science, and maintenance protocols will sustain competitive advantage in a rapidly evolving landscape.

Robust Research Methodology Combining Primary Interviews Secondary Data Analysis and Rigorous Validation to Ensure Comprehensive Textile Printing Insights

Our research methodology integrates a rigorous blend of primary and secondary data sources. Extensive interviews with senior executives at textile mills, equipment vendors, and leading brands provided firsthand perspectives on operational challenges, technology adoption, and market forecasts. These qualitative insights were complemented by a thorough review of industry publications, regulatory filings, and association reports to validate emerging trends.

Quantitative analysis involved cross-referencing trade statistics, where available, with proprietary survey data from printer end users. This dual approach ensured robust triangulation of adoption rates for key technologies, regional investment patterns, and segment performance. All data points underwent multiple validation rounds, including peer reviews by subject-matter experts, to ensure accuracy and relevance.

Geographical coverage spanned the Americas, EMEA, and APAC regions, with careful calibration for local policy impacts and supply chain idiosyncrasies. Segmentation frameworks were stress-tested through scenario analysis, evaluating the influence of tariff shifts, sustainability regulations, and technological breakthroughs. This methodology underpins the comprehensive market insights presented in this report, delivering actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Textile Printing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Textile Printing Market, by Printing Technology

- Textile Printing Market, by Ink Type

- Textile Printing Market, by Substrate Material

- Textile Printing Market, by Production Volume

- Textile Printing Market, by Application

- Textile Printing Market, by Region

- Textile Printing Market, by Group

- Textile Printing Market, by Country

- United States Textile Printing Market

- China Textile Printing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Conclusion Synthesizing Critical Insights and Strategic Takeaways to Inform Decision-Making in the Evolving Textile Printing Industry Landscape

In summary, the textile printing industry stands at the convergence of innovation and disruption. Digital technologies are not only redefining production paradigms but also driving sustainability gains that align with consumer and regulatory demands. At the same time, evolving tariff structures underscore the importance of supply chain agility and regional diversification. By leveraging segmentation insights across printing technologies, fabric types, end uses, ink chemistries, and run lengths, stakeholders can tailor strategies to specific market niches.

Moreover, regional dynamics highlight the need for localized solutions-from nearshoring in the Americas to compliance-driven upgrades in EMEA and capacity expansion in Asia-Pacific. Collaboration among equipment manufacturers, ink suppliers, and converters will be pivotal in delivering end-to-end value and mitigating cost pressures. Finally, a clear focus on sustainability, workforce training, and data-driven decision making will underpin success in an industry shaped by both rapid change and enduring demand for custom printed textiles.

Unlock In-Depth Textile Printing Market Intelligence Today by Engaging Ketan Rohom for a Comprehensive Research Report Tailored to Your Business Needs

If you are looking to gain a competitive edge and secure unparalleled insights into the latest textile printing innovations, our comprehensive market research report can guide every strategic decision. You can engage Ketan Rohom, Associate Director, Sales & Marketing, to access tailored analysis of industry trends, supply chain developments, and tariff impacts. Reach out to learn more about customizing the report to your organization’s priorities and unlock the actionable intelligence you need to drive growth and outperform the competition.

- How big is the Textile Printing Market?

- What is the Textile Printing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?