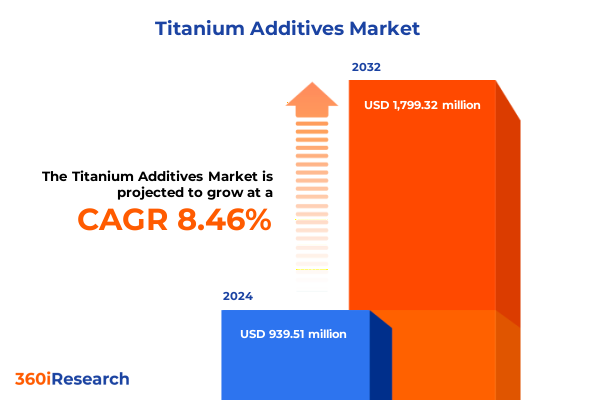

The Titanium Additives Market size was estimated at USD 1.02 billion in 2025 and expected to reach USD 1.09 billion in 2026, at a CAGR of 8.43% to reach USD 1.79 billion by 2032.

Introducing the Evolving Landscape of Titanium Additives and Their Growing Relevance in High-Performance Material Applications

Titanium additives have emerged as pivotal components in high-performance applications, offering unparalleled properties such as enhanced strength, abrasion resistance, and UV stability. From nanostructured titanium dioxide utilized in advanced coatings to carbide formulations enabling next-generation semiconductor fabrication, these additives are reshaping product portfolios across diverse industries. As global demand intensifies for lightweight, durable, and multifunctional materials, titanium additive technologies are gaining center stage in research laboratories and manufacturing lines alike.

This executive summary distills the critical findings of a detailed market research undertaking, articulating transformative trends, tariff impacts, segmentation dynamics, regional nuances, and competitive landscapes. By delineating clear insights into product innovation, end-use applications, and form factors, the analysis offers a strategic roadmap for stakeholders seeking to capitalize on emerging opportunities. Through methodical examination of supply chain shifts, regulatory influences, and technology adoption, this introduction sets the stage for informed decision-making and targeted investments within the titanium additives arena.

Exploring the Convergence of Nanotechnology Innovations and Sustainability Imperatives Reshaping Titanium Additives

The titanium additives market is undergoing profound transformation driven by technological breakthroughs and shifting customer priorities. Rapid advancements in nanotechnology have enabled the development of nano-sized titanium dioxide powders that deliver unprecedented opacity and UV shielding in automotive and architectural coatings. Concurrently, the integration of titanium aluminum carbide and titanium nitride in advanced electronics has unlocked new frontiers in thermal management, enabling semiconductors to operate at higher power densities with improved reliability.

Moreover, sustainability imperatives are reshaping the supply chain, prompting producers to adopt eco-friendly synthesis methods that reduce energy consumption and minimize hazardous byproducts. Green chemistry approaches are being integrated into the production of titanium dioxide, fostering closed-loop recycling initiatives within coatings and plastics manufacturing. In parallel, digitalization and Industry 4.0 frameworks are enhancing process control through real-time monitoring and predictive maintenance, driving cost optimization and quality consistency across production lines.

Geopolitical shifts and trade realignments have further accelerated the pace of change. Manufacturers are proactively diversifying sourcing strategies to mitigate the impacts of export restrictions and raw material shortages. Strategic partnerships and strategic capacity expansions in emerging markets are redefining competitive positioning, while start-ups harnessing proprietary synthesis techniques are challenging established players. Together, these transformative shifts constitute a dynamic environment where agility, innovation, and sustainability coalesce to shape the future of titanium additives.

Assessing the Cumulative Impact of United States Tariffs on Titanium Additives Supply Chains and Cost Structures

United States tariffs on titanium sponge and related intermediate compounds, introduced under Section 232 in 2018 and maintained into 2025, have exerted cumulative pressure on domestic manufacturing costs and supply chain stability. While initial measures targeted titanium metal, ancillary duties and anti-dumping actions on titanium forms have influenced feedstock availability for additive producers. As import duties increased, several downstream converters experienced input cost increments, prompting adjustments in pricing strategies and procurement policies.

