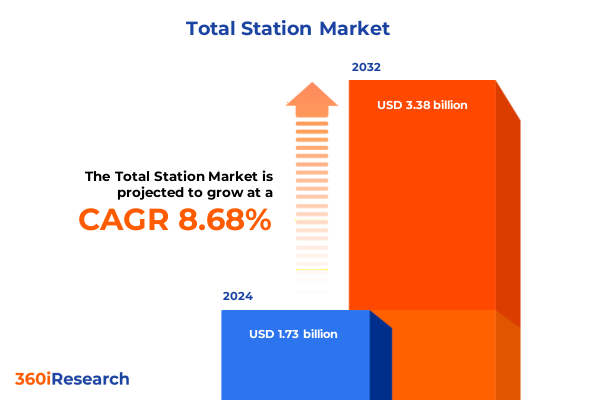

The Total Station Market size was estimated at USD 1.88 billion in 2025 and expected to reach USD 2.03 billion in 2026, at a CAGR of 8.71% to reach USD 3.38 billion by 2032.

Setting the Stage for Precision Measurement Solutions: Understanding the Rising Importance and Scope of Total Stations Across Industries

In today’s fast-evolving engineering and surveying landscape, total stations have emerged as indispensable instruments for capturing spatial data with unparalleled accuracy. By seamlessly combining electronic distance measurement with angular measurement capabilities, these devices empower professionals to execute tasks ranging from site layout and topographic mapping to complex inspection routines. Over the decades, the evolution of total stations has transcended traditional prism-based models to incorporate reflectorless and robotic variants that dramatically enhance on-site productivity and reduce manual intervention.

As infrastructure spending surges globally and digital transformation initiatives permeate every aspect of the built environment, understanding the trajectory of total station technology becomes paramount. Innovations such as integrated GNSS positioning, cloud-based data workflows, and advanced imaging sensors are redefining best practices across construction, mining, and surveying operations. Decision-makers need a clear, concise synthesis of these trends in order to develop robust strategies that align with organizational goals and emerging regulatory standards.

This executive summary distills the most critical insights shaping the total station market. It examines transformative shifts in the competitive landscape, analyzes the cumulative impact of recent United States tariffs, unveils deep segmentation and regional dynamics, and highlights the strategies of leading manufacturers. By navigating this overview, stakeholders will gain the context required to make informed investments and secure a competitive edge in a rapidly advancing industry.

How Connectivity Automation and Data Integration Are Reshaping the Total Station Market into a Digitally Driven Precision Ecosystem

The total station market is undergoing a fundamental metamorphosis driven by the convergence of connectivity, automation, and data-centric workflows. Where once field crews relied solely on manual targeting and post-processing reconciliation, today’s practitioners harness robotic total stations equipped with live data streaming to central command centers. This integration not only reduces field turnaround times but also minimizes human error, enabling near-real-time project adjustments and tighter alignment with design specifications.

Simultaneously, the proliferation of Internet of Things frameworks and 5G networks is accelerating the adoption of remote monitoring and predictive maintenance capabilities. Sensors embedded within total station units now continuously relay performance metrics, alerting maintenance teams to calibration drift or hardware anomalies before they interrupt critical field operations. In parallel, software ecosystems have matured to support seamless integration with building information modeling platforms, geospatial databases, and enterprise resource planning systems, dissolving historical siloes between hardware outputs and digital project management tools.

These transformative shifts are further amplified by advancements in machine learning algorithms that automate feature recognition and error correction, bolstering the precision of reflectorless measurements across challenging terrains. As the industry embraces a new standard of intelligent instrumentation, manufacturers and end users alike are compelled to rethink procurement strategies, training programs, and value propositions to harness the full potential of this digitally driven precision ecosystem.

