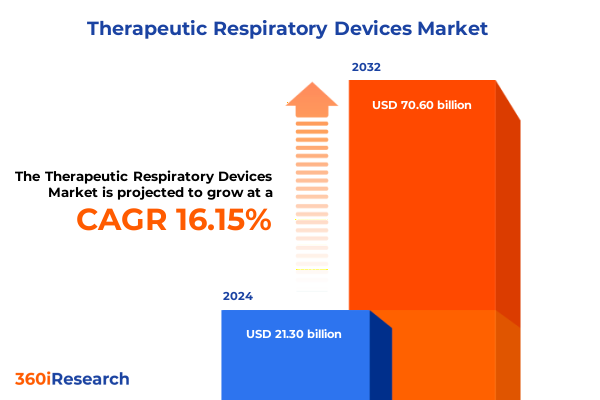

The Therapeutic Respiratory Devices Market size was estimated at USD 24.68 billion in 2025 and expected to reach USD 28.61 billion in 2026, at a CAGR of 16.19% to reach USD 70.60 billion by 2032.

Rising Global Respiratory Disease Burden and Demographic Shifts Are Driving Demand for Next-Generation Therapeutic Devices

The therapeutic respiratory devices sector is anchored in responding to a growing global burden of chronic respiratory conditions and the imperative for innovative care models. Chronic obstructive pulmonary disease (COPD) alone affects approximately 392 million individuals worldwide, driven largely by tobacco smoking and environmental pollutants, and represents the third leading cause of death globally. In the United States, nearly 16 million adults are diagnosed with COPD, and the age-adjusted prevalence reached 3.8% in 2023, with the oldest age groups bearing the highest burden; these figures underscore substantial pressures on health systems and highlight an urgent need for advanced treatment modalities.

Simultaneously, demographic shifts toward aging populations and heightened chronic disease prevalence have accelerated the adoption of home-based and telehealth-enabled respiratory care. Homecare settings, once niche, now host an expanding array of devices-from portable oxygen concentrators to digital inhalers-facilitating continuous patient engagement outside traditional hospital walls. This evolution is complemented by regulatory incentives and reimbursement frameworks in mature markets that favor outpatient management of long-term oxygen therapy and sleep apnea, reflecting a broader shift toward value-based care.

Digital Connectivity and Miniaturized Portable Systems Are Catalyzing a Paradigm Shift in Respiratory Care Delivery

Innovations in digital therapeutics and smart connectivity are redefining the therapeutic respiratory devices landscape. Digital inhaler systems embedded with sensors and wireless communication enable clinicians to monitor adherence, inhalation quality, and environmental triggers in near real time. Meta-analyses have demonstrated that patient-facing digital inhalers significantly improve asthma control and may reduce severe exacerbations, with users achieving clinically meaningful improvements at higher rates compared to standard care. Long-term economic models further reveal cost savings exceeding $3,000 per patient annually by optimizing medication adherence and reducing reliance on expensive add-on biologics.

Parallel to digital integration, device miniaturization has revolutionized ambulatory oxygen therapy. Portable oxygen concentrators now weigh as little as two kilograms, offer multi-hour battery life, and support dynamic flow settings that adapt to patient activity levels; usage studies report patients employing these units for over 15 hours per day, often as their primary oxygen source. This mobility fosters greater independence and improves quality of life, while emerging research highlights comparable survival and cost-effectiveness of portable systems relative to stationary oxygen modalities in real-world patient populations.

New U.S. Tariffs on Medical Device Imports Are Triggering Supply Chain Adjustments and Higher Healthcare Costs

The reinstatement of Section 301 tariffs on Class I and II medical devices in early 2025 has introduced significant cost pressures across the therapeutic respiratory devices supply chain. Tariffs ranging from 10% to 50% on components and finished goods imported from China and select partner countries have elevated raw material and finished product costs, prompting leading medtech firms to diversify manufacturing footprints and accelerate near-shoring initiatives. This realignment, while bolstering supply chain resilience, imposes near-term capital expenditures and may delay product launches.

Hospitals and healthcare providers are already responding to tariff-driven price increases by freezing non-essential capital projects and renegotiating long-term supply contracts. A recent survey found that 81% of equipment manufacturers anticipate longer lead times and potential shortages, while 90% of hospital finance executives plan to shift increased costs to payers and patients, foreshadowing higher out-of-pocket expenses for end users. Trade associations, including the American Hospital Association, are lobbying for exemptions on essential respiratory supplies to mitigate these impacts and safeguard patient access.