In response, a segment of manufacturers repatriated certain production processes, investing in U.S. capacity expansions to bypass tariff barriers. This nearshoring trend has encouraged capital expenditure on advanced reactors and milling facilities, fostering local expertise and reducing reliance on imports. However, smaller specialty additive firms have encountered margin compression, with limited ability to absorb higher raw material costs or renegotiate supplier contracts. Consequently, partnerships between domestic sponge producers and value-added processors have become more prevalent, aiming to achieve end-to-end integration and mitigate tariff impacts.

On a broader scale, the tariff environment has accelerated innovation in alternative precursor development. Research initiatives targeting recycled titanium streams and secondary feedstocks are gaining traction, driven by both cost containment and environmental sustainability. Collaborative projects between industry consortia and government laboratories are exploring pyro-hydrometallurgical routes to produce titanium compounds domestically at competitive cost structures, potentially redefining the additive supply chain landscape beyond traditional tariff circumvention strategies.

Revealing Critical Insights from Product Types Applications End-Use Industries and Form Factors Guiding Titanium Additives Strategies

Insights into product-type segmentation reveal distinct growth vectors. Titanium aluminum carbide is capturing attention for extreme wear applications in mining and aerospace, whereas titanium carbide formulations are favored for high-heat environments. Titanium dioxide remains the cornerstone for UV-resistant coatings, benefiting from continuous improvements in surface treatment and dispersibility. The emergence of titanium nitride as a dielectric and conductive layer in electronics underscores the expanding utility of nitride chemistries beyond traditional hard coatings.

Application-based segmentation highlights the ascendancy of high-performance coatings, where architectural paint systems leverage nano-titanium dioxide to meet stringent environmental regulations and aesthetic demands, automotive coatings utilize tailored carbide blends for scratch and chemical resistance, and industrial coatings deploy functionalized particles to extend service life in harsh processing environments. In cosmetics, titanium additives serve as safe, inert colorants and UV filters, with makeup formulations prioritizing fine titanium dioxide grades and skincare products integrating anti-oxidative titanium nitride phases. Within plastics, titanium-based masterbatches ensure color consistency and UV stabilization across polyethylene packaging, polypropylene automotive parts, and PVC building materials.

End-use industries display differentiated adoption patterns. In automotive, aftermarket coatings rely on rapid-cure titanium systems for repair applications, while OEM coatings demand specialty formulations for superior gloss and corrosion resistance. The chemical sector incorporates titanium additives as catalysts and pigment precursors, with construction markets embracing them for long-lasting architectural finishes in commercial, infrastructure, and residential projects. Electronics and semiconductor fabrication offer high-value opportunities, particularly in electronic component layering and wafer processing, where titanium nitride serves as a barrier and adhesion layer critical to device performance.

Form factor segmentation underscores the strategic importance of handling and processing considerations. Granular inorganic and polymer-bound forms facilitate easy dosing and dispersion in masterbatch production. Masterbatches enable standardized additive concentrations, simplifying downstream compounding workflows. Micro and nano-sized powders provide high surface area for coatings and cosmetics, enhancing performance attributes. Slurries, both aqueous and solvent-based, support direct use in paints and inks, reducing processing steps and streamlining formulation protocols.

This comprehensive research report categorizes the Titanium Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- End Use Industry

Deciphering Regional Growth Dynamics Across the Americas Europe Middle East Africa and Asia-Pacific Titanium Additives Markets

Regional dynamics in the Americas are shaped by robust aerospace and automotive ecosystems, driving demand for high-purity titanium carbides and nitrides in coatings and additive manufacturing. The United States leads research collaborations focused on advanced titanium chemistries, while Canada and Brazil contribute significant raw material production and downstream processing expertise. Latin American markets are exploring pigment applications for agricultural films and consumer goods, highlighting evolving opportunities in emerging economies.