Assessing the Ripple Effects of 2025 United States Tariffs on Total Station Supply Chains Pricing Dynamics and Strategic Sourcing

The introduction of new United States tariffs on imported precision measurement equipment in early 2025 has precipitated a series of cascading effects throughout the total station supply chain. Manufacturers reliant on components sourced from affected regions faced immediate cost escalations, compelling them to reassess procurement strategies and explore alternative vendor partnerships in Southeast Asia and domestic markets. These supply chain pivots, while essential to maintain production continuity, have often resulted in extended lead times and sporadic inventory constraints, challenging project managers to build more resilient ordering pipelines.

On the demand side, end users have reacted to price volatility by deferring discretionary purchases, particularly of high-accuracy robotic units that command premium pricing. Instead, there has been an uptick in the refurbishment and calibration services for existing equipment, as firms seek to extract maximum operational value under tighter budgetary constraints. Concurrently, distributors and online platforms have adopted more dynamic pricing models, leveraging digital storefronts to manage clearance of legacy stock while balancing margin pressures.

In response, forward-looking suppliers are negotiating long-term fixed-cost contracts for key components and investing in local assembly facilities to mitigate exposure to further trade policy shifts. These strategic adaptations not only buffer the market from tariff headwinds but also signal a broader trend toward regionalization of critical manufacturing capabilities. As the industry continues to navigate this evolving regulatory landscape, stakeholders must remain vigilant, continuously evaluating trade regulations and supply chain alternatives to safeguard both profitability and delivery timelines.

Unveiling Deep Insights from Type Application and User Segmentation to Decode the Complex Demand Patterns in Total Station Markets

A deep dive into total station segmentation reveals nuanced demand patterns driven by both operational requirements and technological preferences. When categorized by type, conventional prism-based instruments retain their relevance for straightforward surveying tasks, while reflectorless options gain traction in environments where line-of-sight constraints impede prism placement. Robotic total stations, equipped with either Bluetooth communication for short-range deployments or radio communication for extended distances, dominate large-scale projects demanding full automation of instrument aiming and data capture.

Application-oriented analysis underscores that construction teams increasingly favor systems optimized for rapid site layout workflows, whereas inspection professionals prioritize high-definition scanning capabilities to detect structural anomalies. In mining operations, ruggedized total stations address harsh environmental conditions and long-range measurement needs, while surveying and mapping experts leverage integrated GNSS support to streamline geospatial data collection across varied terrains.

Examining end-user verticals, civil engineering firms depend on precise angle and distance calculations for infrastructure projects, with bridges and railways representing major subsegments of the broader roads category. Public mapping authorities rely on certified accuracy thresholds to update cadastral records, whereas mining and quarrying operations emphasize mobility and durability. Oil and gas companies value total stations that offer high positional repeatability for pipeline surveys and rig layout tasks. Across distribution channels, traditional direct sales and dealer networks coexist with digital channels; manufacturer websites and e-commerce platforms facilitate expedited procurement, complementing established distributor relationships. Finally, accuracy tiers ranging from up-to-two-second instruments for premium applications, to two-to-five-second models for general surveying, and over five-second devices for basic layout tasks, illustrate how precision requirements shape purchasing decisions.

This comprehensive research report categorizes the Total Station market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End User

- Distribution Channel

- Accuracy

Comparative Regional Dynamics Highlighting Growth Opportunities and Challenges Across Americas EMEA and Asia-Pacific Total Station Markets

Regional dynamics within the total station market reflect diverse infrastructure priorities, regulatory environments, and technological adoption curves. In the Americas, robust capital expenditure on highways, bridges, and energy infrastructure continues to fuel demand for high-accuracy and robotic instruments. United States and Canada have also demonstrated leadership in integrating total station outputs with digital twin frameworks and smart city initiatives, positioning the region at the forefront of data-driven asset management.

Across Europe, the Middle East, and Africa, landscape heterogeneity leads to a bifurcation in equipment preferences. Western European nations favor precision models that comply with stringent accuracy standards for urban redevelopment and heritage site conservation, whereas emerging markets in the Middle East allocate significant resources to large-scale mining ventures, driving demand for ruggedized and long-range total stations. Regulatory alignment with pan-European geospatial directives further encourages the adoption of instruments capable of seamlessly exporting standardized coordinates to centralized mapping authorities.

