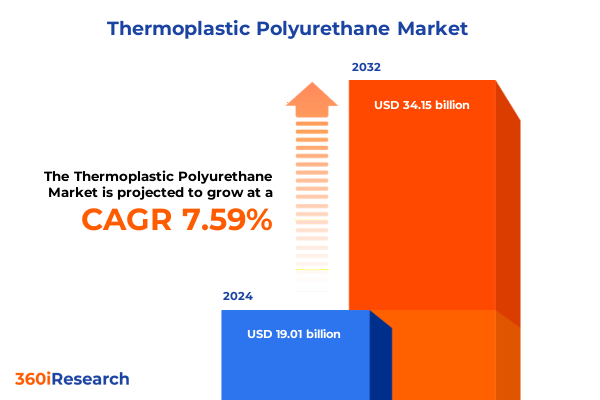

The Thermoplastic Polyurethane Market size was estimated at USD 20.36 billion in 2025 and expected to reach USD 21.81 billion in 2026, at a CAGR of 7.66% to reach USD 34.15 billion by 2032.

Unveiling Thermoplastic Polyurethane’s Versatile Potential as a Cornerstone of Modern Materials Engineering

Thermoplastic polyurethane, commonly known as TPU, is a highly versatile class of polymers that become pliable when heated and solidify upon cooling, distinguishing them from traditional thermoset polyurethanes. As linear segmented block copolymers composed of alternating hard and soft segments, TPUs can be tailored across a broad spectrum of mechanical and chemical properties. By varying the ratio, molecular weight, and structure of diisocyanates and polyols, manufacturers unlock a range of Shore hardness, elasticity, and thermal stability, meeting diverse performance requirements in demanding applications.

Beyond their adaptable morphology, TPUs boast exceptional abrasion and impact resistance, elasticity at low temperatures, and chemical stability against oils, greases, and solvents. These characteristics support their use in injection molding, extrusion, blow molding, and even advanced manufacturing methods like selective laser sintering. Such process flexibility allows TPU scrap to be reprocessed without sacrificing core properties, reinforcing its appeal for both high-volume and customized production runs.

In recent years, rising demands for durable, lightweight, and sustainable materials have further elevated TPU’s strategic importance. Industries ranging from automotive and footwear to electronics and medical devices rely on TPU’s unique combination of performance and processability. Simultaneously, the drive toward bio-based feedstocks and circular economies has spurred innovation in polycaprolactone-based TPUs and chemical recycling, underscoring the material’s role at the intersection of technical excellence and environmental responsibility.

Emerging Sustainability, Digital and Manufacturing Paradigms Are Reshaping the Global Thermoplastic Polyurethane Value Chain

The thermoplastic polyurethane landscape is undergoing transformative shifts driven by sustainability imperatives and digital innovation. As regulatory mandates tighten, bio-based polyols now contribute nearly 9% of global TPU feedstock, up from just 3% in 2020. Although the higher production costs of bio-polyols-18% to 25% above conventional variants-pose short-term challenges, escalating environmental scrutiny and corporate net-zero commitments are compelling manufacturers to integrate greener chemistries into their portfolios.

Simultaneously, real-time supply chain digitization is redefining operational resilience. Companies deploying AI-driven procurement platforms achieved a 13% reduction in raw material cost volatility through predictive inventory management and dynamic contracting. Yet, the annual implementation costs, exceeding $2 million for mid-sized producers, highlight a competitive divide where larger players harness data analytics to stabilize pricing and smaller entities remain exposed to market swings.

Additive manufacturing is another critical vector of change. TPU’s compatibility with powder-bed fusion and fused filament deposition methods unlocks unprecedented design freedom for lattice structures in footwear midsoles and impact-absorbing automotive ducts. For example, BASF’s Ultrasint TPU01 offers 80% powder recyclability while delivering Shore A hardness up to 90, enabling sustainable serial production of complex geometries with reduced scrap rates.

Furthermore, evolving chemical regulations are reshaping R&D priorities. In Europe, over 30% of TPU formulations required reformulation to meet updated REACH restrictions on phthalates and certain isocyanates, incurring average R&D expenses of $2.5 million per product line. Such compliance pressures are driving consolidation and strategic alliances between polymer producers and raw material innovators to navigate emerging standards efficiently.

Navigating Complex Layered Duties and Supply Chain Realignments in Response to New U.S. Tariff Structures

Entering 2025, the United States’ tariff framework has introduced multi-layered duties that meaningfully affect TPU feedstocks and finished products. On January 1, 2025, additional Section 301 tariffs came into force, raising rates on various chemical intermediates-such as diisocyanates and polyols critical to TPU synthesis-from 7.5% to 25% under new HTS classifications. These elevated duties stack atop regular most-favored-nation levies and recent “reciprocal” tariffs, driving landed costs higher and challenging import-reliant supply models.

