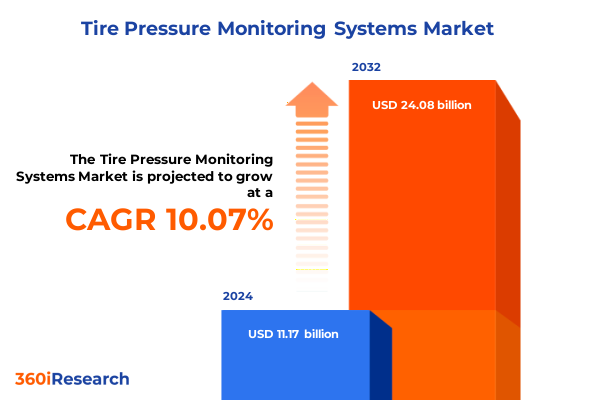

The Tire Pressure Monitoring Systems Market size was estimated at USD 12.20 billion in 2025 and expected to reach USD 13.37 billion in 2026, at a CAGR of 10.19% to reach USD 24.08 billion by 2032.

A high-level strategic framing explaining why modern TPMS has become a systems-level capability that links safety compliance, EV efficiency, and fleet telematics

The tire pressure monitoring systems (TPMS) landscape is at a pivotal junction where embedded safety regulations, rapid electrification, and data-driven fleet operations converge to reframe product, channel, and supplier choices for OEMs and service providers. The introduction clarifies why TPMS has evolved from a compliance checkbox into a systems-level capability: it now informs vehicle energy efficiency, supports predictive maintenance workflows, and acts as a sensor node for broader connected-vehicle architectures. Consequently, decision-makers must see TPMS not only as an individual safety subsystem but also as a potential enabler of recurring revenue streams through telematics-enabled services and aftermarket upgrades. This framing shapes how procurement, engineering, and product teams prioritize integration, supplier partnerships, and data strategies as they plan roadmaps for the next three to five years.

Contextually, the industry is experiencing simultaneous shifts in hardware miniaturization, communication protocols, and sensor intelligence. These changes are accelerating new use cases-ranging from EV range optimization to automated fleet maintenance scheduling-that increase the value proposition of modern TPMS beyond simple pressure warnings. At the same time, regulatory foundations continue to underpin baseline demand for TPMS across multiple vehicle categories. Taken together, these forces are redefining ROI calculations, warranty exposure, and total cost of ownership for both OEM and aftermarket stakeholders, making a strategic, systems-level view essential for boards and product leaders.

How innovations in multi-parameter sensors, energy-harvesting prototypes, and BLE retrofit kits are fundamentally shifting where value is created in the TPMS ecosystem

Over the past 24 months the TPMS landscape has undergone transformative shifts that recast where value accrues across the ecosystem. Advanced sensor architectures and multi-parameter sensing have moved the technology from a single-function safety alert to a multi-dimensional data source capable of reporting pressure, temperature, load and, in some implementations, tread and wear proxies. This technical maturation is being coupled with new wireless options such as Bluetooth Low Energy for retrofit use cases and persistent telematics gateways for commercial fleets, enabling higher-fidelity datasets and more frequent reporting intervals. Continental’s recent integrations and product launches illustrate this trend toward continuous digital tire management and richer telematics connections for fleets.

Concurrently, energy and sustainability considerations are prompting rapid R&D into low-power and energy-harvesting sensor designs. Academic and prototype work on mechanical and RF energy harvesters shows a credible technical trajectory toward battery-extended or batteryless sensors, which would materially lower lifecycle maintenance and environmental costs for large fleets. These innovations would also change service models, shifting some aftermarket revenues toward software and analytics while compressing recurring hardware replacements.

Finally, the aftermarket is being reshaped by universal retrofit kits and BLE-based solutions that lower the friction of deployment for non‑TPMS-equipped vehicles. Vendors are explicitly targeting light-duty towable trailers, RVs and other segments that were previously underserved by factory-fit TPMS. These retrofit pathways, combined with direct OEM integrations, are broadening addressable use cases and fragmenting value capture across sensors, transceivers, and cloud services. Product leaders need to adapt to a market where software, connectivity, and data platforms can quickly become as important as sensor hardware in defining margins and customer lock-in.

