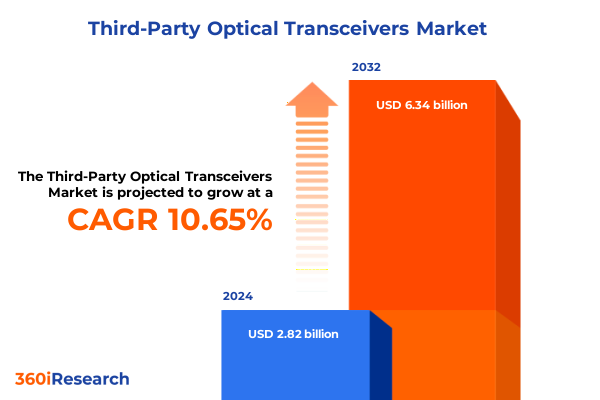

The Third-Party Optical Transceivers Market size was estimated at USD 3.11 billion in 2025 and expected to reach USD 3.43 billion in 2026, at a CAGR of 10.67% to reach USD 6.34 billion by 2032.

Introducing the Rise of Third-Party Optical Transceivers in Dynamic Network Environments Transforming Cost Structures and Performance Expectations

The evolution of optical networking has reached a pivotal juncture as network operators grapple with unprecedented bandwidth demands and escalating cost pressures. Third-party optical transceivers have emerged as a compelling alternative to traditional OEM-branded modules, offering network architects a pathway to optimize both capital and operational expenditures. By introducing competitive price points without compromising interoperability, these modules empower enterprises and service providers to scale high-speed networks with greater budgetary flexibility and agility. This is particularly crucial in hyperscale data centers and cloud environments where incremental hardware costs can cascade into significant financial burdens over time.

Disruptive Technological and Supply Chain Shifts Reshaping the Third-Party Optical Transceiver Ecosystem for Next-Gen Connectivity

The landscape of optical transceiver deployment is undergoing a profound transformation driven by the convergence of disaggregated network architectures and advanced optical technologies. Network operators are increasingly adopting software-defined and white-box switching platforms that separate hardware from software components, demanding more versatile, high-density optical modules capable of dynamic provisioning and on-the-fly reconfiguration. This shift has prompted third-party transceiver vendors to innovate rapidly, delivering pluggable optics that seamlessly integrate with multi-vendor equipment and support evolving interface standards without extensive hardware requalification.

Assessing the Cumulative Ripple Effects of U.S. Trade Tariff Measures on Third-Party Optical Transceiver Supply Chains and Costs in 2025

Since the initial imposition of Section 301 tariffs in 2018, the United States has maintained a 25 percent duty on certain China-origin optical transceivers under HTS headings 8541 and 8542, significantly elevating landed costs for importers. In early 2025, additional tariffs enacted via the International Emergency Economic Powers Act and Reciprocal Tariffs raised duties by an extra 10 percent on a broad range of Chinese imports, while retaliatory Reciprocal Tariffs on April 9 escalated rates to 125 percent before a subsequent trade deal adjusted duties back to 10 percent by mid-May. These layered levies have prompted many contact manufacturers to reroute supply chains and reconsider manufacturing footprints.

Delving into Key Market Segmentation Dimensions to Uncover Performance Drivers and Customer Preferences Across optical Transceiver Categories

Market segmentation reveals that data rate requirements range from legacy 10 gigabit and 25 gigabit interfaces up to emerging ultra-high speeds such as 800 gigabit and 1.6 terabit links, compelling vendors to offer a spectrum of transceiver options to align with diverse bandwidth needs. Form factors likewise span compact SFP+ and SFP28 modules, mid-density QSFP+ and QSFP28 pluggable optics, and high-density CFP2 variants, while cutting-edge form factors like COBO, OSFP, and QSFP-DD address the insatiable port-density demands of hyperscale environments. Applications extend across data center fabrics, enterprise LANs, industrial networks, and telecom transport layers, with reach capabilities tailored from short-reach multimode links to ultra-long-reach coherent solutions. Connector choices such as LC, MPO, SC, E2000, and FC enable compatibility with existing cabling infrastructure, while end-user segments including cloud service providers, enterprise IT divisions, hyperscale operators, telecom carriers, and government and defense entities each drive specific performance and compliance criteria.

