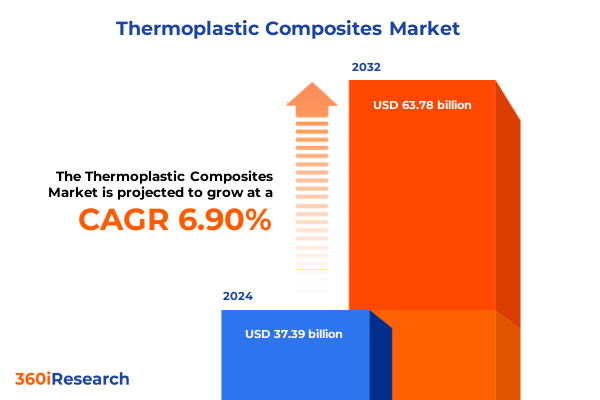

The Thermoplastic Composites Market size was estimated at USD 39.95 billion in 2025 and expected to reach USD 42.53 billion in 2026, at a CAGR of 6.90% to reach USD 63.78 billion by 2032.

Unveiling the Dynamic Rise of Thermoplastic Composites Shaping Today's High-Performance Materials Landscape Across Diverse Industrial Applications

Thermoplastic composites have emerged as a transformative class of materials, combining the inherent advantages of thermoplastic polymers with high-performance reinforcing fibers to deliver unprecedented strength-to-weight ratios, design flexibility, and recyclability. This convergence of properties has accelerated innovation across industries ranging from aerospace and defense to consumer electronics, where engineers and manufacturers seek materials that can endure rigorous operating environments while reducing overall weight and environmental impact. As global supply chains become more integrated and regulatory pressures for sustainable solutions intensify, thermoplastic composites stand out for their capacity to address both performance and ecological imperatives.

With advanced processing techniques such as injection molding and thermoforming gaining traction, designers are able to realize complex geometries and integrate multiple functions into single composite structures. At the same time, ongoing developments in fiber types, including carbon, glass, and emerging natural fibers, have broadened the palette of available performance profiles, enabling targeted optimization for specific applications. Against this backdrop of rapid technological progress and shifting end-use demands, stakeholders across the value chain must navigate a landscape defined by accelerated innovation cycles, evolving regulatory frameworks, and a push toward circular economy models.

Navigating Revolutionary Technological and Sustainability-Driven Transformations Redefining Thermoplastic Composite Applications and Capabilities

In recent years, thermoplastic composites have undergone a paradigm shift driven by breakthroughs in material science and increasing emphasis on sustainability. Key advances in polymer chemistry have yielded high-temperature resins such as polyetheretherketone and polyetherimide, enabling composite components to withstand demanding thermal and chemical environments. Coupled with high-precision manufacturing processes like additive manufacturing and compression molding, these developments have redefined the boundaries of what is possible in structural, functional, and aesthetic design.

At the same time, customer expectations have evolved, with original equipment manufacturers requiring faster time-to-market and greater customization without compromising reliability. This has spurred investment in digital twin technologies and in-line quality monitoring systems that ensure consistent part quality and process repeatability. Moreover, as global regulations increasingly prioritize carbon footprint reduction, companies are reevaluating their material sourcing strategies, favoring recycled or bio-derived feedstocks and implementing closed-loop recycling programs. These intersecting technological and sustainability drivers have collectively transformed the thermoplastic composite landscape, setting the stage for next-generation applications in electric mobility, lightweight infrastructure, and advanced consumer products.

Assessing the Compounding Effects of Recent United States Tariff Adjustments on the Thermoplastic Composite Supply Chain and Cost Structures

Throughout 2025, a series of tariff adjustments enacted by the United States government have introduced new cost layers to thermoplastic composite imports, reshaping supply chains and procurement strategies. These measures, aimed at protecting domestic producers and addressing trade imbalances, have impacted not only raw materials such as carbon fiber and specialty resins but also finished composite components sourced from Asia-Pacific and European manufacturers.

As a result, manufacturers have been compelled to revisit their global sourcing footprints, balancing the higher landed costs of imported feedstocks against investments in domestic production capacity. Some industry leaders have accelerated alliances with local resin producers, while others have explored regional consolidation to leverage economies of scale. In parallel, the shifting tariff landscape has heightened interest in near-shoring production to mitigate exposure to further policy fluctuations. Though these strategic shifts introduce near-term cost volatility, they also present an opportunity to foster resilient, regionally integrated supply networks that can withstand future trade uncertainties.

