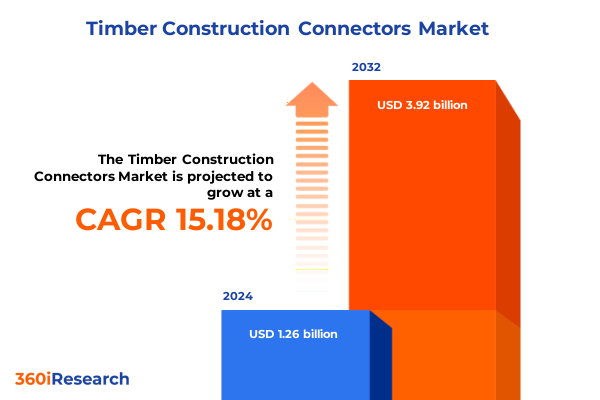

The Timber Construction Connectors Market size was estimated at USD 1.45 billion in 2025 and expected to reach USD 1.67 billion in 2026, at a CAGR of 15.22% to reach USD 3.92 billion by 2032.

Embracing a New Era of Timber Connection Excellence That Reinforces Structural Integrity While Driving Eco-Friendly Practices Across Construction Projects

Timber construction connectors have long served as the unsung heroes of structural wood assembly, providing the critical link between raw lumber and engineered resilience. As a new era unfolds, these metal interfaces are evolving from basic fasteners to sophisticated components that ensure structural safety, environmental sustainability, and design flexibility. What was once a niche category of construction hardware has become central to modern building practices, driving innovation in residential, commercial, and industrial applications alike.

Moreover, timber connectors are increasingly recognized not only for their load-bearing capacities but also for their role in promoting sustainable forestry management. By enabling the use of engineered wood products in high-rise and modular structures, these connectors facilitate the displacement of carbon-intensive materials such as steel and concrete. Simultaneously, architects and engineers are experimenting with novel geometries and surface treatments to enhance corrosion resistance and reduce material waste.

Consequently, industry stakeholders are investing heavily in research and development to optimize connector geometries, improve installation efficiencies, and integrate smart monitoring technologies. As building codes adapt to reflect these advancements, manufacturers face both opportunities and challenges in aligning production capabilities with the stringent demands of green certification standards. Ultimately, the trajectory of timber connector innovation will be shaped by a balanced pursuit of safety, sustainability, and cost effectiveness.

Unearthing Fundamental Shifts in Timber Connector Dynamics That Propel Technological Evolution and Reshape Industry Standards for Future Construction Demands

In recent years, fundamental shifts have emerged in the timber connector landscape, driven by digital transformation, prefabrication trends, and ever-stricter sustainability mandates. Building information modeling and robotic assembly techniques are streamlining installation, reducing human error, and optimizing material utilization. As practitioners integrate these technologies, connectors are being redesigned to accommodate automated setting tools and rapid on-site adjustments.

Furthermore, the surge in modular construction has placed a premium on standardized connector dimensions and mechanical performance. Manufacturers are collaborating with prefab suppliers and off-site construction firms to develop plug-and-play connector systems that arrive factory-calibrated and require minimal on-site modification. This not only accelerates project timelines but also enhances predictability in supply chain logistics.

Meanwhile, regulatory bodies across major markets are tightening requirements around fire performance and seismic resilience, compelling connector makers to innovate new alloys and galvanization techniques. The push for circularity in building materials has led to the exploration of detachable connectors that enable component reuse and end-of-life recycling. These transformative trends collectively signal a departure from legacy fastening solutions toward integrated systems that elevate the entire timber construction process.

Analyzing the FarReaching Consequences of 2025 United States Tariff Policies on Timber Connector Supply Chains Manufacturing Costs and Competitive Dynamics

The imposition of new United States tariffs on key raw materials and imported connector components throughout 2025 has yielded a complex array of effects across the timber connector supply chain. Initially, alternate sourcing strategies emerged as manufacturers sought to mitigate cost inflation by diversifying supplier networks and nearshoring critical metal fabrication processes. Domestic steel and aluminum producers experienced heightened demand, prompting capacity expansions and further investments in precision stamping equipment.

In addition, smaller connector producers were compelled to absorb a greater share of the incremental tariff burden, eroding margins and catalyzing consolidation activity within the sector. As a result, joint ventures between established brands and regional fabricators have become more common, enabling companies to leverage local tariff exemptions or benefit from preferential trade agreements under renegotiated bilateral frameworks.

