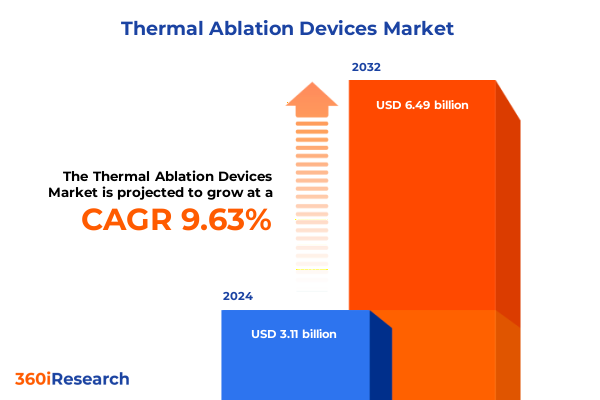

The Thermal Ablation Devices Market size was estimated at USD 3.40 billion in 2025 and expected to reach USD 3.73 billion in 2026, at a CAGR of 9.66% to reach USD 6.49 billion by 2032.

Embracing the Era of Precision Energy Therapies as Thermal Ablation Technologies Reshape Minimally Invasive Treatment Paradigms

Thermal ablation devices have emerged as a cornerstone of modern interventional medicine, offering clinicians a suite of energy-based modalities that precisely target pathological tissue while preserving surrounding structures. As minimally invasive therapies gain priority in both acute and chronic care settings, radiofrequency, microwave, laser, cryoablation, and high-intensity focused ultrasound systems are replacing more invasive surgical procedures. This paradigm shift is underpinned by robust innovation in energy delivery and imaging integration, ensuring that ablation can be performed with real-time monitoring and enhanced safety profiles.

Among the leading ablation technologies, radiofrequency ablation continues to hold a dominant position due to its precision, predictable lesion formation, and widespread clinician familiarity. Microwave ablation systems, noted for their ability to create larger and more uniform ablation zones, are rapidly gaining traction in oncology programs. Laser-based ablation, encompassing CO₂, diode, and Nd:YAG systems, provides versatile options in dermatology, gynecology, and otolaryngology. Cryoablation harnesses extreme cold-via argon or nitrous oxide-to create well-demarcated freeze zones, while high-intensity focused ultrasound offers a truly noninvasive thermal approach under MRI or ultrasound guidance.

The ascent of thermal ablation is driven by the global rise of chronic and complex diseases. The American Cancer Society reported nearly 1.9 million new cancer diagnoses in 2021, underscoring the urgent need for localized, tissue-sparing therapies. In parallel, cardiovascular conditions such as atrial fibrillation affect millions of patients and have prompted electrophysiology practices to adopt energy-based catheter ablation as the standard of care for many arrhythmias. Advances in 3-D mapping, contact force sensing, and pulsed field ablation are further refining procedural success and reducing complication rates.

Despite this momentum, thermal ablation faces challenges that shape market dynamics. High acquisition and operating costs can slow adoption in smaller facilities, while the need for specialized training and credentialing creates barriers in some regions. Moreover, evolving regulatory pathways for new ablation modalities and reimbursement policies-particularly in outpatient and ambulatory surgical center settings-demand strategic navigation by industry stakeholders. Addressing these hurdles effectively will be crucial to broadening access and sustaining the growth of thermal ablation technologies.

Pioneering Shifts in Thermal Ablation with Advanced Imaging, AI Integration, and Patient-Centric Outpatient Models Driving Unprecedented Growth

Over the past five years, the thermal ablation landscape has been transformed by the convergence of advanced imaging, digital health, and next-generation energy modalities. Real-time integration of high-resolution CT, MRI, and ultrasound has empowered clinicians to visualize lesion formation and perfusion changes intraoperatively, elevating procedural accuracy and patient safety. This has been exemplified in liver and lung tumor ablations, where operators can now confirm complete coverage of tumor margins and adjust energy delivery in response to perfusion feedback.