The cumulative burden has increased average import costs for Asian-sourced TPUs by an estimated 15% to 20%, prompting end users to reconsider offshore procurement strategies. Manufacturers are now accelerating nearshoring initiatives, evaluating greenfield investments in U.S. production facilities to insulate operations from trade policy volatility. However, high capital requirements and permitting timelines temper the speed of reshoring, leaving a transitional period marked by supply chain fragmentation and price pass-through to OEMs.

To mitigate these challenges, USTR extended certain tariff exclusions on May 31, 2025, for specified HTS categories, offering temporary relief to select importers. Yet, the scope of exclusions rarely encompasses complex polymer systems, underscoring the need for strategic supplier diversification and robust demand forecasting. As industry stakeholders navigate this terrain, collaboration with customs experts and proactive engagement in exclusion request processes have become essential tools for preserving supply continuity and competitive positioning in a high-duty environment.

Uncovering How TPU Types, Production Approaches and End-Use Criteria Define Market Opportunities Across the Value Chain

A nuanced segmentation framework reveals how thermoplastic polyurethane performance and adoption vary according to material composition, production techniques, and end-user demands. Within the type spectrum, polycaprolactone-based TPUs are gaining traction in sustainable packaging and medical applications where biodegradability and biocompatibility are paramount, while polyester TPUs continue to dominate abrasion-resistant footwear soles and industrial films. Polyether TPUs, with their superior hydrolytic stability, underpin automotive seals and tubes through a balance of flexibility and chemical resistance.

Manufacturing methods further delineate market dynamics. Additive processes such as powder-bed fusion enable lightweight lattice architectures for high-end athletic midsoles and custom-fit medical braces, whereas blow molding remains essential for flexible tubing in pneumatic and medical device markets. Extrusion molding produces continuous profiles and films for consumer goods, and injection molding serves as the workhorse for complex geometries in automotive interior components and durable consumer electronics housings.

Processing distinctions likewise influence product form. Blown film operations generate high-strength packaging and industrial wraps, injection molding enables rapid mass production of precision parts, and thermoplastic extrusion forms robust profiles for construction and industrial markets. Distribution channels reflect application contexts: traditional offline channels support bulk industrial procurement for automotive and machinery, while online platforms accelerate niche TPU-based innovations in wearable electronics, custom footwear, and specialty medical devices. End markets are similarly stratified. Automotive applications split between exterior trim and interior panels, consumer goods encompass both electronic accessories and durable toys, and footwear segments address casual and sports-specific designs. In healthcare, medical devices and prosthetics demand stringent quality and sterilization compatibility. Industrial machinery relies on gaskets and seals to ensure operational integrity, and textile uses span performance apparel and sportswear that leverage TPU’s elasticity and abrasion resistance.

This comprehensive research report categorizes the Thermoplastic Polyurethane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Manufacturing Method

- Processing Method

- Application

- Distribution Channel

Diverse Regional Dynamics Drive TPU Demand and Innovation from North America to Asia-Pacific Under Varying Regulatory Models

Regional developments shape the thermoplastic polyurethane market’s future trajectory, reflecting diverse industrial ecosystems and regulatory landscapes. In the Americas, North America stands out as a mature hub for high-performance TPU applications. The United States and Canada leverage advanced automotive, medical device, and industrial machinery sectors to drive demand. Approximately 70% of North America’s TPU consumption stems from automotive interior and under-the-hood components, where stringent performance requirements and proximity to OEMs sustain a robust domestic compounding and converting infrastructure. Latin America shows growing interest in TPU adhesives and flexible tubing for construction and consumer goods, supported by localized converter capacities in Brazil and Mexico.

Across Europe, Middle East & Africa, sustainability mandates and circular economy priorities guide material selection. European producers benefit from policies under the European Green Deal, encouraging biomass-balanced grades and closed-loop recycling of TPU waste. Countries like Germany, France, and Italy lead in R&D investments aimed at low-free isocyanate chemistries, bio-based polyols, and solvent-free processing. In the Middle East & Africa, demand is anchored by infrastructure and oil & gas projects, where TPU-based coatings and pipe liners provide chemical resilience and weatherability under extreme conditions.