In Europe, Middle East, and Africa, stringent environmental regulations and the transition to electric vehicles are fueling demand for eco-friendly titanium dioxide grades in automotive coatings and architectural paints. Germany and France serve as innovation hubs for specialty additive development, supported by government incentives for green manufacturing and circular economy initiatives. The Middle East’s construction boom and North Africa’s growing cosmetics markets underscore diverse regional applications, while Africa’s nascent electronics sectors are beginning to integrate titanium nitride solutions in solar and telecommunication equipment.

Asia-Pacific remains the largest regional consumer of titanium additives, driven by China’s expansive coatings and plastics industries, Japan’s leadership in semiconductor materials, and South Korea’s electronics manufacturing clusters. India and Southeast Asia are rapidly scaling capacity for titanium dioxide production to serve burgeoning infrastructure projects, while Australia focuses on export-oriented feedstock supply. Regional trade agreements and free trade zones are facilitating cross-border collaboration, further cementing the Asia-Pacific region’s pivotal role in shaping global titanium additive trends.

This comprehensive research report examines key regions that drive the evolution of the Titanium Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Moves Partnerships and Technological Innovations Driving Key Titanium Additives Players

Leading firms in the titanium additives sector are pursuing differentiated strategies to gain competitive edge. One prominent player has expanded its vertical integration by acquiring upstream sponge facilities and establishing downstream coating lines, thereby capturing value across the supply chain and enhancing margin stability. Another global specialty chemicals provider is focusing on joint ventures with nano-technology start-ups to co-develop advanced titanium oxide dispersions, targeting premium automotive and electronics applications.

Strategic collaborations between pigment specialists and coating formulators have emerged as a key trend, enabling faster time-to-market for high-performance additive packages. Several established producers are increasing investment in digital R&D platforms, leveraging machine learning to optimize particle synthesis and functionalization processes. Meanwhile, niche manufacturers with proprietary titanium nitride chemistries are forging alliances with semiconductor equipment suppliers, securing long-term off-take agreements and enhancing their influence in critical technology supply chains.

Despite consolidation pressures, new entrants with modular manufacturing capabilities are disrupting traditional operations by offering flexible batch sizes and rapid prototyping services. These agile competitors are attracting investment for their ability to tailor formulations and accelerate innovation cycles. Established corporations are responding by streamlining global manufacturing footprints, rationalizing low-margin assets, and reinforcing customer support networks to maintain brand loyalty and service excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Titanium Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AP&C

- ATI Inc.

- Cinkarna Celje, d. d.

- Evonik Industries AG

- GfE Metalle und Materialien GmbH

- Ishihara Sangyo Kaisha, Ltd.

- Kronos Worldwide, Inc.

- LB Group Co. Ltd.

- Metalysis Limited

- Ningbo Zhongyuan Advanced Materials Technology Co. Ltd.

- OSAKA Titanium Technologies Co. Ltd.

- Reading Alloys, Inc.

- RTI International Metals, Inc.

- Shaanxi TMT Titanium Industry Co. Ltd.

- TAYCA Corporation

- TEKNA Plasma Technologies Inc.

- The Chemours Company

- Toho Titanium Co. Ltd.

- Tronox Limited

- Venator Materials PLC

Recommending Strategic Initiatives for Raw Material Diversification Collaboration and Sustainable Innovation in Titanium Additives

Industry leaders should prioritize diversification of raw material sourcing to mitigate geopolitical and tariff-related risks, exploring partnerships with recycled titanium feedstock providers and developing secondary processing capabilities to reduce exposure to external supply shocks. In parallel, investing in next-generation nanoformulations will differentiate product offerings by enabling enhanced performance characteristics and regulatory compliance, unlocking high-margin opportunities in automotive and electronics sectors.