This comprehensive research report categorizes the Third-Party Optical Transceivers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Data Rate

- Form Factor

- Distance

- Connector Type

- Application

- End User

Unveiling Regional Market Dynamics to Highlight Strategic Opportunities Across the Americas, EMEA, and Asia-Pacific Third-Party Transceiver Markets

In the Americas, robust hyperscale and cloud service provider expansions underpin strong uptake of third-party optical transceivers, buoyed by domestic manufacturing incentives and regional assembly initiatives that mitigate import duty exposure. North American operators prioritize interoperability and rapid deployment, often leveraging long-term supply agreements and fixed-price contracts to hedge against tariff volatility. Across Europe, the Middle East, and Africa, stringent data sovereignty regulations and energy efficiency mandates shape procurement strategies, encouraging investments in low-power optics and multi-vendor interoperability solutions that align with pan-regional harmonization efforts. Stringent environmental and quality standards also drive vendors to certify modules against regional compliance requirements, bolstering confidence among telecom carriers and enterprise end users alike. Asia-Pacific stands out for its aggressive 5G rollout schedules and rapid digital transformation initiatives in markets such as China, India, and Southeast Asia, which together fuel demand for high-speed, cost-effective transceiver modules. Manufacturing hubs across Taiwan, South Korea, and Southeast Asia continue to expand capacity, while localized supply chains reduce lead times and lower logistic costs for regional end users.

This comprehensive research report examines key regions that drive the evolution of the Third-Party Optical Transceivers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Leadership and Innovation Drivers Among Key Players in the Third-Party Optical Transceiver Market

Competitive intensity in the third-party optical transceiver arena is led by established photonics specialists and agile newcomers alike. Industry stalwarts such as Lumentum, II-VI Incorporated, and Broadcom leverage deep expertise in laser and photonic integrated circuit technologies to deliver high-performance modules with rigorous quality assurance programs. At the same time, diversified component suppliers such as Amphenol and Applied Optoelectronics have broadened their portfolios by integrating assembly, testing, and firmware capabilities, enabling them to offer turnkey solutions across multiple form factors and data rates. Emerging vendors like FS.COM and Innolight emphasize rapid time-to-market and customer-driven customization, carving niche positions in specialized verticals such as industrial automation and government-grade transport networks. Collaborative partnerships between optical chipset providers and switch OEMs further accelerate validation cycles and expand interoperability, fostering a dynamic vendor ecosystem where continuous innovation and strategic M&A activity define the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Third-Party Optical Transceivers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acacia Communications Inc.

- Accelink Technology Co. Ltd.

- AddOn Networks

- Applied Optoelectronics Inc.

- Approved Technology Ltd.

- ATOP Corporation

- Broadcom Inc.

- CBO GmbH

- Champion ONE

- Ciena Corporation

- Coherent Corp.

- DataLight Optics Inc.

- Eoptolink Technology Inc. Ltd.

- ETU-Link Technology Co. Ltd.

- FluxLight Inc.

- Fujitsu Optical Components Limited

- Hisense Broadband Inc.

- Hummingbird Networks

- INNOLIGHT Technology Inc.

- Intel Corporation

- Juniper Networks Inc.

- Lumentum Operations LLC

- ProLabs Ltd.

- Source Photonics Inc.

