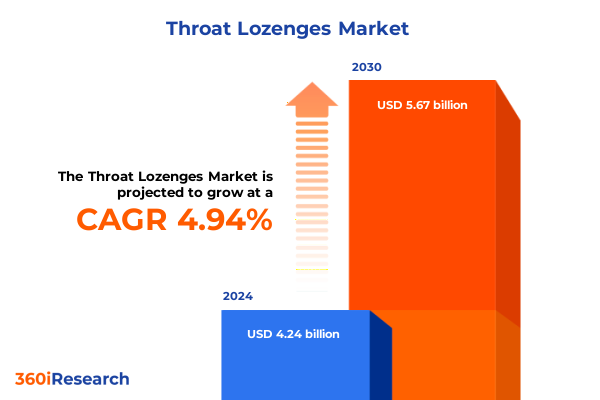

The Throat Lozenges Market size was estimated at USD 4.24 billion in 2024 and expected to reach USD 4.45 billion in 2025, at a CAGR of 4.94% to reach USD 5.67 billion by 2030.

Navigating the Evolving Dynamics of the Throat Lozenges Market in a Consumer-Driven Healthcare Landscape Amid Rising Self-Care Trends

The throat lozenges category has become an integral part of over-the-counter self-care strategies, providing accessible relief for pharyngitis and respiratory discomfort through convenient, on-demand formats. According to a 2024 global strategic review, growing cold and flu prevalence alongside environmental irritants such as pollution and seasonal allergens fueled widespread lozenge usage, reflecting their established role in consumer health routines. Concurrently, heightened consumer awareness around proactive self-care and preventive symptom management has driven demand beyond acute treatment, positioning lozenges as daily wellness aids rather than solely episodic remedies.

Throughout North America, adult and pediatric demographics turned increasingly to lozenges for throat soothing benefits, supported by pharmacy endorsements and robust retail distribution networks. At the same time, emerging markets across Asia-Pacific and Latin America recorded notable uptake, as expanding middle classes sought affordable, nonprescription solutions to support vocal professionals, students, and aging populations. The introduction of multifaceted formulations-combining analgesic, antiseptic, and demulcent properties-further broadened appeal, cementing lozenges’ significance within an evolving at-home healthcare continuum.

Uncovering the Transformative Shifts Reshaping the Throat Lozenges Sector Through Digital Innovation and Natural Ingredient Adoption

Over the past five years, digital transformation has dramatically reshaped distribution channels for throat lozenges, as brands pivoted swiftly from predominantly brick-and-mortar pharmacy outlets to omnichannel models that leverage online marketplaces. Recent industry analysis highlights that more than one-third of global lozenge sales now derive from e-commerce platforms, marking a decisive shift in consumer purchasing behavior that accelerated following the pandemic and remains resilient in 2025. This surge in digital adoption has enabled brands to deploy targeted marketing, subscription services, and data-driven personalization, deepening consumer engagement and fostering loyalty.

Simultaneously, the category has witnessed a pronounced pivot toward natural and herbal formulations, driven by health-conscious consumers seeking transparent ingredient sourcing and cleaner labels. Market research indicates that herbal and sugar-free options jointly account for over 40% of global demand, as repeat buyers gravitate toward products featuring plant-based actives like aloe vera, honey, and eucalyptus oil. Brands have seized this opportunity to highlight botanical extracts and functional add-ins such as zinc and vitamin C, positioning lozenges not only as symptomatic relief but also as immunity-support companions.

Another transformative trend involves tailored consumer experiences, with manufacturers expanding pediatric-friendly formats featuring milder flavors and adjustable dosing mechanisms alongside adult-oriented variants containing enhanced functional ingredients. This segmentation-driven innovation underscores the rising importance of catering to specific use cases-whether soothing sore throats from vocal strain, supporting respiratory wellness during allergy seasons, or delivering fast-dissolving analgesic relief.

Assessing the Far-Reaching Consequences of New US Import Tariffs on Raw Materials and Supply Chains Impacting Throat Lozenges Production

In April 2025, the U.S. administration implemented a universal 10% tariff on all imported goods under emergency economic powers, alongside elevated country-specific rates such as a 34% levy on Chinese imports. These policies, effective from April 5, have imposed direct cost pressures on raw materials integral to lozenge manufacturing, including menthol, eucalyptus oil, and specialty herbal extracts sourced from Asia and Europe. Faced with these duties, manufacturers are encountering increased input expenses that erode margin structures and prompt strategic sourcing adjustments.