Collaborative R&D initiatives with end-users offer a pathway to co-create bespoke additive solutions, aligning formulation parameters closely with application requirements in coatings and semiconductor fabrication. Establishing dedicated pilot lines for rapid prototyping and customer trials can accelerate adoption cycles and reinforce supplier-customer relationships. Furthermore, embedding sustainability frameworks across the value chain-such as closed-loop solvent recovery and energy-efficient synthesis routes-will not only meet evolving regulatory standards but also resonate with environmentally conscious buyers.

To enhance market intelligence capabilities, organizations should deploy advanced data analytics platforms that integrate real-time pricing, consumption patterns, and patent trends. This will facilitate proactive decision-making and early identification of emerging competitors. Finally, engaging with policymakers through industry associations can shape future trade policies and environmental regulations, ensuring that tariff structures and sustainability mandates reflect the interests of domestic titanium additive producers and their downstream customers.

Detailing the Rigorous Research Framework Blending Primary Interviews Secondary Analysis and Data Triangulation

The research methodology underpinning this analysis combines primary interviews, secondary literature review, and data triangulation to ensure robust insights. Primary interviews were conducted with industry executives, technical R&D leaders, and procurement managers across coatings, electronics, and plastics segments, offering firsthand perspectives on market dynamics and supply chain challenges. Secondary research encompassed peer-reviewed journals, patent databases, regulatory filings, and trade association publications to validate technological and regulatory trends.

Quantitative insights were derived through bottom-up analysis of production capacities, process yields, and input-output ratios, supplemented by qualitative assessments of innovation pipelines and strategic initiatives. Data triangulation was applied to reconcile any discrepancies between publicly disclosed financial reports, proprietary supplier information, and anecdotal findings from field visits. Cross-validation processes and expert panel reviews ensured that the final conclusions reflect a balanced perspective, minimizing bias and enhancing the credibility of the recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Titanium Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Titanium Additives Market, by Product Type

- Titanium Additives Market, by Form

- Titanium Additives Market, by Application

- Titanium Additives Market, by End Use Industry

- Titanium Additives Market, by Region

- Titanium Additives Market, by Group

- Titanium Additives Market, by Country

- United States Titanium Additives Market

- China Titanium Additives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Concluding Synthesis of Technological Sustainability and Strategic Realignments Shaping the Titanium Additives Industry

In summary, the titanium additives market stands at a crossroads defined by technological innovation, sustainability imperatives, and evolving trade policies. Nanotechnology breakthroughs are expanding the performance envelope of titanium compounds, while environmental and regulatory pressures are driving greener production pathways. Tariff measures have catalyzed strategic realignments, with nearshoring and value chain integration emerging as key responses to cost and supply uncertainties.

Segmentation analysis underscores the diverse applications and form factors that demand tailored additive solutions, from high-purity powders for semiconductor fabrication to masterbatches for durable plastics. Regional insights reveal unique market drivers and collaboration opportunities across the Americas, EMEA, and Asia-Pacific, each with distinct regulatory landscapes and end-use priorities. Competitive dynamics are characterized by established players reinforcing scale and integration, alongside agile entrants leveraging modular manufacturing and rapid innovation cycles.

Looking ahead, success will hinge on the ability to innovate sustainably, forge strategic partnerships, and maintain supply chain resilience. By embracing a holistic approach that aligns product development with customer needs and regulatory requirements, industry participants can unlock new growth vectors and reinforce leadership positions in the evolving titanium additives ecosystem.

Empower Your Strategic Planning by Securing Direct Access to the Comprehensive Titanium Additives Market Report with Ketan Rohom

To explore tailored insights and unlock in-depth analysis that will empower your strategic initiatives in the rapidly evolving titanium additives landscape, connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By partnering directly, you will gain early access to proprietary data, expert commentary, and customized advisory sessions designed to accelerate decision-making and drive measurable impact in coatings, electronics, cosmetics, and beyond. Reach out today to secure your comprehensive market research report and position your organization at the forefront of innovation and growth.

- How big is the Titanium Additives Market?

- What is the Titanium Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?