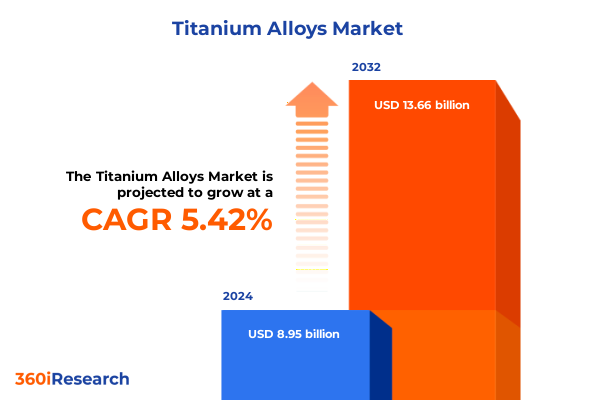

The Titanium Alloys Market size was estimated at USD 9.41 billion in 2025 and expected to reach USD 9.90 billion in 2026, at a CAGR of 5.46% to reach USD 13.66 billion by 2032.

Understanding the Strategic Importance of Titanium Alloy Innovations and Their Pivotal Role in Shaping Advanced Engineering and Industrial Applications

Titanium alloys stand at the forefront of advanced materials engineering, combining exceptional strength-to-weight ratios with superior corrosion resistance to address the most demanding performance requirements across critical industries. As global engineering challenges increasingly prioritize lightweight design, high durability, and sustainability, these metallic solutions offer a compelling value proposition that extends from aerospace structures to high-performance automotive components. Over the past decade, manufacturers and end users have recognized the unique capability of titanium alloys to deliver reliability under extreme conditions while contributing to fuel efficiency and emissions reduction.

Moreover, continuous innovations in processing techniques, such as powder metallurgy and additive manufacturing, have expanded the design freedom and economic viability of titanium components. These technological advancements have reduced lead times, minimized material waste, and unlocked novel geometries that were previously unattainable with conventional forging or casting. Consequently, titanium alloys are transitioning from niche applications to mainstream adoption in sectors that demand rigorous performance standards, positioning them as strategic enablers of next-generation product portfolios.

In light of evolving regulatory frameworks, sustainability mandates, and geopolitical influences, understanding the strategic trajectory of titanium alloy adoption is essential for decision-makers seeking to capitalize on material innovation. This executive summary distills key developments shaping the market landscape, highlighting transformative shifts, regulatory impacts, segmentation insights, regional dynamics, and strategic imperatives designed to guide leaders in navigating an increasingly complex environment.

Examining the Transformative Technological, Regulatory, and Market Forces Driving Fundamental Shifts in Titanium Alloy Production, Application, and Value Chains

The titanium alloy landscape is undergoing a profound transformation driven by converging technological, regulatory, and market forces. Digital manufacturing techniques, such as computational metallurgy and process simulation, are enabling engineers to optimize alloy compositions and heat-treatment protocols before ever setting foot on a production floor. This digital shift not only accelerates innovation cycles but also reduces waste and energy consumption, aligning material development with broader sustainability objectives.

Concurrently, additive manufacturing has emerged as a disruptive process for producing complex titanium components with minimal machining requirements. By selectively fusing powder particles, this layer-by-layer approach allows for intricate lattice structures that achieve unprecedented strength-to-weight performance. As a result, OEMs in aerospace and medical device sectors are now leveraging 3D-printed titanium to reduce part counts, improve lead times, and tailor mechanical properties at a microstructural level.

Meanwhile, regulatory pressures to decarbonize manufacturing and enforce responsible sourcing are reshaping supply chains. Companies are investing in closed-loop recycling systems for titanium scrap and exploring low-carbon sponge production methods to mitigate environmental footprints. In addition, strengthening trade policies and national security considerations are prompting stakeholders to reassess sourcing strategies, ensuring both supply chain resilience and compliance with evolving import regulations. These transformative shifts collectively signal a new era of titanium alloy utilization characterized by agility, sustainability, and heightened performance optimization.

