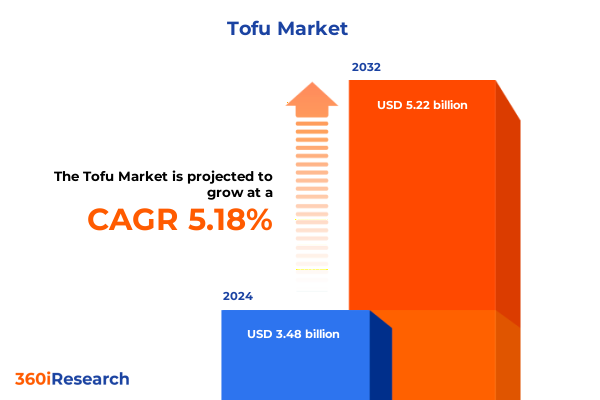

The Tofu Market size was estimated at USD 3.66 billion in 2025 and expected to reach USD 3.82 billion in 2026, at a CAGR of 5.18% to reach USD 5.22 billion by 2032.

Unveiling the Expanding Landscape of Tofu Consumption Amidst Shifting Dietary Preferences and the Plant-Based Revolutionary Surge

Over the past decade, tofu has transcended its traditional culinary roots to emerge as a cornerstone of modern plant-based diets, driven by evolving consumer priorities around health, sustainability, and versatile nutrition. Once perceived primarily as an alternative protein for niche dietary preferences, it now commands broad appeal among mainstream audiences seeking high-quality, plant-derived protein sources. This transformation is underscored by rising awareness of environmental impacts and dietary wellness, prompting both established food manufacturers and agile startups to intensify their focus on tofu innovation and distribution.

The convergence of dietary trends emphasizing clean-label products and the pursuit of sustainable agricultural practices has elevated tofu to a strategic priority for stakeholders across the food value chain. Retailers are expanding shelf space to reflect growing basket penetration, while foodservice operators integrate tofu-based formulations into menus that span casual dining to quick service. Beyond mere availability, product differentiation through texture variants, flavor infusions, and value-added formulations has become essential for brands seeking to capture consumer interest and foster loyalty.

This executive summary synthesizes the critical forces catalyzing the current momentum in the tofu market, unpacking supply chain advancements, tariff-driven cost pressures, and nuanced segmentation insights. Readers will gain a cohesive understanding of regional dynamics, corporate strategies, and actionable recommendations designed to navigate the complexities of this rapidly evolving sector.

Highlighting the Critical Supply Chain Innovations and Consumer-Driven Transformations Reshaping the Tofu Market Ecosystem

The tofu industry is at the forefront of transformative shifts precipitated by rapid advances in supply chain technology and intensifying consumer demand for sustainable food choices. Manufacturers have embraced digital traceability platforms, enabling end-to-end visibility from soy cultivation through processing and packaging. This transparency not only enhances quality assurance but also builds consumer trust by highlighting responsible sourcing, which has become a non-negotiable attribute for health- and eco-conscious buyers.

Simultaneously, the proliferation of e-commerce and direct-to-consumer channels has redefined how tofu reaches end users. Traditional brick-and-mortar retail partnerships remain essential for volume distribution, yet emerging subscription-based delivery models and online specialty platforms are enabling brands to cultivate deeper customer engagement and gather real-time feedback. This dual-channel approach ensures both mass accessibility and targeted premium experiences, fostering loyalty through curated product assortments and personalized communication.

Product innovation has also entered a new phase as companies leverage functional ingredients, such as fermented extracts and plant-derived fibers, to enhance nutritional profiles and organoleptic properties. These novel formulations cater to a sophisticated consumer base seeking not only protein content but also digestive health benefits, clean-label claims, and gastronomic versatility. As a result, the tofu landscape is being reshaped by the interplay of cutting-edge processing techniques, agile distribution models, and a consumer ethos oriented toward wellness and authenticity.

Examining the Layered Effects of United States Tariff Policies on Tofu Supply Chains, Pricing Dynamics, and Import Strategies in 2025

In early 2025, the escalation of United States tariffs on imported soybeans and related processed products has introduced layered complexities for tofu producers and importers. These elevated duties have incrementally increased the landed cost of soy-based raw materials, compelling manufacturers to reassess sourcing strategies and negotiate new partnerships to retain margin stability. Domestic soybean mills have experienced heightened demand, with processors prioritizing efficiency gains to bridge the gap created by more expensive imports.

Price pressures have inevitably cascaded through to the downstream value chain, influencing retail pricing structures and prompting consumer sensitivity around perceived value propositions. In response, many brands have diversified their ingredient portfolios to include alternative legumes such as chickpeas and peas, mitigating overreliance on tariff-affected soy supply. This strategy has expanded the definition of “tofu-like” products, supporting the development of hybrid offerings that align with tariff risk management and evolving dietary trends.

Moreover, the cumulative effects of tariffs have galvanized collaboration between manufacturers and logistics providers, fostering the creation of bonded storage facilities and strategic import consolidation centers. These innovations aim to optimize inventory levels while reducing per-unit import expenses. As the industry adapts to this new tariff landscape, resilience is emerging through agile sourcing protocols, diversified ingredient mixes, and shared infrastructure solutions that temper the financial burden and safeguard consistent product availability.