Simultaneously, artificial intelligence and machine learning algorithms are being embedded into ablation platforms to predict tissue response, optimize probe placement, and minimize collateral damage. Early clinical pilots have demonstrated that AI-guided treatment planning can reduce procedure times by up to 20% while maintaining ablation efficacy, a critical advantage in high-throughput oncology centers. Robotic catheter navigation systems in electrophysiology suites are collaborating with AI-driven mapping to create super-sensitive lesion indices, advancing the safety of atrial fibrillation and ventricular tachycardia treatments.

Patient-centric care models are driving a surge in outpatient and ambulatory surgical center procedures. Compact, portable ablation consoles have enabled same-day discharge for a growing portion of cardiac, dermatologic, and oncologic indications. For instance, outpatient atrial fibrillation ablations are estimated to generate significant cost savings while maintaining high satisfaction and comparable safety profiles to traditional inpatient approaches. As value-based care mandates prioritize reduced length of stay and lower complication rates, executives are investing in office-based ablation suites and wearable monitoring technologies to ensure close post-procedure follow-up.

Meanwhile, the rise of pulsed field ablation for cardiac arrhythmias represents a seismic shift in electroporation-mediated therapies. By using nonthermal electrical pulses to selectively ablate myocardial tissue, pulsed field systems are minimizing collateral muscle and nerve damage, reducing recovery times, and expanding indications to persistent atrial fibrillation. Regulatory approvals for second-generation pulsed field platforms are slated for late 2025, positioning this modality as a key growth driver in the second half of the decade.

Assessing the Multifaceted Consequences of Expanded Section 301 Tariffs on the Thermal Ablation Device Supply Chain and Cost Structures

In 2025, the United States Trade Representative’s final modifications to Section 301 tariffs have imposed significant increases on a range of medical products sourced from mainland China, including critical components for ablation devices. Consumable device categories such as syringes and needles now face a 100% tariff, while medical gloves have seen duties climb to 50%, impacting disposable probe sheaths and ancillary supplies essential to ablation procedures. These escalated costs threaten to raise the overall expense of energy-based therapies and place upward pressure on procedural pricing for hospitals and outpatient centers.

The heightened tariffs have also compelled device manufacturers to reassess their global supply chains, accelerating initiatives to diversify component sourcing and regionalize assembly operations. According to industry analysis, over a quarter of China’s medical device exports were previously destined for the U.S. market, making these tariffs a substantial blow to cost structures and inventory planning. Companies are now exploring partnerships with contract manufacturers in Southeast Asia and Latin America to mitigate risk, though this transition is being hampered by the complexity of qualified supplier certifications and U.S. regulatory approvals.

For U.S.-based ablation device firms, the tariff environment has underscored the importance of reshoring high-value manufacturing and increasing domestic capacity for critical components such as radiofrequency generators and imaging integration modules. Federal incentives and tax credits aimed at onshoring medical device production are gaining renewed attention, presenting an opportunity for stakeholders to secure more predictable supply chains and contain input costs. Nonetheless, the short-term consequence remains a potential uptick in capital equipment pricing and a squeeze on margins as companies absorb or partially pass through these added duties.

Clinicians and procurement leaders are now closely monitoring the evolving tariff landscape, with some hospitals pre-purchasing devices and consumables before planned duty increases take effect. The cumulative impact of these trade measures is reshaping competitive dynamics, as manufacturers with diversified sourcing strategies and domestic production capabilities gain a clear advantage in pricing negotiations and supply reliability.

Illuminating Critical Market Segments Reveals Demand Drivers from Ambulatory to Research Settings and From Diverse Energy Delivery Modes

Analyzing the thermal ablation market through an end-user lens reveals that hospitals continue to hold the lion’s share of device and consumable sales, driven by their extensive procedural volumes and advanced infrastructure. However, ambulatory surgical centers and clinics are emerging as pivotal growth channels for minimally invasive ablative therapies, leveraging compact consoles and streamlined recovery protocols to meet patient demand for convenience and cost-effectiveness. Research institutes, in turn, are fueling the next wave of innovation by conducting pivotal trials and driving preclinical optimization of novel energy delivery systems.

