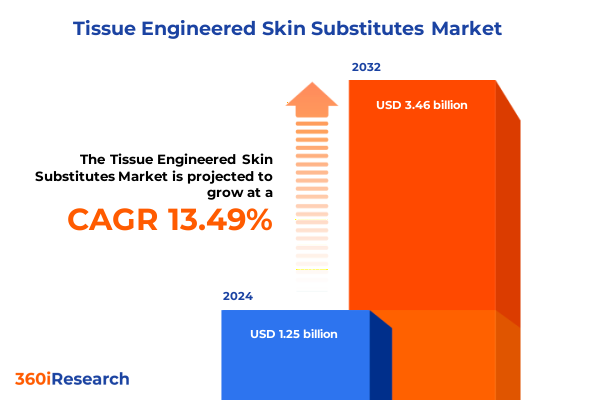

The Tissue Engineered Skin Substitutes Market size was estimated at USD 1.42 billion in 2025 and expected to reach USD 1.61 billion in 2026, at a CAGR of 13.51% to reach USD 3.46 billion by 2032.

Exploring the Convergence of Biomanufacturing Innovation and Emerging Clinical Needs Driving the Future of Tissue Engineered Skin Substitute Solutions

The field of tissue engineered skin substitutes has emerged at the intersection of regenerative medicine and advanced biomaterials, transforming patient care paradigms for acute and chronic wounds. Over the past decade, breakthroughs in scaffold design, cellular therapies, and biofabrication techniques have converged to deliver novel products that not only promote rapid re-epithelialization but also restore physiological skin functions. Simultaneously, shifting demographics-marked by an aging population and rising prevalence of diabetes, burns, and trauma-have intensified clinical demand, driving significant interest from healthcare providers and investors alike.

Recent regulatory milestones have further catalyzed industry momentum. Accelerated approval pathways and expanded reimbursement policies in key markets have reduced time-to-market barriers, fostering a more favorable environment for innovation. Alongside this, strategic collaborations between biotech firms, academic research centers, and medical device manufacturers have accelerated translational research, yielding a robust pipeline of next-generation substitutes tailored to diverse clinical applications.

Looking ahead, the interplay of technological refinement, evolving clinical protocols, and patient-centric outcomes will define the trajectory of tissue engineered skin substitutes. This report delves into the critical inflection points that stakeholders must navigate, offering a foundational understanding of market dynamics and an outlook on emerging opportunities.

Identifying the Pivotal Technological, Regulatory, and Clinical Shifts Reshaping the Tissue Engineered Skin Substitutes Ecosystem and Market Dynamics

The landscape of tissue engineered skin substitutes is undergoing transformative shifts driven by converging technological, regulatory, and clinical forces. At the technological frontier, the integration of 3D bioprinting with advanced hydrogel matrices has enabled the fabrication of bespoke skin constructs that closely mimic native dermal and epidermal structures. Coupled with the advent of induced pluripotent stem cell–derived keratinocytes and fibroblasts, developers can now engineer substitutes that deliver enhanced vascular integration and reduced scarring.

On the regulatory front, health authorities are increasingly receptive to novel modalities, establishing clear guidance on characterization, sterility assurance, and potency assays. These frameworks have reduced uncertainty around product approval and encouraged manufacturers to invest in scalable production platforms. Concurrently, payers are recognizing the long-term cost-effectiveness of tissue engineered solutions in reducing chronic wound care burden, resulting in more favorable reimbursement landscapes.

Clinically, the standard of care for wound management continues to evolve toward early intervention with bioengineered grafts, replacing conventional dressings and autografting in complex cases. This shift is amplified by a growing emphasis on patient quality of life, driving demand for substitutes that offer both functional restoration and aesthetic outcomes. Together, these multifaceted drivers are reshaping market dynamics, setting the stage for a new era of personalized, high-efficacy skin repair therapies.

Evaluating the Complex Cumulative Effects of the 2025 United States Tariff Framework on the Production, Importation, and Cost Structures in Advanced Skin Substitutes

Beginning January 1, 2025, the United States implemented a new tranche of Section 301 tariffs targeting medical imports from China, including consumable devices such as surgical and non-surgical respirators, facemasks, rubber gloves, and syringes. Under this measure, tariffs on surgical and non-surgical respirators and facemasks rose to 25%, while rubber medical and surgical gloves are now subject to a 50% levy, with syringes and needles facing a 100% duty excluding enteral syringes as an interim exemption through 2025.