A focused analysis of how U.S. tariff actions in 2025 reshaped TPMS sourcing economics, supplier selection dynamics, and near-term operational uncertainty

In 2025 U.S. tariff actions targeting automobiles and automobile parts introduced a material new variable for global TPMS supply chains and cost structures. A presidential proclamation announced an across-the-board tariff on specified imported automobiles and certain parts, with a 25 percent ad valorem duty applying to listed articles and an implementation schedule that included automobile parts by early May 2025. The proclamation and subsequent Federal Register notice establish both the tariff framework and processes for later annexes that could expand covered parts. For manufacturers and buyers, the immediate consequence was a recalibration of sourcing strategies and landed-cost models. Suppliers and OEMs that rely on transnational component flows-particularly sensors, ECUs and RF transceivers sourced from affected jurisdictions-faced higher input costs and the need to re-evaluate localization or supplier diversification strategies.

This policy action also created significant near-term operational uncertainty because of concurrent legal and political developments. Court rulings and public debate raised questions about the tariffs’ durability and the potential for retroactive adjustments or refunds, complicating capital planning and contract negotiations. In practice, procurement teams took a two-track approach: they instituted contingency sourcing plans while negotiating transitional pricing and offset mechanisms with domestic assemblers that could apply limited duty relief for qualifying content under existing trade arrangements. The net effect is that suppliers with flexible manufacturing footprints and near-shore capacity have emerged as preferred partners, while those without rapid reallocation options face margin compression and order volatility. News coverage and analysis in the months following the proclamation documented how tariff uncertainty propagated through automotive supply chains and influenced buyer behavior.

Strategically, tariff pressure has accelerated a longer-term trend toward supplier consolidation and vertical integration for critical TPMS subcomponents. OEMs and tier‑1 suppliers are increasingly building redundancy into sourcing strategies for antennas, sensors and ECUs, and they are also exploring more aggressive localization of high-volume items to protect program economics. In short, tariffs in 2025 changed negotiating leverage and elevated operations risk as a primary input to supplier selection decisions.

A disciplined segmentation-driven view of TPMS that links product architecture, component exposure, channels, end users, and vehicle classes to design and commercial priorities

Segmentation analysis reveals distinct technology and commercial vectors that determine product configuration and go‑to‑market strategy across the TPMS value chain. Product-type segmentation-covering direct, hybrid and indirect TPMS architectures-highlights a bifurcation in value: direct TPMS continues to dominate as the verified safety and data source for OEMs, while hybrid and indirect systems retain cost-sensitive roles in certain aftermarket and lower-tier vehicle segments. Component segmentation-spanning antennas, ECUs, sensors, TPM warning lights, and transceivers-makes clear which subsystems are most exposed to tariff risk, supply-chain concentration, and cost-down pressure; sensing elements and ECUs are the most technically differentiated and therefore command premium margins tied to accuracy and integration features. Sales-channel segmentation differentiates OEM and aftermarket strategies: OEM programs prioritize qualification cycles, long-term supplier partnerships and integration with vehicle electronics, whereas aftermarket offerings prioritize retrofit ease, BLE connectivity and simplified commissioning for service providers and independent garages. End-user segmentation, which considers automotive manufacturers, service providers, and tire equipment suppliers, clarifies the locus of purchasing power and performance expectations: manufacturers demand validated durability and engineering support, service providers value install efficiency and diagnostics, and tire equipment suppliers look for compatibility with shop workflows and aftermarket tool ecosystems. Vehicle-type segmentation-covering commercial vehicles, passenger vehicles, and two‑wheelers, with commercial further split into heavy and light commercial vehicles-emphasizes divergent telemetry, update frequency and ruggedization requirements: commercial fleets emphasize continuous monitoring, high-availability telematics gateways and minimal downtime, while passenger vehicle deployments emphasize cost, user experience, and integration with infotainment systems. Together, these segmentation lenses determine R&D priorities, certification timelines, and aftermarket enablement plans across suppliers and integrators.

This comprehensive research report categorizes the Tire Pressure Monitoring Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Sales Channel

- End User

- Vehicle Type

A comparative regional assessment explaining how Americas, EMEA, and Asia-Pacific demands drive distinct TPMS product families, go-to-market models, and investment priorities

Regional dynamics shape strategy and investment priorities for TPMS suppliers and buyers in materially different ways across the Americas, Europe-Middle East & Africa, and Asia-Pacific. In the Americas, regulatory baselines and large fleet operations create a strong demand vector for integrated telematics and retrofit solutions that reduce downtime and deliver operating-cost savings; North American fleets are prime adopters of high‑frequency reporting and predictive maintenance services. Evidence of this orientation appears in strategic integrations between tire technology providers and telematics platforms, aimed at presenting tire health inside fleet management dashboards.