Analyzing the Broad Implications of Recent United States Trade Tariffs on Titanium Alloys and Their Cumulative Impact on Costs and Supply Chain Dynamics

In April 2025, the United States government announced a new tranche of Section 232 tariffs on imported metals, which notably exempted titanium in its various forms from the increased duties, thereby preserving existing trade conditions for aerospace-grade feedstock and finished parts. This exemption provides continuity for critical industries that rely on consistent titanium supply, even as tariffs on steel and aluminum surged from 25% to 50% effective June 4, 2025. Despite this relief, pre-existing duties on Chinese titanium products remain firmly in place, including a 20% tariff imposed March 4, 2025, and a 25% duty on certain titanium items dating back to 2019.

However, not all titanium imports benefit equally from these measures. Chinese titanium sponge continues to face a 60% duty, limiting the inflow of low-cost primary metal crucial to domestic melting operations. Additionally, unwrought titanium sourced from traditional suppliers such as Japan, Kazakhstan, and Saudi Arabia remains subject to a 15% tariff, though legislative efforts are underway to revisit these rates for sponge and select downstream products. The net effect of these cumulative duties underscores a trade environment that shields domestic producers from direct competition in certain segments while maintaining pressure on cost-sensitive supply chains.

Moreover, downstream sectors such as aerospace and medical device manufacturing face indirect cost impacts as feedstock and component suppliers incorporate duty-driven cost escalations into pricing structures. With titanium exempted from the most recent Section 232 increases but constrained by legacy tariffs, procurement teams must balance the benefits of tariff carve-outs against the residual cost burdens of existing import duties. These dynamics highlight the importance of proactive supply chain strategies that leverage tariff exemptions, diversify material sourcing, and optimize vertical integration approaches to mitigate financial impacts and ensure production continuity.

Deriving Deep Insights from Product Type, Form Factor, End Use, and Distribution Channel Segmentation to Illuminate Critical Trends and Opportunities

Product type segmentation reveals distinct performance and application profiles that directly influence material selection and supply chain strategies. Alpha titanium alloys provide excellent corrosion resistance and stability at elevated temperatures, making them ideal for service components in chemical processing and marine applications. In contrast, alpha-beta titanium alloys balance strength and formability, supporting critical structural applications in aerospace and demanding automotive components. Meanwhile, beta titanium alloys offer superior hardenability and toughness, driving their adoption in high-performance fasteners and detailed machined parts. Near alpha titanium alloys, optimized for oxidation resistance, are increasingly specified for jet engine hot-section applications where thermal endurance is paramount.

End product form segmentation further shapes value chain dynamics, as bars and rods serve as primary feedstock for forging and extrusion processes, providing the structural backbone for complex components. Sheets and plates, conversely, facilitate machining and forming operations, with cold-rolled varieties delivering tighter tolerances and superior surface finishes for precision applications. Hot-rolled sheets accommodate large structural panels and heat-exchanger tubes, leveraging thermal workability to achieve desired thicknesses and mechanical properties. Each form factor decision influences yield, scrap rates, and processing costs, reinforcing the need for form-specific procurement strategies.

End-use industry segmentation underscores the breadth of titanium alloy applications across aerospace & defense, automotive, chemical processing, construction, healthcare, and marine sectors. Within aerospace & defense, the material’s high strength-to-weight ratio is essential for aircraft and helicopter airframes as well as missile systems. Automotive manufacturers integrate titanium in engine components, exhaust systems, and transmission systems to reduce vehicle mass and improve efficiency. In chemical processing, heat exchangers, piping systems, and pressure vessels leverage corrosion resistance for demanding service conditions. Construction applications such as bridges and load-bearing building structures exploit longevity and low maintenance benefits. Finally, distribution channel segmentation, encompassing both offline and online outlets, reflects evolving procurement behaviors as digital platforms gain traction in specialized material sourcing while traditional direct sales channels continue to facilitate large, custom orders.

