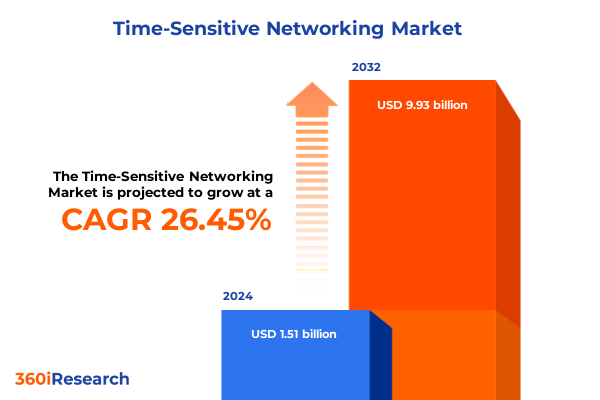

The Time-Sensitive Networking Market size was estimated at USD 1.89 billion in 2025 and expected to reach USD 2.37 billion in 2026, at a CAGR of 26.67% to reach USD 9.93 billion by 2032.

Embracing Deterministic Ethernet Excellence by Unveiling the Transformative Promise of Time-Sensitive Networking for Future-Proof Connectivity

Time-Sensitive Networking represents an evolutionary shift in Ethernet technology, embedding deterministic capabilities into standard networks to guarantee bounded latency, minimal jitter, and near-zero packet loss. Born out of the IEEE 802.1 Working Group’s Audio Video Bridging Task Group and formally rechartered in November 2012, TSN extends traditional Ethernet with mechanisms such as precise time synchronization, traffic shaping, and seamless redundancy to fulfill the stringent requirements of real-time applications. These enhancements empower converged IT/OT environments to deliver both high-throughput and mission-critical performance over a unified infrastructure.

The imperative for deterministic networking is being driven by the proliferation of Industry 4.0, autonomous vehicles, and next-generation telecommunications. As industries demand guaranteed performance for control loops, sensing, and actuation, TSN’s ability to reserve network resources for critical streams and enforce quality-of-service guarantees has become indispensable. Moreover, the integration of TSN into emerging verticals-from industrial robotics and smart grids to 5G transport and automotive Ethernet-underscores its role as a foundational technology for the digital transformation era.

Navigating the Convergence of Industrial Automation, Automotive Evolution, and Advanced Ethernet Architectures in the Era of Time-Sensitive Networking

The landscape of connectivity is being reshaped by converging technological megatrends that place deterministic performance at the core of network evolution. In manufacturing and industrial automation, 3GPP Release 16 introduced support for TSN integration within 5G New Radio standards, enabling ultra-reliable low-latency communications for smart factories and Industrial IoT deployments. By aligning IEEE 802.1 specifications with 5G quality-of-service frameworks, this convergence unlocks seamless bridging between cellular and Ethernet domains, fostering a new era of intelligent, factory-wide connectivity.

Simultaneously, the automotive sector is undergoing a profound shift toward in-vehicle Ethernet architectures, bolstered by TSN features such as time-aware shaping (IEEE 802.1Qbv) and frame preemption (IEEE 802.1Qbu). These capabilities ensure safe and deterministic data delivery for advanced driver assistance systems and autonomous driving functions, redefining network design for next-generation mobility solutions. As vehicles become mobile computing platforms, TSN’s deterministic guarantees provide the low latency and reliability essential for mission-critical control and sensor fusion.

Meanwhile, the energy and telecommunications industries are modernizing their infrastructures with TSN-enabled solutions. Smart grid implementations demand precise synchronization and robust fault tolerance to manage distributed renewable generation and substation automation. In parallel, telecom providers are leveraging TSN for deterministic fronthaul, backhaul, and transport networks to meet the exacting performance requirements of 5G and beyond. Taken together, these shifts underscore TSN’s role as a pivotal enabler of integrated, real-time networks across diverse sectors.

Assessing the Layered Impact of U.S. Trade Measures and Emerging Tariff Dynamics on Time-Sensitive Networking Component Supply Chains

Since 2018, the United States has imposed Section 301 tariffs on select Chinese-origin technology goods, including semiconductors and networking equipment, at a baseline rate of 25 percent. These levies were aimed at addressing intellectual property concerns and reshaping critical supply chains, and they have applied uniformly to integrated circuits and Ethernet hardware used in Time-Sensitive Networking deployments.

In a significant escalation, effective January 1, 2025, the tariff rates for semiconductors classified under Harmonized Tariff Schedule headings 8541 and 8542 were doubled from 25 percent to 50 percent. This increase directly impacts the cost structures of switches, network interface cards, and other TSN-capable ASICs and FPGAs that underpin deterministic Ethernet solutions.