To prevent the compounding of overlapping duties, an Executive Order issued on April 29, 2025, established a process for excluding cumulative tariff “stacking” when a single importable article would otherwise face multiple overlapping duties. Under this directive, U.S. Customs will apply the highest applicable tariff rather than layering Section 301, section 232, and anti-dumping duties together on the same product, reducing unintended escalation of duty burdens on advanced skin substitute components and raw biomaterials.

Despite these mitigations, the net effect of higher duty rates has translated into increased landed costs for imported scaffolds, growth factors, and single-use surgical kits essential to substitute fabrication. According to industry analysis, elevated Section 301 rates will heighten supply chain vulnerabilities and erode the competitive price advantage of Chinese manufacturers, prompting domestic suppliers to capture greater market share but also potentially driving up healthcare consumable expenses for providers and patients.

In parallel, ongoing trade negotiations with the European Union suggest that while certain medical device categories may be exempted from new 15% tariffs under a prospective U.S.-EU agreement, broad-based protectionist pressures persist. Stakeholders must monitor these developments carefully, as shifting trade regimes will directly influence procurement strategies, supplier selection, and long-term investment planning in the tissue engineered skin substitute sector.

Uncovering Deep Segmentation Trends Revealing How Product Types, Applications, End Users, Materials, and Cellular Compositions Define Market Opportunities and Challenges

Insight into market segmentation reveals distinct pathways for innovation and commercialization within the tissue engineered skin substitutes domain. The product type dimension encompasses composite, dermal, and epidermal substitutes, with dermal products further distinguished by biosynthetic, natural, and synthetic compositions. These sub-classifications extend deeper into natural derivatives-collagen, fibrin, and hyaluronic acid-and synthetic polymers such as PLGA, polycaprolactone, and polyurethane, underscoring the diversity of scaffold architectures.

Application-based segmentation covers acute wound care, burn treatment, chronic wound management, and cosmetic and aesthetic uses. Notably, chronic wound care is heavily subdivided into diabetic foot ulcers, pressure ulcers, and venous leg ulcers, each presenting unique physiological challenges that drive specialized graft requirements. End-user analysis spans ambulatory surgical centers, home care settings, hospitals, and specialty clinics, highlighting the varied clinical environments in which these substitutes must perform reliably.

From a material standpoint, the market tracks biosynthetic, natural, and synthetic scaffolds-mirroring the product type breakdown yet offering a lens on raw material sourcing, biocompatibility, and manufacturing scalability. Cellular composition adds another layer, contrasting acellular matrices with cultured allogeneic or autologous preparations, and xenogeneic options sourced from bovine and porcine tissues. This multidimensional framework allows stakeholders to pinpoint high-growth niches, optimize R&D roadmaps, and align product portfolios with evolving clinical demands.

This comprehensive research report categorizes the Tissue Engineered Skin Substitutes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Material

- Cellular Composition

Examining Regional Variations and Market Drivers Across the Americas, EMEA, and Asia-Pacific To Reveal Geographic Growth Trajectories in Skin Substitute Adoption

Regional dynamics in tissue engineered skin substitutes reflect a confluence of healthcare infrastructure maturity, regulatory environments, and patient epidemiology. In the Americas, robust spending on advanced wound care and a well-established reimbursement ecosystem have accelerated the adoption of premium substitutes in both hospital and outpatient settings. Clinical preference for off-the-shelf allogeneic grafts coexists with growing interest in autologous and personalized constructs, supported by strong venture capital activity and strategic partnerships between U.S. and Canadian biotechs.

Across Europe, the Middle East & Africa, divergent healthcare systems yield varied uptake patterns. Western European markets demonstrate high penetration of engineered grafts under national health services, driven by centralized procurement and cost-effectiveness mandates. Meanwhile, in emerging Eastern European, Middle Eastern, and African markets, access remains constrained by infrastructure gaps and regulatory heterogeneity, although private sector adoption in elective and aesthetic procedures is emerging as a catalyst for growth.