Deep Dive into Device Types, Channels, and Patient Cohorts Illuminates Market Complexity and Tailored Segment Needs

Device type segmentation reveals that inhalers remain central to outpatient respiratory management, with dry powder, metered dose, and soft mist formulations each addressing distinct patient preferences and clinical requirements. Nebulizer subtypes-jet, mesh, and ultrasonic-continue to serve patients with severe airflow limitations or pediatric needs, while oxygen concentrators split into portable and stationary platforms to support ambulation or continuous home oxygen therapy, respectively. Within critical care, invasive ventilators, further classified into pressure and volume controlled modes, coexist alongside noninvasive ventilators that enhance patient comfort and reduce sedation requirements.

Application-based segmentation underscores diverse use cases: ambulatory care settings leverage compact devices for routine monitoring, emergency medical services prioritize ruggedized, rapid-deploy nebulizers and bag-valve masks, homecare settings integrate connected concentration units and digital inhalers, and hospitals deploy advanced ventilators and high-flow therapy systems. End users mirror these channels, with ambulatory care centers, emergency services, homecare settings-encompassing both professional support and self-administration-and both private and public hospitals relying on tailored device portfolios.

Distribution channels span hospital purchase agreements, retail pharmacy dispensing of inhalers, specialty clinic offerings of noninvasive ventilation, and growing online retail platforms that cater to home-based patients. Technological segmentation highlights jet, mesh, and ultrasonic nebulization, alongside pressure controlled delivery systems, while mode of use bifurcates into invasive and noninvasive categories. Finally, patient types-from pediatric to adult and geriatric cohorts-drive device specification, ensuring that ergonomic, dose-appropriate, and ease-of-use factors are accounted for across the product lifecycle.

This comprehensive research report categorizes the Therapeutic Respiratory Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Application

- End User

- Distribution Channel

- Technology

- Mode

- Patient Type

Regional Disparities in Prevalence, Policy, and Infrastructure Shape Distinct Growth Paths Across Key Global Markets

The Americas remain the largest market for therapeutic respiratory devices, fueled by high COPD prevalence, robust reimbursement frameworks, and rapid adoption of homecare models supported by strong telehealth infrastructure. U.S. adult COPD prevalence stands at 4.2%, resulting in substantial demand for outpatient inhaler therapies and portable oxygen systems. In Latin America, rising chronic respiratory disease burdens and expanding healthcare access are creating new opportunities for device makers.

In Europe, underdiagnosis and inequities in diagnostic capacity have been spotlighted by a joint WHO and European Respiratory Society report, which estimates over 80 million individuals living with chronic respiratory diseases and calls for uniform policy action to address a $21 billion annual healthcare cost burden. Diverse regulatory landscapes and variations in national reimbursement schemes pose both challenges and openings for market entry, particularly for smart, connected devices that demonstrate clear health economic value.

Asia-Pacific is the fastest-growing region, driven by infrastructure investments in hospital and homecare settings, rapidly aging populations, and increasing prevalence of respiratory illnesses in low- and middle-income countries. Projections indicate a 32.7% rise in COPD cases within LMICs by 2050, highlighting significant addressable patient pools for portable concentrators, digital inhalers, and ventilator technologies.

This comprehensive research report examines key regions that drive the evolution of the Therapeutic Respiratory Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading OEMs and Innovative Entrants Are Competing on Connectivity, AI, and Cost-Effective Form Factors

ResMed continues to lead in positive airway pressure therapy and connected sleep devices, leveraging its diverse manufacturing footprint to mitigate tariff risks and reporting a 10% revenue increase to $1.3 billion in its most recent quarter, driven by innovations such as the AirTouch N30i mask and AI-enabled ventilator platforms. Philips Respironics remains a formidable competitor in home and hospital ventilation, recently launching a next-generation noninvasive ventilator to address chronic disease and neuromuscular disorder markets.

Medtronic and GE Healthcare collaborate on integrated monitoring solutions that combine ventilator and patient data streams, while Fisher & Paykel Healthcare advances humidification and mask technologies for homecare applications. Inogen’s portable oxygen concentrators, validated through large-scale retrospective analyses demonstrating survival benefits and cost-effectiveness, exemplify competitive differentiation in ambulatory care. Emerging players such as Aerin Medical and respiratory start-ups are securing strategic partnerships to introduce AI-driven drug-device hybrids and personalized mask fittings via 3D printing, intensifying innovation dynamics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Therapeutic Respiratory Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B.N.O.S Meditech Ltd.

- Bhagawati Oxygen Ltd.

- Cramer Decker Medical, Inc.

- Desco Medical, Inc.

- Drägerwerk AG & Co. KGaA

- Ellenbarrie Industrial Gases Ltd.