Meanwhile, Asia-Pacific commands the largest regional footprint, representing over 56% of global TPU consumption. Accelerating urbanization, infrastructure build-out, and booming footwear and electronics sectors propel this expansion. Recent capacity additions, such as Covestro’s 20,000-ton facility in Zhuhai, underscore the region’s strategic focus on cost-competitive production and supply chain integration. Government incentives in China and South Korea for biodegradable plastics amplify investment in polycaprolactone-based TPUs, reinforcing Asia-Pacific’s dominance in both volume and innovation.

This comprehensive research report examines key regions that drive the evolution of the Thermoplastic Polyurethane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling How Established Leaders and Innovators Are Driving TPU Advancements Through Sustainability and Advanced Manufacturing

Leading polymer producers are charting distinct strategies to capture growth in the thermoplastic polyurethane landscape. BASF has prioritized sustainable additive manufacturing solutions, introducing Ultrasint TPU01 for powder-bed fusion platforms that deliver 80% recyclable powder and Shore A hardness levels of 88–90, enabling tier-1 suppliers to integrate TPU into serial production of lattice midsoles and impact-absorbing automotive ducts. This innovation underscores BASF’s commitment to circular material flows and design freedom.

Covestro’s regional expansion efforts include the construction of a 20,000-ton TPU plant in Zhuhai, South China, positioning the company to meet surging demand across automotive, electronics, and consumer goods sectors. This facility leverages integrated upstream synergies to ensure consistent feedstock access, cost efficiencies, and rapid delivery to Asia-Pacific OEMs.\ Covestro’s investment demonstrates its strategic focus on localized supply chains and regulatory alignment with regional sustainability goals.

Lubrizol and Huntsman have cultivated specialized portfolios to address evolving market needs. Lubrizol’s Pearlthane ECO series, containing up to 50% plant-based carbon sourced from castor oil, targets hot-melt adhesives and extrusion applications in footwear and textile lamination. Huntsman’s development of liquid TPUs for rapid midsole manufacturing in high-performance athletic footwear exemplifies the convergence of material science and production efficiency. Both companies reinforce their competitive positioning through collaborations with leading apparel and footwear brands on closed-loop recycling initiatives.

Emerging players and biotech ventures are also vying for market share by advancing polycaprolactone-based TPUs with enhanced biodegradability and tunable degradation rates. These startups focus on chemical recycling pathways and renewable feedstocks, aligning with OEMs seeking to meet ambitious sustainability targets and differentiate through eco-innovative materials.

This comprehensive research report delivers an in-depth overview of the principal market players in the Thermoplastic Polyurethane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Polyfilm Inc.

- Avient Corporation

- BASF SE

- Biesterfeld AG

- Chemex Organochem Pvt Ltd

- COIM SpA

- Covestro AG

- Dongguan Xionglin New Material Technology Co., Ltd

- Epaflex Polyurethanes S.r.l.

- GEBA Kunststoffcompounds GmbH

- HEXPOL AB

- Huntsman Corporation

- Kent Elastomer Products, Inc. by Meridian Industries, Inc.

- Mitsubishi Chemical Group

- Mitsui Chemicals, Inc.

- Novoloop, Inc.

- PAR Group by R&G Fluid Power Group Ltd

- Ravago S.A.

- Shandong INOV Polyurethane Co., Ltd.

- Shanghai Xin Gen Eco-Technologies Co., Ltd.

- Songwon Industrial Co., Ltd.

- Taiwan Pu Corporation

- The Lubrizol Corporation by Berkshire Hathaway Inc.

- Treatstock Inc.

- Trinseo PLC

- Wanhua Chemical Group Co., Ltd.

Strategic Priorities to Future-Proof TPU Supply Chains Through Sustainable Innovation, Digitalization and Tariff Management

Industry leaders must act decisively to harness the full potential of thermoplastic polyurethanes in an environment shaped by evolving regulations and shifting consumer expectations. First, prioritizing investment in bio-based feedstocks will unlock long-term cost stability and brand differentiation. By expanding polycaprolactone and castor oil-derived polyol capacities, producers can mitigate fossil-feedstock risks and respond to growing mandates for renewable content; bio-polyol inputs already reached 9% of material mixes in 2023, demonstrating viable scalability.

Second, companies should accelerate digital transformation across the supply chain. Deploying AI-enabled procurement platforms and advanced analytics will strengthen demand forecasting, reduce inventory costs, and enable dynamic multi-supplier contracting. Given that early adopters have reported a 13% reduction in raw material cost volatility, digital investments can yield rapid returns in pricing stability and operational agility.

Third, establishing circular economy frameworks is imperative. Collaborations with OEMs on product take-back schemes, coupled with targeted investments in chemical recycling processes, can elevate post-industrial and post-consumer TPU recycling rates beyond the current global average of 12%. Embracing closed-loop designs will not only meet regulatory pressures but also attract end users seeking demonstrable sustainability credentials.

