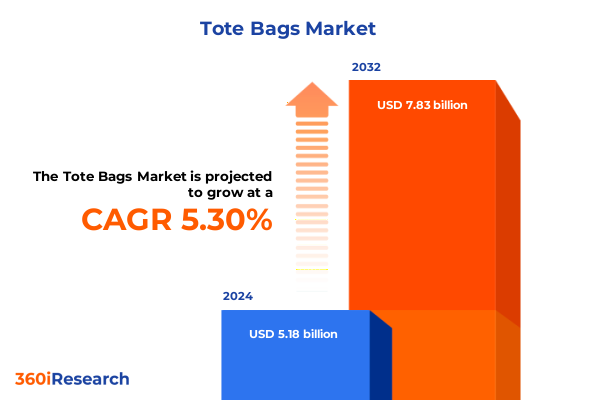

The Tote Bags Market size was estimated at USD 5.18 billion in 2024 and expected to reach USD 5.43 billion in 2025, at a CAGR of 5.30% to reach USD 7.83 billion by 2032.

Elevating the Tote Bag Market Through Evolving Consumer Behaviors, Eco-Friendly Practices, and Innovative Retail Channels

The global tote bag market has undergone a remarkable evolution in recent years, driven by shifting consumer preferences, rising environmental consciousness, and rapid advancements in manufacturing techniques. As everyday accessories transition from purely functional items to statements of personal identity and sustainability, tote bags have emerged as a versatile canvas for brands and consumers alike. This transformation has placed the market at the intersection of fashion, retail innovation, and ecological responsibility, setting the stage for robust strategic opportunities.

Amidst a backdrop of intensified competition and changing retail paradigms, industry stakeholders must appreciate the multifaceted drivers shaping demand. The surge of reusable tote bags aligns with heightened consumer focus on reducing single-use plastics, yet it also reflects broader lifestyle trends favoring customization, convenience, and digital engagement. In this context, understanding the confluence of cultural, technological, and regulatory factors is essential for crafting resilient business models and forging meaningful connections with discerning audiences.

How Sustainability Imperatives and Digital Commerce Are Revolutionizing Materials, Production, and Buyer Engagement in the Tote Bag Industry

The tote bag landscape is experiencing transformative shifts as sustainability imperatives and digital transformation converge to redefine value creation. In response to stricter environmental regulations and consumer-led activism, brands are exploring novel materials and production processes that minimize carbon footprints while maintaining aesthetic appeal. Consequently, traditional fibers like canvas and cotton are being augmented by jute, non-woven polypropylene, and even bio-based synthetics. This material diversification not only addresses eco-conscious demands but also unlocks new design possibilities for texture, durability, and print quality.

Simultaneously, the proliferation of e-commerce platforms and the rise of omnichannel retail have recalibrated distribution dynamics. Online marketplaces now empower niche boutique labels to reach global audiences with minimal overhead, while brick-and-mortar establishments are integrating digital touchpoints to offer seamless shopping journeys. As digital print technologies advance, customization at scale has become increasingly feasible, enabling brands to offer made-to-order designs that resonate with individual lifestyles. This convergence of sustainable materials, direct-to-consumer models, and personalized experiences is reshaping the competitive framework and creating new pathways for growth.

Assessing the Strategic Repercussions of 2025 US Tariffs on Sourcing, Production Agility, and Competitive Pricing Strategies

In 2025, the cumulative impact of United States tariffs has introduced critical considerations for supply chain optimization and cost management within the tote bag sector. Heightened duties on imported materials, particularly synthetic fibers and finished products from traditional manufacturing hubs, have prompted many companies to reassess sourcing strategies. Rather than simply transferring additional costs to end consumers, industry leaders are evaluating nearshoring options and forging partnerships with regional suppliers to maintain quality standards while mitigating exposure to trade volatility.

Moreover, the tariff environment has accelerated innovation in manufacturing efficiencies. Brands and converters are investing in automation, lean production methodologies, and vertical integration to cushion against margin erosion. At the same time, strategic pricing adjustments and value-added services-such as design consultations, multi-pack offerings, and eco-certification programs-have emerged as critical levers for preserving market positioning. As the interplay between trade policy and operational agility intensifies, companies that prioritize supply chain resilience and collaborative supplier relationships will be best positioned to navigate the shifting landscape.

Deep-Dive Synthesis of How Type, Material, Capacity, Size, Distribution Pathways and Price Tiers Drive Distinctive Performance Dynamics

A nuanced examination by type reveals that drawstring designs have captivated cost-sensitive segments seeking lightweight, compact solutions, whereas foldable variants appeal to travelers and urban commuters who prize space efficiency. Simultaneously, zippered tote bags have carved out a niche among premium audiences demanding enhanced security and multifunctional utility. These type-based distinctions underscore the importance of aligning product form factors with specific consumption occasions and user expectations.

