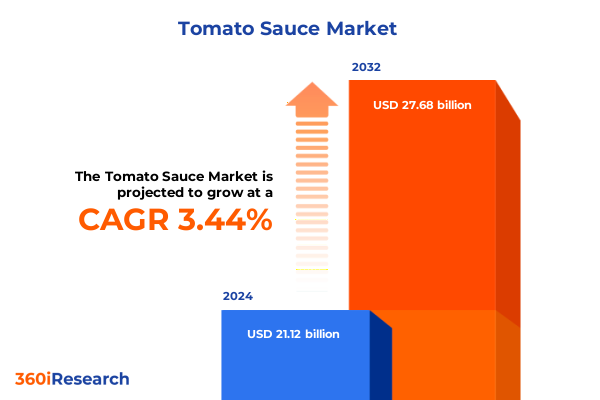

The Tomato Sauce Market size was estimated at USD 21.81 billion in 2025 and expected to reach USD 22.54 billion in 2026, at a CAGR of 3.46% to reach USD 27.68 billion by 2032.

An authoritative orientation to the evolving consumer, ingredient, and retail forces that are shaping contemporary product development and commercial strategies in tomato sauce

The tomato sauce category is in the midst of a structural evolution driven by changing consumer palates, heightened ingredient transparency expectations, and a more complex retail and e-commerce mix. Rising interest in culinary experimentation alongside an emphasis on simple, recognizable ingredient lists has pushed manufacturers to revisit formulations while maintaining cost discipline. Simultaneously, retail shelf strategies and online assortment choices are exerting pressure on packaging formats and unit economics, prompting brand and private-label actors to re-evaluate portfolio breadth and SKU rationalization.

Against this backdrop, product developers are prioritizing clean-label claims, natural preservation approaches, and flavor innovations that extend beyond traditional profiles. These shifts are accompanied by supply chain considerations that affect sourcing, lead times, and packaging choices. Foodservice demand patterns remain a critical variable for volume players, while convenience-driven consumption occasions are reshaping portion sizes and on-the-go formats.

Given these dynamics, leaders must synthesize consumer-facing trends with operational realities to preserve margin and relevance. This introduction frames the subsequent sections, which examine structural shifts, tariff-driven pressures, segmentation intelligence, regional nuances, competitor behavior, and practical recommendations to guide strategic responses.

A strategic synthesis of consumer premiumization, packaging evolution, and omnichannel retail imperatives that are transforming how tomato sauce brands compete and grow

Major transformative shifts are redefining competitive advantage across the tomato sauce landscape, as consumers pursue both authenticity and convenience, and as manufacturers respond with differentiated formulations and packaging innovations. Flavor extension strategies are moving beyond classic profiles to capture niche palates, while the demand for transparency is encouraging brands to disclose sourcing practices and simplified ingredient lists. Packaging technology is also evolving to balance sustainability imperatives with cost and convenience, reshaping both primary packaging choices and secondary merchandising tactics.

Retail and e-commerce channels are not merely alternate distribution routes; they impose distinct assortment logics, promotional mechanics, and pricing pressure that necessitate cross-functional alignment between category managers and supply planners. The growing importance of direct-to-consumer initiatives and subscription models has prompted producers to reassess unit economics and lifetime value calculations. Concurrently, supply chain digitization and traceability systems are becoming table stakes for quality assurance and compliance, enabling faster responses to demand swings and raw material volatility.

Taken together, these shifts require integrated capabilities that marry rapid product innovation with robust operational controls. Companies that align R&D, procurement, and commercial teams around identified consumption occasions and channel economics will be better positioned to capture premiumization opportunities while protecting margins through efficiency gains.

A practical examination of how evolving US tariff actions are reshaping supply chain sourcing decisions, procurement risk management, and distribution economics for manufacturers

Recent policy adjustments and tariff measures implemented by the United States have introduced cumulative pressures that ripple through sourcing, ingredient costs, and trade flows for tomato sauce producers and ingredient suppliers. These measures have altered cost stacks for import-dependent inputs, incentivized some firms to re-evaluate supplier portfolios and nearshore certain parts of their supply chains to mitigate exposure. As a result, procurement teams are prioritizing supplier diversification and longer-term contracting where feasible to stabilize input availability and manage price unpredictability.

