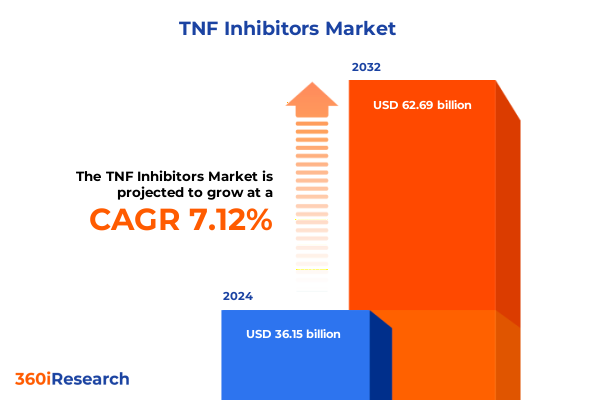

The TNF Inhibitors Market size was estimated at USD 26.08 billion in 2025 and expected to reach USD 27.33 billion in 2026, at a CAGR of 5.07% to reach USD 36.89 billion by 2032.

Setting the Stage for the Current TNF Inhibitors Market Dynamics, Emerging Treatment Paradigms, and Strategic Imperatives to Guide Future Investments

The landscape of chronic inflammatory diseases has evolved dramatically over the past decade, driven in large part by the advent of tumor necrosis factor (TNF) inhibitors. These biologic therapies have transformed treatment paradigms for conditions ranging from rheumatoid arthritis to ulcerative colitis by targeting a key cytokine in the inflammatory cascade. As more patients achieve remission and improved quality of life, the industry has witnessed a surge of innovation, fierce competition among originators and biosimilars alike, and a demand for deeper strategic insights.

Against this backdrop, market stakeholders must navigate intricate pipelines, shifting regulatory requirements, and intensifying pricing pressures. Moreover, the convergence of novel delivery mechanisms and patient-centric care models underscores the need for adaptable business strategies. This executive summary provides a comprehensive overview of the forces shaping the TNF inhibitors sector, examining industry-transforming shifts, the cumulative effects of recent U.S. tariffs, and critical segmentation and regional perspectives.

By synthesizing these dimensions, decision-makers can understand how indications such as Crohn disease, plaque psoriasis, and psoriatic arthritis each present distinct clinical and commercial considerations. In addition, insight into drug types, distribution channels, administration routes, and end users will illuminate pathways to optimize market penetration. Finally, actionable recommendations will equip industry leaders to refine R&D priorities, streamline access strategies, and foster collaborative growth. This introduction sets the stage for a detailed exploration of the market forces redefining TNF inhibitors today.

Unveiling the Transformative Shifts in Therapeutic Innovations, Competitive Dynamics, and Patient-Centric Approaches Redefining the TNF Inhibitors Landscape

The TNF inhibitors market has undergone seismic transformations driven by scientific breakthroughs, regulatory milestones, and evolving stakeholder expectations. Biologic therapies have proliferated as patent expirations unlocked the rise of biosimilars, while advanced molecular engineering has enabled next-generation antibody fragments with improved receptor specificity and half-life profiles. Concurrently, patient advocacy and real-world evidence initiatives have elevated the importance of safety and long-term outcome data, compelling both originator and biosimilar developers to invest in comprehensive post-marketing studies.

Moreover, competitive dynamics have intensified as strategic alliances and licensing agreements multiply. Established pharmaceutical giants collaborate with emerging biotech firms to leverage complementary strengths in R&D, manufacturing, and commercial execution. Value-based contracting and risk-sharing frameworks are reshaping payer relationships, incentivizing companies to demonstrate cost-effectiveness and patient adherence in clinical practice. As a result, market entrants must not only offer therapeutic differentiation but also deliver quantifiable value across the care continuum.

In parallel, digital health solutions and telemedicine platforms are revolutionizing patient engagement and supply chain logistics. Remote monitoring and direct-to-patient distribution channels address barriers to access, particularly for patients in rural or underserved areas. These convergent trends underscore a broader shift toward patient-centric business models, where speed to market, affordability, and seamless care coordination are as crucial as clinical efficacy. Through these transformative forces, the TNF inhibitors landscape continues to redefine the therapeutic frontier.