Moreover, end-users in the residential and light commercial segments adjusted procurement strategies by ordering larger volumes ahead of anticipated tariff escalations. This front-loaded purchasing compressed lead times and strained distributor inventories, accelerating the development of vendor-managed inventory programs and just-in-time delivery models. In retrospect, the cumulative tariff impact has not only redrawn cost structures but also redefined competitive dynamics and strategic partnerships spanning North America’s timber construction ecosystem.

Unraveling Critical Segmentation Perspectives That Illuminate Product Design Applications Materials Distribution Pathways and EndUser Preferences Informing Strategy

A granular examination of product type reveals divergent growth patterns among angle brackets, joist hangers, nailing plates, post bases, straps & ties, and timber bolts. Adjustable angle brackets are capturing interest among modular home builders seeking on-site alignment flexibility, while fixed angle brackets remain the backbone of traditional framing operations. Within the joist hanger category, face mount variants dominate retrofit applications, whereas flush mount and top flange hangers are favored in new construction for their clean aesthetic and load distribution benefits. In parallel, nailing plates bifurcate into double and single-wing designs, with double-wing configurations preferred in high-load industrial settings and single-wing plates adopted by residential renovators.

Transitioning from product distinctions to market context, commercial projects leverage heavy-duty connectors to meet stringent safety codes, industrial facilities demand high-strength assemblies for large-span structures, and residential developments prioritize cost-effective, easy-install connectors. Material choices further diversify the landscape, with aluminum connectors prized for their lightweight corrosion resistance, stainless steel variants used in coastal applications, and carbon steel retaining its cost advantage for general framing work. Distribution channels are equally varied: traditional distributors serve established construction firms, e-commerce platforms cater to do-it-yourself homeowners and small contractors, and manufacturer direct models support large-scale prefab integrators. Meanwhile, new construction drives core volume, while repair & renovation activities-spanning both maintenance tasks and retrofit upgrades-inject a steady flow of replacement and specialty connector demand.

This comprehensive research report categorizes the Timber Construction Connectors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- End Use

- Distribution Channel

Examining Regional Dynamics Across Americas Europe Middle East Africa and AsiaPacific That Drive Demand Variations Supply Logistics

North American demand remains buoyed by residential housing starts and commercial retrofits, with regional sustainability incentives further elevating connector adoption in energy-efficient building programs. As a result, manufacturers in the Americas have accelerated investments in local production capabilities to bypass cross-border tariff hurdles and ensure timely responsiveness to sudden project schedule shifts.

In contrast, Europe, the Middle East, and Africa present a mosaic of regulatory environments and infrastructure needs. European markets are characterized by rigorous performance standards and green building certifications, compelling suppliers to emphasize product traceability and recycled metal content. Simultaneously, Middle Eastern megaprojects and African industrial expansions are driving bespoke connector designs tailored to extreme climate conditions and larger structural footprints.

Asia-Pacific continues to register the fastest growth trajectory, fueled by urbanization in emerging economies and a renaissance of timber architecture in developed nations. Manufacturers serving this region have established regional hubs in Southeast Asia and Australia to reduce lead times and capitalize on free-trade agreements. Collectively, these regional dynamics underscore the necessity of adaptive strategies that align manufacturing footprints, compliance frameworks, and logistical networks with local market imperatives.

This comprehensive research report examines key regions that drive the evolution of the Timber Construction Connectors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Timber Connector Manufacturers Their Strategic Priorities R D Collaborations and Competitive Positioning in a Rapidly Evolving Industry

Leading connector manufacturers are charting distinct paths to consolidate their competitive advantages. One prominent provider has prioritized extensive R D investment to pioneer lightweight, high-strength alloys and digitally integrated alignment jigs. Another global leader has forged strategic partnerships with construction software vendors to embed connector specifications directly into digital procurement platforms, fostering seamless design-to-ordering workflows.

Meanwhile, innovators specializing in high-precision metal injection molding are expanding capacity through joint ventures, enabling both scale and geographic diversification. A family-owned enterprise renowned for its custom fabrication prowess is leveraging that reputation to capture niche retrofit projects in historic preservation, where tailored connector geometries are paramount. Additionally, several manufacturers are piloting circularity programs that collect end-of-life connectors for metal reclamation, reinforcing their sustainability credentials.

Across these varied approaches, common threads emerge: a focus on material innovation, an embrace of digital integration, and a commitment to customer-centric value creation. Companies that effectively align these strategic pillars stand to differentiate their offerings and solidify long-term customer loyalty in a marketplace marked by dynamic regulatory shifts and evolving design paradigms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Timber Construction Connectors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adolf Würth GmbH & Co. KG

- BPC Building Products Ltd.