In Europe, the Middle East & Africa region, regulatory pressure and sustainability mandates tilt investments toward end‑to‑end digital tire management and services that support emissions and safety compliance. European suppliers are also leading on features such as automated tread-depth measurement and tighter OEM‑grade integration, reflecting a commercial environment where premium safety and regulatory compliance are critical purchasing criteria. These regional product choices are reinforced by a strong aftermarket service network and by fleet operators that increasingly expect coordinated tire and vehicle-level analytics.

Asia‑Pacific remains a differentiated market where scale, cost optimization, and rapid vehicle electrification coexist. Several large OEMs and suppliers continue to invest heavily in localized manufacturing and sensor R&D, and retrofit solutions are gaining traction in parts of the region where regulatory rollouts are more recent. Because vehicle mix and regulatory schedules vary across the region, suppliers must balance cost-competitive product lines for high-volume passenger vehicles with ruggedized, telemetry-rich offerings for commercial customers. The combined effect across regions is a market environment where global suppliers must offer modular product families and regional go‑to‑market playbooks that align to local regulatory, channel and fleet priorities.

This comprehensive research report examines key regions that drive the evolution of the Tire Pressure Monitoring Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

A synthesis of competitive strategies showing why hardware vendors, tier‑1 integrators, and platform players are competing on software, data access, and lifecycle services as much as on sensors

Competitive positioning in TPMS now spans legacy sensor manufacturers, tier‑1 automotive suppliers, digital fleet platform providers, and specialized retrofit players. Leading sensor OEMs emphasize reliability, frequency stability and broad part coverage for replacement markets, while tier‑1 suppliers couple sensors with ECU and gateway solutions to capture higher-value integration contracts with automakers. At the same time, tire manufacturers and fleet-platform vendors are moving into adjacent services-creating digital ecosystems that package TPMS data with tire management, predictive maintenance and warranty analytics. These moves place a premium on interoperability, firmware management and secure over‑the‑air update capabilities.

Several recent product announcements illustrate divergent competitive plays: traditional TPMS suppliers are extending their portfolios to include Bluetooth retrofit kits and extended-coverage OE replacement sensors designed for new EV and passenger vehicle platforms, while larger mobility suppliers are embedding tire analytics into fleet management platforms to offer predictive tire maintenance and routing optimization. This competitive mix means that supplier selection is not purely a hardware choice; it increasingly depends on software hooks, data access policies, lifecycle services, and the supplier’s ability to provide integration support through qualification and warranty periods. Organizations evaluating partners must therefore score potential suppliers on systems integration, data governance, and roadmap alignment as much as on unit cost and delivery performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tire Pressure Monitoring Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alps Alpine Co. Ltd.

- Baolong Automotive Corporation

- Bartec USA LLC

- Bendix Commercial Vehicle Systems LLC

- Continental AG

- Denso Corporation

- Doran Manufacturing LLC

- Garmin Ltd.

- Hella GmbH & Co. KGaA

- Infineon Technologies AG

- Nira Dynamics AB

- NXP Semiconductors N.V.

- Pacific Industrial Co. Ltd.

- Robert Bosch GmbH

- Schrader Electronics Ltd.

- Sensata Technologies Inc.

- Steelmate Co. Ltd.

- Texas Instruments Incorporated

- TRW Automotive Holdings Corp.

- WABCO Holdings Inc.

- ZF Friedrichshafen AG

A pragmatic, multi-step playbook for supplier diversification, modular product design, subscription monetization, and low-power R&D that preserves margin and reduces operations risk

Industry leaders should immediately adopt a multi-pronged action agenda that balances short-term operational resilience with medium-term product and data strategy. First, companies must re-evaluate supplier risk and diversify production footprints for high‑exposure components such as sensors, ECUs and transceivers; dual sourcing and near‑shoring options should be assessed to mitigate tariff and logistics shocks. Second, product teams must prioritize integration-ready sensor platforms that support both OEM CAN/CENTRAL BUS integration and BLE-enabled retrofit modes, ensuring solutions are serviceable across channels and vehicle classes. Third, commercial leaders should design monetization pathways that move beyond one-time hardware sales: subscription services for fleet analytics, predictive maintenance packages, and managed retrofit deployment programs will capture recurring revenue and deepen customer relationships. Fourth, R&D portfolios must include options for low‑power and energy‑harvesting sensor variants where technically and commercially viable, because these designs can materially reduce maintenance cost and improve sustainability credentials over a multi-year horizon. Finally, procurement and legal teams need to embed scenario planning for tariff volatility into supplier contracts, including negotiated price triggers and inventory hedging clauses to smooth cost pass-through.

