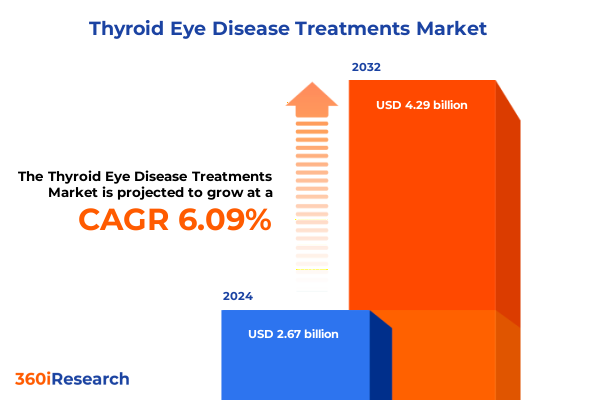

The Thyroid Eye Disease Treatments Market size was estimated at USD 2.83 billion in 2025 and expected to reach USD 2.99 billion in 2026, at a CAGR of 6.14% to reach USD 4.29 billion by 2032.

Unveiling the Evolving Landscape of Thyroid Eye Disease Management Through Innovative Therapeutics and Patient-Centric Strategies in Today’s Healthcare Environment

Thyroid Eye Disease (TED) represents one of the most intricate intersections between endocrinology and ophthalmology, manifesting through an autoimmune attack on orbital tissues that leads to pain, disfigurement, and vision-threatening complications. As an orphan condition with significant patient burden, TED demands a multifaceted therapeutic approach that addresses both the systemic thyroid dysfunction and the localized orbital inflammation and tissue remodeling. Over the past decade, advancements in our understanding of the insulin-like growth factor-1 receptor (IGF-1R) axis and related immunomodulatory pathways have given rise to targeted biologics, while refinements in surgical techniques have provided new avenues for functional and aesthetic rehabilitation. Despite the burden of disease-estimated between 90 and 300 cases per 100,000 people in the United States-the market has historically been underserved, resulting in high unmet needs and an elevated reliance on off-label therapies.

In recent years, the approval of teprotumumab as the first FDA-endorsed IGF-1R monoclonal antibody has catalyzed renewed investment and innovation in the TED space. This landmark development validated molecular targeting as an effective disease-modifying strategy and paved the way for a robust pipeline of novel biologics, small molecules, and even gene therapy candidates. Moreover, the heterogeneity of clinical presentations-from mild ocular discomfort to sight-threatening optic neuropathy-has underscored the importance of precision medicine and adaptive treatment paradigms. In parallel, evolving regulatory frameworks have begun to accommodate accelerated pathways for rare disease therapies, offering sponsors opportunities for expedited development and market entry.

As stakeholder expectations evolve, the imperative for comprehensive, evidence-based insights into treatment modalities, patient segmentation, and supply chain considerations has never been greater. This executive summary distills the critical trends shaping TED therapy development and adoption, equipping decision-makers with the strategic knowledge required to navigate a rapidly transforming landscape.

Identifying Breakthrough Shifts in Molecular and Gene Therapies Redefining Treatment Paradigms and Patient Outcomes in Thyroid Eye Disease

The therapeutic landscape for Thyroid Eye Disease is undergoing a profound transformation fueled by breakthroughs in immunology, molecular biology, and gene therapy technologies. Early successes with teprotumumab not only validated IGF-1R blockade but also galvanized interest in alternative mechanisms of action, including FcRn inhibition and cytokine modulation. Viridian Therapeutics’ veligrotug, a next-generation IGF-1R antagonist, demonstrated significant reduction in proptosis in its Phase III trial, positioning itself as a potential rival with its more convenient dosing regimen. Concurrently, IL-6 inhibition has emerged as a promising frontier, with Tourmaline Bio’s pacibekitug targeting the pro-inflammatory cytokine pathway to address the upstream drivers of orbital tissue remodeling. Preliminary data from the SpiriTED Phase 2b study suggest durable symptom relief and a favorable safety profile, highlighting the potential for a new class of biologics to complement or even supplant existing therapies.