Assessing the Cumulative Impact of 2025 United States Tariffs on Supply Chains, Pricing Structures, Market Access, and Regulatory Compliance for TNF Inhibitors

In 2025, cumulative United States tariffs on imported pharmaceutical ingredients and biomanufacturing equipment have imposed nuanced challenges on the TNF inhibitors value chain. Increased duties on key components have reverberated through contract manufacturing organizations, elevating production costs and prompting supply chain reassessments. Furthermore, tariff-induced lead times have complicated inventory management for both originator biologics and biosimilar manufacturers, requiring firms to adopt more agile sourcing strategies.

These elevated import costs have exerted pricing pressure across private and public payers. Manufacturers must balance margin preservation against the risk of contracting delays or reimbursement hurdles, particularly under government programs such as Medicare and Medicaid, which closely monitor unit pricing. As a result, companies have accelerated efforts to localize critical manufacturing steps and diversify supplier networks to mitigate tariff exposure.

Moreover, regulatory compliance has become more complex as firms navigate tariff exemptions and free trade agreement provisions. In response, many organizations have intensified engagement with customs authorities and trade consultants to secure preferential treatment for essential biologics ingredients. By proactively addressing these regulatory nuances, manufacturers can optimize cost structures and safeguard uninterrupted patient access to TNF inhibitor therapies.

Illuminating Key Segmentation Insights That Drive Treatment Adoption, Distribution Strategies, and Competitive Positioning in the TNF Inhibitors Market

A nuanced understanding of market segmentation reveals differentiated growth trajectories and tailored strategic imperatives. Indication-specific dynamics show that patients with rheumatoid arthritis and plaque psoriasis represent the largest cohorts owing to established clinical guidelines and high levels of treatment adherence, while those with ankylosing spondylitis and Crohn disease demand specialized formulations and monitoring protocols. Meanwhile, psoriatic arthritis and ulcerative colitis each present unique efficacy and safety profiles that influence prescribing behavior and reimbursement decisions.

Drug-type segmentation underscores the competitive balance between originator molecules-such as adalimumab, certolizumab pegol, etanercept, golimumab, and infliximab-and their biosimilar counterparts, including versions of adalimumab, etanercept, and infliximab. Biosimilar entrants have lowered pricing benchmarks and catalyzed broader access, yet they also necessitate robust pharmacovigilance and physician education to overcome prescriber inertia.

Distribution channels further shape market reach. Hospital pharmacies remain critical for inpatient infusions, whereas online pharmacy models, both direct-to-patient and via third-party platforms, accommodate patients seeking convenience and subscription-based adherence programs. Retail pharmacies-spanning national chains and independent outlets-drive community-level dispensing for subcutaneous injections, supporting patient self-administration with digital training and adherence support.

Routes of administration reveal a preference for subcutaneous injections in chronic outpatient care due to ease of use and reduced infusion center burden, even as intravenous infusion retains a vital role for acute loading doses or complex cases. Finally, end-user segmentation spans clinics, home care settings, and hospitals, each requiring tailored support services, from nursing training in community clinics to telehealth-enabled monitoring in home environments. Together, these segmentation insights inform precision targeting and resource allocation across the commercial spectrum.

This comprehensive research report categorizes the TNF Inhibitors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Indication

- Drug Type

- Route Of Administration

- Distribution Channel

- End User

Revealing Key Regional Insights into Differing Demand Drivers, Healthcare Infrastructure, and Regulatory Environments Across Global TNF Inhibitor Markets

Regional market dynamics exhibit distinctive patterns linked to healthcare infrastructure, regulatory frameworks, and patient demographics. In the Americas, the United States continues to lead in biologic adoption, driven by high per-capita healthcare expenditure and strong payer reimbursement models. Canada’s emphasis on cost-containment and public formulary listings, however, creates a selective environment for both originators and biosimilars, fostering competitive tender processes and value-based agreements.

In Europe, Middle East, and Africa, a mosaic of reimbursement systems-from single-payer models in Western Europe to mixed public-private schemes in the Middle East and evolving infrastructures in Africa-yields divergent access pathways. Western European markets have embraced biosimilar substitution policies, resulting in near-universal uptake in countries like the United Kingdom and Germany. By contrast, markets in the Middle East and Africa face capacity constraints in cold-chain logistics and limited specialist networks, underscoring the need for strategic partnerships with local distributors and healthcare ministries.

