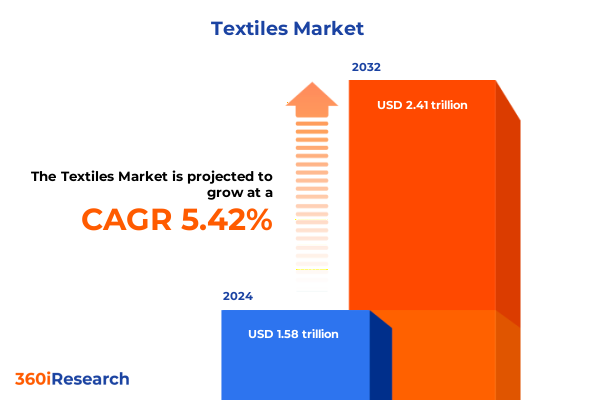

The Textiles Market size was estimated at USD 1.66 trillion in 2025 and expected to reach USD 1.74 trillion in 2026, at a CAGR of 5.47% to reach USD 2.41 trillion by 2032.

Unveiling the Transformative Forces and Strategic Imperatives Reshaping the Global Textile Industry’s Future Trajectory Amidst Rapid Disruption

The global textile industry has entered a new era defined by rapid technological advancements, shifting consumer expectations, and evolving geopolitical landscapes. Innovations in sustainable fiber production, such as bio-based polymers and waterless dyeing techniques, have moved from pilot phases to commercial adoption, signaling a broader commitment to environmental stewardship. Simultaneously, digitalization initiatives spanning from AI-driven demand forecasting to automated manufacturing lines are redefining operational efficiency and cost structures. As labels such as circularity and traceability gain prominence, brands and manufacturers are forging collaborative ecosystems that balance profitability with ethical responsibility.

In parallel, trade policy developments and supply chain disruptions have underscored the importance of sourcing agility and regional diversification. Against this backdrop, the United States has navigated an intricate web of tariffs, trade agreements, and nearshoring incentives, compelling stakeholders to reassess long-held procurement strategies. Moreover, end consumers are increasingly drawn to value propositions that merge functionality with sustainability credentials, compelling the industry to innovate across the entire textile value chain.

This executive summary synthesizes these complex drivers, providing a cohesive narrative to guide decision-makers through a landscape marked by both challenges and opportunities. By unpacking transformative shifts, tariff impacts, segmentation nuances, regional growth patterns, and leading-company strategies, this document equips executives with the strategic clarity needed to forge resilient pathways in a dynamically evolving textile market.

Redefining Textile Industry Dynamics through Sustainability Innovation High-Tech Digitalization and Agile Resilience Across Disrupted Supply Chains

The textile landscape is being redefined by three interlinked transformational pillars. First, sustainability has materialized as a non-negotiable business imperative rather than a niche concern. Major players across the value chain invest in regenerative agriculture partnerships, recycled-content integrations, and closed-loop manufacturing processes to meet consumer and regulatory demands. These initiatives extend beyond product labeling, reaching deep into raw material sourcing, water stewardship protocols, and end-of-life recovery schemes.

Concurrently, digital transformation is stimulating unprecedented levels of visibility and responsiveness. Advanced analytics platforms enable real-time monitoring of production metrics, while digital twins provide simulation capabilities that accelerate process optimization. This convergence of data and manufacturing is fostering a more agile, demand-led operating model capable of mitigating supply chain bottlenecks and responding to emerging style waves with greater precision.

Finally, supply chain resilience has emerged as a strategic priority after a series of disruptions. Leading organizations are diversifying their supplier portfolios geographically, incorporating nearshoring and reshoring strategies to reduce transit times and exposure to geopolitical risks. Strategic inventory positioning and the integration of flexible manufacturing units further enhance the ability to pivot rapidly when market conditions shift. Together, these pillars underpin a textile ecosystem that is more sustainable, more responsive, and more resilient than ever before.

Assessing the Cumulative Consequences of United States Tariffs in 2025 on Textile Sourcing Production and Cost Structures

United States tariff policies have exerted a notable influence on textile sourcing, production economics, and cost structures in 2025. The continuation of Section 301 duties on select imports has prompted many apparel brands and textile mills to explore alternative sourcing markets, particularly within Latin America and Southeast Asia. By realigning supplier networks, companies aim to mitigate the incremental cost burdens introduced by tariff escalations.

At the same time, domestic manufacturing initiatives have gained momentum in response to protective measures aimed at bolstering local industry. Investments in advanced spinning, weaving, and finishing technologies have accelerated, enabling manufacturers to partially offset higher raw-material expenses with efficiency gains. Furthermore, tariff-induced cost retention within the domestic economy has spurred the growth of specialized technical textile segments, where higher value-add and customization dilute the relative impact of duty expenses.

Although these measures have delivered localized benefits, they also present complex trade-offs. Brands must weigh faster production lead times against potentially higher unit costs, while manufacturers navigate capital-intensive upgrades to maintain competitive positioning. As tariff regimes remain fluid, continued strategic scenario planning will be paramount to sustaining profitability and ensuring supply chain continuity.