Beyond biologics, the promise of gene therapy is materializing through Kriya Therapeutics’ KRIYA-586 program, an AAV-based peribulbar injection designed to deliver sustained local expression of an anti-IGF-1R antibody. By engineering orbital adipocytes and fibroblasts to produce therapeutic antibodies in situ, this one-time treatment approach seeks to overcome the limitations of chronic systemic administration and enhance patient adherence. In parallel, the FcRn pathway has garnered attention for its role in autoantibody recycling, with batoclimab and efgartigimod advancing through late-stage trials to reduce pathogenic IgG levels and ameliorate disease activity. These converging modalities exemplify a shift toward precision immunomodulation and personalized regimens informed by patient-specific disease markers.

As these groundbreaking therapies progress toward regulatory filings in late 2025 and beyond, the competitive dynamics within the TED ecosystem will intensify, prompting strategic alliances, licensing deals, and potential M&A activity. Stakeholders must therefore align clinical development strategies with emerging scientific insights and evolving payer expectations, ensuring that differentiation is underscored by demonstrable patient benefit and long-term value.

Assessing the Comprehensive Impact of New United States Tariff Policies on Supply Chain Costs, Access, and Innovation in Thyroid Eye Disease Treatments in 2025

The introduction of new tariffs on pharmaceutical imports in 2025 has prompted industry-wide reassessment of supply chain resilience and cost management for Thyroid Eye Disease treatments. In early April, the administration initiated Section 232 investigations with the aim of imposing 10–25% duties on pharmaceutical and semiconductor imports under national security prerogatives, potentially extending to over-the-counter ingredients and active pharmaceutical components. Shortly thereafter, a 25% tariff on Chinese APIs and a 20% levy on Indian intermediates were enacted, directly impacting the production costs for monoclonal antibodies, small molecules, and critical excipients integral to TED therapies.

These levies have cascading effects throughout the value chain, increasing raw material costs, straining thin-margin generic subcontractors, and heightening the risk of localized drug shortages in ophthalmology. Industry associations have warned of potential disruptions, noting that nearly 80% of biologic APIs and over 50% of specialized surgical consumables are sourced from tariffed countries. To mitigate these pressures, manufacturers are rapidly diversifying their supplier base, expanding “local-for-local” sourcing initiatives, and in some cases accelerating onshore API production investments-a process that can require five to ten years to fully materialize and stabilize production capacities.

While these strategic pivots aim to safeguard downstream manufacturing and maintain access for patients, they also introduce transitional challenges, including qualification of new suppliers, regulatory revalidation for drugs and devices, and potential delays in product launches and trial timelines. Moving forward, stakeholders must engage proactively with policymakers to secure targeted exemptions for orphan and critical ophthalmic therapies, while simultaneously pursuing innovative supply chain financing and public-private partnerships to support domestic API capabilities and ensure continuity of care.

Uncovering Strategic Insights from Treatment Modalities to Administration Routes and Care Settings Shaping Market Dynamics in Thyroid Eye Disease

The landscape of Thyroid Eye Disease therapies is shaped by distinct segmentation criteria that inform clinical, commercial, and strategic decision-making. Treatment modalities bifurcate into medical and surgical interventions, each encompassing specialized subcategories. Within medical treatments, corticosteroids remain frontline agents for acute inflammation control, while immunosuppressants provide adjunctive immunomodulation. Monoclonal antibodies represent a rapidly growing class, exemplified by IGF-1R and IL-6 inhibitors, and emerging tyrosine kinase inhibitors aim to target intracellular signaling cascades. Thyroid hormone control completes the medical armamentarium, stabilizing systemic endocrinopathy to complement localized treatment efficacy. On the surgical side, eyelid procedures, orbital decompression, and strabismus correction address functional and cosmetic sequelae, with each discipline requiring unique instrumentation and perioperative protocols.