Asia-Pacific dynamics are shaped by rapid population growth, varying regulatory timelines, and an expanding middle class. Japan’s stringent biosimilar approval process coexists with established originator franchise strength, while China’s recent acceleration of biosimilar guidelines has spurred domestic and international players to invest in localized manufacturing. Emerging Southeast Asian markets present both opportunity and complexity, with growing demand tempered by price sensitivity and nascent pharmacovigilance systems. These regional insights highlight the imperative for market-specific strategies that account for infrastructure maturity, payer landscapes, and cultural considerations.

This comprehensive research report examines key regions that drive the evolution of the TNF Inhibitors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Key Strategies, R&D Investments, and Competitive Collaborations Among Leading Companies in the TNF Inhibitors Sector

Leading companies in the TNF inhibitors sector exhibit distinct approaches to innovation, commercialization, and strategic alliances. Global originators continue to invest heavily in next-generation biologics and biosimilar imprinting, leveraging high-value pipelines and extensive clinical networks. At the same time, biosimilar-focused organizations have deepened collaborations with contract development and manufacturing firms to scale production efficiently and navigate regulatory landscapes across multiple regions.

R&D investments remain concentrated on optimizing molecular structures for enhanced efficacy and reduced immunogenicity, as well as exploring novel delivery technologies such as on-body injectors and pre-filled pens. Partnerships between large pharmaceutical firms and biotech startups accelerate early-stage discovery, enabling agile development cycles and shared risk. In parallel, commercial alliances with specialty pharmacy providers and health systems advance patient support programs, delivering adherence services and digital monitoring platforms.

Competitive positioning also hinges on strategic licensing deals and co-promotion agreements. Companies with strong global footprints negotiate cross-territory rights to broaden market access, while smaller biotech innovators seek distribution partnerships to leverage established sales networks. Furthermore, value-based contracting pilots are on the rise, with several organizations collaborating directly with payers to tie reimbursement to real-world outcomes. These combined efforts underscore an industry-wide commitment to deliver differentiated TNF inhibitor solutions while maintaining sustainable growth trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the TNF Inhibitors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- Celltrion Healthcare Co., Ltd.

- Dr Reddy's Laboratories Ltd.

- Emcure Pharmaceuticals Ltd.

- Glenmark Pharmaceuticals Ltd.

- Intas Pharmaceuticals Ltd.

- Janssen Biotech, Inc.

- Merck & Co., Inc.

- Pfizer Inc.

- Samsung Bioepis Co., Ltd.

- Sandoz International GmbH

- UCB S.A.

- Viatris Inc.

Formulating Actionable Recommendations for Industry Leaders to Optimize Pipeline Prioritization, Market Access, and Value-Based Care Integration in the TNF Inhibitors Market

Industry leaders must proactively refine strategic priorities to capitalize on the evolving TNF inhibitors environment. First, organizations should prioritize pipeline portfolios that align with high-unmet-need indications such as ankylosing spondylitis and ulcerative colitis, ensuring that clinical differentiation carries clear regulatory and payer value. In tandem, investment in global biosimilar manufacturing capacity can yield cost advantages while meeting diverse regional demand profiles.

Second, enhancing market access through value-based contracting and outcome-based pricing models will be crucial. By engaging payers early in the product lifecycle and leveraging real-world evidence to demonstrate therapeutic impact, companies can secure favorable formulary positions. Third, building integrated patient support ecosystems-combining telemedicine services, digital adherence tools, and direct-to-patient fulfillment-will strengthen treatment retention and improve overall health outcomes.

Finally, fostering strategic collaborations remains vital. Whether through co-development partnerships, licensing arrangements, or shared manufacturing ventures, alliances can accelerate time to market and distribute risk. Executives should also explore opportunities for data-sharing consortia to enhance pharmacovigilance and comparative effectiveness research. By adopting these actionable recommendations, industry leaders will be well-positioned to drive sustainable growth, enhance patient access, and fortify competitive advantage in the dynamic TNF inhibitors marketplace.