Unveiling Critical Market Segmentation Insights Across Material Types Applications and Distribution Channels Fuelling Strategic Positioning

The textile market’s competitive landscape is deeply influenced by the interplay between material types, applications, and distribution channels. Within material segmentation, blends continue to command attention for their balance of cost and performance, whereas natural fibers have experienced renewed interest due to their biodegradability and premium positioning. Cotton remains the cornerstone of natural fiber demand, while emerging linen and silk niches cater to high-end home textiles and luxury apparel. Concurrently, synthetic fibers such as polyester and nylon maintain dominance in volume-driven applications, supported by ongoing enhancements in recycled-content integration and functional finishes.

Application-based insights reveal that fashion and clothing sectors, buoyed by rapid trend turnover and consumer appetite for seasonal collections, are driving volume across both apparel and accessories. Household textiles are diversifying beyond traditional bedding and towel categories, with kitchen fabrics and upholstery becoming hotspots for innovation in stain resistance and easy-clean treatments. Technical applications are expanding at the intersection of automotive, medical, and agricultural markets, where tailored functionality and performance standards enable premium pricing and collaborative product development.

Distribution channel dynamics underscore an omnichannel paradigm. Department stores and specialty retailers continue to serve experiential shopping needs for higher-end consumers, whereas e-commerce platforms and brand websites capture demand for niche or value-led products. Wholesalers and distributors remain pivotal in streamlining procurement for bulk end-users, while the agility of direct-to-consumer models challenges incumbents to continuously refine their digital engagement strategies.

This comprehensive research report categorizes the Textiles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Application

- Distribution Channel

Exploring Region-Specific Textile Market Dynamics and Growth Drivers across the Americas EMEA and Asia-Pacific Markets with Nuanced Consumer Trends and Regulatory Environments

Regional textile markets exhibit distinct dynamics shaped by consumer preferences, regulatory frameworks, and supply chain infrastructures. In the Americas, the drive toward nearshoring has accelerated as North American brands prioritize shorter lead times and reduced logistic complexity. Domestic fiber producers and converters are scaling capabilities, particularly in sustainable cotton and recycled polyester, in response to reshoring incentives and consumer demand for locally sourced products.

Meanwhile, Europe, the Middle East, and Africa present a multifaceted tapestry of high-end fashion hubs, emerging manufacturing clusters, and robust regulatory environments. The EU’s stringent sustainability reporting mandates have catalyzed investments in traceability systems and eco-label certifications, while the apparel capitals of Italy and France continue to set quality benchmarks. In parallel, select African geographies are attracting investment in cotton improvements and spinning capacities, driven by partnerships with global brands aiming to diversify sourcing portfolios.

Asia-Pacific remains the industry’s powerhouse, with established exporters like China, Bangladesh, and Vietnam continuing to dominate volume outputs. However, rising labor costs and environmental compliance pressures have pushed manufacturers to upgrade machinery, adopt cleaner production practices, and explore alternative fiber blends. Simultaneously, domestic consumption in large markets such as India and Indonesia is propelling demand for both value apparel and premium home textiles, reinforcing the region’s dual role as a production hub and vital growth catalyst.

This comprehensive research report examines key regions that drive the evolution of the Textiles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Textile Industry Actors’ Strategic Moves Innovations Partnerships and Competitive Differentiation Strategies

Leading textile companies are employing differentiated strategic initiatives to maintain competitive advantage. Integrated fiber-to-fashion organizations are leveraging vertical capabilities to optimize cost control and traceability, while specialized players focus on high-value technical textiles or premium natural fibers. Partnerships between polymer innovators and garment manufacturers have accelerated the market introduction of advanced recycled and bio-based materials, reinforcing sustainability credentials across brand portfolios.

In addition to R&D collaborations, mergers and acquisitions remain a pivotal strategy for capacity expansion and technology acquisition. Recent tie-ups have centered on acquiring circular economy expertise and digital platform assets, reflecting the premium placed on end-to-end lifecycle management. Concurrently, multinationals are expanding production footprints in proximity to key consumer markets to balance tariff exposures and lead time requirements.

Furthermore, leading brands are enhancing customer engagement through transparency initiatives, leveraging blockchain tracking and QR-enabled tags to communicate product origin and environmental impact. These investments not only meet evolving consumer expectations but also provide critical data inputs for continuous improvement in supply chain performance and product innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Textiles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Birla Group

- Albini Group

- Alpek Polyester S.A. de C.V

- Arvind Limited by Lalbhai Group

- Asahi Kasei Corporation

- Barnhardt Manufacturing Company

- Charles Parsons Group

- China Textiles (Shenzhen) Co.,Ltd.

- Compagnie de Saint-Gobain S.A.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Elevate Textiles, Inc.

- Far Eastern New Century Corp.

- Formosa Plastics Group

- Freudenberg & Co. KG

- Huvis Corporation

- Hyosung Corporation

- Indorama Ventures

- Invista by Koch Industries

- James Dunlop Textiles

- JCT Limited by the Thapar Group

- Kolon Industries, Inc.

- KPR Mill Limited

- Kuraray Co., Ltd.

