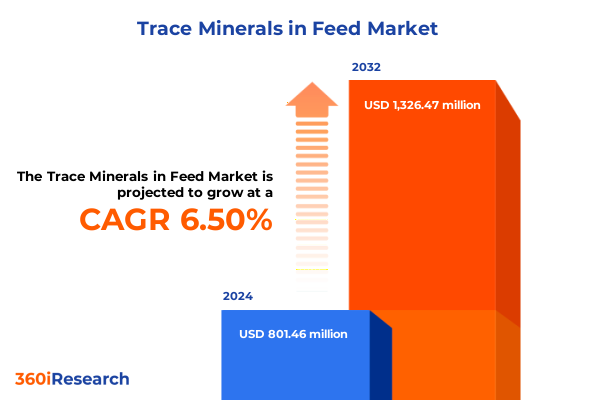

The Trace Minerals in Feed Market size was estimated at USD 846.33 million in 2025 and expected to reach USD 895.82 million in 2026, at a CAGR of 6.63% to reach USD 1,326.47 million by 2032.

Unlocking the Strategic Necessity of Trace Minerals in Feed Formulations for Maximizing Livestock Health Welfare and Production Efficiency

Animal nutrition has undergone a profound evolution over the past decade, with trace minerals emerging as foundational components for achieving peak livestock performance. As micronutrients that act as essential cofactors in enzymatic processes, these elements-copper, iron, manganese, selenium, and zinc-play an indispensable role in bolstering immune defenses, optimizing metabolic pathways, and ensuring robust reproductive outcomes. Their nuanced interactions within animal physiological systems have prompted feed formulators and integrators to reexamine traditional supplementation approaches, ushering in innovative delivery formats and precision-targeted formulations.

The contemporary feed industry is responding to rising consumer demand for sustainable protein production by integrating trace minerals into holistic health management strategies. This shift reflects a broader paradigm in which livestock health is viewed through the dual lenses of productivity and welfare. Regulatory agencies worldwide are also tightening permitted inclusion levels and encouraging the adoption of organic-bound mineral complexes to minimize environmental excretion. Such policy developments underscore the pressing need for feed producers and ingredient suppliers to adapt rapidly to maintain compliance while preserving economic viability.

Given these converging forces-heightened performance expectations, evolving regulations, and sustainability mandates-trace mineral supplementation has transcended its historical status as a niche technical consideration. It now stands at the forefront of feed innovation, where science-driven formulations and data analytics are leveraged to meet both producer profit objectives and end-consumer values. This report’s introduction establishes the context for exploring transformative landscape shifts, tariff impacts, segmentation dynamics, regional variations, and strategic recommendations to help stakeholders capitalize on this critical market axis.

Navigating the Convergence of Advanced Delivery Technologies Data-Driven Precision Nutrition and Sustainable Bio-Based Mineral Complexes

The feed additives landscape is witnessing transformative shifts driven by advances in nutritional science, material technologies, and digital analytics. First, the refinement of chelated and organic-bound mineral complexes has markedly improved bioavailability compared with traditional inorganic salts. Consequently, manufacturers are increasingly investing in next-generation delivery systems that harness microencapsulation and nanoparticle carriers to protect minerals through the gastrointestinal tract and release them at optimal absorption sites. This evolution marks a departure from century-old supplementation practices, offering higher absorption rates and reduced waste excretion.

In parallel, precision livestock farming tools-ranging from real-time biometric sensors to artificial intelligence–powered health diagnostics-are enabling bespoke mineral regimens tailored to individual animal needs rather than broad herd averages. These data-driven methodologies allow nutritionists to fine-tune trace mineral inclusion rates according to growth stage, breed-specific requirements, and health status, driving both cost-efficiency and performance reliability.

