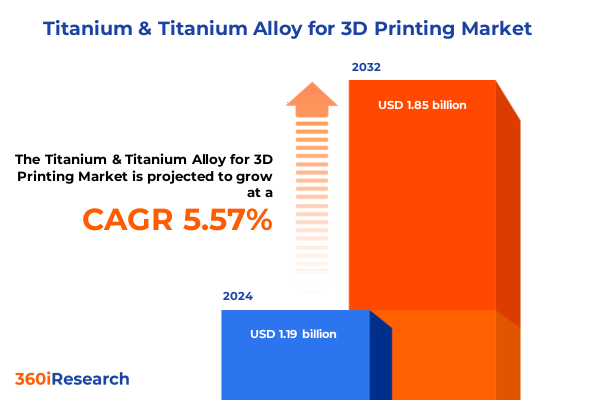

The Titanium & Titanium Alloy for 3D Printing Market size was estimated at USD 1.24 billion in 2025 and expected to reach USD 1.32 billion in 2026, at a CAGR of 5.80% to reach USD 1.85 billion by 2032.

Understanding the Role of High-Performance Titanium Materials in Shaping the Future of 3D Printing for Critical Aerospace, Medical, and Industrial Applications

The convergence of additive manufacturing and advanced titanium materials is generating unprecedented opportunities across critical industries. With intrinsic properties such as high strength-to-weight ratio, corrosion resistance, and biocompatibility, pure titanium and titanium alloys are redefining performance benchmarks in aerospace, medical, automotive, and industrial sectors. As prototypes evolve into complex production parts, manufacturers are embracing 3D printing to capitalize on geometries and topologies that were once unattainable through conventional subtractive methods.

Innovations in titanium powder production and alloy formulation now deliver consistent particle size distribution and optimal flow characteristics. These enhancements have notably elevated the reliability of powder bed fusion processes and directed energy deposition, enabling the fabrication of intricate engine components, lightweight structural elements, and custom medical implants. In turn, this progress is driving collaboration between material scientists, equipment vendors, and end users to co-develop application-specific solutions that accelerate product development cycles.

Furthermore, the integration of digital twins and real-time monitoring platforms is fostering tighter control over critical parameters such as melt pool dynamics, residual stress, and microstructure evolution. These advancements support a shift from prototyping toward qualified production runs, bolstering confidence among original equipment manufacturers and regulatory authorities. Consequently, the additive manufacturing ecosystem is poised to transition from a niche innovation stage toward mainstream adoption of titanium-based components.

Examining the Technological Breakthroughs and Market-Driven Dynamics Transforming Titanium Additive Manufacturing Landscape Across Industries

The titanium additive manufacturing landscape is undergoing transformative shifts driven by rapid advancements in materials science, equipment design, and digital integration. Recent breakthroughs in alloy development have yielded variants such as Ti6Al4V ELI with enhanced ductility and fatigue resistance tailored for load-bearing medical and aerospace applications. Simultaneously, refinements in powder atomization techniques are producing ultra-fine, spherical powders that optimize layer deposition and reduce porosity, elevating part performance and repeatability.

Moreover, the emergence of hybrid systems that combine directed energy deposition and subtractive machining within a single platform is redefining precision and cycle times. These hybrid cells facilitate near-net-shape manufacturing for large-scale structures, cutting down on material waste and post-processing efforts. In parallel, the adoption of AI-driven process parameter optimization is enabling predictive control of thermal gradients and microstructure outcomes, minimizing trial-and-error experimentation and accelerating certification pathways.

In addition to these technological evolutions, strategic alliances between equipment manufacturers and service bureaus are fostering end-to-end ecosystems that encompass powder supply, design for additive manufacturing consultancy, and part qualification services. This collaborative model is reshaping value chains by streamlining customer access to turnkey solutions, reducing time to market, and democratizing the use of titanium materials across a broader spectrum of applications.