- Lenzing AG

- Luthai Group

- Milliken & Company

- Noble Group

- Paramount Textile Mills (P) Ltd.

- Raymond Limited

- Reliance Industries Limited

- Sinopec Shanghai Petrochemical Company Limited

- Successori Reda S.B.p.A

- Teijin Limited

- Tex Tech Industries

- The Bombay Dyeing & Manufacturing Co Ltd.

- Tongkun Group Co., Ltd. by Zhejiang Leixin Industry Co., Ltd.

- Toray Industries, Inc.

- Toyobo Co., Ltd.

- Trelleborg AB

- Trident Limited

- Unifi, Inc.

- Vardhman Textiles Limited

- Welspun Group

Empowering Industry Leaders with Actionable Strategic Recommendations for Sustainability Innovation and Supply Chain Optimization

Industry leaders must adopt an integrated approach to remain resilient and capture growth opportunities. Prioritizing sustainable raw material sourcing by forging partnerships with regenerative agriculture and recycled content suppliers will strengthen brand equity and preempt regulatory pressures. Equally important is the deployment of digital twins and advanced analytics platforms to enhance production forecasting accuracy and reduce waste across the value chain.

Moreover, diversifying geographic footprints through a balance of nearshoring for rapid response and strategic offshore partnerships for cost efficiency will mitigate future disruptions. Collocating smaller, flexible production units near high-volume consumer centers can offer both speed to market and customization capabilities. Concurrently, investing in workforce upskilling for automation technologies will preserve operational agility and reduce dependency on volatile labor markets.

Finally, fostering open innovation ecosystems by collaborating with material science startups, technology incubators, and academic research centers will accelerate the development of next-generation fibers and functional finishes. Embedding circular design principles and take-back programs into product development cycles will not only address environmental objectives but also unlock new revenue streams through recycling and resale initiatives.

Detailing Rigorous Research Methodologies Combining Primary Interviews Secondary Desk Review Data Triangulation and Expert Validation Processes

This report synthesizes insights through a multifaceted research methodology that combines primary interviews, exhaustive secondary reviews, and rigorous data triangulation. Primary research involved structured discussions with over fifty stakeholders across the textile value chain, including fiber producers, garment manufacturers, distributors, and brand executives. These conversations were designed to uncover firsthand perspectives on emerging challenges, investment priorities, and innovation roadmaps.

Secondary research encompassed a comprehensive review of industry publications, peer-reviewed journals, regulatory filings, and sustainability frameworks. Key topics addressed included trade policy developments, fiber technology breakthroughs, digital transformation case studies, and regional market reports. Data from government sources and industry associations was cross-referenced to validate trends and support qualitative findings.

All information was subjected to a triangulation process to ensure consistency and accuracy. Quantitative and qualitative data points were reconciled through expert validation workshops, where independent consultants and thought leaders provided critical scrutiny. This layered approach guarantees that the insights and recommendations presented are both robust and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Textiles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Textiles Market, by Material Type

- Textiles Market, by Application

- Textiles Market, by Distribution Channel

- Textiles Market, by Region

- Textiles Market, by Group

- Textiles Market, by Country

- United States Textiles Market

- China Textiles Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Imperatives to Navigate the Evolving Textile Industry Landscape with Confidence

The textile industry stands at an inflection point where sustainability, technology, and geopolitical factors converge to redefine competitive parameters. Companies that embrace circularity and digitalization while maintaining strategic supply chain agility will emerge as the new market leaders. Regional nuances underscore the importance of tailored approaches, whether capitalizing on nearshoring trends in the Americas, navigating stringent regulatory frameworks in EMEA, or balancing production modernization with cost pressures in Asia-Pacific.

As tariff landscapes evolve, stakeholders must employ proactive scenario planning and strategic diversification to safeguard margins and service levels. Furthermore, segmentation strategies that align material innovation and end-use applications with distribution channel imperatives will be critical for unlocking differentiated value propositions. Success will hinge on cross-sector partnerships and a relentless focus on consumer-centric sustainability narratives.

Ultimately, the capacity to synthesize these multifaceted drivers into coherent, forward-looking strategies will determine which organizations thrive in this era of transformation. Decision-makers equipped with the insights and recommendations detailed herein will be well positioned to navigate uncertainty, accelerate innovation, and drive resilient growth in the global textile ecosystem.

Engage with Ketan Rohom for Customized Textile Market Intelligence to Drive Strategic Growth and Informed Decision-Making Today

To acquire the comprehensive textile market research report filled with in-depth analysis, strategic insights, and actionable data visualizations, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in textile dynamics and client-centric consultation ensures that you receive a tailored briefing aligned with your organizational priorities.

Connect with him to schedule a personalized walkthrough of the report findings, discuss bespoke deliverables, and secure early-access pricing offers. Engaging at this stage empowers your leadership team to capitalize on emerging market opportunities, mitigate risks associated with trade policy shifts, and fast-track innovation agendas. By partnering closely with Ketan Rohom, you position your organization at the vanguard of textile industry transformations, equipped with the clarity and confidence needed to drive sustainable competitive advantage.

- How big is the Textiles Market?

- What is the Textiles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?