- CQFD SAS

- Eurotec GmbH

- Fischerwerke GmbH & Co. KG

- Globus Industries GmbH

- GRK Fasteners, LLC

- Hilti AG

- Illinois Tool Works Inc.

- Knapp GmbH

- MiTek Industries, Inc.

- MTC Solutions

- PennEngineering Company

- Rothoblaas S.p.A.

- SFS Group AG

- Simpson Strong‑Tie Company, Inc.

Empowering Industry Leaders with Tactical Guidance to Optimize Connector Selection Streamline Supply Chains and Enhance Collaboration

Companies that seek to maintain or expand their foothold should intensify research efforts into novel coating processes and smart sensor integrations, enabling real-time load monitoring and predictive maintenance capabilities. In parallel, supply chain resilience demands diversification of metal suppliers and the establishment of regional fabrication cells to mitigate tariff and logistics disruptions. Strategic alliances with prefabrication specialists and design software providers can unlock co-innovation opportunities and streamline customer workflows, thereby reducing project cycle times.

Moreover, embracing digital sales channels and customized e-commerce experiences can extend market reach to the growing do-it-yourself and light commercial segments. Concurrently, manufacturers would benefit from developing targeted training and certification programs that equip contractors with installation best practices, driving both brand trust and connector performance consistency. Finally, integrating circular economy principles-such as detachable connector systems and take-back initiatives-can enhance sustainability credentials and anticipate future regulatory requirements.

Detailing Rigorous Research Methodologies Encompassing Primary Interviews Secondary Data Analysis and Statistical Techniques That Ensure Robust Findings

The research framework commenced with a series of in-depth interviews involving connector designers, structural engineers, distribution executives, and key end users. These primary discussions provided qualitative insights into emerging use cases, product performance requirements, and evolving procurement behaviors. Concurrently, secondary data sources including industry publications, technical standards documents, and trade association reports were systematically reviewed to corroborate market narratives and historical trends.

Subsequently, a robust dataset of product introduction timelines, material specifications, and regulatory filings was synthesized to identify innovation hotspots and compliance thresholds. Statistical analysis techniques, including cross-segmentation correlation and scenario modeling, were deployed to validate thematic observations and assess the relative impact of tariff policies on cost structures. Throughout this process, iterative workshops with a panel of industry experts ensured that findings remained grounded in operational realities and strategic imperatives. This multilayered methodology underpins the rigorous quality and credibility of the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Timber Construction Connectors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Timber Construction Connectors Market, by Product Type

- Timber Construction Connectors Market, by Material

- Timber Construction Connectors Market, by Application

- Timber Construction Connectors Market, by End Use

- Timber Construction Connectors Market, by Distribution Channel

- Timber Construction Connectors Market, by Region

- Timber Construction Connectors Market, by Group

- Timber Construction Connectors Market, by Country

- United States Timber Construction Connectors Market

- China Timber Construction Connectors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Discoveries and Insights to Illuminate Strategic Pathways and Reinforce the Imperative Role of Timber Connectors in Contemporary Construction

This comprehensive review underscores the pivotal role that timber connectors play in bridging traditional carpentry and cutting-edge construction science. By embracing advanced fastening solutions, stakeholders can augment structural resilience, expedite build cycles, and align with global sustainability goals. The convergence of digital tools, material advancements, and circular economy principles is redefining what connectors can achieve within complex building systems.

Recognizing the differentiated demands across product types, end-uses, materials, distribution channels, and applications enables manufacturers to tailor their innovation pipelines and go-to-market strategies more effectively. Regional nuances in regulatory frameworks, project scales, and environmental conditions further accentuate the need for geographically attuned operational models. As competitive pressures intensify, leading companies will be those that marry strategic R D investments with agile supply chain architectures.

Ultimately, the insights presented here chart a clear path: by capitalizing on segmentation intelligence, adapting to tariff-influenced dynamics, and forging collaborative partnerships, industry participants can secure a sustainable advantage. The decisions made today will shape the timber construction connector landscape of tomorrow, reinforcing its critical importance in delivering resilient and eco-efficient structures.

Seize the Opportunity to Elevate Your Projects with Comprehensive Timber Connector Intelligence Reach Out to Ketan Rohom to Access Definitive Research Findings

Thank you for exploring the executive summary of our comprehensive analysis on timber construction connectors. For decision makers seeking deeper insights into product innovations, supply chain navigations under 2025 tariff landscapes, and actionable segmentation strategies, the full report offers unparalleled depth. Connect with Ketan Rohom to obtain definitive findings that will empower your organization with the data and strategic direction needed to outperform competition in a rapidly evolving industry.

- How big is the Timber Construction Connectors Market?

- What is the Timber Construction Connectors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?