The Asia-Pacific region presents the fastest overall expansion, fueled by a rising incidence of diabetes and burn injuries, coupled with government initiatives to bolster domestic biofabrication capabilities. Markets such as China, Japan, South Korea, and Australia have advanced clinical trials and regulatory frameworks in place, but supply chain resilience remains a concern amid geopolitical tensions. Southeast Asian and South Asian countries are investing in capacity building and regulatory harmonization to close the gap on mature markets, positioning the region as a key battleground for future market leadership.

This comprehensive research report examines key regions that drive the evolution of the Tissue Engineered Skin Substitutes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders and Innovative Enterprises Shaping the Competitive Landscape of Tissue Engineered Skin Substitutes Through Cutting-Edge Solutions

The competitive landscape of tissue engineered skin substitutes is anchored by a mix of established players and emerging innovators. Key public companies have leveraged scale and regulatory experience to advance multiple product lines, while smaller biotechs drive differentiation through novel biomaterials and cell sourcing strategies. Strategic collaborations among device manufacturers, academic spin-offs, and contract manufacturing organizations have yielded co-development agreements that de-risk pipeline progression and expand global reach.

Notable companies have prioritized modular platform development, enabling rapid customization of scaffold properties and cell compositions to meet diverse clinical indications. Investment in automated manufacturing has improved batch consistency and reduced production costs, facilitating broader market penetration. Meanwhile, several mid-sized enterprises have secured breakthrough designations for allogeneic substitutes, underscoring the paradigm shift toward off-the-shelf therapies with predictable performance profiles.

In parallel, partnerships with academic institutions and hospital networks have accelerated real-world evidence generation, validating clinical outcomes and informing reimbursement dossiers. M&A activity continues to reshape the landscape, as larger conglomerates absorb innovative start-ups to bolster their regenerative medicine portfolios. This convergence of capabilities and capital underscores the strategic imperative to integrate R&D, regulatory, and commercial functions for sustainable competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tissue Engineered Skin Substitutes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acelity L.P. Inc. (3M Company)

- AlloSource

- Amniox Medical, Inc. (a Tides Medical company)

- Anika Therapeutics, Inc.

- Avita Medical, Inc.

- B. Braun Melsungen AG

- Coloplast Group

- ConvaTec Group Plc

- Integra LifeSciences Holdings Corporation

- Medline Industries, LP

- MIMEDX Group, Inc.

- MiMedx Group, Inc.

- Mölnlycke Health Care AB

- Organogenesis Holdings Inc.

- RTI Surgical Holdings, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Vericel Corporation

Outlining Strategic and Operational Recommendations for Industry Leaders to Capitalize on Innovation, Optimize Supply Chains, and Navigate Complex Trade Environments

To capitalize on the burgeoning opportunities in tissue engineered skin substitutes, industry leaders should focus on several strategic imperatives. First, investing in advanced biomaterials tailored for accelerated integration and minimal immunogenicity will differentiate products in an increasingly crowded marketplace. Collaborative research alliances with academic and materials science centers can accelerate development timelines and uncover novel scaffold chemistries.

Second, strengthening supply chain resilience is critical amid shifting trade policies and raw material constraints. Organizations should diversify sourcing of key biopolymers and negotiate multiyear procurement agreements to mitigate tariff volatility and capacity bottlenecks. Concurrently, establishing parallel domestic and near-shoring manufacturing hubs will reduce lead times and ensure regulatory compliance across primary markets.

Third, aligning regulatory and reimbursement strategies with emerging health policy trends is essential. Proactive engagement with health technology assessment bodies, payers, and patient advocacy groups will streamline access pathways and secure favorable coverage terms. Tailoring clinical trial design to generate health-economic evidence will bolster value propositions and accelerate scale-up in hospital and outpatient settings.

Finally, embracing digital and data-driven approaches can enhance product performance monitoring and post-market surveillance. Integrating remote patient monitoring platforms and real-world data analytics will support iterative product improvements and strengthen the evidence base, driving adoption in both acute and chronic care environments.