Logistics and customs processing have become additional operational focal points, with some exporters adjusting packaging and shipment configurations to optimize tariff classifications and freight efficiencies. For brands that rely on imported specialty ingredients or packaging components, the cumulative tariff landscape has accelerated conversations around formulation adjustments and domestically sourced alternatives. These choices are being weighed against quality perceptions and the potential need for consumer-facing communications to explain any change in taste or ingredient provenance.

On the distribution side, channel managers are recalibrating margin assumptions and promotional plans to account for higher landed costs. Strategic responses include concentrated efforts to improve manufacturing yields, tighter inventory governance, and renegotiated terms with retail partners. Overall, the tariff environment functions as an amplifying factor that raises the importance of resilient sourcing strategies, cost-to-serve discipline, and scenario planning across commercial and operations teams.

A nuanced segmentation-driven framework that clarifies product, packaging, flavor, and distribution imperatives to guide targeted NPD and channel strategies

Segmentation analysis reveals distinct opportunity windows and capability requirements across product types, packaging choices, flavor architectures, and distribution strategies, each demanding tailored commercial and operational playbooks. When viewed through product type distinctions between classic and flavored offerings, classic variants are often positioned for broad-based, value-oriented demand while flavored options serve culinary exploration and premiumization strategies, requiring targeted marketing and potentially shorter innovation cycles.

Packaging material decisions between glass jar, plastic jar, pouch, and sachet influence cost structures, shelf presence, and sustainability narratives. Glass jars convey premium cues and recyclability advantages but carry higher transport and breakage considerations; plastic jars may offer convenience and lower weight; pouches deliver improved portability and lower materials usage per unit volume; sachets enable single-serve occasions and impulse purchases. Flavor profile segmentation into herb infused and spicy formats-and within herb infused into basil and oregano, and within spicy into hot chili and jalapeno-highlights opportunities for specialized sourcing of herbs and peppers, distinct sensory claims, and differentiated labeling strategies that speak to target consumers.

Distribution channel segmentation between offline and online-and within offline across convenience stores, food service, and supermarkets & hypermarkets, and within online across company website and marketplace-creates divergent requirements for packaging configuration, minimum order quantities, promotional calendars, and data-driven assortment optimization. Offline channels demand consistent in-store merchandising and trade promotion alignment, whereas online channels require enhanced SKU data, imagery, and logistics readiness for direct fulfillment and marketplace protocols. Integrating insights across these segments supports precise resource allocation and enables differentiated go-to-market plans that respect both consumer occasioning and channel economics.

This comprehensive research report categorizes the Tomato Sauce market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Material

- Flavor Profile

- Distribution Channel

A regional analysis linking consumer palate differences, regulatory complexity, and channel maturity across the Americas, EMEA, and Asia-Pacific to strategic product and distribution choices

Regional dynamics exert substantial influence on ingredient sourcing preferences, regulatory considerations, and consumer taste profiles, and therefore are central to strategic planning for global and regional brands. In the Americas, a strong legacy demand for tomato-based condiments coexists with growth in bold flavor variants and on-the-go formats, prompting ongoing adjustments in domestic sourcing and supply chain logistics to respond to both retail and foodservice requirements. Regional trade relationships and plant footprint decisions are influencing lead-time considerations and packaging localization choices.

In Europe, the Middle East & Africa, cultural diversity and regulatory frameworks create a matrix of labeling and ingredient expectations that manufacturers must navigate carefully; premium positioning and heritage-driven flavor claims tend to perform well in many European markets, while in parts of the Middle East and Africa, cost sensitivity and logistical constraints continue to shape distribution strategies and format preferences. Consumer expectations around provenance and natural ingredients are especially pronounced across several European markets.

