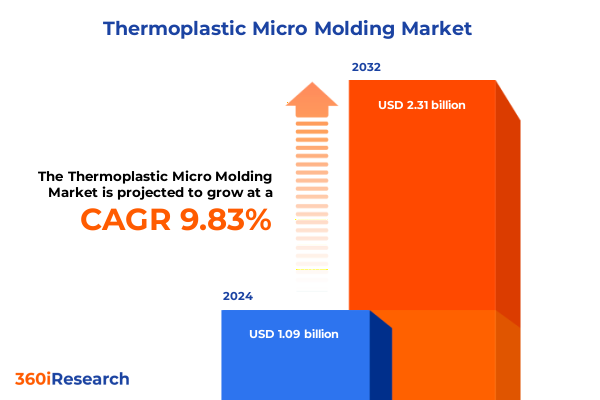

The Thermoplastic Micro Molding Market size was estimated at USD 1.20 billion in 2025 and expected to reach USD 1.30 billion in 2026, at a CAGR of 9.79% to reach USD 2.31 billion by 2032.

Unveiling the Critical Role and Emerging Opportunities in Thermoplastic Micro Molding for High-Precision Manufacturing Applications

Thermoplastic micro molding has emerged as a cornerstone of advanced manufacturing, enabling the production of intricate plastic components with unparalleled precision and consistent quality. This highly specialized process involves injecting molten thermoplastic materials into micro-scale mold cavities under tightly controlled conditions, resulting in parts that often feature dimensions below one millimeter and tolerances in the micron range. From medical diagnostic devices to microelectromechanical systems (MEMS) and consumer electronics, thermoplastic micro molding addresses the demand for miniaturized and multifunctional components that cannot be achieved through conventional molding techniques.

As industries pivot toward greater miniaturization and complexity, the relevance of micro molding is more pronounced than ever. Medical device manufacturers rely on these processes to produce drug delivery systems and surgical instruments that require biocompatible and sterilizable thermoplastics. Simultaneously, the electronics sector demands connectors, micro coils, and sensor housings that withstand stringent performance criteria while occupying minimal space. In the automotive industry, fluidic components and micro gears are increasingly integrated into advanced driver-assistance systems and engine control units, demonstrating how thermoplastic micro molding serves as a catalyst for innovation across diverse sectors.

Moreover, the push for shorter product development cycles and first-pass yield optimization has intensified investment in this domain. Manufacturers now leverage advanced simulation tools and in-process monitoring to predict flow behavior and avoid defects before tooling fabrication, thereby accelerating time to market. This combination of design agility and precision production underscores why thermoplastic micro molding is mission-critical for companies seeking to maintain competitive advantage in rapidly evolving technology landscapes.

How Industry 4.0 Innovation and Sustainability Imperatives Are Redefining the Competitive Dynamics of Thermoplastic Micro Molding

The landscape of thermoplastic micro molding has undergone monumental transformations driven by digitalization, material innovation, and sustainability imperatives. Cutting-edge Industry 4.0 technologies-such as machine learning algorithms, real-time process monitoring, and predictive maintenance-have become integral to micro molding operations. By deploying sensors and data analytics on the production floor, manufacturers can dynamically adjust processing parameters to optimize cycle times and minimize material waste, elevating both throughput and yield. This integration of cyber-physical systems is redefining traditional manufacturing paradigms, making agility and adaptability nonnegotiable competitive differentiators.

Simultaneously, evolving material science has unlocked a new generation of thermoplastics tailored for micro molding. Bio-based polymers and recyclable resins address stringent regulatory and environmental mandates, particularly in medical and consumer segments where sustainability is a critical purchasing driver. At the same time, the rise of multi-shot micro molding techniques allows for the integration of multiple materials or colors in a single mold cycle, reducing assembly steps and enhancing component functionality. The confluence of multi-material molding and miniaturization has expanded application possibilities, enabling designers to embed features like overmolded seals or conductive pathways directly within micro assemblies.

Moreover, the automation of handling and secondary operations through collaborative robotics has streamlined micro molding workflows. Robots equipped with vision systems can extract delicate parts, perform inline quality inspections, and transfer components to downstream processes without manual intervention. These automated solutions not only mitigate contamination risks in sensitive industries but also ensure the repeatability required for high-precision micro components. Together, these transformative shifts are propelling the thermoplastic micro molding sector toward unprecedented levels of efficiency and innovation.

