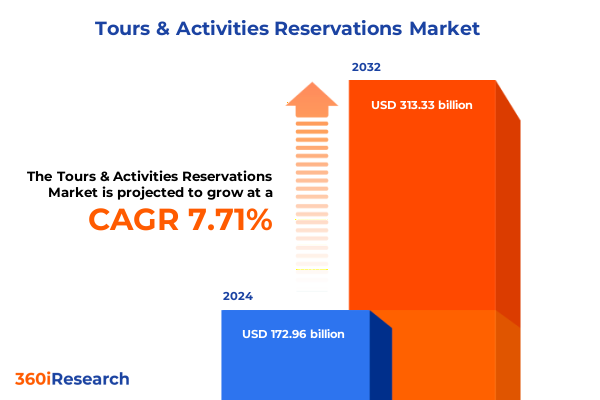

The Tours & Activities Reservations Market size was estimated at USD 185.52 billion in 2025 and expected to reach USD 198.99 billion in 2026, at a CAGR of 7.77% to reach USD 313.33 billion by 2032.

Setting the stage for a comprehensive exploration of how tours and activities reservations are reshaped by evolving traveler preferences and economic trends

The tours and activities reservations landscape has undergone profound evolution, reflecting the interplay between traveler expectations and technological advancements. As more consumers seek personalized, immersive experiences, digital platforms have become indispensable, facilitating seamless discovery, booking, and post-trip engagement. This ecosystem now transcends traditional travel agencies, encompassing online marketplaces, mobile applications, and hybrid models that combine human expertise with algorithm-driven recommendations.

Against this backdrop, decision-makers require a nuanced understanding of cross-cutting trends, regulatory developments, and consumer dynamics that together define market trajectories. The following analysis delves into the fundamental drivers underpinning current performance, examines transformative shifts reshaping competitive benchmarks, and uncovers the implications of policy actions on operational resilience. By articulating segmentation lenses and regional particularities, we aim to equip leaders with the analytical rigor needed to differentiate their offerings and optimize resource allocation.

This executive summary is designed to serve as a strategic compass, delivering clarity on critical inflection points and guiding investment priorities. It synthesizes insights derived from an extensive research process, ensuring that stakeholders are well-positioned to refine their value propositions, strengthen partnerships, and harness emerging growth vectors within the dynamic realm of tours and activities reservations.

Uncovering the seismic shifts redefining the tours and activities reservations landscape through technological innovation and consumer behavior evolution

Over the past several years, the convergence of advanced technologies and shifting consumer sensibilities has catalyzed a tectonic realignment in how tours and activities are sourced, packaged, and booked. Mobile-first interfaces now dominate engagement, spurred by an expectation of instantaneous access and frictionless booking processes. Meanwhile, the proliferation of data analytics and artificial intelligence has enabled hyper-personalization, ensuring that recommendations resonate more deeply with individual traveler profiles. Consequently, operators are redefining service delivery, embedding real-time customization and dynamic pricing into their core offerings.

Equally significant is the surge in demand for sustainable and authentic experiences. Travelers increasingly prioritize locally curated activities that foster cultural immersion and environmental stewardship, driving providers to integrate community partnerships and carbon-offset initiatives. At the same time, digital wallets and contactless payments have achieved mainstream adoption, facilitating cross-border transactions and expanding the addressable audience. These cumulative shifts underscore a broader industry metamorphosis, wherein the nexus of technology, personalization, and purpose is setting new benchmarks for value creation and differentiation.

A deep dive into how United States trade policies and tariffs in 2025 reverberate across tours and activities reservation ecosystems

In 2025, adjustments to United States trade policies and tariffs have rippled through the tours and activities reservation ecosystem, with equipment suppliers and service providers bearing the immediate brunt of increased import duties on leisure and transportation assets. As tariffs on specialized vehicles, outdoor gear, and digital hardware rose, operators faced elevated procurement costs, necessitating strategic reevaluations of sourcing models. Many turned to domestic manufacturers or diversified their supplier base to mitigate exposure, reshaping longstanding partnerships and supply chains.

The downstream impact on pricing structures and consumer demand has been multifaceted. While some operators absorbed cost increases to maintain competitive rate cards, others implemented tiered pricing and bundled offerings to preserve margins. This period of adjustment has underscored the imperative for agility in cost management and contractual flexibility. Moreover, the tariff landscape has prompted an uptick in entrepreneurial ventures offering locally crafted experiences, leveraging artisanal equipment and skill sets that circumvent import dependencies altogether. The net effect is a more resilient, diversified market that reflects a proactive response to evolving trade environments.

Illuminating key segmentation insights that reveal opportunities across traveler groups defined by size, duration, destination, booking mode, and end-user profiles

A granular look at market segmentation reveals differentiated growth levers and value propositions. When examining traveler cohorts by size, the couple segment seeks bespoke, intimate excursions that blend personalization with exclusivity, whereas group travel leverages economies of scale, emphasizing community experiences and curated itineraries. Solo adventurers, in contrast, prioritize flexibility and social integration features, driving platforms to embed peer-matching functionalities and solo traveler communities within their offerings.