Route of administration segmentation further refines product development and patient adherence strategies. Intravenous infusions, often administered in hospital or infusion center settings, offer rapid bioavailability for severe presentations, whereas subcutaneous and intramuscular injections provide enhanced convenience and potential for self-administration. Oral therapies promise the greatest patient autonomy but must overcome bioavailability and off-target safety hurdles. Topical formulations, though less common in TED, continue to be explored for localized management of mild symptoms.

Classification by disease phenotype into Type I (primarily inflammatory) and Type II (fibrotic, with significant tissue remodeling) drives differentiated clinical trial design and post-market positioning. Diagnostic segmentation-including blood assays, imaging modalities, orbital ultrasound, and radioactive iodine uptake tests-enables early detection and patient stratification, ensuring appropriate therapy selection. Finally, end-user segmentation across hospitals, outpatient centers, and specialty clinics affects distribution channels, reimbursement negotiations, and service delivery models, underscoring the importance of tailored commercialization plans for each care setting.

This comprehensive research report categorizes the Thyroid Eye Disease Treatments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Route of Administration

- Type

- Diagnosis

- End-User

- Distribution Channel

Decoding Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific That Influence Adoption and Access to Thyroid Eye Disease Therapies

Geographic dynamics play a crucial role in shaping the adoption and penetration of Thyroid Eye Disease therapies across major regions. In the Americas, the United States remains the epicenter of innovation, boasting rapid regulatory approvals, substantial reimbursement frameworks, and a well-established network of specialized orbital centers. Canadian and Latin American markets, while smaller in scale, benefit from spillover effects in clinical expertise and cross-border access programs, though pricing negotiations and public payer policies vary significantly.

Europe, the Middle East, and Africa (EMEA) present a heterogeneous regulatory environment, with the European Medicines Agency setting centralized standards for biologics licensing while individual countries navigate divergent health technology assessment and reimbursement pathways. High-income markets in Western Europe often achieve relatively swift market uptake for novel therapies, whereas access in Eastern Europe and parts of the Middle East and Africa hinges on tiered pricing, managed entry agreements, and local manufacturing partnerships to meet budgetary constraints.

In the Asia-Pacific region, growth is being driven by expanding healthcare infrastructure, rising incidence of autoimmune thyroid disorders, and increasing physician awareness. Japan and South Korea are at the forefront of biologic adoption, supported by accelerated approval mechanisms and robust patient advocacy. China’s recent approval of therapeutics like teprotumumab N01 underscores the market’s potential, with local licensing pathways enabling faster entry for domestically developed analogs. India, Australia, and Southeast Asian nations are poised for rapid growth, contingent upon the expansion of specialty ophthalmology networks and evolving reimbursement schemes that accommodate high-cost biologics.

This comprehensive research report examines key regions that drive the evolution of the Thyroid Eye Disease Treatments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Movements, Collaborations, and Pipeline Innovations Driving Growth and Disruption Among Key Players in Thyroid Eye Disease Therapeutics

The competitive landscape in Thyroid Eye Disease is defined by a blend of established pharmaceutical leaders and nimble biotechnology innovators. Amgen’s acquisition of Horizon Therapeutics in late 2023 consolidated its position as the market incumbent, leveraging teprotumumab’s proven efficacy and its recent submission of a Marketing Authorization Application to the EMA for EU approval. At the same time, Viridian Therapeutics has emerged as a formidable challenger with its veligrotug program, distinguished by less frequent dosing and favorable tolerability in late-stage trials.

Tourmaline Bio is advancing the IL-6 inhibitor pacibekitug into pivotal studies, positioning it as a potential first-line or combination therapy that addresses upstream inflammatory drivers beyond the IGF-1R axis. Concurrently, Kriya Therapeutics has taken a bold gene therapy approach with KRIYA-586, targeting durable local production of an anti-IGF-1R antibody via adeno-associated virus delivery, expected to enter clinical trials in late 2025. Roche’s development of satralizumab for IL-6R blockade and argenx’s efgartigimod for FcRn antagonism further diversify the near-term pipeline, each leveraging established safety data from other autoimmune indications.