Assessing the Comprehensive Impact of 2025 United States Tariff Measures on Thermoplastic Micro Molding Supply Chains and Production Economics

The tariff landscape in the United States has undergone significant recalibration in 2025, with direct consequences for thermoplastic micro molding producers and their supply chains. In early March, the federal government enacted a 10% tariff on plastic industry imports originating from China and a 25% levy on analogous shipments from Canada and Mexico. This policy shift was justified under national security and economic realignment objectives, aiming to balance trade deficits and encourage domestic sourcing. These elevated duties have introduced immediate cost pressures on imported resins and finished micro components, eroding margin structures for manufacturers dependent on global supply chains.

Concurrently, the imposition of a 25% tariff on imported steel and aluminum for mold fabrication, effective March 12, 2025, has disrupted traditional tooling economics. Many thermoplastic micro molding toolmakers historically relied on precision-grade steel and lightweight aluminum alloys sourced from Canada and Europe. With tariffs inflating input prices by up to one-quarter, mold construction costs have risen sharply, driving longer amortization periods for high-precision tooling investments. This has compelled a subset of producers to seek alternative domestic suppliers or absorb increased expenses to maintain project timelines and cost commitments.

The combined effect of duties on raw materials and tooling underscores the criticality of supply chain resilience strategies. Some manufacturers are preemptively relocating mold production in the United States or Mexico to circumvent tariff exposure, while others are diversifying material specifications to leverage lower-tariff alternatives. These strategic adaptations, however, require upfront capital and ramp-up time, and not all micro molding operations have the scale or flexibility to deploy them seamlessly. In the short term, the cumulative tariff burden is likely to translate into delayed project approvals and upward price revisions for end users.

Deep Dive into Segmentation Dynamics Reveals Material, Technology, Machine, and Application Trends Shaping Thermoplastic Micro Molding

A nuanced understanding of market segmentation reveals critical inflection points in material preferences, processing technologies, machine investments, and application demands driving thermoplastic micro molding adoption. Across the material spectrum, acrylonitrile butadiene styrene (ABS) remains a workhorse for its balance of toughness and printability, while engineering resins such as polyamide and polycarbonate are chosen for their elevated mechanical and thermal performance. Meanwhile, polyoxymethylene (POM) and polypropylene serve niche roles where low friction and chemical resistance are paramount. The emergence of thermoplastic elastomers in micro molding portfolios addresses the growing requirement for flexible features like soft grips and gaskets in compact assemblies.

On the technological front, traditional micro injection molding continues to dominate high-volume precision production. However, the adoption of micro extrusion molding and insert micro molding techniques is on the rise for continuous geometries and composite assemblies, respectively. Notably, multi-shot micro molding has gained traction, enabling manufacturers to combine materials or colors in a single cycle. Within this domain, two-shot processes are often leveraged for sealing applications, while three-shot configurations are favored when integrating rigid cores, soft overmolds, and functional inserts in complex medical or sensor components.

Machine selection further differentiates micro molding strategies. Electric micro molding machines offer the tightest parameter control and lowest cycle variability, making them ideal for micrometer-scale features. Hybrid machines, which blend electric drives with hydraulic force, provide a balance of precision and cost efficiency for medium throughput. Hydraulic micro molding machines remain prevalent for higher clamping forces and longer production runs, especially in sectors with entrenched investment cycles.

Finally, the breadth of applications spans automotive fluidic components and micro gears, consumer electronics connectors and micro optics, industrial sensors, and an expanding universe of medical devices-from diagnostic chips to implantable systems and drug delivery microstructures. This complex mosaic of segmentation underscores why tailored process designs and material selections are pivotal to commercial success in thermoplastic micro molding.

This comprehensive research report categorizes the Thermoplastic Micro Molding market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Technology

- Machine Type

- Application

Regional Market Variations Highlight the Divergent Growth Trajectories of Thermoplastic Micro Molding across Americas EMEA and Asia-Pacific

Geographic markets exhibit pronounced differences in adoption rates, regulatory landscapes, and investment priorities for thermoplastic micro molding. In the Americas, North American manufacturers benefit from proximity to major OEMs in automotive and healthcare, spurring investments in localized production to mitigate tariff risks. The United States and Canada have witnessed a resurgence in domestic tooling and resin compounding, enabled by government incentives aimed at strengthening advanced manufacturing capacities. Conversely, Latin American markets are gradually embracing micro molding for medical device and telecommunications components, supported by regional free trade agreements that enhance access to North American supply chains.

