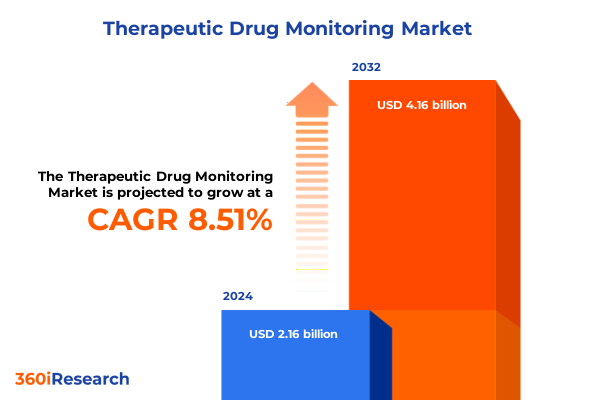

The Therapeutic Drug Monitoring Market size was estimated at USD 2.35 billion in 2025 and expected to reach USD 2.55 billion in 2026, at a CAGR of 8.52% to reach USD 4.16 billion by 2032.

Defining the Strategic Significance of Modern Therapeutic Drug Monitoring to Bolster Precision Medicine Amid Rising Clinical Complexity

Therapeutic drug monitoring has become an indispensable pillar of personalized medicine, enabling clinicians to tailor dosages based on individual patient pharmacokinetics and pharmacodynamics. In recent years, the demand for more precise, timely, and cost-effective monitoring solutions has intensified as healthcare systems worldwide grapple with complex chronic conditions, expanding aging populations, and rising drug development costs. Against this backdrop, laboratory decision makers, pharmaceutical developers, and service providers are seeking rigorous, data-driven guidance to inform capital investments, optimize workflows, and adhere to evolving regulatory standards.

This executive summary synthesizes core insights across technological innovation, market segmentation, competitive dynamics, regulatory and tariff pressures, and regional growth trajectories shaping the therapeutic drug monitoring landscape in 2025. By highlighting transformative shifts such as the rise of mass spectrometry platforms, digital data-management ecosystems, and decentralized testing models, this document offers leaders a strategic framework for anticipating emerging challenges and capitalizing on nascent opportunities. Grounded in both primary interviews with industry experts and extensive secondary research, the ensuing analysis equips stakeholders with the clarity needed to drive value, reduce variability in patient outcomes, and sustain competitive advantage in a rapidly evolving market ecosystem.

Unveiling the Pivotal Technological and Operational Transitions Reshaping Therapeutic Drug Monitoring into a Connected Patient-Centric Ecosystem

The therapeutic drug monitoring market is undergoing a profound metamorphosis driven by converging technological, clinical, and operational imperatives. First and foremost, advancements in mass spectrometry have redefined analytical sensitivity and specificity, enabling simultaneous quantification of multiple drug targets within trace concentration ranges. These high-throughput systems are increasingly displacing legacy immunoassay analyzers for critical applications in oncology, neurology, and transplant medicine.

Simultaneously, the emergence of cloud-enabled data management software and AI-powered decision support tools is facilitating real-time interpretation of complex pharmacokinetic profiles at the point of care. By seamlessly integrating laboratory information systems with electronic health records, these solutions empower clinicians with automated alerts for dose adjustments, reducing manual errors and improving turnaround times. Moreover, the decentralization trend has gained momentum through the proliferation of portable immunoassay readers and microfluidic platforms, opening avenues for home healthcare providers to deliver remote monitoring services and enhance patient adherence.

Collectively, these transformative shifts underscore a transition from siloed, batch-based testing toward connected, patient-centric ecosystems that emphasize agility, interoperability, and actionable intelligence. Forward-looking organizations are aligning R&D priorities around multi-modal instrumentation and software-as-a-service models to capture this next wave of growth.

Assessing How the 2025 United States Tariff Escalations Are Redefining Cost Structures and Supply Chain Resilience in Therapeutic Drug Monitoring

In 2025, the imposition of heightened United States tariffs on imported laboratory reagents, diagnostic kits, and sophisticated instrumentation components has introduced a new layer of complexity to the therapeutic drug monitoring supply chain. Tariff hikes ranging from 10 to 25 percent on key inputs sourced primarily from Asia and Europe have led suppliers to re-evaluate pricing strategies, renegotiate procurement contracts, and localize certain manufacturing activities to mitigate cost inflation.