The heightened tariff environment has compelled supply-chain diversification, as companies explore alternative production hubs and raw-material origins to mitigate elevated duties. Many are sourcing menthol precursors from domestic or nearby markets to circumvent Chinese tariff rates, while forging partnerships with suppliers in India, Brazil, and Southeast Asia to maintain consistent access to eucalyptus oil and honey derivatives. Despite these initiatives, the complexity of qualifying botanical ingredients and ensuring consistent potency creates operational challenges, reinforcing the need for agile procurement strategies and robust supplier networks.

In-Depth Segmentation Analysis Revealing Key Formulations, Distribution Pathways, Ingredients, Flavor Profiles, End Users, and Pricing Dynamics

The throat lozenges landscape is intricately dissected by a spectrum of formulation and distribution axes, each revealing nuanced subsegments that guide strategic positioning and product development. Hard and soft formats anchor the category, with hard lozenges produced through compressed and extruded methodologies delivering durable, slow-dissolving profiles, while soft variants-ranging from chewable tablets to jelly lozenges-offer rapid dissolution and enhanced flavor release. Meanwhile, distribution channels span convenience retail, traditional grocery, online marketplaces, and pharmacy outlets, each presenting unique margin structures, promotional dynamics, and consumer research touchpoints.

Within the active ingredient domain, products capitalize on the soothing properties of eucalyptus and menthol, the latter subdivided into natural and synthetic sources, alongside herbal blends featuring aloe vera and honey as primary actives. Flavor innovation navigates fruit extracts like berry and citrus, mellifluous honey variants, and cooling mint profiles articulated through peppermint and spearmint essences. The end-user orientation bifurcates into adult and pediatric offerings, the latter designed with gentler taste matrices and reduced ingredient concentrations. Concurrently, a tiered pricing framework classifies lozenges into economy, standard, and premium ranges, reflecting shifts in ingredient quality, formulation complexity, and brand positioning within value, mainstream, and high-end segments.

This comprehensive research report categorizes the Throat Lozenges market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Flavor

- Ingredient

- End User

- Application

- Distribution Channel

Regional Market Variations Highlight Diverse Growth Drivers for Throat Lozenges Across Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics underscore the global heterogeneity of throat lozenge consumption, with the Americas anchoring substantial value contributions due to mature healthcare infrastructures, strong pharmacy distributions, and consumer familiarity with over-the-counter remedies. The U.S. market alone was estimated at $1.4 billion in 2023, ranking it among the largest national markets worldwide. In contrast, Europe, the Middle East, and Africa reflect a mosaic of demand drivers: Western European markets prioritize sugar-free and herbal compositions aligned with wellness trends, while Eastern European and Middle Eastern markets embrace traditional formulations infused with regional botanical extracts.

Asia-Pacific emerges as the fastest growing geography, propelled by rapid urbanization, heightened public health initiatives, and environmental factors such as air pollution that exacerbate respiratory ailments. China’s throat lozenge consumption is projected to expand at a 5.6% CAGR, fueled by rising disposable incomes and evolving consumer preferences for functional health products. Across Southeast Asia and India, burgeoning e-commerce ecosystems catalyze online purchasing, complemented by local manufacturers capturing market share through culturally tailored ingredients and flavors.

This comprehensive research report examines key regions that drive the evolution of the Throat Lozenges market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovative Entrants Driving Competitive Dynamics in the Global Throat Lozenges Marketplace

Leading global players drive the competitive intensity of the throat lozenges market through established brand equity, expansive distribution reach, and continuous product innovation. Reckitt Benckiser’s Strepsils brand remains a cornerstone, leveraging dual-action formulations and strategic promotional initiatives, although its health division recorded a modest 2.4% sales growth in late 2024 amid seasonal fluctuations. Kraft Heinz’s Halls brand sustained its prominence by launching an extra-menthol variant incorporating decongestant benefits, which yielded a 19% sales uptick in its initial quarter post-launch.

Swiss herbal specialist Ricola AG has broadened its sugar-free lozenge portfolio with new diabetic-friendly herbal flavors, capturing roughly 22% of its European sales and reflecting consumer demand for low-calorie options. Procter & Gamble entered the immunity segment with its Zinc+ lozenge line enhanced with vitamin C, securing 16% pharmacy shelf space in North America within six months of launch. Meanwhile, niche brands such as Fisherman’s Friend capitalized on sustainable packaging innovations, driving a 34% improvement in approval ratings among eco-conscious consumers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Throat Lozenges market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bliss GVS Pharma Ltd

- Catalent, Inc. by Novo Holdings A/S

- Church & Dwight Co., Inc.

- Cipla Limited

- Cloetta AB

- Dabur Ltd.

- Doetsch Grether AG

- Dr. August Wolff GmbH & Co. KG Arzneimittel

- Ernest Jackson Ltd.

- Fisherman's Friend

- G. R. Lane Health Products Ltd.