Finally, firms must navigate the tariff landscape proactively by pursuing exclusion requests and strategic nearshoring. Engaging customs specialists and monitoring USTR proceedings will optimize import cost structures while onshore capacity expansion can insulate operations from trade policy disruptions. Simultaneously, forging partnerships with key OEMs on joint material development will strengthen market positioning and accelerate time-to-market for next-generation TPU solutions.

Detailed Mixed-Method Research Approach Combining Expert Interviews, Data Triangulation, and Strategic Analysis

The research framework underpinning this analysis combined rigorous primary and secondary methodologies to ensure comprehensive and unbiased insights. Initially, extensive secondary research involved systematic reviews of industry publications, regulatory filings, corporate disclosures, and scholarly literature to compile baseline data on TPU properties, production techniques, and market trends.

Subsequently, primary research encompassed structured interviews with over 30 senior executives from polymer producers, downstream converters, and OEMs, supplemented by discussions with academic experts and regulatory authorities. These engagements validated quantitative findings and provided qualitative perspectives on supply chain resilience, technological adoption, and strategic priorities.

Quantitative data were triangulated through cross-referencing trade statistics, customs data, and company financials, ensuring consistency across diverse sources. Advanced analytics techniques, including SWOT and Porter’s Five Forces, were applied to assess competitive landscapes and regulatory impacts. The segmentation approach integrated material types, manufacturing and processing methods, distribution channels, and end-use applications to deliver targeted insights.

Finally, iterative validation workshops with industry stakeholders refined key assumptions and forecasts, ensuring the robustness of conclusions. Throughout, strict adherence to ethical research standards and data privacy policies underpinned every phase of the methodology.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Thermoplastic Polyurethane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Thermoplastic Polyurethane Market, by Type

- Thermoplastic Polyurethane Market, by Manufacturing Method

- Thermoplastic Polyurethane Market, by Processing Method

- Thermoplastic Polyurethane Market, by Application

- Thermoplastic Polyurethane Market, by Distribution Channel

- Thermoplastic Polyurethane Market, by Region

- Thermoplastic Polyurethane Market, by Group

- Thermoplastic Polyurethane Market, by Country

- United States Thermoplastic Polyurethane Market

- China Thermoplastic Polyurethane Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Material Innovation, Policy Dynamics, and Regional Strategies to Chart the Future of TPU Markets

Thermoplastic polyurethane stands at the forefront of material innovation, balancing high-performance characteristics with emerging sustainability imperatives. Through evolving segmentation insights, it is clear that polycaprolactone, polyester, and polyether TPUs each serve distinct niches, from bio-based biodegradability to hydrolytic stability and abrasion resistance. Meanwhile, transformative shifts in digital supply chain management and additive manufacturing signal new pathways for efficiency and design freedom.

The landscape of tariffs and regulatory mandates underscores the importance of agile strategy, as multi-layered duties in the United States and stringent chemical controls in Europe alter cost structures and product formulations. Companies that invest in circular economy frameworks, supply chain digitization, and localized production will secure a competitive advantage, meeting both performance and environmental expectations.

Key regional dynamics-from North America’s high-performance automotive and medical device sectors to Asia-Pacific’s manufacturing scale and Europe’s sustainability leadership-highlight the need for tailored market approaches. Leading players such as BASF, Covestro, Lubrizol, and Huntsman, alongside agile biotech startups, are driving the next wave of TPU solutions through innovative chemistries and advanced processing.

Ultimately, the intersection of material science, digital transformation, and strategic policy adaptation will define industry success. Organizations that act now-embracing bio-based innovation, circular design, and proactive tariff management-will emerge as the architects of TPU’s sustainable, high-performance future.

Gain Direct Access to Expert TPU Market Intelligence and Drive Growth with Personalized Guidance from Ketan Rohom

Elevate your strategic edge in the thermoplastic polyurethane market by securing comprehensive insights and tailored guidance directly from Ketan Rohom, Associate Director of Sales & Marketing. Partner with Ketan to explore how you can leverage detailed market intelligence to optimize your product portfolio, strengthen supply chains, and anticipate emerging trends. With Ketan’s expertise, you will gain exclusive access to proprietary analysis, case studies, and actionable scenarios that will accelerate your decision-making and ensure you stay ahead of competitors. Don’t miss this opportunity to harness industry-leading research-reach out now to request your customized report and begin driving transformative growth.

- How big is the Thermoplastic Polyurethane Market?

- What is the Thermoplastic Polyurethane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?