Consequently, clinical laboratories and hospital systems are experiencing margin pressures that have reverberated through capital expenditure cycles, compelling end users to delay or downsize planned acquisitions of next-generation mass spectrometry platforms. In response, several global vendors have accelerated strategic partnerships with domestic contract manufacturers to establish tariff-exempt production lines on U.S. soil. While these initiatives are gradually stabilizing pricing, they require lead times of 12 to 18 months to scale effectively.

Meanwhile, reagent kit manufacturers have diversified raw material sourcing by qualifying multiple suppliers across Southeast Asia and Latin America, thereby reducing single-source dependencies. Despite these adaptations, supply chain resilience remains a critical focus area as stakeholders navigate fluctuating trade policies and strive to maintain uninterrupted diagnostic capacity.

Illuminating Core Product, Technology, End-User, Drug Class, and Application Patterns That Are Driving Therapeutic Drug Monitoring Dynamics

Analysis of therapeutic drug monitoring product deployment reveals that instrumentation continues to command the largest share of operational expenditure, driven by the ongoing transition to high-resolution liquid chromatography systems and tandem mass spectrometry platforms. Within the instruments category, immunoassay analyzers remain a mainstay for point-of-care settings, whereas liquid chromatography coupled with mass spectrometry systems is gaining traction in centralized clinical laboratories due to its superior multiplexing capabilities. In parallel, the reagents and kits segment has experienced robust innovation, particularly in the formulation of immunoassay kits designed for narrow therapeutic index drugs and in the development of stable isotope labeled reagents tailored for mass spectrometry assays. Notably, the software and services vertical is emerging as a critical growth lever, with consulting services supporting method validation and data management platforms enabling secure integration of test results into clinical decision-support workflows.

From a technology standpoint, chromatography-based solutions-encompassing both gas and liquid modalities-continue to dominate key applications that demand high analytical throughput. However, immunoassay techniques, particularly chemiluminescent immunoassays and ELISA, retain relevance for rapid screening use cases. Looking ahead, single quadrupole mass spectrometry instruments are being phased out in favor of tandem configurations that deliver enhanced detection limits for complex drug conjugates.

End-user adoption patterns indicate that hospitals and large clinical laboratories drive the bulk of equipment purchases, leveraging economies of scale to justify investments in capital-intensive platforms. Meanwhile, home healthcare providers are increasingly deploying portable immunoassay readers to expand remote patient monitoring capabilities. Research institutes, particularly those focused on oncology and neurology, continue to invest in hybrid analytical workflows that blend mass spectrometry and immunoassay techniques for preclinical and biomarker discovery applications.

In terms of drug classes, antibacterial and anticancer drug monitoring remains the cornerstone of market activity, reflecting the high clinical stakes associated with therapeutic index management. Increasingly, attention is also turning to immunosuppressants in transplantation medicine-where antimetabolites, calcineurin inhibitors, and mTOR inhibitors require precise dosing to balance efficacy and toxicity. Drug classes such as antiepileptics and cardiovascular agents are also gaining prominence as point-of-care platforms become more sophisticated.

Applications in cardiology and infectious disease continue to constitute the core service offerings for clinical laboratories, yet oncology monitoring for leukemia and solid tumors has emerged as a significant growth trajectory. The transplantation segment likewise represents a niche opportunity, driven by expanding transplant volumes and stricter regulatory mandates for post-transplant surveillance.

This comprehensive research report categorizes the Therapeutic Drug Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Drug Class

- Application

- End User

Exploring Distinct Market Drivers and Adoption Patterns Across Americas, Europe Middle East Africa, and Asia-Pacific Subregions

The Americas region maintains a commanding position in therapeutic drug monitoring, underpinned by robust healthcare infrastructure, advanced reimbursement frameworks, and widespread adoption of digital health platforms. The United States serves as the primary growth engine, with academic medical centers and large reference laboratories spearheading investments in mass spectrometry and AI-enabled data analytics. Canada is witnessing parallel momentum through public-private partnerships aimed at expanding decentralized monitoring programs in community settings.