Revealing the Multifaceted Segmentation of the Tofu Market Through Product Types, Distribution Channels, Sourcing Origins, and Application Scenarios

The tofu market can be distinguished by its product type spectrum, encompassing extra firm options prized for their structural integrity in stir-fries and grilling applications, firm textures that strike a balance between stability and mouthfeel, silken varieties favored in desserts and creamy sauces, and soft preparations suited for spreads and mousses. Each of these product iterations meets specific culinary use cases, with manufacturers allocating production capacities and marketing efforts to align with evolving recipe trends.

Distribution channels contribute further complexity, as convenience stores capture impulse purchases and on-the-go snack occasions, online retail platforms deliver wider variety and subscription convenience, specialty stores curate artisanal and small-batch tofu offerings for discerning consumers, and supermarket hypermarkets ensure broad national availability with diverse SKU assortments. This multifaceted channel structure requires brands to adapt packaging sizes, communication strategies, and inventory planning to match the unique operational and promotional dynamics of each route to market.

Sourcing credentials offer critical differentiation as conventional soy remains the industry standard, non-GMO certifications reinforce consumer confidence in ingredient purity, and organic designations command premium positioning through ecological stewardship claims. These tiers of sourcing transparency enable brands to cater to segments seeking cost efficiencies, health assurance, or environmental friendliness. Applications likewise bifurcate along food service and retail lines, with food service encompassing full service restaurants, institutional catering, and quick service restaurants that demand consistent bulk supply and tailored formulations, while retail packages are designed for household convenience and recipe experimentation.

This comprehensive research report categorizes the Tofu market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Source

- Application

Delineating the Regional Growth Patterns and Consumer Preferences Across Americas, Europe Middle East and Africa, and Asia-Pacific Markets

In the Americas, burgeoning consumer interest in plant-based diets has fueled rapid expansion of retail shelf presence and restaurant menu inclusion. urban centers host specialty brand pop-ups and immersive tasting events, while mainstream grocers have augmented their private label portfolios to capture cost-sensitive shoppers. This region benefits from well-developed cold chain logistics and robust domestic soybean production, although tariff volatility continues to influence procurement policies.

Across Europe, the Middle East, and Africa, growth trajectories exhibit pronounced heterogeneity. Western European nations demonstrate steady uptake through established health food retailers and government-supported dietary guidelines promoting plant proteins. In contrast, Middle Eastern markets are witnessing nascent demand driven by increasing health awareness and expatriate communities introducing tofu into local diets. African markets remain early stage, with pilot import programs and food aid initiatives gradually introducing tofu products to urban consumers.

Asia-Pacific remains the historical epicenter of tofu consumption and innovation, with Japan and China leading in both production volume and culinary diversity. Traditional fermented tofu delicacies coexist alongside advanced extruded formats that mimic meat textures. Southeast Asian markets are experiencing surging interest as rising disposable incomes and Western dietary influences converge. Regional manufacturing hubs are investing in automation to scale production, while cross-border trade agreements shape the flow of raw material and finished goods.

This comprehensive research report examines key regions that drive the evolution of the Tofu market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Maneuvers and Innovation Roadmaps of Leading Industry Stakeholders Shaping the Tofu Market Evolution

Leading stakeholders are executing differentiated strategies to strengthen market positioning. Major food conglomerates are integrating tofu into broader plant-based portfolios, leveraging cross-brand synergies and centralized distribution networks to achieve economies of scale. Simultaneously, mid-tier and niche producers are capturing premium segments through artisanal production techniques, small-batch flavor innovations, and localized branding that resonates with regional consumer identities.

Innovation roadmaps reveal a strong emphasis on extending product lifecycles through improved packaging technologies, such as modified atmosphere sealing and biodegradable films, which preserve freshness while aligning with circular economy principles. Partnerships with technology firms have expedited the adoption of rapid microbial testing, ensuring quality compliance and reducing time to market. Furthermore, investment in new processing equipment has enabled customization of texture gradients and the creation of hybrid products blending soy with complementary plant proteins.

Collaborative ventures between chefs, nutritionists, and research institutions are driving novel applications, from plant-based seafood analogs to high-protein snack bars, thereby expanding tofu’s relevance beyond traditional culinary categories. These cross-industry alliances underscore a forward-looking approach, where shared expertise accelerates product diversification and addresses emerging consumer needs for nutrient-rich, convenient, and sustainable offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tofu market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Azumaya Foods Inc.

- Eden Foods Inc.

- Hain Celestial Group Inc.

- Hangzhou Bean Food Co. Ltd.

- House Foods Group Inc.

- Meiji Holdings Co. Ltd.

- Morinaga Nutritional Foods Inc.

- Nasoya Foods

- Phoenix Bean Tofu

- Pulmuone Co. Ltd.

- Sagamiya Foods Inc.

- Sanritsu Foods Inc.

- Shanghai Tramy Green Food Group Co. Ltd.

