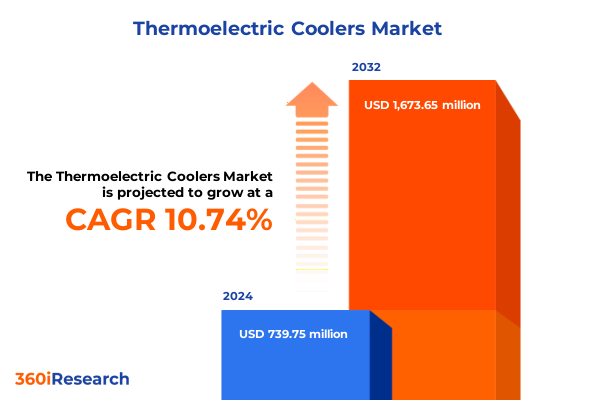

The Thermoelectric Coolers Market size was estimated at USD 817.89 million in 2025 and expected to reach USD 896.29 million in 2026, at a CAGR of 10.77% to reach USD 1,673.65 million by 2032.

Envisioning the Future of Cooling through Thermoelectric Innovation to Drive Efficiency and Sustainability in Diverse Industry Applications

Thermoelectric coolers represent a transformative technology poised to redefine how industries manage heat, offering a solid-state solution that converts electrical energy directly into a temperature gradient without moving parts or refrigerants. This introduction examines the fundamental principles that underpin thermoelectric cooling, tracing its origins from early semiconductor discoveries to its present status as a critical component in precision thermal management. By leveraging the Peltier effect, these devices deliver compact, reliable, and environmentally friendly performance, gaining traction in applications that demand silent operation, precise control, and enhanced longevity.

With accelerating trends toward miniaturization, energy efficiency, and sustainability, thermoelectric coolers have captured the attention of decision-makers across sectors. Their deployment spans from cooling sensors and photonic components in aerospace and telecommunications to temperature regulation in medical devices and consumer electronics. This opening overview sets the stage for a deep dive into the paradigm shifts, regulatory influences, segmentation dynamics, and actionable recommendations that will shape strategic investments and innovations in the thermoelectric cooler landscape.

Unpacking Pivotal Technological, Regulatory, and Supply Chain Transformations Reshaping the Thermoelectric Cooler Industry Landscape

Over the past decade, thermoelectric cooler technology has undergone seismic shifts propelled by breakthroughs in materials science, manufacturing processes, and integration strategies. Novel semiconducting alloys and nanostructuring techniques have elevated the figure of merit for Peltier modules, enabling greater cooling efficiency and power density. Concurrently, additive manufacturing and precision assembly methods have streamlined production of multi-stage and thin film devices, reducing unit costs while enhancing customization capabilities for specialized requirements.

Beyond technological advancements, regulatory frameworks emphasizing energy efficiency and environmental stewardship have catalyzed adoption of thermoelectric systems. Incentives for low-global-warming-potential cooling solutions, along with stricter thresholds on refrigerant emissions, have accelerated the shift away from vapor compression in targeted applications. At the same time, digital transformation in supply chains and heightened emphasis on resilience have underscored the importance of diversified material sourcing and domestic manufacturing capacity. Together, these forces are reshaping the competitive landscape and defining new frontiers for market entrants and incumbents alike.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Thermoelectric Cooler Supply Dynamics and Industry Competitiveness

In 2025, the United States implemented a suite of tariffs aimed at imported thermoelectric modules and precursor materials, significantly altering cost structures and vendor relationships across the value chain. Import duties on bismuth telluride and silicon germanium compounds introduced margin pressures for companies relying on offshore fabrication, prompting many to reevaluate supplier agreements and logistics strategies. These policy changes have intensified efforts to bolster domestic production capabilities, with OEMs and material specialists accelerating investments in local pilot lines and joint ventures.

Tariff-driven impacts extend beyond production economics to end-user pricing and competitiveness. Cooling and heating module manufacturers have navigated a delicate balance between passing increased input costs to customers and preserving market share in consumer electronics, automotive, and medical segments. While some players have successfully mitigated these headwinds through long-term contracts and backward integration, others are exploring alternative materials such as lead telluride and skutterudite to diversify their supply portfolio. As this landscape evolves, staying attuned to policy developments and strategically aligning with government incentives will be paramount for sustainable growth.

Gleaning Strategic Insights across Application, Module Type, Material, Technology, Operation Mode, and End User Segments to Inform Thermoelectric Cooler Market Positioning

An application-centric view of the thermoelectric cooler market reveals distinctive value propositions across aerospace, automotive, consumer electronics, food and beverage, medical devices, and telecommunication equipment. In aerospace, reliability and high-altitude performance drive demand for customized, multi-stage solutions, whereas the automotive sector increasingly integrates single-stage modules for cabin and battery thermal management. Consumer electronics prioritize thin film micro modules to accommodate sleek form factors, while the food and beverage industry leverages bulk standard modules for portable refrigeration units.