Diving Deep into Segment-Specific Drivers and Requirements Illuminating the Diverse Demand Patterns Within the Thermoplastic Composites Landscape

Delving into the myriad segments that compose the thermoplastic composites market reveals distinct demand drivers, each shaped by unique performance requirements and end-use imperatives. In aerospace and defense, the imperative to reduce aircraft weight without sacrificing safety has fueled demand for commercial aircraft interiors and military airframes that deploy carbon and aramid fiber-reinforced polyetheretherketone and polyetherimide. In the automotive sector, the rapid transition to electric vehicles has spurred deployment of lightweight structural components, battery enclosures, and under-the-hood parts, where fused carbon or glass fiber reinforcements deliver the dual benefits of mechanical strength and thermal stability. Construction and infrastructure applications, meanwhile, emphasize long-term durability and cost-effectiveness, driving uptake of glass fiber composites in pipes, profiles, and structural panels.

At the same time, consumer electronics firms are integrating composites into mobile devices and wearable technology through finely engineered sheets and films based on polycarbonate resins, while the energy sector explores corrosion-resistant pipe and tubing solutions for oil and gas, as well as emerging offshore wind infrastructure. Healthcare device manufacturers are adopting bio-compatible polymer composites for diagnostic equipment and surgical instruments, capitalizing on the ease of sterilization and mechanical reliability. Finally, marine, sports, and leisure applications leverage injection-molded and thermoformed fiber-reinforced plastics to deliver high-performance, lightweight hulls, equipment, and protective gear. Across all these domains, fiber selection-including basalt, natural, and specialty glass variants-intersects with manufacturing method and product form choices to define highly tailored solutions.

This comprehensive research report categorizes the Thermoplastic Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fiber Type

- Manufacturing Process

- Product Form

- Resin Type

- End Use Industry

Exploring Regional Dynamics Shaping Thermoplastic Composite Adoption Trends and Market Penetration Across the Americas EMEA and Asia-Pacific

Regional dynamics play a pivotal role in shaping the trajectory of thermoplastic composite adoption, as different markets exhibit varying priorities around innovation, sustainability, and cost. In the Americas, the confluence of a mature aerospace supply chain, growing electric vehicle manufacturing hubs, and government incentives for lightweight infrastructure has catalyzed investment in both domestic material production and advanced processing facilities. While North America leads demand for high-performance resins suited to defense and automotive applications, South America presents emerging opportunities in agricultural equipment and construction products where durable, corrosion-resistant composites can enhance operational longevity.

In Europe, Middle East, and Africa, stringent regulatory frameworks focused on emissions reduction and recycling mandates have driven original equipment manufacturers to source high-temperature thermoplastics compatible with circular economy principles. Europe’s robust automotive and industrial sectors serve as early adopters of polyphenylene sulfide and polyamide composites, while the Middle East invests in offshore energy and infrastructure projects that rely on glass and basalt fiber-reinforced solutions. Meanwhile, the Asia-Pacific region continues to register rapid capacity expansions across material, fiber, and component manufacturing, supported by government subsidies and growing consumption in electronics, consumer goods, and renewable energy. These regional nuances underscore the importance of customized market strategies that account for local regulations, supply chain maturity, and end-user preferences.

This comprehensive research report examines key regions that drive the evolution of the Thermoplastic Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Driving Competitive Differentiation and Technological Advances in Thermoplastic Composite Solutions

A landscape of both established conglomerates and agile newcomers characterizes the competitive terrain of thermoplastic composites. Leading global chemical companies have fortified their portfolios with high-performance thermoplastic resins and integrated fiber solutions, leveraging decades of experience in polymer development and large-scale production. Concurrently, pure-play composite specialists have deepened their expertise in fiber integration techniques and automated manufacturing systems, offering turnkey component solutions to sectors as varied as medical devices and luxury automotive interiors.

Emerging start-ups are also making their mark by pioneering novel fiber treatments, bio-derived matrix materials, and AI-driven process optimization platforms that reduce cycle times while enhancing part consistency. Strategic partnerships between resin producers, fiber manufacturers, and equipment suppliers are driving co-innovation initiatives aimed at lowering production barriers and accelerating market entry for next-generation composite solutions. This interplay between legacy players with extensive supply chain reach and nimble innovators with targeted technological expertise is fostering a dynamic ecosystem poised for continued growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Thermoplastic Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Asahi Kasei Corporation

- Avient Corporation

- BASF SE

- Celanese Corporation

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Gurit Holding AG

- Hanwha Corporation

- Hexcel Corporation

- LANXESS AG

- Mitsubishi Chemical Corporation

- Owens Corning

- RTP Company

- SABIC (Saudi Basic Industries Corporation)

- SGL Carbon SE

- Solvay S.A.