Duration-based segmentation further distinguishes market dynamics. Single day tours capture the interest of urban explorers and business travelers with limited discretionary time, leading to investment in streamlined booking processes and last-mile logistics. By contrast, multi-day tours emphasize in-depth immersion, requiring robust partnerships with lodging, transportation, and local guides to deliver seamless experiences across extended itineraries. This dichotomy shapes product roadmaps and distribution strategies in distinct ways.

Destination focus also influences value chains, as domestic travel corridors benefit from established brand equity and regulatory familiarity, while international adventures carry higher complexity around visa support, cross-border compliance, and multi-currency settlement. Booking mode preferences highlight a persistent offline segment that values human touchpoints and bespoke consultation, even as online channels continue to capture digitally native demographics. Finally, end-user segmentation underscores the importance of tailoring solutions to corporate clients seeking conferences and networking events, pilgrimage organizers catering to spiritual journeys, and recreational & leisure travelers engaging in extended vacations or weekend getaways. Each dimension demands a customized approach to product design, distribution partnerships, and marketing narratives.

This comprehensive research report categorizes the Tours & Activities Reservations market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Size

- Duration of Tour

- Destination

- Booking Mode

- End-User

Revealing regional market dynamics that illuminate how tours and activities reservations diverge across the Americas, EMEA, and Asia-Pacific regions

Regional nuances play a pivotal role in shaping performance and strategic priorities. In the Americas, mature markets exhibit high digital penetration, with travelers expecting seamless omnichannel engagement and integrated loyalty ecosystems. Operators in North America and Latin America leverage data-driven personalization to drive repeat business, while forging strategic alliances with regional airlines and hospitality partners to create integrated travel suites.

Across Europe, the Middle East, and Africa, heterogeneity in regulatory frameworks and cultural expectations demands nuanced compliance mechanisms and localized content. Providers navigate varying visa protocols, tax regimes, and consumer protection laws, crafting offerings that respect diverse travel conventions. Technological adoption rates vary widely, prompting a blended approach that combines digital self-service with augmented customer support hubs in key urban centers.

In the Asia-Pacific region, rapid urbanization and a burgeoning middle class fuel exponential demand for experiential travel. High mobile engagement and preference for social-commerce integrations compel operators to optimize digital storefronts and livestreamed experience previews. Meanwhile, local partnerships with community-based enterprises enhance authenticity and support sustainable tourism objectives, positioning Asia-Pacific as a crucible for innovation in tours and activities reservations.

This comprehensive research report examines key regions that drive the evolution of the Tours & Activities Reservations market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the strategies, competitive positioning, and innovative approaches of leading companies driving growth in tours and activities reservation spaces

Leading companies in the tours and activities space are executing multifaceted strategies to fortify their market positions. Several have invested heavily in proprietary technology platforms that consolidate inventory, streamline supplier integration, and offer end-to-end journey management through a single interface. This approach not only enhances operational efficiency but also facilitates data aggregation, enabling predictive analytics and tailored upselling opportunities.

Strategic partnerships have emerged as a critical differentiator. Industry frontrunners collaborate with airlines, hotel chains, and local tourism boards to develop co-branded packages, driving cross-sell synergies and expanding distribution reach. Concurrently, private equity participation and merger activity have accelerated, consolidating niche operators and unlocking scale economies that underpin investment in advanced capabilities, such as machine learning-powered recommendation engines.

In parallel, a new wave of disruptors is gaining traction by emphasizing hyper-local curation and sustainability credentials. These agile entrants leverage community relationships and purpose-driven narratives to engage conscientious travelers. By integrating user-generated content and crowd-sourced reviews, they foster trust and social proof, compelling incumbents to elevate transparency and community engagement as part of their strategic playbook.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tours & Activities Reservations market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbnb, Inc.

- bookingkit GmbH

- CIVITATIS TOURS S.L.

- Expedia, Inc.

- FareHarbor B.V.

- GetYourGuide Deutschland GmbH

- Go Turify, S.L.

- Headout Inc

- Klook Travel Technology Limited

- MAKEMYTRIP PVT. LTD.

- Manawa by ADRENALINE HUNTER SAS

- Miki Travel Limited

- NutmegLabs Inc.

- Peek Travel Inc

- Project Expedition

- Rakuten Group, Inc.

- Rezdy Pty Limited

- Thrillophilia

- Tiqets International B.V.

- Traveloka Group

- Tripadvisor LLC

- TRYTN, Inc.

- TUI Group

- Withlocals B.V.

- Xola Inc.

Delivering pragmatic recommendations that equip industry leaders to navigate evolving challenges and capitalize on emerging opportunities in reservations

Industry leaders should adopt an integrated digital transformation agenda that prioritizes both front-end user experience and back-end operational resilience. Investing in modular, API-driven architectures enables swift integration with emerging technologies, such as real-time translation, AI-enhanced customer support, and immersive media formats. This foundation will support continuous innovation and rapid feature deployment.