Additionally, emerging small molecule programs such as Sling Therapeutics’ linsitinib aim to deliver oral IGF-1R inhibition, while batoclimab’s FcRn-targeted mAb is positioned for disease-modifying potential in advanced clinical stages. These dynamics underscore a trend toward multi-mechanistic strategies and combination regimens, compelling industry stakeholders to differentiate through innovative trial designs, real-world evidence generation, and strategic collaborations across the diagnostic and therapeutic continuum.

This comprehensive research report delivers an in-depth overview of the principal market players in the Thyroid Eye Disease Treatments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- ACELYRIN, INC.

- Amgen Inc.

- argenx SE

- Bausch & Lomb Incorporated

- Biocon Limited

- BioXpress Therapeutics SA

- Cipla Limited

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- Genmab A/S

- GlaxoSmithKline PLC

- H. Lundbeck A/S

- Hetero Drugs Limited

- Immunovant, Inc.

- Intas Pharmaceuticals Ltd.

- Johnson & Johnson Services Inc.

- Lupin Limited

- Merck KGaA

- Novartis AG

- Pfizer, Inc.

- Regeneron Pharmaceuticals, Inc.

- Sling Therapeutics, Inc.

- Teva Pharmaceutical Industries Ltd.

- Viridian Therapeutics, Inc.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities, Mitigate Supply Chain Risks, and Enhance Patient Outcomes in Thyroid Eye Disease

Industry leaders must adopt a multifaceted approach to thrive in the evolving Thyroid Eye Disease ecosystem. First, diversifying supply chains by establishing multi-regional API partnerships and investing in domestic manufacturing will mitigate the disruptive effects of tariff-induced cost pressures and minimize the risk of shortages. Collaborative frameworks with chemical distributors and specialty suppliers can expedite supplier qualification and ensure continuity of critical raw material flow.

Second, accelerating translational research into novel mechanisms-such as FcRn inhibition, IL-6 ligand blockade, and gene therapy platforms-will expand the therapeutic arsenal beyond IGF-1R, fostering personalized treatment algorithms informed by biomarker stratification. Strategic alliances between biotechs and large pharma can facilitate resource sharing, reduce time to market, and leverage complementary expertise in regulatory and commercialization pathways.

Third, proactive engagement with payers and regulatory bodies is essential to secure tailored reimbursement models, managed entry agreements, and accelerated approval designations for orphan and first-in-class therapies. Demonstrating real-world value through patient-reported outcome data, long-term safety profiles, and economic modeling will strengthen formulary positioning and market access.

Finally, integrating digital health solutions-ranging from tele-ophthalmology for early diagnosis to adherence-monitoring platforms-can enhance patient engagement and support decentralized clinical trial designs. By leveraging data analytics and AI-driven insights, companies can optimize trial recruitment, monitor outcomes in real time, and refine post-marketing surveillance, thereby sustaining competitive advantage in a data-driven era.

Detailing a Comprehensive Research Framework Integrating Primary Stakeholder Interviews, Secondary Data Analysis, and Advanced Analytical Models to Uncover Actionable Insights

This market research report is underpinned by a rigorous methodology that combines both qualitative and quantitative analyses to ensure comprehensive and reliable insights. Primary research included in-depth interviews with leading endocrinologists, ophthalmologists, health economists, and patient advocacy representatives across key geographies to capture expert perspectives on clinical trends, unmet needs, and adoption barriers. These conversations were supplemented by surveys and roundtable discussions to validate emerging hypotheses and refine segmentation models.

Secondary research encompassed the review of peer-reviewed journals, clinical trial registries, regulatory filings, press releases, and financial reports to map the evolving pipeline of therapeutic candidates and assess competitive positioning. Data triangulation techniques were employed to cross-verify critical metrics and reconcile discrepancies across multiple sources, ensuring robustness in thematic conclusions.