Module type segmentation distinguishes between multi-stage designs, which excel under extreme temperature differentials, and single-stage variants tailored for moderate cooling and heating. Material selection further refines performance profiles: bismuth telluride remains a workhorse for near-room-temperature operations, lead telluride extends capabilities into higher temperature ranges, silicon germanium suits high-temperate industrial uses, and skutterudite offers promising thermoelectric efficiency. Within the technology dimension, bulk modules deliver cost-effective standard or customized assemblies, while thin film devices-ranging from MEMS modules to micro thermoelectric modules-drive miniaturized, precision-controlled applications. Operation mode analysis highlights diverging requirements for pure cooling versus bidirectional heating, influencing design specifications and power electronics. Finally, end-user categorization splits aftermarket and OEM channels, with the automotive and consumer electronics aftermarket demanding retrofit solutions, and OEMs in automotive, consumer electronics, and medical devices integrating modules as core system components, each pathway carrying unique go-to-market imperatives.

This comprehensive research report categorizes the Thermoelectric Coolers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Module Type

- Material

- Technology

- Operation Mode

- Application

Analyzing Regional Dynamics and Emerging Technological Adoption Trends in Americas, Europe Middle East & Africa, and Asia-Pacific Thermoelectric Cooler Markets

Across the Americas, adoption of thermoelectric coolers is driven by robust R&D ecosystems and a focus on advanced mobility and consumer technology. North American manufacturers lead in integrating cooling modules into electric vehicles and wearable electronics, while Latin American markets, though nascent, exhibit growing interest in portable refrigeration for food and beverage applications. Collaboration between industry and research institutions bolsters innovation pipelines, but logistical complexities and tariff fluctuations necessitate agile supply chain frameworks.

Within Europe, Middle East & Africa, regulatory commitments to carbon neutrality and stringent environmental standards have fueled uptake of solid-state cooling in medical devices and precision instrumentation. European OEMs emphasize high-reliability bulk solutions and customized multi-stage modules for aerospace and industrial uses, while Middle Eastern and African markets gradually expand as infrastructure investments and healthcare modernization create new entry points. Asia-Pacific stands as both the largest manufacturing hub and the fastest-growing end-user market. China, Japan, and South Korea dominate production of bulk and thin film technologies, underpinning global supply. Meanwhile, emerging economies in Southeast Asia and India demonstrate rising demand for energy-efficient cooling solutions across telecommunication, automotive, and consumer electronics sectors, driven by urbanization and digital transformation trends.

This comprehensive research report examines key regions that drive the evolution of the Thermoelectric Coolers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market-Leading Manufacturers, Technological Innovators, and Strategic Collaborations Driving Competitive Dynamics in the Thermoelectric Cooler Sector

Key players in the thermoelectric cooler arena are distinguished by their prowess in material innovation, module customization, and strategic partnerships. Leading manufacturers have invested heavily in next-generation semiconductors, leveraging internal development and acquisitions to secure proprietary alloy blends and nanostructuring capabilities. Collaborative alliances with electronics OEMs have accelerated co-development programs, ensuring module designs align with evolving system architectures and form-factor requirements.

In parallel, specialized thermal management firms have established integrated service models, combining design consultation, rapid prototyping, and volume production to meet complex customer specifications. Select enterprises have embraced vertical integration strategies, acquiring raw material suppliers to insulate operations from supply disruptions and tariff volatility. Competitive differentiation increasingly hinges on the ability to offer scalable manufacturing footprints, certified quality systems, and flexible production lines capable of delivering both standardized and tailored thermoelectric solutions on compressed timelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Thermoelectric Coolers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CUI Devices, Inc.

- Custom Thermoelectric LLC

- Everredtronics Ltd.

- Ferrotec (USA) Corporation

- Hi-Z Technology, Inc.

- II-VI Incorporated

- KELK Ltd.

- Komatsu, Ltd.

- Kryotherm GmbH

- Laird Thermal Systems, Inc.

- Marlow Industries (II-VI Incorporated)

- P&N Technology, Inc.

- Phononic, Inc.

- RMT Ltd.

- TE Technology, Inc.

- TEC Microsystems GmbH

- Thermion Company

- Thermonamic Electronics (Jiangxi) Corp., Ltd.

- Z-MAX Co., Ltd.