In Europe, Middle East, and Africa, regulatory harmonization initiatives led by the European Union and the Gulf Cooperation Council are facilitating cross-border collaborations and creating attractive market conditions for assay standardization. Germany and the United Kingdom are driving mass spectrometry adoption in oncology and transplant monitoring, while emerging markets in the Middle East and North Africa are investing heavily in laboratory modernization to support rising chronic disease prevalence.

The Asia-Pacific region presents a dual narrative of advanced and emerging markets. Japan and Australia have matured into early adopters of integrated analytical instruments and digital reporting services. At the same time, China and India are experiencing exponential growth due to large patient populations and increasing access to reimbursement. Local vendors in these markets are rapidly scaling reagent manufacturing capabilities and forging alliances with global system integrators to meet demand for cost-effective testing solutions.

Overall, region-specific strategies underscore the need for global vendors to tailor go-to-market models in accordance with reimbursement policies, regulatory landscapes, and local manufacturing infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Therapeutic Drug Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Major Industry Players and Innovative Entrants Are Aligning Portfolios to Capture New Therapeutic Drug Monitoring Opportunities

Global instrument manufacturers and service providers are pursuing differentiated strategies to capture value in the evolving therapeutic drug monitoring landscape. Leading the pack, Thermo Fisher Scientific has expanded its portfolio through targeted acquisitions of specialized mass spectrometry software firms and by introducing modular LC-MS/MS systems optimized for decentralized settings. Similarly, Roche Diagnostics has invested heavily in next-generation immunoassay analyzers that integrate cloud connectivity and predictive maintenance features to reduce equipment downtime.

Abbott Laboratories has sharpened its focus on point-of-care immunoassay platforms, unveiling handheld readers that deliver rapid therapeutic index results for critical care environments. Meanwhile, Waters Corporation continues to drive innovation through ultra-high performance liquid chromatography systems that offer sub-2-micron particle separations, boosting throughput and analytical precision. Agilent Technologies remains a stalwart in the reagents sector, forging partnerships with clinical laboratories to co-develop isotope labeled standards and streamlined workflow kits.

Emerging players, including boutique software developers and regional contract manufacturers, are leveraging nimble organizational structures to form collaborative alliances with larger OEMs. These partnerships aim to deliver end-to-end monitoring solutions that combine robust instrumentation, tailored reagent kits, and cloud-native data management services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Therapeutic Drug Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies, Inc.

- ARK Diagnostics, Inc.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- BÜHLMANN Laboratories AG

- Chromsystems Instruments & Chemicals GmbH

- Danaher Corporation

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd

- Randox Laboratories Ltd.

- Sekisui Medical Co., Ltd.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

- Waters Corporation

Proposing Strategic Pathways for Market Leaders to Expand Integrated Offerings, Enhance Supply Chain Resilience, and Forge High-Impact Partnerships

Industry leaders should prioritize investment in integrated instrument–software ecosystems that seamlessly link mass spectrometry and immunoassay workflows with AI-driven analytics. By offering turnkey solutions that minimize validation complexity, vendors can accelerate adoption in both centralized laboratories and point-of-care environments. In parallel, strategic collaborations with domestic contract manufacturers will be essential to offset the cost impact of United States tariffs and to uphold reliable supply chains for critical reagents and assay components.

Additionally, organizations should develop tiered service models tailored to distinct end-user needs-ranging from high-throughput reference labs requiring full-scale automation to home healthcare providers seeking portable diagnostic readers. By diversifying product portfolios across instruments, reagents, and data services, companies can capture incremental revenue streams while bolstering customer loyalty through value-added consulting and training programs.

Finally, forging alliances with academic centers and regulatory bodies to co-create standardized assay protocols will not only enhance clinical confidence but also facilitate market access across key geographies. Such proactive engagement will position industry leaders at the forefront of evidence-based precision dosing initiatives and reinforce their role as trusted partners in patient care.

