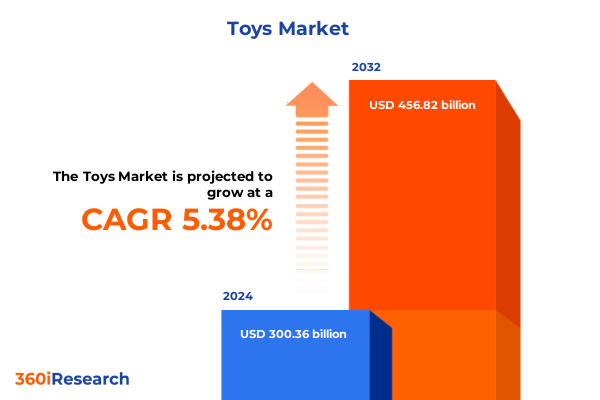

The Toys Market size was estimated at USD 315.92 billion in 2025 and expected to reach USD 332.38 billion in 2026, at a CAGR of 5.40% to reach USD 456.82 billion by 2032.

How changes in consumer behavior, retail models, and regulatory pressures are converging to redefine product strategy and supply resilience in the toy industry

The contemporary toy landscape is defined by a collision of enduring human behaviors-play, nostalgia, and collection-and rapid systemic change driven by technology, retail transformation, and regulatory pressure. Consumers are not only buying products; they are buying narratives: fandoms, reusable play experiences, and items that promise emotional or developmental value. This shift elevates intellectual property and experiential storytelling as prime levers for brands looking to deepen engagement and command premium positioning.

At the same time, the supply side of the industry is negotiating a new normal. Manufacturers face an increasingly complex set of requirements that span sustainability commitments, evolving safety standards, and volatile trade policy. These structural forces are reshaping supplier networks and forcing brands to weigh near-term cost pressures against long-term resilience. In practice, that means sourcing strategies that once prioritized cost efficiency are now being rebalanced to include agility, transparency, and environmental credentials as core criteria.

For decision-makers, the implication is clear: success will accrue to companies that treat play as a holistic experience, deploy IP and product innovation to capture diversified demand across age cohorts, and build supply chains that can absorb policy shocks and seasonal surges. The remainder of this executive summary frames those pressures, surfaces the practical implications across product, material, age, and channel segments, and outlines the critical steps leaders should prioritize in the coming quarters.

Three catalytic industry trends-digital community commerce, adult-driven collector demand, and sustainability mandates-are disrupting product design and retail approaches

Three transformative forces are converging to reshape the toy industry: digitization of play and discovery, shifting consumer demographics and motivations, and sustainability as both regulatory requirement and market differentiator. Digital platforms have expanded how fans discover, share, and validate products; social and community-driven commerce now amplifies collector markets and short-lived fads while creating durable demand for licensed and collectible products. Consequently, product design and marketing must account for rapid cultural feedback loops that can turn niche products into global phenomena overnight.

Parallel to digital acceleration, the demographic footprint of play has broadened. Adults and collectors are a critical audience whose purchasing behavior is often driven by nostalgia, investment potential, and social signaling. Younger cohorts continue to prioritize developmentally meaningful and screen-complementary experiences, prompting manufacturers to blend low-tech tactile play with tech-enabled features that extend engagement and enable recurrent monetization.

Finally, sustainability and regulatory shifts have moved from aspirational to operational. Standards governing chemical safety, battery access, and traceability are tightening, and leading manufacturers are investing in material innovation and energy-efficient manufacturing as a defensive and offensive response. These changes increase short-term complexity but create durable differentiation for brands that can demonstrate safer, greener, and longer-lived products. Together, these trends compel manufacturers and retailers to pursue integrated strategies that unite product innovation, channel optimization, and responsible sourcing.

Evolving U.S. tariff actions and temporary trade truces are compelling manufacturers and retailers to redesign sourcing, inventory, and pricing playbooks to protect margins

U.S. tariff policy developments in 2025 have become a central operational concern for companies that rely on cross-border sourcing for finished goods and components. Recent diplomatic developments have temporarily moderated immediate escalation risk, but the existence of heightened tariff scenarios has already forced firms to revisit sourcing footprints, inventory planning, and pricing strategies. In response, many companies have accelerated supplier diversification, shortened lead times where feasible, and restructured product assortments to prioritize higher-margin and IP-led SKUs that can better absorb incremental landed costs. The recent extension of a tariff truce illustrates how quickly the policy context can shift and why scenario planning has become a nonnegotiable element of commercial planning.