Material-based evaluation uncovers canvas as the enduring workhorse valued for its durability and print receptivity, while cotton totes resonate with consumers prioritizing natural fibers and tactile softness. Jute offerings speak to eco-first audiences drawing on provenance narratives, and leather totes have retained their position as status-emblems in luxury segments. In parallel, non-woven polypropylene has established itself as a cost-effective, recyclable alternative for mass campaigns, while nylon totes appeal to performance-driven consumers seeking water-resistant and lightweight solutions.

Capacity-focused insights indicate that under-5 kg totes serve everyday errands and point-of-sale giveaways, with above-10 kg options catering to wholesalers, bulk purchasers, and specialized industrial uses. Mid-range 5-10 kg bags occupy the largest overlap between daily utility and promotional marketing opportunities, requiring a delicate balance of strength and portability. Regarding size, small totes reflect minimalist trends, medium sizes strike a balance of versatility, and large formats satisfy shopper demands for substantial carrying volume during grocery or trade show visits.

Distribution channel analysis shows that offline presence remains vital in convenience stores, department stores, and supermarkets or hypermarkets where consumers can physically assess material quality and engage with in-store promotions. Conversely, company websites and third-party platforms facilitate direct-to-consumer relationships, personalized upselling, and subscription-based replenishment models. Lastly, price range distinctions indicate that economic offerings dominate corporate giveaway and budget-conscious retail segments, whereas premium and luxury tote bags thrive in lifestyle boutiques and brand collaborations that emphasize craftsmanship and exclusivity.

This comprehensive research report categorizes the Tote Bags market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Capacity

- Size

- Distribution Channel

- Price Range

Exploring How Americas, EMEA, and Asia-Pacific Regions Navigate Sustainability Regulations, Cultural Trends, and Production Innovations

Regional dynamics play a pivotal role in shaping tote bag market trajectories, beginning with the Americas, where North American consumers show an escalating affinity for ethically sourced materials and collaboration-driven limited editions. Sustainability certifications have become a purchasing trigger, and creative partnerships between manufacturers and local artists are boosting regional engagement. Meanwhile, Latin American markets are leveraging cost-effective non-woven polypropylene totes for mass promotional campaigns, supported by government initiatives to reduce plastic waste.

In Europe, the Middle East, and Africa, regulatory rigor and social responsibility narratives propel demand for organic cotton and recycled jute totes. European Union directives on single-use plastics have incentivized retailers to offer branded canvases and foldable jute bags, while Middle Eastern luxury labels are experimenting with high-end leather and laser-etched prints. African artisanal producers are integrating traditional weaving techniques into contemporary tote designs, creating culturally resonant products that attract both local buyers and global ethical trade networks.

Across the Asia-Pacific region, manufacturing prowess in China, India, and Southeast Asia continues to underpin global supply chains, with a growing emphasis on automated production lines and quality assurance protocols. Domestic e-commerce giants foster direct-to-consumer tote bag boutiques, often featuring rapid digital printing and marketplace-driven customization. Additionally, eco-conscious urban pockets in Australia and New Zealand are embracing hemp-infused fibers and innovative blends, pushing the envelope of material science and green branding.

This comprehensive research report examines key regions that drive the evolution of the Tote Bags market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering How Market Leaders Harness Sustainable Materials, Digital Platforms, and Strategic Alliances to Outpace Competition

Leading players in the tote bag industry have distinguished themselves through integrated strategies that blend design excellence, operational efficiency, and sustainability commitments. Innovative start-ups have disrupted traditional value chains by offering hyper-personalized printing services and modular design platforms, while established manufacturers are scaling eco-friendly material portfolios through strategic acquisitions of bioplastic and organic fiber startups.

Collaborations between accessory brands and high-profile fashion labels have created premium tote bag lines that command higher price points and drive aspirational marketing narratives. Concurrently, technology-driven companies are investing in digital platforms that allow real-time order management, batch traceability, and on-demand printing, enhancing customer engagement and reducing excess inventory. Partnerships with logistics specialists have also emerged as a critical factor, enabling just-in-time deliveries, reverse logistics for recycling programs, and global distribution at reduced lead times.

Furthermore, leading organizations are institutionalizing sustainability by obtaining third-party certifications, publishing complete material traceability reports, and embedding circular economy principles into product lifecycles. By aligning corporate social responsibility objectives with consumer expectations, these forward-looking companies are cementing their reputations as market leaders and setting new benchmarks for brand loyalty and stakeholder trust.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tote Bags market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blivus Bags Private Limited

- BOSTON BAG CO.

- Burberry Group Plc

- Capri Holdings Ltd.

- Chanel Ltd.