In Asia-Pacific, rapid urbanization and industrialization are propelling growth across both established markets such as Japan and Australia and high-growth economies including India and Southeast Asia. Municipal governments and private developers in metropolitan hubs are increasingly integrating cloud-enabled total stations into building information modeling workflows, while remote infrastructure projects in rural regions rely on durable reflectorless and prism instruments to overcome logistical challenges. This variegated regional landscape offers both scale and specificity, underscoring the need for manufacturers to adopt localized product roadmaps and channel strategies.

This comprehensive research report examines key regions that drive the evolution of the Total Station market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Landscape Through a Closer Look at Leading Total Station Manufacturers and Their Strategic Differentiators

The competitive landscape of the total station market is shaped by a blend of established precision instrument manufacturers and agile technology entrants. Market incumbents have fortified their positions by rolling out next-generation robotic total stations with enhanced imaging sensors and proprietary data integration platforms. In contrast, emerging players are carving out niches by offering modular hardware architectures that simplify field upgrades and software subscription models that democratize access to advanced analysis tools.

Key industry participants differentiate themselves through distinct go-to-market strategies. Some emphasize end-to-end portfolio solutions, bundling hardware, software and training services to create sticky ecosystems that span the entire project lifecycle. Others focus on disruptive pricing by leveraging low-cost manufacturing clusters and streamlined distribution channels. Partnerships and strategic alliances have become critical, as leading vendors collaborate with GIS software providers and cloud specialists to deliver turnkey solutions that meet the evolving demands of digital transformation.

Moreover, recent mergers and acquisitions reflect intensified efforts to capture adjacent geospatial technology segments, including drone-based photogrammetry and 3D laser scanning. As the boundaries between traditional surveying instruments and broader remote-sensing hardware blur, companies with the most comprehensive product roadmaps-and the agility to integrate new capabilities-are poised to lead the market’s next phase of growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Total Station market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Surveying Instruments India Pvt. Ltd.

- Crain Enterprises Inc.

- CST/berger

- David White LLC

- GeoMax AG

- Gurin Products LLC

- Hexagon AB

- Hi-Target Surveying Instrument Co. Ltd.

- Kolida Instrument Co. Ltd.

- Leica Geosystems AG

- Maple International Instruments Inc.

- Nikon-Trimble Co. Ltd.

- Northwest Instrument Inc.

- Ruide Surveying Instrument Co. Ltd.

- Sokkia Co. Ltd.

- South Surveying & Mapping Instrument Co. Ltd.

- Stonex Srl

- Topcon Corporation

- Trimble Inc.

Actionable Strategic Imperatives to Empower Industry Leaders in Navigating Disruptions and Capitalizing on Emerging Total Station Trends

To thrive amid technological disruption and geopolitical volatility, industry leaders must adopt a multi-pronged strategic approach. Diversifying component sourcing and establishing regional assembly hubs will reduce exposure to tariff fluctuations and shipping delays while strengthening responsiveness to local market nuances. Concurrently, expanding digital offerings-such as cloud-based collaboration platforms and AI-driven data analytics-can unlock recurring revenue streams and position suppliers as indispensable partners in the data lifecycle.

Customer-centric initiatives are equally vital. By embedding operator training programs and proactive maintenance services into product offerings, firms can enhance user proficiency, reduce downtime, and cultivate long-term relationships. Customization options, such as configurable communication modules or accuracy tiers, will allow clients to align equipment specifications with project requirements, thereby enhancing perceived value and justification for premium pricing.

Finally, vigilance in monitoring regulatory trends and industry standards ensures that product roadmaps remain compliant with emerging accuracy mandates and data interoperability protocols. By instituting agile innovation processes informed by field feedback loops, organizations can swiftly incorporate new sensor technologies, communication standards, and software integrations, staying ahead of competitors and maintaining relevance in a rapidly evolving landscape.