Analyzing the Cumulative Impact of the 2025 United States Tariffs on Titanium and Titanium Alloy Supply Chains and Manufacturing Costs

In 2025, the United States implemented a series of cumulative tariffs targeting critical raw materials, including titanium sponge and alloy imports, in response to trade imbalances and domestic supply chain vulnerabilities. These levies have materially increased landed costs for manufacturers relying on imported feedstocks, prompting a reassessment of sourcing strategies. As a result, organizations have initiated dialogues with mineral producers in Australia and Kazakhstan to negotiate long-term supply agreements that mitigate exposure to tariff-induced price volatility.

Furthermore, the tariff impositions have accelerated investments in local titanium sponge production facilities, with several mining and metallurgical firms announcing expansion projects to establish domestic refining capabilities. These developments aim to shorten supply chains, reduce freight risks, and ensure compliance with evolving regulatory standards. However, the transition toward localized material generation carries upfront capital expenditure and extended timeline considerations, emphasizing the need for robust risk assessments and phased implementation plans.

Consequently, additive manufacturers are exploring alternative alloy chemistries and scrap recycling programs to alleviate cost pressures. By optimizing powder reuse protocols and leveraging closed-loop material traceability, companies can preserve feedstock quality while improving overall production economics. This strategic pivot underscores the importance of supply chain resilience and underscores that tariff policies, while challenging, can catalyze self-sufficiency and innovation within the titanium 3D printing community.

Deriving Strategic Insights from Diverse Application, Material, Technology, Form, and Distribution Segmentation Frameworks within Titanium 3D Printing

Deriving meaningful insights from the multifaceted segmentation of the titanium 3D printing market reveals nuanced growth drivers and competitive differentiators. When considering applications, aerospace and defense dominate due to critical engine component and structural parts requirements, while automotive firms are increasingly adopting custom tools, heat exchangers, and lightweight components to meet stringent emissions and efficiency targets. Simultaneously, the consumer goods sector is exploring design freedoms for personalized products, and industrial players leverage titanium’s durability for wear-resistant tooling. In the medical domain, dental implants, orthopedic implants, and surgical instruments benefit from biocompatibility and patient-specific geometries, whereas oil and gas operators demand corrosion-resistant parts for extreme environments.

Turning to material types, pure titanium retains a core position in applications where weight reduction and corrosion resistance are paramount. In contrast, titanium alloys such as Ti6Al4V and its ELI grade are favored for their superior mechanical strength and fatigue properties, unlocking performance envelopes necessary for aerospace airframes and medical orthopedics. The interplay between material selection and post-processing heat treatments also influences microstructure and, ultimately, part lifecycle.

Evaluating printing technologies uncovers distinct value propositions: directed energy deposition, encompassing both laser-DED and wire arc additive manufacturing, offers near-net-shape capabilities for large structures, while powder bed fusion-via electron beam melting and selective laser melting-delivers high surface finish and precision for complex geometries. Material form further refines this landscape; powders drive powder bed fusion processes, wires optimize feed rates in wire-arc systems, and filaments cater to emerging extrusion-based titanium printers. Finally, distribution channels ranging from direct sales to distributors and online platforms shape market accessibility, with each route offering different levels of service support, inventory management, and delivery speed.

This comprehensive research report categorizes the Titanium & Titanium Alloy for 3D Printing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Printing Technology

- Application

- Distribution Channel

Unveiling Regional Dynamics and Growth Drivers Shaping Titanium and Titanium Alloy 3D Printing Markets across Americas, EMEA, and Asia-Pacific

A regional perspective underscores varied market dynamics and strategic imperatives across the globe. In the Americas, established aerospace primes and a robust defense sector drive significant demand for titanium 3D printing, supported by government initiatives to bolster domestic manufacturing capabilities. Lead users are advancing qualification protocols for critical parts, while U.S. and Canadian companies invest in powder production and recycling facilities to secure feedstock continuity.