- Dolce and Gabbana Srl

- Enviro‑Tote, Inc.

- Giorgio Armani Spa

- Gucci Group

- Hermes International SA

- Kering SA

- Longchamp SAS

- LVMH Moet Hennessy Louis Vuitton SE

- Miraggio Lifestyles Pvt. Ltd.

- Mulberry Group Plc

- Prada S.p.A

- PVH Corp.

- Ralph Lauren Corp.

- Samsonite International SA

- Tapestry Inc.

- Targus Inc.

- The Pack Corporation

- Tory Burch LLC

- VF Corp.

- XIAMEN NOVELBAG CO. LTD.

Strategic Blueprint for Industry Leaders to Enhance Supply Chain Resilience, Operational Agility, and Consumer Engagement

To capitalize on emerging opportunities, industry leaders should prioritize forging resilient supply chains by diversifying material sources and exploring regional nearshoring partnerships. Implementing advanced manufacturing technologies-such as automated cutting, digital printing, and lean flow processes-will reduce lead times and mitigate the impact of trade fluctuations. Furthermore, integrating real-time data analytics across procurement and operations can empower proactive decision-making, enabling rapid responses to shifting tariff conditions and material availability.

In parallel, brands must deepen consumer connections by offering customizable experiences backed by intuitive online platforms and augmented reality previews. Establishing brand narratives rooted in authenticity and social impact-such as transparent carbon-labelling initiatives and community-focused artisan collaborations-will differentiate offerings and foster long-term loyalty. Expanding omnichannel engagement, including pop-up activations and subscription-based refill programs, will further solidify market presence and unlock recurring revenue streams.

Comprehensive Methodology Integrating Secondary Research, Expert Interviews, Primary Surveys, and Rigorous Data Triangulation

This research employs a comprehensive methodology combining secondary data analysis, expert interviews, and field-level validation to ensure robust insights. Initial data gathering encompassed public filings, trade association reports, academic publications, and regulatory documents to establish baseline market context. Subsequently, qualitative interviews were conducted with material scientists, manufacturing executives, and sustainability experts to capture emerging trends and proprietary innovations.

To augment depth and accuracy, the study incorporated primary surveys with purchasing managers, brand directors, and retail category specialists, providing firsthand perspectives on sourcing preferences, design priorities, and channel performance. Collected data underwent rigorous triangulation, cross-referencing multiple sources to resolve discrepancies and validate conclusions. Finally, analytical frameworks such as PESTEL analysis and Porter’s Five Forces were applied to synthesize how macroeconomic, regulatory, and competitive factors converge to shape the tote bag market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tote Bags market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tote Bags Market, by Type

- Tote Bags Market, by Material

- Tote Bags Market, by Capacity

- Tote Bags Market, by Size

- Tote Bags Market, by Distribution Channel

- Tote Bags Market, by Price Range

- Tote Bags Market, by Region

- Tote Bags Market, by Group

- Tote Bags Market, by Country

- Competitive Landscape

- List of Figures [Total: 32]

- List of Tables [Total: 663 ]

Synthesizing How Sustainability, Digitalization, and Strategic Collaboration Will Define the Future Leaders of the Tote Bag Market

The tote bag market stands at an inflection point where sustainability, digital innovation, and strategic collaboration converge to redefine competitive advantage. As consumers increasingly demand eco-friendly materials and personalized experiences, successful players will be those who can seamlessly integrate advanced manufacturing technologies with authentic brand narratives. Regional diversification and agile supply chains will further buffer companies against policy fluctuations and logistical disruptions.

Ultimately, the industry’s trajectory will be determined by the ability to translate methodological rigor into actionable strategies, harness data-driven insights, and foster cross-sector partnerships that amplify social and environmental value. Organizations that embrace these imperatives are poised not only to thrive in an increasingly complex market but also to lead the evolution toward a more sustainable, connected, and consumer-centric future.

Unlock Exclusive Tote Bag Market Intelligence by Connecting with Our Associate Director for Tailored Strategic Insights

To secure a comprehensive understanding of the tote bag market and obtain the full report, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging with Ketan will grant you immediate access to proprietary analyses, detailed data breakdowns, and bespoke insights tailored to your strategic needs. His expertise ensures that you will receive personalized guidance on how to leverage the findings for maximum competitive advantage in the evolving marketplace.

Whether you are exploring new product launches, refining distribution strategies, or evaluating sustainability initiatives, Ketan can facilitate seamless access to the complete dataset, advisory services, and future briefing sessions. Don’t miss the opportunity to equip your organization with the market intelligence necessary to drive growth and innovation in the tote bag industry. Contact Ketan today to purchase the definitive tote bag market research report and position your company at the forefront of this dynamic sector

- How big is the Tote Bags Market?

- What is the Tote Bags Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?