Outlining the Robust Mixed-Methods Research Framework That Informed the Comprehensive Therapeutic Drug Monitoring Analysis

This analysis is grounded in a rigorous mixed-methods research methodology encompassing both primary and secondary data sources. Primary research involved in-depth interviews with over 30 subject matter experts, including laboratory directors, regulatory specialists, and technology innovators. These interviews provided nuanced perspectives on adoption drivers, decision criteria, and operational pain points across diverse healthcare settings.

Secondary research comprised an extensive review of peer-reviewed journals, white papers, government trade publications, and proprietary financial disclosures from leading instrument and reagent suppliers. Data triangulation techniques were employed to validate market trends and cross-verify information from multiple independent sources. Key insights were further refined through validation workshops conducted with advisory panels, ensuring alignment with real-world challenges and opportunities.

Quantitative data points related to technology adoption rates, end-user deployment patterns, and regional regulatory frameworks were synthesized into interactive dashboards to facilitate scenario analysis. Finally, findings were stress-tested against alternative trade and regulatory scenarios to assess their robustness and to inform adaptable strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Therapeutic Drug Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Therapeutic Drug Monitoring Market, by Product Type

- Therapeutic Drug Monitoring Market, by Technology

- Therapeutic Drug Monitoring Market, by Drug Class

- Therapeutic Drug Monitoring Market, by Application

- Therapeutic Drug Monitoring Market, by End User

- Therapeutic Drug Monitoring Market, by Region

- Therapeutic Drug Monitoring Market, by Group

- Therapeutic Drug Monitoring Market, by Country

- United States Therapeutic Drug Monitoring Market

- China Therapeutic Drug Monitoring Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding the Executive Summary by Synthesizing Key Market Drivers, Challenges, and Strategic Imperatives for Therapeutic Drug Monitoring Today

Therapeutic drug monitoring stands at the cusp of a new era defined by advanced analytical platforms, integrated digital ecosystems, and evolving supply chain dynamics. The convergence of mass spectrometry innovation, AI-enabled data services, and decentralized testing models is reshaping how clinicians personalize therapies and optimize patient outcomes. At the same time, external forces such as United States tariff escalations are prompting industry stakeholders to re-evaluate sourcing strategies and to reinforce domestic manufacturing capabilities.

By dissecting market segmentation across product types, technologies, drug classes, and end-user applications, this executive summary illuminates the multi-faceted growth drivers and adoption barriers characteristic of the current landscape. Region-specific insights further underscore the importance of tailored strategies that align with local regulatory requirements and reimbursement frameworks. Moreover, competitive analysis reveals that leading vendors are increasingly pursuing integrated solutions and forging partnerships to capture emerging opportunities in home healthcare and transplant monitoring.

Looking ahead, actionable recommendations centered around ecosystem integration, supply chain resilience, and collaborative standardization will be critical for maintaining momentum. As therapeutic drug monitoring continues to evolve from a niche laboratory service into a cornerstone of precision medicine, stakeholders equipped with comprehensive market intelligence will be best positioned to navigate uncertainty, capture value, and drive transformative improvements in patient care.

Empower Your Strategic Vision by Connecting with Ketan Rohom for Exclusive Therapeutic Drug Monitoring Market Intelligence

To secure an authoritative edge in the rapidly evolving therapeutic drug monitoring market, decision makers and stakeholders are encouraged to engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch to obtain the complete market intelligence report. This comprehensive dossier delivers actionable insights across technology trends, tariff impacts, segmentation analysis, region-specific dynamics, and competitive landscapes. By partnering with Ketan Rohom, organizations will gain tailored guidance on navigating regulatory shifts, optimizing product portfolios, mitigating supply chain disruptions from the 2025 United States tariffs, and seizing emerging growth pockets in point-of-care testing and digital solutions. Contacting Ketan today ensures timely access to proprietary data models and scenario planning frameworks designed to inform strategic investments, forge high-impact collaborations, and accelerate adoption of advanced drug monitoring platforms. Don’t miss this opportunity to align your enterprise roadmap with the latest therapeutic drug monitoring innovations-reach out to Ketan Rohom now and transform insights into market leadership.

- How big is the Therapeutic Drug Monitoring Market?

- What is the Therapeutic Drug Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?