Europe, Middle East & Africa (EMEA) presents a heterogeneous picture. Western European countries have led adoption curves through high-technology clusters in Germany, Switzerland, and Scandinavia, where micro injection processes support precision instrumentation and sensor manufacturers. The region’s rigorous regulatory frameworks for medical devices and automotive safety systems demand stringent quality certifications and validation protocols, driving technology investments. Emerging markets in Eastern Europe and select Middle Eastern hubs are increasingly positioning themselves as competitive outsourcing destinations, leveraging lower labor costs and improving infrastructure to attract micro molding projects. Africa remains an early-stage adopter but shows potential for growth in telecom infrastructure and consumer electronics as local manufacturing ecosystems mature.

Asia-Pacific reigns as the most dynamic region, propelled by robust electronics and automotive manufacturing sectors in countries such as Japan, South Korea, and China. The proliferation of consumer electronics, medical device production, and telecommunication infrastructure deployment has necessitated high-volume micro molding capacity. India and Southeast Asian nations are rapidly closing the technology gap, with several greenfield facilities adopting electric micro molding machines to penetrate global supply chains. Regional clusters in Taiwan and Malaysia specialize in multi-shot molding for micro connectors, while China’s expansive polymer compounding industry secures cost-competitive resin supply. The confluence of favorable production costs, infrastructure investments, and government support cements Asia-Pacific’s leadership in thermoplastic micro molding innovation and volume output.

This comprehensive research report examines key regions that drive the evolution of the Thermoplastic Micro Molding market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Intelligence Exposes Strategic Moves by Leading Thermoplastic Micro Molding Manufacturers and Emerging Challengers Driving Innovation

The competitive landscape of thermoplastic micro molding is defined by a blend of global machinery suppliers, specialized toolmakers, and integrated resin formulators collaborating to deliver end-to-end solutions. Dominant machine manufacturers such as Milacron, with centuries of molding experience, are capitalizing on domestic resourcing trends to offer fully electric presses tailored for micro applications. Milacron’s strategy to leverage its U.S. manufacturing footprint exemplifies how proximity to processors can translate into faster service and tariff avoidance, positioning the company as a preferred partner for cost-sensitive production ramps.

Meanwhile, niche players like PTi focus on developing turnkey lines for sheet extrusion and micro sheet molding, addressing emerging needs for compact microfluidic and flexible film assemblies. Their limited dependence on imported components has enabled them to weather tariff volatility more effectively, underscoring the value of vertical integration in critical process areas. In the mold making arena, traditional tool shops in Germany and the United States have invested in advanced machining centers and AI-driven design software to meet shrinking tolerances and accelerate delivery timelines.

On the materials front, global chemical conglomerates are racing to introduce next-generation thermoplastic elastomers and bio-based polymers certified for medical use, responding to end-user demands for sustainable micro components. Partnerships between resin suppliers and micro molding specialists are increasingly common, fostering joint development programs that co-validate material and process parameters. This collaborative R&D model not only shortens qualification cycles but also drives innovation across multi-shot and overmolding techniques. As the field evolves, companies that can seamlessly integrate machine, mold, and material expertise will maintain a competitive edge in meeting the exacting requirements of micro-scale manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Thermoplastic Micro Molding market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACCU Mold LLC

- ALC Precision

- American Precision Products

- BMP Medical

- DONGGUAN SINCERE TECH Co Ltd

- Isometric Micro Molding Inc

- Kamek Precision Tools

- Makuta Technics Inc

- Microsystems UK

- MTD Micro Molding

- Paragon Medical

- Plastikos

- PRECIKAM Inc

- Precipart

- Rapidwerks Inc

- RAUMEDIC AG

- SMC Corporation

- Sovrin Plastics Limited

- Spectrum Plastics Group Inc

- Springboard Manufacturing Solutions

- Stack Plastics

- Stamm AG

- Veejay Plastic Injection Molding Company

Actionable Strategic Recommendations to Empower Industry Leaders in Thermoplastic Micro Molding to Navigate Disruption and Accelerate Growth

Industry leaders must adopt proactive strategies that balance immediate cost pressures with long-term resilience to thrive in the evolving thermoplastic micro molding landscape. First, companies should establish diversified supply chains that include domestic and nearshore tooling and resin sources. This approach not only mitigates exposure to tariff shifts but also enables rapid response to demand fluctuations. Building strategic partnerships with resin compounders and mold makers who maintain certifications for critical applications will streamline material approvals and accelerate production ramps.

Second, embracing advanced digital technologies is a strategic imperative rather than a luxury. Firms should invest in integrated process monitoring platforms, combining real-time sensor data with predictive analytics to continuously optimize cycle parameters. This not only reduces scrap rates but also enhances overall equipment effectiveness, driving cost efficiencies that can offset tariff-induced input price increases. Third, product line rationalization aligned with core competencies will enable sharper capital deployment. By focusing on high-value applications-such as medical diagnostic components or automotive sensor housings-manufacturers can allocate resources to differentiated processes like multi-shot micro molding or conductive thermoplastics, yielding superior margins.