Furthermore, consumer preferences for naturally derived, sustainable ingredients have catalyzed research into plant-based chelators and fermentation-derived mineral complexes. Such bio-based options not only satisfy regulatory pressures to lower inorganic mineral discharge in manure but also align with corporate sustainability commitments. Collectively, these dynamic shifts signal a broader industry trajectory toward smarter, greener, and more efficacious trace mineral solutions as integral pillars of modern animal nutrition.

Adapting Sourcing and Procurement Strategies to Mitigate Rising Costs and Supply Chain Complexities from Recent U.S. Trace Mineral Tariffs

Since the introduction of the latest U.S. tariff adjustments in early 2025, trace mineral import dynamics have undergone notable recalibrations. Incremental duty increases on select inorganic mineral precursors prompted feed manufacturers to diversify their supplier networks and explore domestic production alternatives. Although the magnitude of these duties varied depending on specific HTS codes, the overarching effect was a rise in landed cost for critical raw materials, particularly copper sulfate, zinc oxide, and manganese chloride.

Businesses responded by accelerating partnerships with local mining operations and by evaluating forward contracts to hedge against further tariff volatility. In turn, some ingredient formulators reengineered their recipes to favor organic-bound alternatives that fell outside the most stringent tariff classifications. These strategic adjustments mitigated cost spikes but also introduced new supply chain considerations, such as lead times for custom-manufactured chelates and capacity constraints among specialty ingredient providers.

Critically, this tariff-driven landscape has underscored the importance of agile procurement strategies. Companies with diversified geographic sourcing footprints have fared better at containing cost pressures, while those reliant on single-origin imports faced sharper margin contractions. As policymakers continue to review trade policies, feed industry leaders must remain vigilant and maintain flexible sourcing models to navigate any future shifts in trade relations.

Illuminating How Product Form and Livestock-Focused Strategies Align with Application Goals and Distribution Models in Trace Mineral Supplementation

Insight into product-level trends reveals that organic-bound forms of copper, iron, manganese, selenium, and zinc are increasingly displacing their inorganic counterparts due to superior bioavailability and favorable regulatory positioning. Livestock categories are likewise exhibiting nuanced demand patterns; aquaculture operations prioritize selenium and zinc to bolster antioxidant defenses in aquatic species, while poultry integrators focus on manganese and copper for skeletal development and feather quality. Within ruminants, beef cattle nutritionists emphasize trace minerals to enhance muscle deposition, whereas dairy producers target selenium and zinc to support udder health and milk yield. Swine operations, by contrast, lean heavily on iron and copper for neonatal piglet viability and growth acceleration.

At the same time, feed manufacturers are optimizing the ratio of inorganic to organic mineral forms to strike a balance between cost and performance, while a select segment of premium producers markets fully organic portfolios to differentiate on feed conversion and animal welfare metrics. Applications in disease prevention leverage selenium and zinc’s immunomodulatory properties to reduce antibiotic reliance, whereas growth-promotion strategies harness copper’s gut health benefits. Reproductive enhancement protocols integrate trace minerals-especially selenium’s role in antioxidative protection during gestation-to improve conception rates and litter uniformity.

Distribution channels are evolving in tandem; direct-sales teams work with high-volume integrators to provide customized supplementation programs, while distributors and feed manufacturers bundle trace minerals into premixes for regional co-ops. Meanwhile, online retail platforms are emerging as agile conduits for specialty mineral formulations, enabling smaller-scale producers to access premium products quickly. Together, these segmentation insights spotlight the diverse ways in which feed industry stakeholders tailor trace mineral strategies to specific production and market demands.

This comprehensive research report categorizes the Trace Minerals in Feed market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Livestock Type

- Form

- Application

- Distribution Channel

Examining Distinct Regulatory Mandates and Production Drivers Shaping Trace Mineral Adoption across Major Global Regions

Regional patterns in trace mineral adoption underscore distinct drivers across the Americas, Europe-Middle East & Africa, and Asia-Pacific. In North and South America, rising demand for high-quality protein and stringent environmental regulations have spurred the uptake of organic-bound minerals; producers in the United States and Brazil increasingly adopt chelated trace elements to comply with manure nutrient management standards while optimizing feed conversion ratios.