Detailing a Robust Multi-Modal Research Approach Integrating Primary Interviews, Secondary Data, and Analytical Frameworks to Deliver Comprehensive Market Insights

This report employs a rigorous multi-modal research methodology designed to deliver comprehensive and actionable insights into the tissue engineered skin substitutes market. Secondary research served as the foundation, encompassing peer-reviewed journals, regulatory filings, patent databases, and industry white papers to map technological advancements and historical market evolution. Government publications, trade association reports, and official tariff schedules provided clarity on policy shifts and supply chain dynamics.

Primary research involved in-depth interviews with stakeholders across the value chain, including R&D executives, clinical investigators, procurement managers, and reimbursement experts. These conversations illuminated real-world challenges and market drivers, validating hypotheses generated through secondary analysis. Quantitative data were triangulated against proprietary surveys targeting healthcare providers and end-users to refine segment priorities and addressable market nuances.

An iterative analytical framework guided the segmentation by product type, application, end user, material, and cellular composition, ensuring alignment with clinical realities and commercialization pathways. Regional assessments leveraged epidemiological and health economics models to project adoption trajectories, while company profiling utilized competitive benchmarking and M&A trend analysis to identify strategic imperatives.

All findings were subjected to a multi-level validation process involving peer review and expert advisory input, guaranteeing both methodological rigor and relevance to senior decision-makers in the regenerative medicine and medical device sectors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tissue Engineered Skin Substitutes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tissue Engineered Skin Substitutes Market, by Product Type

- Tissue Engineered Skin Substitutes Market, by Application

- Tissue Engineered Skin Substitutes Market, by End User

- Tissue Engineered Skin Substitutes Market, by Material

- Tissue Engineered Skin Substitutes Market, by Cellular Composition

- Tissue Engineered Skin Substitutes Market, by Region

- Tissue Engineered Skin Substitutes Market, by Group

- Tissue Engineered Skin Substitutes Market, by Country

- United States Tissue Engineered Skin Substitutes Market

- China Tissue Engineered Skin Substitutes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Drawing Executive-Level Conclusions on the Strategic Imperatives, Market Potential, and Future Outlook for the Tissue Engineered Skin Substitute Industry

The trajectory of tissue engineered skin substitutes underscores a compelling intersection of innovation and unmet clinical need. Technological strides in scaffold engineering and cell biology have matured to the point where products demonstrate not only safety and efficacy but also tangible improvements in wound closure rates and cosmetic outcomes. Concurrently, regulatory and reimbursement landscapes are evolving to recognize the long-term value proposition of these therapies, enabling broader adoption across diverse healthcare settings.

Market segmentation analysis reveals multiple high-potential avenues, from biosynthetic dermal matrices to autologous cultured epidermal grafts, each catering to distinct clinical indications. Regional insights highlight the Americas as an innovation hub with strong reimbursement support, while Asia-Pacific’s rapid capacity building signals formidable future competition. Trade policy developments, particularly the 2025 tariff regime, inject an additional layer of complexity that stakeholders must navigate with agility.

In this dynamic environment, competitive differentiation will hinge on integrated strategies that align R&D innovation with supply chain resilience and regulatory foresight. Strategic partnerships and data-driven value demonstrations will be pivotal in unlocking new market segments, especially within chronic wound care and aesthetic applications. Ultimately, the industry stands at a watershed moment, poised to transform patient outcomes and deliver significant value across the healthcare continuum.

Engaging with Associate Director Ketan Rohom to Secure the Full Market Research Report and Unlock Actionable Insights for Accelerating Skin Substitute Innovations

If you’re seeking comprehensive, data-driven insights into the rapidly evolving landscape of tissue engineered skin substitutes, now is the time to act. Engage with Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to detailed market analyses, regional breakdowns, and strategic recommendations tailored to your organization’s growth objectives.

Securing the full report will empower your team to identify high-potential segments, mitigate emerging trade and regulatory risks, and harness cutting-edge innovations in biomaterials and cellular therapy. Through a direct conversation with Ketan, you can explore customized research add-ons, request deeper dives into specific applications, and obtain priority briefings on imminent market developments.

Don’t let pivotal insights remain untapped. Contact Ketan Rohom to arrange a personalized consultation and secure your copy of the definitive market research report on tissue engineered skin substitutes. Elevate your strategic planning and start capitalizing on the transformative opportunities in next-generation wound care solutions.

- How big is the Tissue Engineered Skin Substitutes Market?

- What is the Tissue Engineered Skin Substitutes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?