- Teijin Limited

- Toray Industries, Inc.

- Victrex plc

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in the Thermoplastic Composite Ecosystem

Industry leaders seeking to harness the full potential of thermoplastic composites should prioritize strategic alignment between material selection, manufacturing capabilities, and end-use specifications. Early engagement with resin and fiber suppliers can accelerate material qualification processes, enabling rapid iteration on design prototypes and reducing time-to-market. In parallel, investing in modular production cells equipped with real-time monitoring and adaptive control systems can optimize throughput while ensuring consistent product quality across varying compound formulations.

To mitigate supply chain risks, executives are advised to diversify sourcing strategies across multiple regions and to cultivate partnerships with local suppliers capable of scaling support in response to demand fluctuations. Furthermore, embracing digital transformation-through digital twins, predictive maintenance algorithms, and integrated enterprise resource planning platforms-will enable more agile decision-making and tighter synchronization between R&D, operations, and sales functions. Finally, sustainability must remain at the core of strategic roadmaps, with leaders evaluating opportunities for recycled feedstocks, closed-loop processing, and end-of-life recovery programs to meet stakeholder expectations and regulatory requirements.

Detailing the Comprehensive Research Framework Underpinned by Rigorous Analytical Processes Guiding the Thermoplastic Composite Market Study

The findings presented herein are grounded in a multi-tiered research approach that balances primary engagements with secondary data synthesis. The study commenced with in-depth interviews and surveys of senior executives across resin manufacturers, fiber producers, composite fabricators, and end-users, capturing nuanced perspectives on performance criteria, technology adoption rates, and future investment plans. These primary inputs were then triangulated with analyses of technical white papers, patent filings, industry association publications, and trade show insights to validate emerging trends and identify potential disruptors.

Quantitative analyses involved mapping the supply chain from raw material feedstocks through manufacturing processes to final product applications, tracking regulatory frameworks and tariff schedules, and assessing regional infrastructure developments. Advanced data validation techniques, including cross-referencing multiple vendor disclosures and counterparty interviews, ensured that the insights presented are both comprehensive and reliable. Throughout the research lifecycle, rigorous quality control measures-spanning data cleansing, consistency checks, and peer review-underpinned the integrity of conclusions drawn regarding market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Thermoplastic Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Thermoplastic Composites Market, by Fiber Type

- Thermoplastic Composites Market, by Manufacturing Process

- Thermoplastic Composites Market, by Product Form

- Thermoplastic Composites Market, by Resin Type

- Thermoplastic Composites Market, by End Use Industry

- Thermoplastic Composites Market, by Region

- Thermoplastic Composites Market, by Group

- Thermoplastic Composites Market, by Country

- United States Thermoplastic Composites Market

- China Thermoplastic Composites Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Critical Findings and Strategic Imperatives to Illuminate the Future Trajectory of Thermoplastic Composites in Advanced Manufacturing

In synthesizing the diverse strands of technological advancement, regulatory shifts, and regional variation, it is clear that thermoplastic composites occupy a strategic intersection of performance, sustainability, and cost efficiency. The confluence of high-temperature resin innovations, advanced manufacturing techniques, and supportive policy frameworks has set the stage for widespread adoption across critical sectors from aerospace to renewable energy.

Looking ahead, the industry’s ability to forge resilient, decarbonized supply chains and to leverage digitalization for accelerated development cycles will determine which organizations emerge as leaders in the next wave of composite applications. By integrating the actionable recommendations outlined and embracing collaborative innovation models, stakeholders can navigate evolving market landscapes with confidence, unlocking the full potential of thermoplastic composites to drive product differentiation and sustainable growth.

Connect with Ketan Rohom to Secure Comprehensive Thermoplastic Composite Market Research and Drive Informed Strategic Growth Decisions

To explore tailored insights and secure a comprehensive analysis that will empower your strategic initiatives in the evolving thermoplastic composites sector, connect directly with Ketan Rohom (Associate Director, Sales & Marketing) today to purchase the full market research report and position your organization for long-term success.

- How big is the Thermoplastic Composites Market?

- What is the Thermoplastic Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?