Rigorous Research Methodology Combining Qualitative Interviews and Quantitative Analyses to Ensure Robust Total Station Market Insights

The findings presented in this executive summary are grounded in a rigorous research methodology designed to capture both breadth and depth of market dynamics. Primary research involved in-depth interviews with a diverse set of stakeholders, including surveyors, civil and mining engineers, project managers, and channel partners. These qualitative insights provided nuanced perspectives on adoption drivers, pain points, and emerging technology preferences.

To complement firsthand accounts, extensive secondary research was conducted across trade journals, industry white papers, regulatory filings, and geospatial technology conferences. Published technical standards and patent databases were also analyzed to identify innovation trajectories. Quantitative data points, such as production volumes, shipment trends, and pricing indices, were triangulated from publicly available records and proprietary databases to ensure a balanced view.

Data validation and synthesis were achieved through a multi-layered verification process. Contradictory or outlier data was cross-checked via multiple sources, and statistical techniques were applied to normalize data sets for consistency. This mixed-methods approach, combining qualitative depth with quantitative rigor, ensures the robustness and credibility of the market insights delineated in this summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Total Station market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Total Station Market, by Type

- Total Station Market, by Application

- Total Station Market, by End User

- Total Station Market, by Distribution Channel

- Total Station Market, by Accuracy

- Total Station Market, by Region

- Total Station Market, by Group

- Total Station Market, by Country

- United States Total Station Market

- China Total Station Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Frame the Future Trajectory and Strategic Priorities for Total Station Market Stakeholders

The total station market is undergoing a profound transformation catalyzed by digital connectivity, automation, and evolving regulatory landscapes. Segment analyses reveal that while traditional prism-based units remain integral for fundamental surveying tasks, advanced reflectorless and robotic systems are rapidly gaining favor for large-scale and high-precision applications. Regional dynamics underscore differentiated growth drivers-from infrastructure development in the Americas, to mining investments in EMEA, to urbanization and smart city initiatives in Asia-Pacific.

The cumulative impact of the 2025 United States tariffs has prompted both supply chain restructuring and adaptive pricing strategies, reinforcing the need for resilient sourcing and agile manufacturing footprints. Meanwhile, the competitive arena continues to diversify as incumbent manufacturers fortify their ecosystems with data platforms and new entrants challenge conventions with modular product offerings and cloud-based services.

Collectively, these insights paint a market characterized by both opportunity and complexity. Success for stakeholders will hinge on the ability to integrate advanced technologies, cultivate customer-centric service models, and maintain strategic flexibility in the face of geopolitical and regulatory shifts. As the boundary between hardware and digital ecosystems continues to blur, the companies that harness these convergences will lead the next wave of innovation in spatial measurement solutions.

Take the Next Step Toward Informed Investment in Total Station Technology with Insights from Our Comprehensive Market Report

To stay ahead in a landscape characterized by rapid technological advancements and shifting regulatory frameworks, leaders must take decisive steps that align organizational capabilities with emerging market dynamics. First, it is essential to diversify supply chains by forging strategic partnerships beyond traditional manufacturing hubs, thereby mitigating the impact of future trade barriers and component shortages. Second, investing in integrated software and cloud services that complement total station hardware will unlock new revenue streams through subscription models, predictive maintenance offerings, and data analytics solutions. Third, targeting high-growth end-user segments such as infrastructure development and smart city planning can position companies to capture premium value; this means tailoring solutions to the precise needs of bridges, railways, and roads projects, as well as oil and gas exploration campaigns. Moreover, a focus on service excellence, including operator training programs and responsive after-sales technical support, will strengthen customer loyalty and promote upselling of advanced accuracy models. Finally, maintaining an agile product development cycle through continuous market feedback loops will ensure that next-generation total stations incorporate the latest communication protocols-whether Bluetooth, radio, or emerging 5G networks-and accuracy enhancements critical for up-to-the-second performance. By implementing these strategic imperatives, industry leaders can not only navigate disruptions such as tariff shocks but also capitalize on the data-driven evolution of spatial measurement tools.

- How big is the Total Station Market?

- What is the Total Station Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?