- Gepach International

- Haleon plc

- Himalaya Wellness Company

- Island Abbey Foods Ltd. by TopGum Industries, Ltd.

- J. B. Chemicals & Pharmaceuticals Limited

- Johnson & Johnson Services, Inc.

- Lozen Pharma Pvt. Ltd

- Mondelēz International, Inc.

- Opella Healthcare Group SAS

- Perrigo Company plc

- Pfizer Inc.

- Piramal Group

- Prestige Consumer Healthcare Inc.

- Procter & Gamble Company

- Reckitt Benckiser Group plc

- Ricola AG

- Traditional Medicinals, Inc.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Market Challenges Effectively

Industry leaders should prioritize strategic sourcing diversification to insulate operations from tariff-induced cost fluctuations by expanding partnerships with suppliers in tariff-exempt regions and exploring regional manufacturing hubs under preferential trade agreements. Concurrently, accelerating direct-to-consumer digital initiatives-leveraging subscription models and personalized marketing-can deepen customer relationships and capture real-time data to inform iterative product enhancements, capitalizing on demonstrated e-commerce growth exceeding one-third of global sales.

Innovation pipelines must pivot toward clean-label and functional formulations that resonate with health-focused consumers, integrating botanicals and micronutrient boosters while maintaining transparent certification. Collaborations with biotech firms for sustainable ingredient alternatives will mitigate external price volatility and align with evolving consumer expectations. Brands can further differentiate by co-branding with healthcare professionals and leveraging telehealth partnerships to validate efficacy and expand reach into new demographic segments, especially among pediatric and voice-intensive end users.

Comprehensive Research Methodology Detailing Rigorous Data Collection, Analysis Frameworks, and Validation Processes Ensuring Report Reliability

This report synthesizes insights through a multistage research methodology encompassing both secondary and primary data collection. Initially, extensive secondary research was conducted, reviewing credible industry publications, regulatory filings, trade journals, and financial disclosures to establish baseline market intelligence. Key sources included publicly available company reports, government tariff schedules, and leading business news outlets.

Primary research involved structured interviews with industry stakeholders-manufacturers, distributors, raw-material suppliers, and subject-matter experts-to validate secondary findings and gather qualitative perspectives on market trends, regulatory impacts, and competitive strategies. Data triangulation ensured consistency and accuracy by cross-referencing quantitative data points across multiple sources.

Finally, rigorous data analysis employed statistical techniques to identify patterns and correlations, while internal quality checks and peer reviews were conducted to uphold the report’s integrity. All findings were synthesized into thematic insights, ensuring that conclusions reflect both macro-level trends and granular market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Throat Lozenges market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Throat Lozenges Market, by Product Type

- Throat Lozenges Market, by Flavor

- Throat Lozenges Market, by Ingredient

- Throat Lozenges Market, by End User

- Throat Lozenges Market, by Application

- Throat Lozenges Market, by Distribution Channel

- Throat Lozenges Market, by Region

- Throat Lozenges Market, by Group

- Throat Lozenges Market, by Country

- United States Throat Lozenges Market

- China Throat Lozenges Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Insights Summarizing Key Findings and Strategic Implications for Stakeholders in the Throat Lozenges Industry

The throat lozenges market stands at an inflection point, shaped by evolving consumer wellness preferences, digital commerce expansion, and geopolitical trade influences. Natural and functional formulations have redefined product portfolios, while omnichannel distribution strategies have extended consumer touchpoints beyond traditional retail. Emerging tariffs introduced in 2025 have underscored the critical need for agile procurement and supply chain resilience, prompting manufacturers to reengineer sourcing strategies and explore alternative regional partnerships.

Competitive intensity remains high, driven by established brands leveraging innovation in flavor, functionality, and sustainability, alongside nimble niche players catering to specific end-use segments. Regional disparities offer strategic opportunities, with Asia-Pacific presenting rapid growth potential and EMEA markets emphasizing herbal and sugar-free variants. By integrating actionable recommendations-such as digital channel acceleration, clean-label innovation, and tariff mitigation strategies-industry stakeholders can position themselves for sustainable growth and heightened consumer engagement in an increasingly complex global landscape.

Connect with Our Associate Director to Secure Your In-Depth Throat Lozenges Market Report Today

To explore this detailed analysis and gain access to comprehensive data on form and ingredient preferences, distribution channels, pricing dynamics, and the full breadth of regional and competitive insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the report’s scope, customization options, and how this intelligence can fuel strategic growth and innovation in your organization. Don’t miss the opportunity to equip your team with the actionable guidance needed to navigate evolving market forces and secure a competitive advantage-connect with Ketan Rohom today to purchase the complete market research report.

- How big is the Throat Lozenges Market?

- What is the Throat Lozenges Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?