When viewed by clinical application, the cardiology segment leads in adoption due to the well-established role of catheter ablation in treating atrial fibrillation and ventricular tachycardia. Within this space, atrial fibrillation accounts for a majority of cardiac procedures, while ventricular tachycardia ablations are growing rapidly in specialized electrophysiology centers. The cosmetic market is also advancing, with laser and high-intensity focused ultrasound technologies deployed for skin lesion treatment and tattoo removal. In gynecology, uterine fibroid ablation has become a standard fertility-preserving option, and the oncology segment is broadening its scope to address bone and soft tissue tumors, as well as hard-to-treat sites like kidney, liver, lung, and thyroid lesions.

The choice of delivery mode is equally instrumental in shaping treatment protocols. Laparoscopic ablation approaches are favored for visceral and gynecologic applications, offering direct visualization and precise probe placement. Open surgical ablation remains critical for complex cases requiring concurrent resections, while percutaneous methods-guided by CT, ultrasound, or MRI-are enabling outpatient oncology and pain management programs. Delivery mode decisions are informed by lesion size, location, and patient comorbidities, underscoring the need for versatile platform designs.

From a technology perspective, radiofrequency ablation maintains a dominant footprint, while microwave and laser systems are embraced for larger volume and superficial tissue targets, respectively. Cryoablation’s reversible freeze-thaw cycles offer unique safety benefits in cardiac and pain applications. High-intensity focused ultrasound, now approved for uterine fibroids and select oncology cases in Europe and Asia, is poised for broader adoption in the U.S. market following recent clinical successes and anticipated regulatory clearances.

This comprehensive research report categorizes the Thermal Ablation Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Delivery Mode

- Technology

- End User

- Application

Contrasting Regional Dynamics in Thermal Ablation Markets Across the Americas, EMEA, and Asia-Pacific to Uncover Growth Opportunities

In the Americas, the United States remains the largest market for thermal ablation devices, characterized by rapid adoption of minimally invasive therapies and robust reimbursement frameworks. While outpatient expansion for cardiac and oncologic ablation procedures is advancing, reimbursement policies in ambulatory surgical centers lag behind hospital outpatient rates, prompting professional societies to intensify advocacy efforts for code inclusion. Despite these challenges, leading healthcare systems are investing in dedicated ablation suites and digital monitoring solutions to enhance procedural throughput and patient follow-up in this high-value care segment.

Europe exhibits a mature yet heterogeneous landscape, where established public and private payers determine access to ablation modalities. Major markets like Germany, France, and the United Kingdom are at the forefront of high-intensity focused ultrasound and cryoablation adoption for fibroid and prostate treatments. However, uneven reimbursement across national health systems and high capital requirements for MRI-guided HIFU systems present barriers in certain regions. Ongoing clinical trials and growing physician awareness are gradually overcoming these hurdles, as evidenced by initiatives such as France’s PULS trial evaluating HIFU for pancreatic cancer and Germany’s rapid integration of next-generation Exablate Prime systems.

The Asia-Pacific sector is experiencing the fastest growth, fueled by increasing healthcare expenditures, rising incidence of cancer and cardiovascular disease, and supportive government programs. Japan’s 2024 public hospital subsidy targeting cryoablation cost reductions exemplifies the region’s commitment to advanced ablation therapies. China’s clinical guidelines now endorse microwave ablation as a first-line option for inoperable lung cancer, resulting in a 120% surge in microwave device sales across Asia. Meanwhile, emerging markets such as India and Southeast Asia are expanding ablation capacity through upgraded cancer centers and cardiac catheterization labs, representing a significant long-term opportunity for device innovators.

Across all regions, economic pressures and care delivery reforms are incentivizing a shift toward value-based ablation programs, with an emphasis on lower procedural risk, same-day discharge, and integrated digital health pathways. Navigating the complex patchwork of reimbursement and regulatory regimes will be critical for manufacturers seeking to scale their footprint across these diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Thermal Ablation Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Innovations and Competitive Strengths of Leading Ablation Device Manufacturers Shaping Industry Trajectories

Boston Scientific has emerged as a market leader in electrophysiology ablation with its Farapulse pulsed field ablation system, achieving a 177% year-over-year increase in its EP sales during the third quarter of 2024 and rapidly advancing clinical trials to expand indications to persistent atrial fibrillation. Despite a temporary enrollment pause in the Avant Guard study, the company’s commitment to safety reviews and trial resumption underscores its strategic focus on differentiated energy modalities.