Beyond Section 301 actions, the President invoked the International Emergency Economic Powers Act (IEEPA) to further adjust tariffs in early 2025. New proclamations implemented an additional 10 percent levy on Chinese imports and a 25 percent tariff on goods from Canada and Mexico, broadening the scope of trade barriers affecting TSN component procurement. These IEEPA-based measures took effect on February 4 and March 4, 2025, respectively, creating urgency for supply chain resilience and diversification in the TSN ecosystem.

Recognizing the strain on critical industries, the Office of the United States Trade Representative extended exclusions for certain Section 301 products through August 31, 2025, offering temporary relief for equipment used in semiconductor manufacturing and advanced networking systems. These extensions were informed by public comments and interagency reviews, yet they remain time bound, compelling stakeholders to plan for reinstatement of full duty exposure.

As a consequence, TSN solution providers are encountering increased component costs, elongating lead times for hardware fabrication and procurement. Organizations are adapting by accelerating inventory accumulation, qualifying alternate suppliers in low-tariff jurisdictions, and reevaluating pricing models to absorb or pass through additional duties while maintaining project timelines.

Unlocking Holistic Perspectives by Integrating Protocol Types, Component Tiers, and Application Verticals to Illuminate Time-Sensitive Networking's Ecosystem

The evolving Time-Sensitive Networking landscape can be thoroughly appreciated by examining the interplay of protocol types, component tiers, and application segments. At the protocol level, IEEE 802.1AS provides the foundational timing and synchronization essential for deterministic operations, while IEEE 802.1CB ensures frame replication and elimination for high availability. Traffic shaping is orchestrated through IEEE 802.1Qbv’s time-aware scheduler and IEEE 802.1Qbu’s frame preemption, with IEEE 802.1QCC offering enhanced configuration interfaces for centralized or decentralized stream reservation. Each amendment and profile standard contributes specific functional value, shaping how network architects deploy TSN features to meet unique performance and reliability targets.

On the component side, hardware demand centers on industrial routers, network interface cards, and Ethernet switches that integrate TSN engines, PHYs, and management ASICs. Software layers include management tools and protocol stacks that configure shaping, policing, and path control, while services such as consulting, integration, and support deliver the expertise required for successful TSN rollouts. The management software and stacks act as the control plane, translating business and operational requirements into deterministic network policies.

Applications further refine TSN’s value proposition across verticals. In aerospace and defense, TSN underpins engine monitoring, flight control systems, and in-flight entertainment networks with mission-critical latency guarantees. Within the automotive realm, integration of advanced driver assistance systems, in-vehicle Ethernet backbones, and infotainment systems rely on TSN to balance safety-critical control traffic with high-bandwidth multimedia streams. Energy sector deployments harness TSN for renewable integration, smart grid synchronization, and substation automation, while industrial automation leverages factory and process automation along with robotics to drive production efficiency. Telecommunications providers deploy TSN in 5G transport, backhaul, and fronthaul networks to secure real-time performance and service level assurances.

By weaving insights across these dimensions, stakeholders can identify optimal entry points for TSN adoption, tailor solutions to environment-specific constraints, and architect converged infrastructures that yield deterministic, resilient, and scalable networks.

This comprehensive research report categorizes the Time-Sensitive Networking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Components

- Applications

Deciphering Regional Dynamics by Exploring Americas' Innovations, EMEA Regulatory Drivers, and Asia-Pacific Industrial Acceleration in TSN Adoption

Regional adoption of Time-Sensitive Networking reveals distinct opportunities and challenges shaped by local industry priorities and regulatory environments. In the Americas, robust manufacturing ecosystems and advanced automotive R&D have positioned the United States and Canada at the forefront of TSN deployments. Early adopters in aerospace and defense sectors have leveraged deterministic Ethernet to modernize avionics networks, while electric vehicle manufacturers and autonomous systems developers champion in-vehicle TSN architectures to achieve functional safety and latency targets.

In Europe, Middle East, and Africa, stringent regulatory frameworks and a strong tradition of industrial automation in markets such as Germany, France, and the United Kingdom are driving TSN integration in factory-of-the-future initiatives. Aerospace primes in France and the United Kingdom have piloted TSN-enabled flight control and cabin networks, while energy utilities across the region are deploying TSN for substation automation and grid synchronization to enhance resilience and support renewable generation targets.