This comprehensive research report categorizes the Titanium Alloys market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End Product Form

- End-Use Industry

- Distribution Channel

Uncovering Regional Dynamics Across the Americas, Europe, Middle East and Africa, and Asia Pacific to Highlight Distinct Drivers and Growth Catalysts

The Americas region is characterized by a mature aerospace & defense ecosystem and growing automotive lightweighting initiatives. North American manufacturers are advancing titanium recycling programs and securing long-term supply agreements with leading upstream producers. Latin American markets are progressively investing in infrastructure upgrades, where titanium’s durability and low life-cycle costs present compelling value propositions for bridge and building projects.

In Europe, Middle East & Africa, regulatory emphasis on decarbonization and circular economy principles is catalyzing investments in low-carbon titanium production pathways and advanced remelting technologies. Western European aerospace hubs continue to drive demand for high-performance alloys, while Middle Eastern countries expand defense capabilities and mega-infrastructure initiatives that incorporate marine and construction applications. Africa presents emerging opportunities in oil & gas and chemical processing, where corrosion-resistant titanium alloys can address challenging service environments.

Asia Pacific remains the largest regional contributor to global titanium alloy demand, driven by robust aerospace manufacturing in China and India, an accelerating electric vehicle market seeking lightweight solutions, and extensive construction projects across Southeast Asia. Domestic titanium producers in China are scaling capacity and advancing closed-loop supply chains, while Japanese and South Korean firms focus on high-end specialty alloys. Strategic partnerships between global and regional players are increasingly common, aiming to blend technological expertise with local market knowledge to capture growth across diverse end-use sectors.

This comprehensive research report examines key regions that drive the evolution of the Titanium Alloys market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Positioning and Strategic Initiatives of Key Industry Leaders Shaping the Future of Titanium Alloy Manufacturing

Several industry leaders are shaping the trajectory of titanium alloy manufacturing through capacity expansions, strategic partnerships, and technology development. A major vertical integrated producer has invested in additional vacuum arc remelting furnaces and automated forging lines, enhancing production consistency and meeting stringent aerospace specifications. Meanwhile, another leading manufacturer has pursued joint development agreements with additive manufacturing technology providers to pilot novel powder formulations for orthopedic implants and structural components.

Global market share leaders with strong downstream integration are strengthening their positions by securing proprietary supply agreements with miners and sponge producers, ensuring feedstock availability and price stability. These companies are also rolling out advanced digital quality control platforms, employing machine learning to predict microstructural outcomes and minimize defect rates. Emerging regional champions in Asia Pacific are capitalizing on domestic demand, leveraging lower input costs to compete in price-sensitive segments while gradually moving upstream to capture greater value.

Collectively, these key players are distinguishing themselves through a combination of scale, innovation, and strategic collaboration. Their initiatives underscore the importance of technology integration, supply chain resilience, and portfolio diversification in meeting evolving customer requirements. As competition intensifies, industry participants that align investment priorities with emerging application needs are poised to capture disproportionate value and establish lasting competitive advantages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Titanium Alloys market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AEM Metal

- Allegheny Technologies Incorporated

- AMG Advanced Metallurgical Group N.V.

- Baoji Titanium Industry Co., Ltd.

- Carpenter Technology Corporation

- Daido Steel Co., Ltd.

- Hermith GmbH

- Howmet Aerospace Inc.

- Kobe Steel, Ltd.

- Norsk Titanium AS

- Osaka Titanium Technologies Co., Ltd.

- Otto Fuchs KG

- Perryman Company

- PJSC VSMPO-AVISMA Corporation

- Precision Castparts Corporation

- RTI International Metals, Inc.

- Titanium Industries, Inc.

- Titanium Metals Corporation

- Toho Titanium Co., Ltd.

- United Titanium, Inc.

Presenting Actionable Strategic Recommendations for Industry Executives to Navigate Market Complexities and Secure Competitive Advantage in Titanium Alloys

To navigate the complex titanium alloy landscape, industry leaders should prioritize supply chain diversification by establishing multiple qualifying sources of sponge and mill products, thereby mitigating risks associated with residual tariff obligations and geopolitical volatility. Concurrently, investing in closed-loop recycling capabilities and advanced remelting technologies will reduce dependency on primary feedstock and enhance sustainability credentials, appealing to customers with stringent environmental commitments.