Johnson & Johnson, through its Varipulse pulsed field system, achieved initial FDA approval but faced a brief suspension of sales due to neurovascular events detected post-commercial launch. These safety concerns have imparted valuable design learnings, reinforcing the importance of waveform optimization and robust adverse event monitoring in next-generation PFA devices.

Insightec has solidified its position in the noninvasive ablation sphere with Exablate Prime, securing CE clearance and broadening European availability in 2024. Its MRI-guided HIFU platform continues to attract investment and clinical interest for neurological and oncology indications, driven by superior targeting accuracy and nonionizing energy delivery.

EDAP TMS has broadened the reach of its Ablatherm-HIFU system across France, supporting both public and private sector deployments. By enabling prostate cancer treatments in major hospitals and mobile clinic settings, the company illustrates how flexible service models can accelerate HIFU uptake even in the absence of full reimbursement.

Medtronic has introduced portable cryoablation consoles, such as the CryoFlex system, facilitating office-based procedures for prostate and cardiac applications. These compact units, combined with wearable ECG and temperature-sensing devices for post-procedural monitoring, highlight Medtronic’s strategy of integrating hardware, software, and services to deliver seamless outpatient ablation solutions.

Collectively, these leading manufacturers demonstrate a clear trend toward diversified energy platforms, integrated imaging guidance, and end-to-end digital health ecosystems that will define competitive success in the thermal ablation market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Thermal Ablation Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AngioDynamics, Inc.

- AtriCure, Inc.

- biolitec AG

- Biotronik

- Boston Scientific Corporation

- CONMED Corporation

- Eufoton srl

- HealthTronics, Inc.

- Hologic, Inc.

- Johnson & Johnson Services, Inc.

- Koninklijke Philips NV

- Lumenis Be Ltd.

- Medtronic

- Merit Medical Systems

- Olympus Europa SE & Co. KG

- RF Medical Co. Ltd.

- Sciton, Inc.

- Smith & Nephew PLC

- Stryker Corporation

- Teleflex Incorporated

- Terumo Corporation

- Varian Medical Systems

- Venclose Inc.

Implementing Targeted Strategies for Supply Diversification, Technology Advancement, and Clinical Advocacy to Accelerate Market Leadership

Industry leaders should prioritize supply chain diversification to safeguard against trade policy fluctuations and input cost volatility. Establishing regional production hubs for critical components can buffer against tariff impacts and enhance responsiveness to local market needs. By leveraging government incentives for domestic manufacturing, stakeholders can optimize total cost of ownership and reinforce supply chain resilience.

Investing in next-generation ablation technologies should remain a strategic imperative. Research and development budgets ought to focus on AI-driven treatment planning, real-time lesion assessment, and novel energy modalities such as pulsed field ablation and high-intensity focused ultrasound. Strategic partnerships with academic institutions and technology innovators can accelerate clinical validation and regulatory approval, ensuring a continuous pipeline of breakthrough therapies.

Advocacy efforts must be intensified to harmonize reimbursement policies across care settings. Engaging with professional societies, payers, and policymakers to align on the clinical and economic value of ablation procedures will facilitate coverage expansions in ambulatory surgical centers and office-based practices. Demonstrating robust real-world evidence of cost savings, reduced readmissions, and superior patient outcomes will be key to securing broader payer support.

Enhancing clinician proficiency through comprehensive training programs and digital learning platforms will expand the pool of qualified operators and drive procedural excellence. Virtual reality simulation, remote proctoring, and standardized credentialing pathways can accelerate skill acquisition and ensure consistent patient care quality across diverse healthcare settings.