Large manufacturers and brand owners have been explicit about the operational impacts and their mitigation playbooks: actions include rebalancing production across Asia and other low-cost regions, creating buffer inventory ahead of key seasonality windows, negotiating alternative freight and contractual terms with suppliers, and selectively implementing pricing adjustments in markets where cost pressure cannot be fully absorbed. Those supply and pricing adjustments are being coordinated with promotional calendars to avoid eroding perceived value while protecting margins. Public statements and investor disclosures from leading companies make clear that tariff exposure has catalyzed multi-year supply chain reconfiguration programs.

For retailers and manufacturers alike, the practical takeaway is to treat tariffs as a dynamic variable rather than a one-time shock. Short windows of policy stability do not eliminate structural risk. Instead, they offer breathing room to operationalize supplier diversification, to refine product portfolios for higher resilience, and to implement pricing approaches that preserve long-term brand equity.

A layered segmentation perspective across product types, materials, age cohorts, and retail channels reveals nuanced opportunities and operational trade-offs for targeted growth

Segmentation is the cornerstone of targeted strategy in the toy sector, and a layered view of product type, material, age group, and sales channel reveals differentiated risk and opportunity. Product categories such as action figures, building sets, and collectible trading cards each follow distinct demand logics: some are driven by entertainment IP cycles and adult collecting behavior, whereas others rely on developmental play patterns and repeat purchases from parents and caregivers. This divergence means that product teams must calibrate launch cadence, licensing investments, and retail partnerships to the specific engagement drivers of each category.

Material choices-plastic, wood, metal, and fabric-carry implications far beyond tactile experience. Plastic-dominant categories face heightened scrutiny around recyclability and embodied carbon, prompting investment in recycled feedstocks and alternative polymers. Wooden and fabric-based lines, while often perceived as more sustainable, require rigor in supply chain traceability to validate claims and to ensure consistent quality and safety. Design-to-material strategies that anticipate regulatory changes and consumer expectations will yield faster adoption and premium positioning.

Age segmentation is equally consequential. Infants and preschoolers demand rigorous safety validation and durable, developmentally appropriate features; school-age children seek complexity and collectibility; teenagers and adult collectors often value aesthetics, rarity, and authenticity tied to licensing. Channel segmentation further complicates the picture: offline retail remains crucial for discovery and experiential merchandising in department stores and specialty locations, while online channels-brand websites and third-party marketplaces-drive convenience, direct-to-consumer relationships, and data-driven personalization. The interplay of these segments requires a coordinated approach to assortment, packaging, pricing, and promotional strategy that aligns inventory velocity with consumer expectations across channels.

This comprehensive research report categorizes the Toys market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Age Group

- Sales Channel

Divergent regional drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific create distinct regulatory, sourcing, and demand considerations for global operations

Regional dynamics exert outsized influence over sourcing, regulatory compliance, and consumer demand patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific. The Americas market remains a critical consumption hub where retail consolidation, large omnichannel players, and holiday seasonality shape supplier timetables and promotional intensity. Consumer tastes in this region increasingly favor licensed and collectible products, while regulatory scrutiny around safety and chemical compliance is enforced through established oversight mechanisms.

In Europe, Middle East & Africa, regulatory complexity and sustainability expectations are particularly pronounced. Manufacturers serving this region must navigate layered compliance requirements and a consumer base that often prizes eco-design and traceable supply chains. Retail structures vary widely across the region, from large national chains to highly localized specialty retailers, which creates opportunities for differentiated go-to-market models.

Asia-Pacific functions dually as a major manufacturing base and a fast-growing consumption market. Investments in regional production capacity and sustainability-minded factories underscore an industry move to shorten and green supply chains. At the same time, Asia-Pacific consumers are driving new product dynamics-especially in categories tied to mobile-first discovery, anime and gaming IP, and youth-centric social commerce. Understanding the interplay among these regions is essential for companies orchestrating global launches and resilient sourcing strategies.