Meanwhile, Europe, Middle East & Africa presents a heterogeneous terrain. Western European nations benefit from advanced research collaborations, particularly in alignment with aerospace tier-one suppliers and medical device clusters. The Middle East is cultivating additive manufacturing hubs through sovereign wealth fund investments and technology parks, whereas African markets remain in nascent stages, focusing on training and pilot projects to demonstrate feasibility and skill development.

In the Asia-Pacific region, growth is propelled by a mix of high-volume industrial applications and cost-competitive manufacturing ecosystems. Japan and South Korea excel in equipment innovation, leveraging strong electronics and semiconductor manufacturing traditions to refine process control. China is aggressively scaling additive capabilities for energy and automotive sectors, while emerging markets such as India and Southeast Asia are integrating titanium 3D printing into medical and dental manufacturing, tapping into large patient populations and favorable regulatory reforms.

This comprehensive research report examines key regions that drive the evolution of the Titanium & Titanium Alloy for 3D Printing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Market Forces among Prominent Organisations Driving Titanium Additive Manufacturing Excellence Globally

Leading organizations are shaping the competitive contours of the titanium additive manufacturing market through technological leadership, strategic partnerships, and targeted acquisitions. Major equipment suppliers continue to refine laser and electron beam platforms, embedding in-process monitoring and closed-loop feedback to elevate part quality. At the same time, alloy developers and powder specialists collaborate closely with hardware vendors to co-engineer feedstocks that maximize process efficiency and mechanical performance.

Service bureaus are consolidating value chains by integrating design for additive manufacturing expertise, qualification labs, and post-processing centers. These full-service models facilitate rapid prototyping to production transitions, appealing to customers seeking turnkey solutions. Additionally, component manufacturers across aerospace, automotive, and medical industries are forming joint ventures with technology providers to secure preferred access to capacity and co-create next-generation applications.

Furthermore, academic institutions and national laboratories are forging consortia that blend fundamental research with industry-driven use cases, ensuring continuous innovation in alloy development, process simulation, and certification methodologies. This tri-sector ecosystem accelerates knowledge transfer and mitigates technical risks, fostering an environment where emerging players can compete alongside established incumbents by leveraging shared research infrastructures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Titanium & Titanium Alloy for 3D Printing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems Corporation

- ADMA Products Pte Ltd.

- Advanced Powders & Coatings Inc.

- Allegheny Technologies Incorporated

- Amaero International Limited

- Carpenter Technology Corporation

- CNPC POWDER

- EOS GmbH

- Fengxiang Titanium Material & Powder Co., Ltd.

- GKN Powder Metallurgy

- Global Titanium & Powder Co. Ltd.

- H.C. Starck Solutions GmbH & Co. KG

- JX Metals Group

- LPW Technology Ltd.

- Metal3DP

- Oerlikon Metco AG

- Puris LLC

- Renishaw plc

- Sandvik AB

- TLS Technik GmbH & Co. KG

- VSMPO-AVISMA Corporation

Actionable Strategies and Best Practices for Industry Leaders to Capitalize on Titanium 3D Printing Innovations and Strengthen Competitive Advantage

Industry leaders seeking to harness the full potential of titanium 3D printing must adopt a strategic, multidimensional approach. First, investing in collaborative R&D partnerships with material scientists and equipment providers can yield tailored alloy formulations and process parameter libraries optimized for specific application requirements. By co-developing solutions, organizations can reduce qualification timelines and improve component performance.

Simultaneously, building supply chain resilience through dual-sourcing strategies and localized material production will buffer against geopolitical risks and tariff fluctuations. Establishing regional powder manufacturing or recycling hubs can secure feedstock availability and enable rapid response to demand fluctuations. Moreover, implementing robust quality assurance frameworks, including powder traceability and in-process monitoring, will reinforce trust among OEMs and regulatory bodies.

Finally, companies should prioritize workforce upskilling and cross-functional training to cultivate a talent pool proficient in design for additive manufacturing principles, metallurgical fundamentals, and digital twin utilization. By fostering a culture of continuous learning and innovation, organizations can accelerate adoption, drive cost efficiencies, and maintain a competitive edge in the evolving additive manufacturing ecosystem.