- Everest Kanto Cylinder Limited

- Fisher & Paykel Healthcare Corporation Limited

- Hamilton Medical AG

- INOX Air Products Pvt. Ltd.

- Invacare Corporation

- Koninklijke Philips N.V.

- Luxfer Uttam India Pvt. Ltd.

- Medtronic plc

- Nihon Kohden Corporation

- Nipro Corporation

- O2 Concepts, LLC

- Precision Medical, Inc.

- ProRack Gas Control Products

- Rama Cylinders Pvt. Ltd.

- ResMed Inc.

- Royax S.r.o.

- SICGIL India Limited

- Taiyo Nippon Sanso Corporation

- Vyaire Medical, Inc.

Diversify Production, Advocate Policy Exemptions, and Invest in Smart Platforms to Thrive in a Tariff-Constrained Environment

Industry leaders should prioritize diversified manufacturing footprints across tariff-advantaged regions to minimize supply disruptions and mitigate cost pressure. Strengthening collaborations with group purchasing organizations and securing exemption carve-outs for essential respiratory supplies will preserve affordability and continuity of care. Investing in digital infrastructure and interoperable platforms can extend device lifecycle value by enabling remote monitoring, predictive maintenance, and enhanced adherence management, thereby unlocking new service revenues.

To capture growth in emerging markets, companies must tailor product portfolios to local clinical practices and reimbursement realities, forging partnerships with regional distributors and health systems. Engaging in policy dialogues to advocate for favorable tariff and reimbursement policies, coupled with demonstrating robust health economic outcomes, will support market access. Finally, fostering R&D in telehealth-enabled and patient-centric device designs will align portfolio strategies with the ongoing shift toward home-based and preventive respiratory care.

Rigorous Mixed-Method Research Leveraging Primary Interviews and Data Triangulation Underpins Robust Market Insights

This report synthesizes insights from extensive secondary research, including peer-reviewed literature, regulatory filings, and industry publications, complemented by primary interviews with respiratory therapists, hospital procurement leaders, and device manufacturers. A bottom-up approach was employed to validate market segmentation across device types, applications, end users, distribution channels, and regional geographies. Data triangulation methods ensured consistency by cross-referencing trade statistics, clinical adoption rates, and publicly disclosed company financials.

Expert panels provided qualitative feedback on emerging technologies and tariff impacts, while proprietary databases tracked product approvals, patent filings, and pricing trends. The research framework was reinforced by iterative consultations with global healthcare consultants and technology partners, delivering a robust foundation for strategic decision-making and investment planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Therapeutic Respiratory Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Therapeutic Respiratory Devices Market, by Device Type

- Therapeutic Respiratory Devices Market, by Application

- Therapeutic Respiratory Devices Market, by End User

- Therapeutic Respiratory Devices Market, by Distribution Channel

- Therapeutic Respiratory Devices Market, by Technology

- Therapeutic Respiratory Devices Market, by Mode

- Therapeutic Respiratory Devices Market, by Patient Type

- Therapeutic Respiratory Devices Market, by Region

- Therapeutic Respiratory Devices Market, by Group

- Therapeutic Respiratory Devices Market, by Country

- United States Therapeutic Respiratory Devices Market

- China Therapeutic Respiratory Devices Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Converging Trends in Disease, Technology, and Trade Are Setting the Stage for Next-Generation Respiratory Care Innovation and Adoption

An increasingly complex and opportunity-rich therapeutic respiratory devices market is emerging at the intersection of chronic disease prevalence, digital transformation, and global trade dynamics. While tariff pressures necessitate agile supply chain strategies, innovation in smart connectivity, portable solutions, and AI-driven therapeutics is redefining patient care pathways. Regional heterogeneity in regulatory ecosystems and disease burdens underscores the importance of tailored go-to-market approaches that balance global scale with local relevance.

Stakeholders who proactively address cost challenges, embrace value-based design, and foster multi-stakeholder partnerships will be best positioned to capture growth across hospital, homecare, and emerging market segments. By aligning R&D investments with evolving reimbursement frameworks and patient expectations, industry leaders can drive sustainable impact and unlock the full potential of next-generation respiratory care solutions.

Unlock the Full Therapeutic Respiratory Devices Market Report by Connecting with Our Associate Director of Sales & Marketing

To procure the comprehensive report and gain a competitive edge in navigating the dynamic therapeutic respiratory devices landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can provide tailored insights, discuss customized research options, and facilitate seamless access to the full market study. Engage now to drive strategic growth, inform investment decisions, and stay ahead of the curve in a rapidly evolving industry.

- How big is the Therapeutic Respiratory Devices Market?

- What is the Therapeutic Respiratory Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?