Finally, cultivating integrated care pathways that embed digital monitoring, patient engagement tools, and outcome analytics will differentiate best-in-class ablation programs. By offering holistic solutions that span pre-procedure planning to long-term follow-up, industry players can deliver meaningful value to providers and patients, cementing their leadership positions in the evolving ablation landscape.

Detailing a Rigorous Mixed-Method Research Framework Combining Primary Expert Insights and Robust Secondary Data Triangulation

This market research report is underpinned by a rigorous methodological framework designed to ensure accuracy, depth, and actionable insights. The secondary research phase involved comprehensive analysis of peer-reviewed journals, regulatory filings, industry white papers, and financial reports. Proprietary databases and government publications provided up-to-date epidemiological data and trade policy information, enabling precise context for market drivers and barriers.

Primary research was conducted through structured interviews with over 25 senior executives, clinical specialists, and procurement professionals across North America, Europe, and Asia-Pacific. These interviews yielded firsthand perspectives on technology adoption, reimbursement dynamics, and supply chain strategies. Survey instruments were deployed among interventional cardiologists, oncologists, and surgical leaders to quantify adoption rates, unmet needs, and future procurement plans.

Quantitative modeling and data triangulation integrated insights from primary and secondary sources, cross-validating shipment volumes, unit pricing, and market penetration rates. Scenario analyses assessed the impact of tariff changes, regulatory milestones, and macroeconomic trends on market trajectories. Sensitivity testing ensured robustness of conclusions under varying assumptions.

Expert validation workshops engaged key opinion leaders in electrophysiology, interventional oncology, and gynecology to review preliminary findings, refine segmentation logic, and identify emerging opportunities. This iterative process guaranteed that the final report reflects both the current state of the thermal ablation market and its anticipated evolution through 2030.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Thermal Ablation Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Thermal Ablation Devices Market, by Delivery Mode

- Thermal Ablation Devices Market, by Technology

- Thermal Ablation Devices Market, by End User

- Thermal Ablation Devices Market, by Application

- Thermal Ablation Devices Market, by Region

- Thermal Ablation Devices Market, by Group

- Thermal Ablation Devices Market, by Country

- United States Thermal Ablation Devices Market

- China Thermal Ablation Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Market Dynamics and Technological Advances to Conclude on the Transformative Future of Thermal Ablation Devices

Thermal ablation devices stand at the intersection of technological innovation and evolving healthcare delivery models. Across cardiology, oncology, gynecology, and dermatology, these energy-based therapies offer compelling clinical outcomes, reduced recovery times, and favorable safety profiles. The confluence of advanced imaging, AI-driven planning, and novel energy modalities such as pulsed field ablation heralds a new era of precision medicine, where lesion margins and tissue selectivity can be controlled with unprecedented accuracy.

Market growth is further propelled by strategic shifts toward outpatient care, enabling ambulatory surgical centers and office-based practices to capture procedural volumes once confined to hospital settings. Yet, industry stakeholders must navigate complex reimbursement pathways and overcome initial capital investment hurdles to fully realize this opportunity.

Trade policy dynamics, particularly the elevated Section 301 tariffs, underscore the necessity of supply chain resilience and regional manufacturing footprints. Manufacturers that proactively diversify sourcing and leverage domestic production incentives will be best positioned to manage input costs and customer expectations.

In this transformative environment, success will hinge on integrated solutions that combine hardware, software, and services to deliver end-to-end ablation programs. From real-time lesion monitoring to post-procedure digital follow-up, a holistic approach will define market leadership and patient satisfaction.

As clinical evidence and healthcare economics continue to align around the value proposition of thermal ablation, the market is poised for sustained expansion. Companies that harness innovation, advocacy, and operational agility will unlock the greatest potential in this dynamic and high-growth segment.

Engage Today for Exclusive Access to In-Depth Thermal Ablation Market Insights with Ketan Rohom to Drive Your Business Forward

To secure immediate and comprehensive insights into the thermal ablation devices market, reach out to Ketan Rohom (Associate Director, Sales & Marketing) and gain exclusive access to the detailed report that will empower your strategic decisions and fuel your growth trajectory.

- How big is the Thermal Ablation Devices Market?

- What is the Thermal Ablation Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?