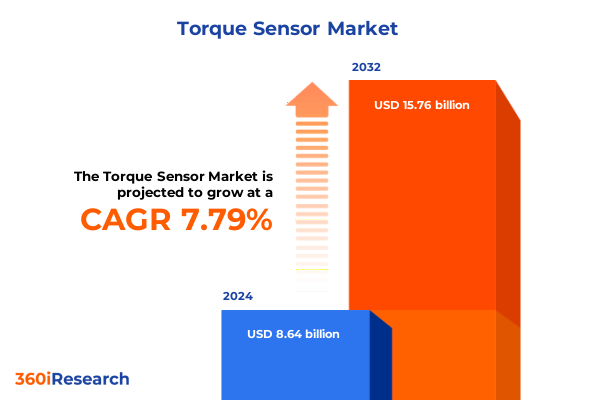

The Torque Sensor Market size was estimated at USD 9.31 billion in 2025 and expected to reach USD 10.03 billion in 2026, at a CAGR of 7.80% to reach USD 15.76 billion by 2032.

Unveiling the Crucial Role of Torque Sensor Technologies in Empowering Precision and Efficiency Across Modern Industrial Applications

The landscape of mechanical measurement is undergoing a profound transformation, and torque sensors sit at the forefront of this evolution. As the demand for precise, reliable torque measurement intensifies across diverse industries, these sensors have become indispensable tools for ensuring operational efficiency and product integrity. From automotive testing benches to robotics end-effectors, the ability to accurately quantify rotational force underpins advancements in performance optimization and predictive maintenance.

In recent years, rapid strides in materials science and signal processing have enabled torque sensors to achieve unparalleled levels of sensitivity and durability. Coupled with the proliferation of digital communication protocols and edge-computing capabilities, modern torque sensing solutions now transcend basic measurement functions. They act as intelligent nodes within interconnected systems, feeding real-time data into analytics platforms that drive informed decision-making. This report delves into the underlying technologies, market forces, and strategic considerations shaping the torque sensor arena, offering a foundational overview for stakeholders poised to capitalize on emerging opportunities.

Embracing Industry 4.0 and Electrification: Key Catalysts Redefining the Future Landscape of the Torque Sensor Market Worldwide

The convergence of Industry 4.0 principles and growing emphasis on energy efficiency has redefined the torque sensor market’s growth trajectory. As manufacturing facilities embrace digital twins and smart factory architectures, torque sensors with integrated telemetry capabilities have become critical for closed-loop control systems. Moreover, the electrification of transportation has accelerated demand for high-precision sensing in electric powertrains, challenging suppliers to innovate beyond traditional electromechanical designs.

Furthermore, the adoption of collaborative robots in automotive assembly lines and medical device manufacturing has spotlighted torque sensors that can deliver rapid response times and fail-safe mechanisms. These robotic applications require sensors that not only measure force but also contribute to adaptive motion control, enabling machines to interact safely alongside human operators. Concurrently, emerging use cases in renewable energy-such as torque monitoring in wind turbine gearboxes-highlight the need for ruggedized solutions capable of withstanding harsh environmental conditions without compromising accuracy.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on Supply Chains, Production Costs, and Strategic Sourcing in the Torque Sensor Market

In early 2025, the United States introduced a comprehensive slate of tariffs targeting imported industrial components, including torque sensors. These measures were designed to encourage domestic manufacturing yet also introduced complexities for global supply chains. As a result, many manufacturers have recalibrated their sourcing strategies, weighing the benefits of near-shoring against the cost implications of maintaining diversified international production networks.

Cost pressures stemming from these tariffs have prompted component suppliers to explore alternative materials and streamline design architectures. Meanwhile, end-use industries such as aerospace and automotive testing have negotiated long-term contracts to hedge against price volatility. Despite the initial uncertainty, these policy shifts have spurred collaborations between domestic sensor producers and systems integrators, facilitating technology transfer and capacity expansion within U.S. facilities. Looking ahead, stakeholders continue to monitor potential adjustments to tariff schedules, recognizing that the cumulative impact on lead times and capital expenditure could shape investment decisions through the next planning horizon.

Decoding Critical Market Segmentation Layers That Drive Technology Adoption and Application Diversity in the Global Torque Sensor Ecosystem

The torque sensor market’s technological underpinnings span a diverse array of measurement principles, each offering unique performance advantages. Capacitive sensors deliver exceptional resolution in low-torque applications, while magnetostrictive designs excel in high‐durability contexts. Optical torque sensors leverage interferometric techniques to achieve sub-micron accuracy, and piezoelectric variants provide rapid dynamic response. Strain gauge solutions, meanwhile, balance cost-effectiveness with adaptability across a broad torque spectrum. These technology tiers coexist within an ecosystem driven by application demands and cost constraints.