In Asia-Pacific, rapid urbanization and expanding modern trade channels are accelerating demand for convenience formats and novel flavor innovations, with rising interest in localized spice profiles and heat-forward taste preferences. E-commerce penetration and omnichannel implementations are particularly important in this region, creating distinct back-end requirements for fulfillment and digital marketing. Understanding these regional contours enables companies to tailor product formulations, packaging investments, and channel partnerships in ways that match local consumption occasions and regulatory obligations.

This comprehensive research report examines key regions that drive the evolution of the Tomato Sauce market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

A competitive assessment highlighting how incumbents, challengers, and private-label actors are balancing innovation, sustainability claims, and operational resilience to win in the category

Competitive activity in the tomato sauce arena reflects a combination of heritage brands protecting mainstream appeal and newer challengers leveraging flavor innovation, sustainability positioning, and agile channel approaches. Leading manufacturers are investing in formulation science to reduce additives while preserving shelf life, and are piloting novel pack formats to address both retail shelf economics and e-commerce fulfillment needs. At the same time, private-label players and specialized artisan producers are pressuring incumbents on price and differentiation, respectively, prompting a range of strategic responses from cost optimization to premium line extensions.

Partnerships with ingredient suppliers and co-manufacturers have become strategic levers for scaling innovation without excessive capital expenditure, and alliances with logistics providers are enabling better control of cold chain and lead-time variability. Several companies are deploying data analytics to refine promotional effectiveness and to segment customers more granularly across channels and occasions. Additionally, investments in traceability and transparent sourcing practices are being used defensively to maintain consumer trust and to meet evolving regulatory expectations.

The competitive landscape rewards firms that can combine responsive innovation with operational resilience. Those that align R&D paradigms with clear commercial metrics, and that maintain nimble supply relationships, will be better equipped to capture shifting consumer preferences without compromising margin integrity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tomato Sauce market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amy’s Kitchen, Inc.

- B&G Foods, Inc.

- Barilla G. e R. Fratelli S.p.A.

- Bertolli

- Campbell Soup Company

- Cento Fine Foods

- Cirio – Società Italiana Conserve Alimentari S.p.A.

- Conagra Brands, Inc.

- Del Monte Foods, Inc.

- General Mills, Inc.

- H.J. Heinz Company

- Hormel Foods Corporation

- Hunts

- La Doria S.p.A.

- McCormick & Company, Inc.

- Mizkan Holdings Co., Ltd.

- Mutti S.p.A.

- Nestlé S.A.

- Prego

- Ragu

- Red Gold, Inc.

- Romero Foods Inc.

- Sclafani Foods Inc.

- The Kraft Heinz Company

- Unilever PLC

A prioritized set of practical recommendations that align product roadmaps, packaging innovation, procurement resilience, and channel economics to accelerate profitable category growth

Industry leaders should adopt a set of prioritized, actionable steps that connect portfolio choices, operational improvements, and channel-specific tactics to measurable outcomes. First, aligning product roadmaps with distinct consumption occasions and channel economics is critical: differentiate core classic SKUs for broad distribution while concentrating flavored and premium SKUs in channels and geographies where willingness to pay and culinary curiosity are highest. This alignment reduces SKU complexity and focuses marketing investment where it delivers the most impact.

Second, packaging strategies must reconcile sustainability commitments with cost and logistics realities. Investing in flexible packaging that supports both retail shelf presence and e-commerce fulfillment will decrease friction and support omnichannel growth. Third, procurement teams need to accelerate supplier diversification and nearshoring where feasible to improve lead-times and reduce exposure to tariff shifts and freight volatility. These tactics should be coupled with stronger contract governance and scenario-based contingency planning.

Fourth, channel managers must refine promotional mechanics to reflect channel-specific elasticity and to minimize margin leakage from indiscriminate discounting. Finally, invest in consumer-facing transparency measures and sensory validation to maintain trust during any formulation or sourcing changes. Executing these recommendations will require cross-functional governance, clear KPIs, and a cadence of rapid-test-and-learn initiatives to optimize rollout and scale successful pilots.