This comprehensive research report examines key regions that drive the evolution of the Toys market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Public company strategies show a coordinated industry pivot toward IP monetization, supply diversification, and sustainability investments to maintain competitive advantage

Major players are responding with distinct but complementary strategies that underscore three priorities: protect and expand IP value, diversify and decarbonize supply chains, and harness retail partnerships for omnichannel reach. Some firms are doubling down on entertainment partnerships and franchise development to create sustained demand cycles that extend beyond single-season hits. Others are accelerating operational programs that formalize supplier diversification, increase automation in manufacturing, and reduce dependency on any single geography.

Corporate communications and public filings reveal an industry-level pivot: companies are investing in manufacturing closer to demand centers where feasible, and making visible commitments to cleaner production and material innovation. These investments are being deployed alongside new product development drives that emphasize collectibility, play longevity, and cross-platform engagement-features that tend to monetize better across both direct and retail channels. Strategic collaborations between toy companies and digital platforms or entertainment studios are increasingly common as firms seek to convert cultural momentum into product velocity and repeat purchase behavior.

For competitive benchmarking, the most instructive signal is execution. Firms that can translate IP strength into premium product assortments, while simultaneously demonstrating credible supply chain and sustainability initiatives, are better positioned to sustain margin and win retailer allocation. Investors and partners are watching not just sales performance but the durability of these operational shifts as proxies for future resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Toys market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AOSHIMA BUNKA KYOZAI Co,.Ltd

- Backyard Products LLC (KidKraft Products, Inc)

- Bandai Namco Holdings Inc.

- Buffalo Games, LLC

- Build-A-Bear Workshop, Inc.

- Candytoy Corporate Pvt. Ltd.

- Cartamundi Group

- Clementoni S.p.A

- CubicFun Toys Industrial Co., Ltd.

- Dream International Limited

- Educa Borras by Team Toys SA

- FUNKO, INC.

- Funtastic International, Inc.

- Gibsons Games Ltd.

- Goliath Group

- Hape International AG

- HASBRO, INC

- Horst Brandstätter Group

- JAKKS Pacific, Inc

- Konami Group Corporation

- Koninklijke Jumbo B.V.

- Lansay

- LEGO Group

- MasterPieces Puzzle Company

- Matrix Holdings Limited

- Mattel Inc.

- MGA Zapf Creation GmbH

- Moose Enterprise Pty Ltd

- Playmates Toys Limited

- Radio Flyer, Inc.

- Ravensburger AG

- SANRIO CO., LTD

- Schmidt Spiele GmbH

- Simba Dickie Group

- Spin Master Corp.

- TOMY COMPANY, LTD

- Trefl S.A.

- VTech Holdings Limited

Concrete priority actions for executives to reduce tariff exposure, diversify supply, accelerate sustainable materials adoption, and capture collector and omnichannel demand

Industry leaders should pursue a set of prioritized actions that balance immediate risk mitigation with medium-term strategic positioning. First, establish a tariff-aware sourcing playbook that embeds scenario planning into quarterly product and procurement reviews; this includes pre-defining trigger points for inventory reallocation and price adjustments tied to specific policy outcomes. Second, accelerate supplier diversification particularly for high-risk product types and components, while investing in smaller, multi-country supplier pools to reduce single-node dependency.

Third, integrate material strategy with brand positioning by piloting recycled or renewable material SKUs in higher-margin lines and by using verified third-party certifications to substantiate claims for consumers and regulators. Fourth, align assortment and marketing to capitalize on adult collector demand: limited editions, direct-to-consumer exclusives, and premium packaging can generate disproportionate margin and social media visibility. Fifth, reinforce omnichannel capabilities by designing product journeys that leverage in-store discovery for experiential play, while using digital platforms for personalization, replenishment, and community building.

Finally, invest in regulatory readiness: formalize testing and tracking requirements to comply with evolving safety standards, and create a cross-functional escalation path for any chemical, battery, or tracking-label regulatory changes. Implemented together, these actions will help leaders protect margin, accelerate growth in priority segments, and reduce the probability of disruptive shortages or compliance setbacks.