Taken together, these actions form a coherent playbook: stabilize near-term operations through sourcing flexibility, expand product breadth to capture both OEM and aftermarket value, and accelerate services and low-power innovation to secure higher-margin recurring revenue. This approach will minimize exposure to policy and supply-chain shocks while positioning incumbent suppliers and new entrants to compete for the software-driven opportunities emerging across fleets and EV segments.

A transparent explanation of the research approach combining primary interviews, regulatory documents, supplier disclosures, and peer-reviewed technical work to produce strategy-focused insights

This research synthesis combines primary and secondary sources to ensure balanced, evidence-based findings. Primary inputs include structured interviews with procurement and engineering leads at OEMs and tier‑1 suppliers, anonymized program-level questionnaires returned by fleet operators and service providers, and a curated set of supplier product specification documents used to validate feature-level claims. Secondary research integrates regulatory texts, official proclamations and Federal Register notices to verify policy impacts, peer-reviewed engineering studies on energy harvesting and sensor design to validate technology trajectories, and company press releases and product pages to corroborate supplier strategies and go‑to‑market initiatives. Where government proclamations or formal rules apply, those documents were treated as primary legal evidence; technical innovation claims rely on peer-reviewed or demonstrable engineering work and supplier disclosures.

Methodologically, the analysis intentionally avoided extrapolating market sizes or forecasting numeric growth figures to remain focused on strategic implications rather than volumetric estimates. Cross-validation was applied by triangulating supplier announcements, government publications and academic prototypes. Limitations include asymmetric access to confidential OEM program roadmaps and the evolving nature of tariff adjudication; where legal or policy status remained in flux, scenario framing was applied rather than definitive judgement. The result is a prioritized set of strategic observations and practical recommendations designed to be decision‑ready for leadership teams evaluating TPMS program investments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tire Pressure Monitoring Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tire Pressure Monitoring Systems Market, by Product Type

- Tire Pressure Monitoring Systems Market, by Component

- Tire Pressure Monitoring Systems Market, by Sales Channel

- Tire Pressure Monitoring Systems Market, by End User

- Tire Pressure Monitoring Systems Market, by Vehicle Type

- Tire Pressure Monitoring Systems Market, by Region

- Tire Pressure Monitoring Systems Market, by Group

- Tire Pressure Monitoring Systems Market, by Country

- United States Tire Pressure Monitoring Systems Market

- China Tire Pressure Monitoring Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

A concise strategic conclusion emphasizing that TPMS decisions must integrate sourcing resilience, software-enabled services, and low-power innovation to protect long-term competitiveness

TPMS has shifted from a narrowly defined safety compliance item to a strategic domain that intersects vehicle energy efficiency, fleet operations, and digital services. The combined effect of sensor evolution, retrofit enablement, fleet telematics integration and policy volatility means that choices made today about supplier footprints, product modularity, and data monetization models will determine competitive positioning over the next product cycle. In the face of tariff-driven cost pressure and supply-chain uncertainty, organizations that align product roadmaps with software-enabled services and that invest selectively in low-power sensor innovation will gain defensive advantages and capture higher-margin recurring revenue. Conversely, firms that prioritize unit-cost reduction alone without addressing integration, firmware lifecycle management and regional go‑to‑market execution risk losing strategic relevance as TPMS becomes more deeply embedded in vehicle and fleet ecosystems. The conclusion is therefore a clear call for holistic, cross-functional planning that treats TPMS as a systems and services opportunity as much as a hardware procurement decision.

A clear and direct next-step invitation to engage Ketan Rohom for a tailored purchase and executive briefing that accelerates decision-making

For an immediate, executive-ready package that translates these insights into deal-level intelligence, please contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can arrange a tailored briefing, provide the full market research report, and deliver a customized slide deck and data workbook aligned to your priorities. Reach out to request the full report, a sample chapter, or a private briefing to accelerate strategic decisions and supplier negotiations.

- How big is the Tire Pressure Monitoring Systems Market?

- What is the Tire Pressure Monitoring Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?