A transparent description of the mixed-methods research approach combining practitioner interviews, secondary policy and retail analysis, and cross-segmentation synthesis to ensure actionable findings

This research combines qualitative interviews with category managers, product developers, and supply chain leaders, alongside secondary analysis of public regulatory filings, trade announcements, and retail channel behavior, to construct an integrated perspective on market dynamics. Primary conversations focused on identifying operational constraints, product innovation priorities, and channel-specific performance considerations, enabling the synthesis of practitioner-tested strategies and common pitfalls. Secondary sources were used to corroborate observed trends on tariff impacts, packaging shifts, and regional consumption patterns, ensuring triangulation between what executives report and observable market behavior.

Analytical approaches included cross-segmentation mapping to reveal where product, packaging, flavor, and channel intersect in ways that materially change go-to-market requirements. Scenario-based analysis was applied to explore the implications of trade policy shifts and supply chain disruptions on procurement and channel economics, producing actionable contingency options. Data quality controls emphasized source verification, timestamping of policy changes, and the use of supplier and distributor interviews to validate logistics observations. Throughout, efforts were made to maintain neutrality, present alternative strategic paths, and surface practical implications that are implementable by commercial and operations teams.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tomato Sauce market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tomato Sauce Market, by Product Type

- Tomato Sauce Market, by Packaging Material

- Tomato Sauce Market, by Flavor Profile

- Tomato Sauce Market, by Distribution Channel

- Tomato Sauce Market, by Region

- Tomato Sauce Market, by Group

- Tomato Sauce Market, by Country

- United States Tomato Sauce Market

- China Tomato Sauce Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1413 ]

A concise synthesis of strategic imperatives that integrates consumer trends, procurement resilience, and channel-specific execution to convert disruption into competitive advantage

In summary, the tomato sauce category sits at an inflection point where consumer expectations for taste, transparency, and convenience are intersecting with evolving trade policy and channel economics. Manufacturers that can synchronize product innovation with resilient procurement and differentiated channel strategies will be best positioned to navigate near-term disruptions while capturing long-term value. The cumulative pressures from tariff changes and packaging expectations underscore the necessity of proactive scenario planning and closer collaboration across R&D, procurement, and commercial teams.

Execution will depend on disciplined SKU rationalization, smarter packaging investments, and targeted promotional designs that respect channel-specific mechanics. Firms that embrace iterative testing-paired with clear stop/go decision criteria-are likely to scale successful innovations more efficiently. Ultimately, a pragmatic blend of consumer insight, supply chain agility, and precise channel segmentation will determine which organizations convert category change into sustainable advantage.

A clear single-point engagement path to procure the comprehensive tomato sauce research package and obtain tailored briefings with direct sales leadership support

For executive and commercial teams seeking an authoritative, actionable report, engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure the full study and tailored briefing that align with your commercial priorities. A direct consultation with the sales lead will clarify report scope, customization options, and delivery timelines and will ensure your team receives the relevant modules and datasets necessary to accelerate decision-making and route-to-market plans.

A purchase conversation led by the named sales contact can also fast-track bespoke annexes, competitor deep dives, and implementation-ready recommendations for product development, labeling, and channel strategies. In addition, scheduling an interactive briefing with the sales lead provides an opportunity to discuss complementary research services, periodic updates, and licensing terms that support ongoing category monitoring.

Contacting the named associate director streamlines procurement and ensures access to analyst time for an executive walk-through of key findings and implications for pricing, distribution, and portfolio priorities. Begin with a short discovery call to outline objectives and receive a tailored proposal and scope, followed by an agreed delivery plan that matches your internal timelines and stakeholder needs.

Act now to guarantee priority onboarding for data rooms and analyst briefings, and to obtain the strategic documentation needed to translate insight into short-term commercial actions and longer-term capability building.

- How big is the Tomato Sauce Market?

- What is the Tomato Sauce Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?