- Sunfood Superfoods

- Tofurky Company

- Vitasoy International Holdings Ltd.

Outlining Actionable Strategies for Industry Leaders to Enhance Competitive Positioning and Navigate Volatility in the Tofu Market

To capitalize on the burgeoning tofu opportunity, industry participants should prioritize diversification of product portfolios by introducing texture variants, flavor-infused formulations, and hybrid blends that incorporate complementary plant proteins, thereby broadening appeal across consumer segments. Concurrently, forging strategic alliances with domestic soy growers and alternative legume suppliers can mitigate exposure to international tariff fluctuations and reinforce supply chain resilience.

Investment in omnichannel distribution capabilities will enable brands to balance mass-market penetration through supermarket and hypermarket channels with targeted engagement via direct-to-consumer platforms. Product packaging designs that cater to on-the-go consumption and subscription-based ordering models can further drive repeat purchases and deepen customer relationships. In parallel, companies should implement robust sustainability frameworks, including certification programs and transparent impact reporting, to solidify trust and address the environmental priorities of modern consumers.

Finally, proactive engagement with foodservice operators-spanning fine dining to institutional catering-can unlock high-volume contracts and foster brand visibility within varied culinary contexts. Tailoring formulations to meet operational requirements, such as extended holding times and multi-temperature service capabilities, will distinguish tofu suppliers as reliable partners. By executing these recommendations in concert, industry leaders can navigate regulatory headwinds, unlock new market segments, and chart a course for sustained growth.

Detailing the Rigorous Research Methodology Employed to Deliver Robust Insights and Ensure Data Integrity for Tofu Market Analysis

The foundation of this report is built upon a comprehensive research methodology combining primary and secondary data sources to ensure depth and accuracy. Primary research included structured interviews and in-depth discussions with executives from tofu producers, procurement managers at retail and foodservice companies, supply chain specialists, and industry consultants. These insights provided firsthand perspectives on strategic priorities, operational challenges, and emerging trends within the sector.

Secondary research efforts encompassed a rigorous review of trade publications, regulatory filings, technical whitepapers, and global trade databases. This phase provided historical context, legislative frameworks, and macroeconomic indicators relevant to soybean cultivation, processing technologies, and international tariff schedules. Triangulation of these secondary insights against primary data points minimized information gaps and validated thematic findings across multiple independent sources.

To uphold data integrity, the analysis incorporated cross-verification protocols, including consistency checks, outlier examination, and peer review by subject matter experts. Geographic representation was ensured through targeted sampling of industry participants across key regions-Americas, EMEA, and Asia-Pacific-while standardized interview guides and analytical models maintained methodological consistency. This robust framework underpins the credibility of the insights and recommendations presented throughout this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tofu market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tofu Market, by Product Type

- Tofu Market, by Distribution Channel

- Tofu Market, by Source

- Tofu Market, by Application

- Tofu Market, by Region

- Tofu Market, by Group

- Tofu Market, by Country

- United States Tofu Market

- China Tofu Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesis of Key Findings Highlighting Future Trajectories and Critical Considerations for Stakeholders in the Tofu Market Landscape

As the tofu market continues to evolve under the influence of shifting dietary mindsets, technological advancements, and policy reforms, stakeholders must remain vigilant in monitoring consumer expectations, supply chain vulnerabilities, and competitive dynamics. Heightened interest in plant-based nutrition underscores the need for product innovation that balances functional benefits with sensory appeal, while tariff-induced cost pressures necessitate agile sourcing and cost management practices.

Regional divergence in consumption patterns indicates that a one-size-fits-all strategy is insufficient; instead, localized approaches attuned to cultural preferences and distribution infrastructures will yield stronger market penetration. Furthermore, segmentation insights reveal that success hinges on catering to specific use cases-from high-structure varieties for foodservice applications to delicate formats for retail consumers seeking convenience and versatility.

By integrating the actionable recommendations outlined herein and harnessing the strategic intelligence derived from rigorous research, companies can effectively navigate volatility, capitalize on growth opportunities, and contribute to the ongoing advancement of the global tofu market. Collaboration, continuous innovation, and a commitment to transparency will serve as the cornerstones of long-term success for industry participants across the value chain.

Empower Your Strategic Decision-Making Today by Securing Comprehensive Tofu Market Intelligence and Connecting with Ketan Rohom for Exclusive Report Access

Elevate your organizational strategy with in-depth insights designed to uncover nuanced consumer behaviors, emerging supply chain strategies, and pivotal market dynamics within the global tofu arena. Engaging with Ketan Rohom (Associate Director, Sales & Marketing) unlocks exclusive access to a comprehensive analytical report that delves into regional growth trajectories, segmentation performance, and policy impacts shaping 2025 and beyond. Through a personalized consultation, decision-makers will receive tailored recommendations alongside proprietary data visualizations that illuminate risk mitigation pathways and innovation opportunities. Take the decisive step toward securing a competitive advantage in an increasingly dynamic plant-based protein landscape by initiating a conversation with Ketan Rohom today and acquiring the essential intelligence that will guide your next strategic move

- How big is the Tofu Market?

- What is the Tofu Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?