Sensor architecture further segments the market into rotary and static configurations. Rotary sensors, which include both non-through-hole and through-hole designs, are favored in drivetrain testing rigs where unobstructed torque transmission is essential. Static sensors-offered in flange, inline, and reaction formats-are deployed in stationary test stands and structural monitoring contexts. Each sensor type aligns with distinct installation requirements and spatial constraints, influencing end-user preferences.

Application segmentation reveals that automotive testing remains a cornerstone, with engine and transmission test benches relying heavily on precision torque measurement. Energy management applications track torque fluctuations in wind turbines and power generation equipment to optimize operational efficiency. Industrial automation platforms integrate torque sensors into robotic end-effectors, with separate requirements for collaborative robots demanding safety-certified sensors and industrial robots favoring high-throughput, repeatable performance. Medical equipment testing and specialized manufacturing use cases round out the portfolio of applications driving innovation.

Industry dynamics reflect the cross-sector relevance of torque measurement, with aerospace & defense prioritizing extreme reliability and minimum drift, the automotive sector emphasizing miniaturization and integration with vehicle control units, and energy & power industries seeking robust performance under cyclical loading. Healthcare applications demand biocompatible materials and sterile operation, while industrial machinery leverages torque sensors to enhance predictive maintenance and process automation.

Output protocols bifurcate into analog and digital modalities, with analog offering straightforward integration into legacy systems. Digital outputs-employing CAN, I2C, or SPI interfaces-enable seamless connectivity with modern control platforms, facilitating real-time diagnostics and firmware updates over networked environments. The choice of output format reflects broader system architecture considerations and the evolution of industrial communication standards.

This comprehensive research report categorizes the Torque Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Sensor Type

- Industry

- Output

- Application

Navigating Regional Dynamics and Growth Drivers in the Americas, EMEA, and Asia-Pacific Shaping the Global Trajectory of Torque Sensor Demand

Regional dynamics underscore the heterogeneous nature of demand for torque sensing technologies. In the Americas, strong ties between automotive OEMs and tier-one suppliers have driven sustained investment in test-bench instrumentation, while growth in oil & gas exploration has reinforced the need for torque measurement in drilling equipment. The United States continues to serve as a hub for technological innovation, with R&D centers collaborating on next-generation sensor miniaturization and robust wireless protocols.

Across Europe, Middle East & Africa, established aerospace clusters in Western Europe champion torque sensors for flight-critical applications, prioritizing compliance with stringent certification standards. Concurrently, Middle Eastern energy projects stimulate demand for high-temperature- and corrosion-resistant sensors, and Africa’s burgeoning industrial base explores torque monitoring solutions to improve manufacturing yield and operational safety. Cross-regional partnerships have emerged to address these diverse requirements, fostering knowledge transfer and standardization efforts.

Asia-Pacific stands out for its rapid adoption of automation in both manufacturing and consumer electronics sectors. Countries such as China, Japan, and South Korea are expanding their robotics ecosystems, creating demand for torque sensors that integrate directly into collaborative and industrial robots. Furthermore, the region’s investment in renewable energy installations, particularly offshore wind, has prompted localized sensor production initiatives aimed at reducing lead times and currency-exposure risks. Together, these regional trends paint a comprehensive picture of how geographic factors influence technology priorities and supply chain configurations.

This comprehensive research report examines key regions that drive the evolution of the Torque Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Innovating Torque Sensor Solutions Through Strategic Partnerships and Technological Advancements

Leading torque sensor suppliers distinguish themselves through sustained investment in specialized materials, miniaturization techniques, and digital integration capabilities. Some companies have achieved market leadership by forging strategic partnerships with automotive OEMs to co-develop sensors tailored for electric and hybrid powertrains. These collaborations often involve joint R&D initiatives focused on reducing sensor footprint and enhancing thermal stability in high-voltage environments.

Other prominent manufacturers have pursued an acquisition strategy, integrating smaller niche players to broaden their portfolio of sensing technologies. By absorbing companies with expertise in optical or piezoelectric measurement, established players have accelerated time-to-market for advanced sensor modules without compromising performance benchmarks. This approach has also enabled these firms to cultivate regional production capacities, addressing tariff-related disruptions by shifting assembly operations closer to key end-users.

Innovation hubs located in Germany and Japan remain hotbeds for breakthrough torque measurement solutions, where research institutions and private enterprises co-invest in next-generation telemetry and self-calibration features. Simultaneously, North American and European test equipment providers are embedding torque sensors into turnkey systems that leverage AI-driven analytics for anomaly detection. Collectively, these strategic initiatives highlight how leading companies are orchestrating technology roadmaps and ecosystem partnerships to sustain competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Torque Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aimco Global

- Applied Measurements Ltd.

- Baumer Holding AG

- Crane Electronics Ltd.

- Datum Electronics Ltd.

- Futek Advanced Sensor Technology, Inc.

- HBM Inc.