Detailing a Robust Research Methodology That Ensures Data Integrity, Analytical Rigor, and Comprehensive Coverage of All Aspects of the TNF Inhibitors Market

The research methodology underpinning this analysis integrates multiple data sources and analytical frameworks to ensure comprehensive coverage and robust insights. Primary research involved in-depth interviews with key opinion leaders, including rheumatologists, gastroenterologists, and dermatologists, to capture nuanced clinical perspectives on treatment pathways. These insights were complemented by discussions with payers, pharmacy benefit managers, and specialty pharmacists to understand formulary decision drivers and distribution challenges.

Secondary research encompassed a thorough review of peer-reviewed literature, regulatory agency publications, and industry white papers to map the evolution of TNF inhibitor approvals and biosimilar guidelines. Commercial transaction data and proprietary supplier databases were analyzed to assess supply chain dynamics and tariff implications. Data triangulation and cross-validation techniques were applied to reconcile potential discrepancies and verify the accuracy of findings.

Analytical rigor was maintained through scenario modeling and sensitivity analysis, exploring the effects of varying tariff levels, adoption rates, and pricing pressures across key regions. Segmentation matrices were developed to align clinical indications, drug types, distribution channels, and administration routes with end-user preferences and infrastructure capabilities. Collectively, this methodology ensures data integrity and practical relevance, forming a solid foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our TNF Inhibitors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- TNF Inhibitors Market, by Indication

- TNF Inhibitors Market, by Drug Type

- TNF Inhibitors Market, by Route Of Administration

- TNF Inhibitors Market, by Distribution Channel

- TNF Inhibitors Market, by End User

- TNF Inhibitors Market, by Region

- TNF Inhibitors Market, by Group

- TNF Inhibitors Market, by Country

- United States TNF Inhibitors Market

- China TNF Inhibitors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Future Imperatives to Illuminate Strategic Paths Forward in the Evolving TNF Inhibitors Landscape

The TNF inhibitors sector stands at the intersection of scientific promise and commercial complexity. Originator biologics and their biosimilar counterparts are converging on multidimensional value propositions, from molecular innovation to patient-centric delivery models. Meanwhile, evolving tariff regimes and regional healthcare ecosystems continue to reshape market access and supply chain resilience.

Key findings highlight the importance of indication-specific strategies, with rheumatoid arthritis and plaque psoriasis serving as cornerstone franchises, even as emerging segments like ankylosing spondylitis offer high-growth opportunities. Distribution models are increasingly fragmented, requiring tailored approaches for hospital pharmacies, online fulfillment networks, and retail outlets. Similarly, the preference shift toward subcutaneous injections underscores the need to integrate patient convenience into product design and support services.

Looking ahead, success will hinge on the ability to balance cost-effectiveness with clinical differentiation, foster strategic alliances, and leverage real-world evidence to inform payer negotiations. By aligning R&D efforts with value-based outcomes and regional imperatives, industry stakeholders can navigate the dynamic landscape effectively. These insights pave the way for informed strategic planning, ensuring that TNF inhibitors continue to deliver meaningful patient benefits while generating sustainable competitive advantage.

Take the Next Step Today to Secure Critical Market Insights, Collaborate Directly with Ketan Rohom for Strategic Sales and Marketing Guidance, and Propel Your Organization’s Success

Are you ready to access the insights that will shape your organization’s strategic trajectory in the TNF inhibitors market? Reach out to Ketan Rohom, the Associate Director of Sales & Marketing, to discuss tailored research solutions that align with your unique objectives. With expert guidance on navigating complex competitive dynamics, emerging regulatory landscapes, and evolving patient preferences, you can gain a decisive advantage.

By partnering directly with Ketan Rohom, you’ll benefit from customized briefings on critical market drivers, one-on-one consultations to explore actionable growth opportunities, and priority access to our most recent analysis. Don’t let uncertainty hinder your decision-making-empower your team with the clarity and foresight needed to outpace competitors.

Connect with Ketan today to secure your copy of the full TNF inhibitors market research report and start translating intelligence into impactful strategies. The time to act is now: leverage specialized expertise, optimize stakeholder engagement, and drive sustained growth in one of the industry’s most dynamic segments.

- How big is the TNF Inhibitors Market?

- What is the TNF Inhibitors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?