To mitigate exposure to external shocks, companies must diversify supplier networks and establish dual-sourcing arrangements for key assets. Emphasizing local partnerships not only reduces tariff vulnerabilities but also enhances authenticity. Concurrently, embedding sustainability metrics into core product offerings and performance dashboards will resonate with increasingly eco-aware travelers and unlock new differentiation vectors.

Finally, leveraging robust analytics to inform dynamic pricing and inventory management will drive yield optimization, while cross-sector collaborations-spanning fintech, transportation, and hospitality-will expand addressable markets and fortify competitive moats. A proactive governance framework, aligned with evolving policy landscapes and data privacy standards, will ensure compliance and nurture stakeholder trust.

Outlining a rigorous research methodology integrating qualitative and quantitative approaches to deliver robust insights on tours and activities reservations

This analysis is underpinned by a rigorous methodology that integrates primary and secondary research across multiple touchpoints. Primary insights were gathered through in-depth interviews with executives, operators, and distribution partners, complemented by a comprehensive survey of frequent travelers to capture sentiment on booking behaviors and experience preferences. These qualitative inputs were triangulated with secondary data from industry publications, regulatory filings, and financial disclosures to ensure contextual accuracy.

Data triangulation was enhanced through expert panels comprising subject matter specialists in travel technology, hospitality management, and international trade. These forums validated emerging trends and stress-tested hypotheses on market drivers, supply chain dynamics, and policy impacts. Quantitative analyses leveraged advanced statistical techniques, including regression modeling and cluster analysis, to delineate segmentation patterns and regional differentials.

Quality control procedures encompassed cross-verification of data sources, iterative review cycles with research advisors, and adherence to ethical guidelines governing respondent confidentiality. The resulting framework ensures that insights are both robust and reliable, providing a solid foundation for strategic decision-making in an ever-evolving tours and activities reservations market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tours & Activities Reservations market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tours & Activities Reservations Market, by Size

- Tours & Activities Reservations Market, by Duration of Tour

- Tours & Activities Reservations Market, by Destination

- Tours & Activities Reservations Market, by Booking Mode

- Tours & Activities Reservations Market, by End-User

- Tours & Activities Reservations Market, by Region

- Tours & Activities Reservations Market, by Group

- Tours & Activities Reservations Market, by Country

- United States Tours & Activities Reservations Market

- China Tours & Activities Reservations Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing key takeaways and emphasizing strategic imperatives essential for thriving in the dynamic world of tours and activities reservations

The analyses presented herein converge on several strategic imperatives. First, digital excellence emerges as a cornerstone for competitive differentiation, necessitating continual investment in user-centric interfaces, data analytics, and ecosystem partnerships. Second, segmentation clarity-across traveler size, tour duration, destination preference, booking mode, and end-user purpose-enables tailored value propositions that resonate with distinct audience subsets.

Regional agility is equally imperative, as regulatory frameworks, cultural nuances, and technological adoption curves vary widely across the Americas, EMEA, and Asia-Pacific. Companies that calibrate their offerings to local market realities while maintaining global coherence will secure the broadest reach. Moreover, resilience against policy shifts-such as tariff changes-demands diversified sourcing strategies and adaptive pricing architectures.

Finally, forward-thinking collaborations and sustainable practices will define market leadership. By aligning service delivery with environmental and social stewardship, operators can appeal to evolving traveler ethics and strengthen brand affinity. These collective insights form a strategic playbook, guiding stakeholders toward sustained growth and robust defensive tactics in the dynamic world of tours and activities reservations.

Encouraging direct engagement with Ketan Rohom to secure comprehensive insights and unlock competitive advantages through our premium market research report

Engaging with Ketan Rohom offers an unparalleled opportunity to transform strategic insights into concrete actions that enhance competitive positioning and operational efficiency. His expertise in sales and marketing ensures a deeply consultative approach, guiding potential buyers through the nuances of the report’s findings and tailoring recommendations to their specific organizational contexts. By securing this market research report, stakeholders gain access to a wealth of evidence-based analyses, enabling them to anticipate shifts, mitigate risks, and capitalize on emerging trends within the tours and activities reservations market.

Decision-makers are encouraged to reach out to Ketan Rohom to discuss customized licensing options, explore volume discounts, and arrange executive briefings that align with their timelines and budgetary parameters. This engagement fosters a collaborative dialogue designed to maximize the value of the report’s insights, ensuring that strategic priorities are clearly defined and actionable roadmaps are in place. Proactive outreach today will empower industry leaders to harness forward-looking intelligence, foster cross-functional alignment, and secure a sustained competitive advantage as market dynamics continue to evolve.

- How big is the Tours & Activities Reservations Market?

- What is the Tours & Activities Reservations Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?