Detailing the Rigorous Research Methodology Underpinning Comprehensive Analysis of Titanium and Titanium Alloy Additive Manufacturing Markets

The research underpinning this analysis follows a structured, multi-phase methodology designed to ensure rigor, accuracy, and practical relevance. Initially, a comprehensive review of secondary sources, including peer-reviewed journals, technical white papers, patent filings, and regulatory publications, established a foundational understanding of material properties, process technologies, and industrial use cases. This desk research was complemented by an extensive mapping of global supply chains and policy frameworks.

Subsequently, primary research involved in-depth interviews with stakeholders across the value chain-ranging from powder manufacturers and equipment OEMs to service bureaus, end-users in aerospace, medical device companies, and trade association experts. These discussions enabled the validation of quantitative findings and provided granular insights into investment priorities, qualification challenges, and emerging application areas.

Finally, a rigorous data triangulation process integrated secondary and primary inputs, ensuring consistency and reliability. Segmentation definitions were refined iteratively to reflect real-world product categorizations and customer buying behaviors. Quality checks, including peer reviews and technical audits, were conducted to align the final deliverables with the highest standards of market intelligence excellence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Titanium & Titanium Alloy for 3D Printing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Titanium & Titanium Alloy for 3D Printing Market, by Material Type

- Titanium & Titanium Alloy for 3D Printing Market, by Printing Technology

- Titanium & Titanium Alloy for 3D Printing Market, by Application

- Titanium & Titanium Alloy for 3D Printing Market, by Distribution Channel

- Titanium & Titanium Alloy for 3D Printing Market, by Region

- Titanium & Titanium Alloy for 3D Printing Market, by Group

- Titanium & Titanium Alloy for 3D Printing Market, by Country

- United States Titanium & Titanium Alloy for 3D Printing Market

- China Titanium & Titanium Alloy for 3D Printing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing Critical Findings and Strategic Implications for Stakeholders in the Titanium and Titanium Alloy 3D Printing Ecosystem

This executive summary has illuminated the critical dynamics shaping the titanium and titanium alloy 3D printing landscape, from transformative material and process innovations to the strategic reverberations of U.S. tariff policies. The segmentation analysis has revealed diverse application needs, material preferences, and technology adoption patterns, while the regional overview highlighted distinct growth corridors and investment hotspots across the Americas, EMEA, and Asia-Pacific.

Prominent organizations are driving market evolution through integrated service offerings, collaborative research consortia, and focused capital investments in localized production capabilities. To remain competitive, industry stakeholders must pursue co-development partnerships, fortify supply chain resilience, and cultivate specialized talent. The actionable recommendations presented herein provide a roadmap for translating insights into strategic initiatives that will enhance product quality, shorten time to market, and optimize cost structures.

In conclusion, the burgeoning maturity of titanium additive manufacturing signals a pivotal shift toward mainstream production readiness. Organizations that align their strategies with evolving material technologies, leverage regional advantages, and maintain agility in the face of policy headwinds will be best positioned to capture the full spectrum of opportunities in this high-growth domain.

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to Secure Your In-Depth Titanium and Titanium Alloy 3D Printing Market Research Report Today

To explore the full breadth of insights and strategic guidance in Titanium and Titanium Alloy additive manufacturing, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your in-depth market research report. Engage directly with an expert to gain tailored intelligence, access exclusive data, and uncover actionable pathways that will accelerate innovation and growth within your organization. Whether you aim to optimize your supply chain, refine material strategies, or expand into emerging regional markets, this report provides the comprehensive analysis and practical recommendations necessary to drive sustainable competitive advantage in the evolving 3D printing landscape.

- How big is the Titanium & Titanium Alloy for 3D Printing Market?

- What is the Titanium & Titanium Alloy for 3D Printing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?