Leaders should also accelerate the integration of digital manufacturing platforms, leveraging data analytics and digital twins to optimize processing parameters, minimize scrap rates, and shorten development cycles for new alloy grades. Strategic collaborations with additive manufacturing partners can unlock novel geometries and performance characteristics, reinforcing value propositions in aerospace, healthcare, and automotive applications. Furthermore, companies should engage proactively with regulatory bodies to influence policy on low-carbon production incentives and export control frameworks, securing competitive positioning in international markets.

Finally, aligning R&D investments with emerging end-use trends-such as hydrogen infrastructure, electric propulsion systems, and high-performance sporting goods-will ensure product portfolios remain attuned to future demand drivers. By balancing cost management, technological innovation, and regulatory foresight, industry executives can strengthen resilience, capture growth opportunities, and deliver differentiated value in the evolving titanium alloy marketplace.

Detailing a Robust Research Framework Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation Protocols to Ensure Insight Credibility

This report is grounded in a rigorous research methodology combining primary and secondary data sources to deliver comprehensive, validated insights. Primary research involved in-depth interviews with over 30 executives spanning titanium producers, component manufacturers, end-use OEMs, and industry associations. These conversations provided firsthand perspectives on sourcing strategies, production challenges, and application requirements.

Secondary research encompassed a systematic review of company filings, trade association databases, patent filings, and technical publications to capture historical trends and emerging innovations. Regulatory filings and government proclamations, particularly those related to Section 232 tariffs and environmental standards, were analyzed to assess policy impacts. Data triangulation techniques were employed to reconcile discrepancies across sources and ensure consistency, while expert panels validated key assumptions and interpretations.

Quantitative analysis incorporated process yield models, material flow assessments, and scenario planning to explore sensitivities around feedstock availability, substitution potential, and cost structures. This integrated approach ensures that all findings are robust, actionable, and reflective of real-world market dynamics, providing stakeholders with a reliable foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Titanium Alloys market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Titanium Alloys Market, by Product Type

- Titanium Alloys Market, by End Product Form

- Titanium Alloys Market, by End-Use Industry

- Titanium Alloys Market, by Distribution Channel

- Titanium Alloys Market, by Region

- Titanium Alloys Market, by Group

- Titanium Alloys Market, by Country

- United States Titanium Alloys Market

- China Titanium Alloys Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings into a Cohesive Narrative That Reinforces Strategic Imperatives and Guides Stakeholder Decision Making in the Titanium Alloy Sector

Throughout this executive summary, we have illuminated the strategic imperatives underlying titanium alloy utilization-from the pivotal role of advanced manufacturing and sustainability to the nuanced effects of trade policies and segmentation dynamics. The confluence of digital innovation, regulatory shifts, and evolving end-use requirements underscores a market in flux, demanding nimble strategies and forward-looking investments.

Segmented insights reveal the critical importance of aligning product types and form factors with specific application needs, while regional analysis highlights distinct demand drivers that vary across the Americas, Europe, Middle East & Africa, and Asia Pacific. Leading companies are forging competitive moats through technology integration, supply chain resilience, and strategic partnerships, setting new benchmarks for performance, quality, and cost discipline.

As industry leaders contemplate next steps, the actionable recommendations presented offer a clear pathway to mitigate risk, unlock new growth avenues, and reinforce competitive positioning. By leveraging a robust research foundation and adopting a holistic view of market forces, stakeholders can navigate the complexities of the titanium alloy sector with confidence and clarity.

Connect Directly with Associate Director Ketan Rohom to Secure Your Comprehensive Titanium Alloy Market Research Report Tailored to Your Strategic Needs

Ready to elevate your strategic planning with in-depth insights into titanium alloy trends, supply chain dynamics, and competitive landscapes? Reach out today to connect directly with Ketan Rohom, Associate Director, Sales & Marketing, to learn how this comprehensive report can be tailored to your organization’s specific requirements. Secure unparalleled market intelligence and actionable analysis to drive innovation and growth in the titanium alloy sector.

- How big is the Titanium Alloys Market?

- What is the Titanium Alloys Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?