Formulating Actionable Strategic Recommendations to Maximize Competitive Advantage and Foster Sustainable Growth in the Thermoelectric Cooler Industry

Industry leaders should prioritize investment in advanced materials research to elevate device efficiency and thermal density. Establishing collaborative consortia that bring together semiconductor specialists, module integrators, and end-use OEMs can accelerate time to market for breakthrough formulations such as graphene-enhanced ceramics or novel skutterudite composites. Simultaneously, diversifying supply chains-through dual-sourcing strategies and localized production partnerships-will mitigate exposure to geopolitical risks and tariff fluctuations.

Fostering aftermarket growth via retrofit and modular upgrade programs can unlock new revenue streams, particularly in the automotive and consumer electronics spaces. Firms should also explore opportunities in thin film MEMS and micro modules, targeting wearable devices and point-of-care medical equipment where space constraints and precision control are paramount. Aligning R&D roadmaps with upcoming regulatory milestones on energy efficiency and environmental impact will ensure compliant, future-proof solutions. Finally, cultivating cross-industry alliances with IoT, power electronics, and battery technology providers will yield integrated thermal management platforms that deliver enhanced value propositions.

Detailing the Robust Mixed-Method Research Methodology Employed to Ensure Comprehensive Analysis of Thermoelectric Cooler Market Dynamics

This analysis draws on a robust mixed-method research framework designed to capture both quantitative metrics and qualitative insights across the thermoelectric cooler ecosystem. Secondary research included a comprehensive review of peer-reviewed journals, patent databases, and publicly accessible regulatory filings to map historical trends in material innovation and policy evolution. Trade data and import-export records provided visibility on supply chain movements and tariff impacts, informing our evaluation of production geographies.

Primary research comprised in-depth interviews and surveys with thermal management experts, module manufacturers, OEM engineers, and end-user procurement decision-makers. Insights from these stakeholders enriched our understanding of pain points related to cost, performance, and supply chain resilience. The triangulation of secondary and primary data ensured rigorous validation of emerging themes, while scenario analysis facilitated exploration of future states under varying policy and technological trajectories. Together, this methodology delivers a comprehensive, actionable perspective on current dynamics and longer-term opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Thermoelectric Coolers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Thermoelectric Coolers Market, by Module Type

- Thermoelectric Coolers Market, by Material

- Thermoelectric Coolers Market, by Technology

- Thermoelectric Coolers Market, by Operation Mode

- Thermoelectric Coolers Market, by Application

- Thermoelectric Coolers Market, by Region

- Thermoelectric Coolers Market, by Group

- Thermoelectric Coolers Market, by Country

- United States Thermoelectric Coolers Market

- China Thermoelectric Coolers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Perspectives on Emerging Opportunities, Challenges, and Future Evolution Trajectories within the Thermoelectric Cooler Market Landscape

Thermoelectric coolers stand at the confluence of material science breakthroughs, regulatory imperatives, and shifting supply chain paradigms. As industries increasingly demand compact, energy-efficient, and environmentally sustainable thermal management solutions, the evolution of Peltier-based modules signals a broader transition toward solid-state cooling technologies. Emerging opportunities in high-growth sectors such as electric mobility, wearable health monitoring, and precision computing underscore the potential for thermoelectric devices to capture new applications beyond traditional niches.

Nevertheless, challenges persist in optimizing materials for extreme temperature differentials, scaling production of thin film and micro modules, and navigating geopolitical headwinds that influence raw material accessibility. Addressing these hurdles will require coordinated efforts among material innovators, equipment manufacturers, and policy-makers to align incentives and drive standards harmonization. With strategic foresight and targeted investment, industry stakeholders can unlock the next wave of performance gains and market expansion, solidifying thermoelectric cooling as a cornerstone of future thermal management architectures.

Connect with Ketan Rohom to Secure Comprehensive Thermoelectric Cooler Market Insights and Propel Your Strategic Decision-Making with Specialized Research

As this executive summary draws to a close, the time to take decisive action has never been more critical. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore how a full, bespoke thermoelectric cooler market research report can give your organization the competitive intelligence required to outpace rivals and anticipate emerging opportunities. By securing access to detailed analysis, exclusive interviews, and forward-looking strategic insights, your team can make informed decisions that drive innovation and profitability.

Contacting Ketan Rohom ensures you receive personalized engagement, rapid turnaround on special requests, and priority delivery of our most comprehensive findings. Elevate your thermal management strategy by leveraging the depth of research and industry expertise contained within our full report. Don’t miss the chance to transform data into action-connect with Ketan today to purchase the definitive thermoelectric cooler market research that will empower your long-term success.

- How big is the Thermoelectric Coolers Market?

- What is the Thermoelectric Coolers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?