Methodology that combines executive interviews, public financial disclosures, regulatory review, and manufacturing announcements to deliver cross-validated industry insights

This research synthesizes industry signals drawn from a multi-method approach to ensure reliability and practical relevance. Primary inputs include structured interviews with senior supply chain, product, and commercial leaders across manufacturers, licensed brand holders, and major retailers, supplemented by targeted discussions with logistics and compliance specialists. These firsthand perspectives were used to validate observed shifts in sourcing footprints and to understand the practical constraints facing operational teams.

Secondary validation leveraged public company disclosures, investor presentations, regulatory filings, and industry association briefings to corroborate strategic priorities and execution timelines. Where applicable, press reporting and official statements regarding trade policy and regulatory updates were referenced to anchor scenario analyses in verifiable developments. The analysis also incorporated manufacturing and factory announcements that signal capital deployment and sustainability commitments in key production markets.

Data synthesis emphasized cross-validation: when interview testimony suggested a strategic trend, supporting documentary evidence was sought to avoid over-reliance on anecdote. The resulting approach yields findings that are grounded in both practitioner experience and public record, offering commercially actionable insight without speculative forecasting.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Toys market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Toys Market, by Product Type

- Toys Market, by Material

- Toys Market, by Age Group

- Toys Market, by Sales Channel

- Toys Market, by Region

- Toys Market, by Group

- Toys Market, by Country

- United States Toys Market

- China Toys Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Final assessment emphasizing that supply chain resilience, sustainability commitments, and IP-driven product experiences will determine competitive advantage in the coming period

In conclusion, the toy industry stands at an inflection point where commercial creativity must be matched by operational rigor. The resilience and responsiveness of supply chains, clarity around material and safety claims, and the ability to translate IP into sustained consumer engagement will separate the companies that merely survive from those that thrive. As policy environments continue to oscillate, the value of preparedness-built from diversified sourcing, scenario-ready inventory policies, and disciplined pricing frameworks-cannot be overstated.

Leaders who invest in product designs that accommodate sustainable materials, who build direct relationships with collector and adult audiences, and who treat regulatory compliance as a strategic asset will benefit from stronger retailer partnerships and more defensible pricing power. Conversely, organizations that delay structural changes in sourcing or that underinvest in safety and traceability risk both reputational and financial exposure. The path ahead rewards intentionality: plan for variability, move with speed to operationalize resiliency, and maintain relentless focus on the consumer experiences that drive loyalty and repeat purchase.

Purchase the comprehensive toy market report by contacting Ketan Rohom to secure tailored briefings, sample chapters, and prioritized strategic support

To obtain the full market research report and secure time-sensitive strategic insights tailored to your business priorities, please contact Ketan Rohom (Associate Director, Sales & Marketing). Ketan can arrange a customized briefing that aligns the report’s granular segmentation analysis, regional trade implications, and actionable recommendations with your commercial objectives. A direct engagement will also include options for bespoke addenda-such as competitor benchmarking across core product types, scenario planning for tariff sensitivities, and prioritized go-to-market playbooks for collector-driven and age-specific categories.

Engaging directly will ensure you receive the most relevant modules immediately, including the detailed segmentation breakdowns by product type, material, age group, and sales channel; the regulatory and safety appendix that synthesizes recent ASTM and CPSC changes; and supplier-disruption scenarios calibrated against the latest tariff developments and regional manufacturing shifts. For executives preparing for the holiday season or planning multi-year product roadmaps, a purchased copy can be coupled with an analyst hour that highlights rapid-win opportunities, supply levers to protect margin, and merchandising recommendations for both brick-and-mortar and e-commerce channels.

Purchase pathways are straightforward and prioritized for stakeholders needing rapid access. Reach out to Ketan Rohom (Associate Director, Sales & Marketing) to schedule a briefing, request a sample chapter, and receive information on licensing and enterprise distribution options. This direct channel ensures your team gains the report insights needed to act with speed and confidence in a rapidly evolving toy market.

- How big is the Toys Market?

- What is the Toys Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?