Strategic Imperatives for Industry Leaders to Build Resilient Supply Chains and Drive Next-Generation Optical Interconnect Innovation

Industry leaders must prioritize development of versatile transceiver platforms that support rapid data rate upgrades and modular firmware parameterization, enabling seamless integration of next-generation speeds without costly hardware redesigns. Establishing regional assembly and testing hubs can significantly reduce tariff exposure and logistics complexities, fostering supply chain resilience in the face of evolving trade policies. Engaging in strategic alliances with switch and router OEMs accelerates interoperability certification, shortening customer deployment timelines and reinforcing vendor credibility. Investing in advanced automation and AI-powered quality assurance processes enhances production yields and drives down per-unit cost, ensuring consistency across high-volume product lines. Embracing co-packaged optics and silicon photonics R&D initiatives positions organizations at the forefront of energy-efficient, low-latency transceiver innovation, aligning with sustainability mandates and next-wave data center architectures. Finally, building structured customer feedback loops through pilot programs and co-development partnerships ensures that product roadmaps remain tightly aligned with real-world network challenges, further strengthening end-user trust and loyalty.

Leveraging a Comprehensive Mixed-Methods Research Framework to Ensure Data Integrity, Cross-Verification, and Actionable Market Intelligence

This research employs a rigorous combination of primary and secondary methodologies to ensure comprehensive coverage and data integrity. Primary research involved structured interviews and surveys with network operators, cloud service providers, hyperscale data center managers, enterprise IT executives, and key optical module vendors. Secondary sources included industry publications, regulatory filings, trade association reports, vendor white papers, and customs duty notifications. Data triangulation was performed by cross-verifying company-reported shipments, customs import data, and third-party market databases. Detailed vendor profiling relied on financial disclosures, patent analyses, and product road maps, while regional market dynamics were assessed through government trade statistics and infrastructure development plans. Qualitative insights from subject matter experts complemented quantitative data, yielding a holistic perspective on market drivers, challenges, and emerging trends.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Third-Party Optical Transceivers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Third-Party Optical Transceivers Market, by Data Rate

- Third-Party Optical Transceivers Market, by Form Factor

- Third-Party Optical Transceivers Market, by Distance

- Third-Party Optical Transceivers Market, by Connector Type

- Third-Party Optical Transceivers Market, by Application

- Third-Party Optical Transceivers Market, by End User

- Third-Party Optical Transceivers Market, by Region

- Third-Party Optical Transceivers Market, by Group

- Third-Party Optical Transceivers Market, by Country

- United States Third-Party Optical Transceivers Market

- China Third-Party Optical Transceivers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Consolidating Insights on Evolving Network Architectures, Supply Chain Realignments, and the Emergence of Cost-Effective, High-Performance Optical Interconnect Solutions in a Dynamic Market

The convergence of cost pressures, evolving network architectures, and geopolitical dynamics has catalyzed the rise of third-party optical transceivers as a strategic imperative for network agility and fiscal prudence. Supply chain realignment, enabled by localized assembly and tariff mitigation strategies, complements the technological shift toward disaggregated, software-centric platforms and advanced optical innovations such as co-packaged optics and silicon photonics. Segmented market analysis underscores the diverse requirements across data rate tiers, form factors, applications, reach profiles, connector interfaces, and end-user verticals, highlighting the importance of adaptable product architectures and tailored go-to-market approaches. Regional insights reveal differentiated adoption patterns shaped by regulatory environments, infrastructure investments, and digital transformation trajectories. Ultimately, vendors that harmonize flexible manufacturing footprints with robust R&D pipelines and customer-centric innovation models will steer the market’s evolution and capture significant growth opportunities in the years ahead.

Unlock tailored insights and secure your definitive market research report on third-party optical transceivers by contacting our Associate Director today

Ready to harness deep market intelligence on third-party optical transceivers tailored to your strategic objectives? Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the definitive market research report. His expertise will guide you through our comprehensive findings and help you identify the insights and actionable strategies most relevant to your business. Don’t miss your opportunity to gain a competitive advantage-contact Ketan today to elevate your optical networking roadmap.

- How big is the Third-Party Optical Transceivers Market?

- What is the Third-Party Optical Transceivers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?