Asia-Pacific markets, including Japan, South Korea, and China, are rapidly scaling both 5G infrastructure and smart manufacturing programs. Network equipment providers in these countries are embedding TSN into telecom transport solutions and industrial switches to meet the high-volume demands of semiconductor fabs and automotive electronics producers. Government-backed initiatives on digital transformation and Industry 4.0, coupled with substantial private sector investments, are accelerating TSN adoption in robotics, process control, and next-generation telecommunications infrastructure.

Across regions, ecosystem development hinges on supportive policy, robust training programs, and active participation in standards bodies. Stakeholders must monitor tariffs, local content requirements, and certification schemes to navigate the complex mosaic of regional dynamics and fully capitalize on TSN’s promise.

This comprehensive research report examines key regions that drive the evolution of the Time-Sensitive Networking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders by Evaluating Strategic Alliances, Technological Innovations, and Competitive Differentiators Among Time-Sensitive Networking Providers

Cisco has been an early innovator in embedding TSN capabilities into its industrial and enterprise switching portfolios. The Industrial Ethernet 4000 family features TSN-compliant hardware combined with Cisco’s IOS software, enabling precise time synchronization and traffic shaping in challenging manufacturing environments. By integrating TSN into ruggedized switches with Power over Ethernet and fiber options, Cisco accelerates IIoT adoption and unlocks operational insights from time-critical processes.

Marvell’s Secure Deterministic Ethernet solution addresses harsh industrial contexts with its Prestera DX1500 switch family and Alaska series Ethernet PHYs. These devices integrate TSN functionality-such as IEEE 802.1AS, 802.1Qbv, 802.1CB, and frame preemption-directly in silicon, eliminating the need for external FPGAs. Built-in security features like Secure Boot and MACsec bolster resilience in utilities, railways, and energy production networks, while compact footprints and reduced power draw meet OEM design constraints.

Texas Instruments extends TSN support to the edge with its AM652x Sitara processors. These MCUs feature multiple industrial communication subsystems capable of up to six TSN ports, alongside hardware time-stamping engines and safety-certified real-time cores. This integration empowers developers to create distributed control devices that synchronize deterministically over Ethernet and operate within stringent functional safety requirements.

Certification and interoperability play an essential role in ecosystem maturation, and the Avnu Alliance facilitates device conformance testing and cross-vendor compatibility. By participating in the Avnu certification program, manufacturers demonstrate that their TSN-enabled products interoperate seamlessly across software-defined industrial and automotive networks, fostering confidence and accelerating adoption.

These leading providers, along with emerging specialists in industrial automation and telecom equipment, are shaping a dynamic competitive landscape. Strategic alliances, open standards adherence, and differentiated value propositions in security, integration, and performance will determine market leadership and technology diffusion in the years ahead.

This comprehensive research report delivers an in-depth overview of the principal market players in the Time-Sensitive Networking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advanced Micro Devices, Inc.

- Advantech Co., Ltd.

- Analog Devices, Inc.

- Belden Inc.

- Broadcom Inc.

- Calnex Solutions PLC

- Cisco Systems, Inc.

- General Electric Company

- HMS Networks

- Intel Corporation

- Keysight Technologies

- Marvell Technology, Inc.

- Microchip Technology Inc.

- Moxa Inc.

- NetTimeLogic GmbH

- Nokia Corporation

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- Spirent Communications PLC

- Synopsys, Inc.

- Telefonaktiebolaget LM Ericsson

- TenAsys Corporation

- Texas Instruments Incorporated

- TTTech Computertechnik AG

- WAGO GmbH & Co. KG

Empowering Leaders with Actionable Strategic Roadmaps to Leverage Time-Sensitive Networking for Competitive Advantage and Operational Excellence

To maintain a competitive edge in the evolving TSN market, industry leaders must adopt a strategic roadmap that balances innovation with practical deployment considerations. First, embedding TSN capabilities into next-generation hardware platforms-ranging from edge compute devices to core switches-ensures readiness for deterministic applications and supports future scalability requirements. Collaboration with standards organizations and certification bodies will enhance interoperability and reduce integration risks.

Second, organizations should cultivate internal expertise in TSN configuration and management by investing in training programs, simulation tools, and pilot labs. Empowering network architects with hands-on experience in shaping, scheduling, and time synchronization will accelerate production rollouts and minimize operational disruptions. Engaging early with key supply chain partners to qualify alternate component sources-particularly in the face of tariff volatility-will mitigate procurement delays and cost fluctuations.