- Honeywell International Inc.

- Infineon Technologies AG

- Interface, Inc.

- Kistler Group

- Kistler Holding AG

- Magcanica Inc.

- MinebeaMitsumi Inc.

- Mountz, Inc.

- OMEGA Engineering, Inc.

- Sensata Technologies, Inc.

- TE Connectivity Ltd.

Strategic Imperatives for Industry Leaders to Capitalize on Digital Integration, Supply Chain Resilience, and Innovation in Torque Sensing

Industry leaders should prioritize the integration of digital connectivity into torque sensing solutions, embedding smart diagnostics and firmware-update capabilities from the earliest design phases. By doing so, suppliers can offer value-added services such as over-the-air calibration and performance analytics, strengthening customer loyalty and creating recurring revenue streams. In tandem, forging partnerships with systems integrators will facilitate seamless adoption within automated production lines, reducing implementation barriers for end-users.

Moreover, companies must diversify their supply chains to mitigate tariff volatility and geopolitical risks. Establishing dual-source agreements and near-shoring assembly operations can preserve continuity of supply while maintaining cost competitiveness. Concurrently, allocating R&D resources toward emerging technologies-such as optical and magnetostrictive sensors with built-in self-health monitoring-will position organizations to address underserved niches in renewable energy and medical device testing.

Finally, cultivating talent skilled in both hardware engineering and data analytics will be critical for bringing next-generation torque sensor platforms to market. Cross-functional teams adept at bridging sensor physics and software integration can accelerate time-to-value for customers seeking turnkey smart sensing solutions.

Employing Rigorous Multi-Source Research Methodology Integrating Primary Insights, Secondary Data, and Expert Validation for Market Intelligence

This analysis is grounded in a multi-stage research framework combining primary and secondary data sources. Initial insights were gathered through in-depth interviews with torque sensor designers, systems integrators, and end-user engineering teams, ensuring a nuanced understanding of real-world challenges and adoption drivers. These qualitative inputs were complemented by extensive desk research, reviewing technical papers, industry standards, and patent filings to identify emerging technology trajectories.

To validate and triangulate findings, the research team conducted iterative workshops with subject matter experts from automotive, aerospace, and energy sectors. These sessions illuminated regional nuances in regulatory requirements and certification pathways. Supplementary data from trade associations and industry conferences provided a quantitative backbone, enabling the cross-comparison of technology roadmaps and integration timetables.

Throughout the process, rigorous data-quality checks and peer reviews were implemented to uphold analytical integrity. This blended approach ensures the insights presented herein accurately reflect the dynamic interplay between technological innovation, policy evolution, and market demands in the torque sensor domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Torque Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Torque Sensor Market, by Technology

- Torque Sensor Market, by Sensor Type

- Torque Sensor Market, by Industry

- Torque Sensor Market, by Output

- Torque Sensor Market, by Application

- Torque Sensor Market, by Region

- Torque Sensor Market, by Group

- Torque Sensor Market, by Country

- United States Torque Sensor Market

- China Torque Sensor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Market Insights Underscoring the Imperative for Strategic Alignment in an Evolving Torque Sensor Industry Landscape

The torque sensor market stands at an inflection point, propelled by the convergence of digital transformation, the electrification of global transport, and evolving policy landscapes. Decision-makers must align product roadmaps with the twin imperatives of connectivity and sustainability, leveraging advanced sensor technologies to unlock operational efficiencies and predictive maintenance capabilities. As tariffs reshape supply chain geographies, strategic sourcing and regional manufacturing will become integral to maintaining cost discipline and resilience.

In this rapidly shifting environment, the capacity to navigate segmentation nuances-from technology types and sensor architectures to application use cases-will distinguish market leaders. By synthesizing the insights within this report, stakeholders can formulate strategies that not only address current challenges but also anticipate the next wave of innovation in torque sensing. Embracing a data-driven mindset will be paramount to achieving a sustainable competitive edge.

Connect with Ketan Rohom to Unlock Comprehensive Torque Sensor Market Research Insights and Drive Informed Strategic Decisions Today

I invite industry stakeholders and decision-makers seeking a deeper understanding of the torque sensor landscape to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through the strategic insights contained within this comprehensive report. By engaging with Ketan, you will gain tailored advice on how to leverage the findings to optimize your product development pipelines, refine your go-to-market strategies, and fortify your competitive positioning.

This direct dialogue facilitates a personalized exploration of the methodologies, key drivers, and actionable recommendations highlighted throughout the report. Ketan’s expertise will ensure you extract maximum value from the insights, enabling you to navigate supply chain complexities, capitalize on emerging segmentation opportunities, and align your innovation roadmap with evolving industry demands. Secure your access today to empower data-driven decision-making and chart a course for sustained growth in the dynamic torque sensor market.

- How big is the Torque Sensor Market?

- What is the Torque Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?