Finally, cultivating workforce expertise through targeted training programs will ensure successful adoption of new equipment and materials. As processes become more complex, cross-functional teams capable of interpreting data analytics and translating insights into process adjustments will be indispensable. By marrying human expertise with digital tools, companies can create robust operational frameworks that are both agile and scalable, positioning themselves to capitalize on emerging micro molding opportunities.

Robust Research Methodology Combining Primary Expert Interviews and Secondary Data Triangulation to Illuminate Thermoplastic Micro Molding Insights

This analysis draws on a hybrid research methodology, combining primary and secondary sources to deliver a rigorous perspective on thermoplastic micro molding. Primary research included in-depth interviews with senior industry executives, tool shop leaders, and process engineers across North America, Europe, and Asia-Pacific. These conversations provided qualitative insights into strategic priorities, emerging pain points related to tariffs, and on-the-ground implementation of advanced molding technologies.

Complementing primary data, secondary research encompassed a comprehensive review of trade association publications, regulatory filings, and corporate disclosures to quantify macroeconomic drivers and policy impacts. Industry reports ranging from specialty plastics outlooks to tooling market analyses were critically evaluated, excluding vendor-supplied projections to ensure impartiality. Historical trade flow data and tariff schedules were sourced from government databases, enabling precise mapping of duty changes and their supply chain implications.

Data triangulation was achieved by cross-verifying interview findings with publicly available performance indicators, such as industrial production indices and trade balance statistics. This multi-angled approach ensures that conclusions are grounded in both empirical evidence and practitioner experience, providing stakeholders with actionable intelligence that withstands market uncertainties.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Thermoplastic Micro Molding market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Thermoplastic Micro Molding Market, by Material Type

- Thermoplastic Micro Molding Market, by Technology

- Thermoplastic Micro Molding Market, by Machine Type

- Thermoplastic Micro Molding Market, by Application

- Thermoplastic Micro Molding Market, by Region

- Thermoplastic Micro Molding Market, by Group

- Thermoplastic Micro Molding Market, by Country

- United States Thermoplastic Micro Molding Market

- China Thermoplastic Micro Molding Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings into a Concise Conclusion Emphasizing the Future Outlook of Thermoplastic Micro Molding in a Rapidly Evolving Market

This executive summary has synthesized critical insights into the evolving dynamics of thermoplastic micro molding, from the foundational mechanics of micro-scale production to the strategic ramifications of fresh tariff regimes in 2025. We have explored how Industry 4.0 technologies and sustainable material innovations are reshaping operational efficiency and unlocking new application frontiers. Our segmentation analysis underscores the multifaceted nature of the market, highlighting distinct pathways driven by material selection, processing technology, machine investment, and application focus. Regional assessments reveal divergent growth trajectories, with Asia-Pacific commanding volume leadership while mature markets in North America and EMEA invest in resiliency and high-value production.

Moreover, our evaluation of competitive landscapes showcases how both established OEMs and specialized challengers are forging partnerships and enhancing capabilities to meet exacting tolerances and faster time-to-market expectations. Actionable recommendations provide a roadmap for industry leaders to fortify supply chains, leverage digital tools, and optimize product portfolios to navigate tariff pressures and capitalize on emerging opportunities. In a field characterized by relentless miniaturization and technological sophistication, manufacturing excellence hinges upon the seamless integration of people, processes, and technology.

As thermoplastic micro molding continues to underpin breakthroughs in medical devices, automotive sensors, and consumer electronics, the companies that embrace innovation, strategic collaboration, and agile operations will stand poised to define the next generation of micro manufacturing excellence.

Connect with Ketan Rohom to Secure Comprehensive Thermoplastic Micro Molding Market Insights and Drive Strategic Decision Making with Expert Support

To explore how these comprehensive insights can inform your strategic initiatives and unlock the full potential of thermoplastic micro molding applications in your organization, reach out to Ketan Rohom. As the Associate Director of Sales & Marketing, Ketan combines deep market expertise with a customer-centric approach to guide you through the nuances of this transformative industry. Engage directly with Ketan to discuss customized research deliverables, secure competitive benchmarking, and tailor actionable intelligence that supports your growth objectives. Contact him today to schedule a consultation and take the next step toward harnessing critical thermoplastic micro molding market insights.

- How big is the Thermoplastic Micro Molding Market?

- What is the Thermoplastic Micro Molding Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?