Third, enterprises should align TSN deployments with broader digital transformation initiatives, integrating real-time networking with edge analytics, AI-driven monitoring, and secure access frameworks. By converging IT and OT domains under a unified deterministic Ethernet fabric, firms can unlock new efficiencies in predictive maintenance, quality assurance, and energy management.

Finally, continuous monitoring of tariff policy changes and proactive participation in trade discussions will enable stakeholders to anticipate regulatory shifts and advocate for exclusion extensions or favorable duty treatments. Diversifying manufacturing footprints and employing nearshoring strategies can further buffer the impact of cross-border tariffs and strengthen supply chain resilience.

By executing these actionable steps, industry leaders can harness TSN’s full potential to drive performance guarantees, operational excellence, and strategic differentiation across their digital ecosystems.

Outlining a Rigorous Multiphase Research Methodology Grounded in Primary Interviews, Secondary Intelligence, and Data Triangulation for Robust Insights

This research employs a multiphase methodology designed to generate robust insights into the Time-Sensitive Networking market. Primary research involved in-depth interviews with key executives, engineers, and standardization experts across hardware vendors, system integrators, and end-user organizations. These qualitative discussions provided firsthand perspectives on technology adoption drivers, implementation challenges, and strategic priorities.

Complementing primary inquiries, secondary research encompassed a comprehensive review of technical specifications, white papers, regulatory filings, and industry reports. Authoritative sources-including IEEE 802.1 standards documentation, USTR press releases, and leading vendor collateral-were synthesized to validate market dynamics and tariff impacts. Trade association publications and peer-reviewed journals offered additional depth on protocol innovations and use case developments.

Data triangulation was achieved by cross-referencing findings from interview transcripts with publicly available implementation case studies and deployment announcements. This iterative validation process ensured consistency and reliability of the insights, mitigating potential biases inherent in any single data stream.

Finally, the research framework incorporated scenario analysis to model the implications of tariff policy shifts, regional regulatory trends, and evolving technical roadmaps for TSN standards. Stakeholder feedback loops refined the scenarios to reflect real-world constraints and projected innovation trajectories. The result is a comprehensive evidence-based foundation that informs both strategic decision-making and tactical execution in the TSN domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Time-Sensitive Networking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Time-Sensitive Networking Market, by Type

- Time-Sensitive Networking Market, by Components

- Time-Sensitive Networking Market, by Applications

- Time-Sensitive Networking Market, by Region

- Time-Sensitive Networking Market, by Group

- Time-Sensitive Networking Market, by Country

- United States Time-Sensitive Networking Market

- China Time-Sensitive Networking Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Transformative Role of Time-Sensitive Networking in Future Connectivity Paradigms

The analysis presented herein highlights Time-Sensitive Networking as a transformative enabler of deterministic, real-time connectivity across diverse industry verticals. By converging Ethernet-based transport with precise synchronization, traffic shaping, and resilience mechanisms, TSN addresses mission-critical performance requirements previously met only by proprietary fieldbus solutions.

Market dynamics are being driven by converging megatrends: the push for Industry 4.0 in manufacturing, the evolution of in-vehicle Ethernet for autonomous driving, the modernization of energy grids, and the stringent performance demands of 5G transport networks. These shifts, coupled with heightened tariff pressures, underscore the need for strategic supply chain management, standards alignment, and ecosystem collaboration.

Segmentation analysis reveals differentiated value propositions at the intersection of protocol innovations-such as IEEE 802.1AS, CB, QBV, QBU, and QCC-component specialization, and vertical application requirements. Regional insights point to distinct adoption patterns shaped by regulatory environments and industrial capabilities in the Americas, EMEA, and the Asia-Pacific.

Key players are extending TSN capabilities from silicon to software, while service providers are building integration competencies to support end-to-end deterministic networks. Actionable recommendations emphasize the integration of TSN into broader digital transformation initiatives, proactive tariff risk management, and investment in domain expertise.

As TSN standards evolve and ecosystem support deepens, organizations that execute this informed strategic blueprint will position themselves to harness deterministic networking as a competitive differentiator, powering the next generation of connected, real-time applications.

Secure Expert Guided Access to the Comprehensive Time-Sensitive Networking Market Research Report by Connecting Directly with Associate Director Ketan Rohom

Are you ready to harness the full potential of Time-Sensitive Networking to drive your organization’s next wave of innovation and operational efficiency? Contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the definitive TSN market research report. With personalized guidance, you will gain prioritized access to the insights and actionable intelligence you need to make confident strategic decisions and outpace the competition.

- How big is the Time-Sensitive Networking Market?

- What is the Time-Sensitive Networking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?