Analytical frameworks, including SWOT and Porter’s Five Forces, were applied to evaluate market dynamics, entry barriers, and long-term strategic opportunities. Regional assessments incorporated healthcare expenditure data, demographic projections, and policy landscapes to contextualize growth drivers and access challenges. Furthermore, scenario modeling was conducted to explore the potential impacts of tariff changes, reimbursement shifts, and emerging technologies on market trajectories.

By integrating these research pillars, the report delivers an authoritative perspective on Thyroid Eye Disease treatment evolution, enabling stakeholders to make informed decisions grounded in empirical evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Thyroid Eye Disease Treatments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Thyroid Eye Disease Treatments Market, by Treatment Type

- Thyroid Eye Disease Treatments Market, by Route of Administration

- Thyroid Eye Disease Treatments Market, by Type

- Thyroid Eye Disease Treatments Market, by Diagnosis

- Thyroid Eye Disease Treatments Market, by End-User

- Thyroid Eye Disease Treatments Market, by Distribution Channel

- Thyroid Eye Disease Treatments Market, by Region

- Thyroid Eye Disease Treatments Market, by Group

- Thyroid Eye Disease Treatments Market, by Country

- United States Thyroid Eye Disease Treatments Market

- China Thyroid Eye Disease Treatments Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing Critical Insights into Emerging Therapies, Market Drivers, and Strategic Considerations Guiding the Future of Thyroid Eye Disease Management

As the Thyroid Eye Disease arena transitions from generalized off-label therapies to targeted, mechanism-driven interventions, the confluence of scientific innovation, regulatory evolution, and market dynamics offers unprecedented opportunities and challenges. The emergence of monoclonal antibodies targeting IGF-1R and IL-6 pathways, the advent of gene therapy candidates, and the progression of FcRn inhibitors underscore a paradigm shift toward personalized immunomodulation. Each of these modalities carries unique development considerations, from supply chain resilience in the face of tariff fluctuations to strategic payer engagement for high-value, orphan-designated treatments.

Segmentation insights reveal that patient subpopulations defined by disease phenotype, diagnostic modality, and care setting require tailored clinical and commercial strategies. Regional variations-from the innovation-driven US market to the cost-sensitive environments of EMEA and the rapidly expanding Asia-Pacific-demand nuanced market access tactics and partnership models. Competitive intelligence highlights a landscape in flux, with incumbents like Amgen and nimble biotechs such as Viridian, Tourmaline, and Kriya vying for differentiation through novel mechanisms and delivery platforms.

Looking ahead, the sustained integration of digital health solutions, real-world evidence generation, and adaptive trial designs will be critical to optimize patient outcomes and demonstrate value. By embracing these structural shifts and operational imperatives, stakeholders can navigate the complexities of the TED treatment landscape and contribute meaningfully to improving patient quality of life.

Contact Our Associate Director of Sales & Marketing for Exclusive Access to a Comprehensive Thyroid Eye Disease Treatment Market Research Report

To secure your organization’s advantage in this rapidly evolving Thyroid Eye Disease landscape and gain access to the in-depth analyses, forward-looking insights, and strategic guidance presented in this comprehensive report, we invite you to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan is available to discuss how the report’s detailed findings align with your specific objectives, address your unique market challenges, and support your decision-making processes with tailored recommendations. By connecting with Ketan, you can explore exclusive subscription options, custom data packages, and collaborative research services that will empower your team with actionable intelligence. Don’t miss the opportunity to leverage this authoritative market research to inform your strategic planning, optimize your product portfolios, and drive sustainable growth in the Thyroid Eye Disease treatment space. Contact Ketan Rohom today to secure your copy and transform insights into impact.

- How big is the Thyroid Eye Disease Treatments Market?

- What is the Thyroid Eye Disease Treatments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?