Across Europe-Middle East & Africa, the regulatory environment remains among the most dynamic globally. The European Union’s Farm to Fork strategy has accelerated the transition away from high-dose inorganic minerals, incentivizing investments in fermentation-derived and plant-based complexes. Meanwhile, emerging markets in the Middle East and North Africa are expanding poultry and dairy operations, creating fresh demand for trace mineral premixes tailored to local feed grain profiles and climate stressors.

In Asia-Pacific, rapid intensification of aquaculture and pork production is driving robust growth in mineral supplementation. China, Vietnam, and Thailand are refining feed formulations to integrate selenium and copper into recirculating aquaculture systems, while India’s dairy sector is embracing zinc boluses to address micronutrient deficiencies in smallholder herds. Regional infrastructure investments and government support for local feed ingredient production are enhancing supply reliability and lowering overall costs, prompting more widespread adoption of advanced trace mineral solutions.

This comprehensive research report examines key regions that drive the evolution of the Trace Minerals in Feed market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering How Integrated Agribusinesses Specialized Ingredient Innovators and Digital Agritech Startups Are Redefining Competitive Dynamics

Leading industry players are charting varied approaches to capture growth in the trace mineral segment. Established agribusiness conglomerates have leveraged integrated supply chains to secure sourcing advantages and offer end-to-end premix solutions. These companies are investing in R&D centers to refine chelation technologies and optimize mineral ratios for specific livestock classes, positioning themselves as one-stop partners for feed millers and integrators.

Specialty ingredient houses, on the other hand, are differentiating through proprietary organic-binding agents and plant-based chelators. By collaborating with universities and contract research organizations, they validate bioefficacy through in vivo feeding trials, thus bolstering technical credibility among nutritionists. A subset of these innovators is also exploring continuous flow manufacturing platforms to scale-up next-generation formulations more efficiently, reducing time-to-market for custom mineral complexes.

Meanwhile, digital agritech startups are embedding trace mineral analytics within broader herd health monitoring systems. These platforms combine sensor-derived performance metrics with mineral inclusion data to recommend real-time diet adjustments. Such convergence of digital services and nutritional inputs is reshaping value propositions, as feed industry stakeholders seek deeper visibility into return on investment metrics for precision supplementation programs.

Collectively, these strategic postures-from integrated agribusiness models to specialized ingredient R&D and data-enabled nutrition ecosystems-are redefining competitive dynamics and setting new benchmarks for efficacy and sustainability in the trace minerals domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Trace Minerals in Feed market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrofeed Ltd

- Alltech

- Archer Daniels Midland Company

- Bluestar Adisseo Company

- Cargill Incorporated

- Chelated Minerals Corporation

- DSM Nutritional Products AG

- Global Animal Products Inc

- Kemin Industries Inc

- Lallemand Animal Nutrition

- Mercer Milling Company Inc

- Novus International Inc

- Nutreco N.V.

- Pancosma SA

- Phibro Animal Health Corporation

- QualiTech Corporation

- Ridley Corporation Limited

- Vamso Biotec Pvt Ltd

- Vetline Limited

- Zinpro Corporation

Implementing Agile Sourcing R&D Partnerships and Regulatory Engagements to Drive Innovation and Resilience in Trace Mineral Supply Chains

Industry leaders must prioritize diversification of raw material sourcing to hedge against tariff disruptions and geographic vulnerabilities. Establishing multi-tiered supplier networks across different regions can buffer procurement pipelines and assure consistent quality standards, while forward-looking procurement contracts lock in favorable terms. Concurrently, investing in in-house or collaborative manufacturing capabilities for organic-bound mineral complexes can reduce reliance on external chelators and enhance margin control.

To further differentiate, companies should allocate R&D resources toward novel delivery technologies that improve bioavailability and reduce excretion. Advancements in microencapsulation or nanoparticle encapsulation can also open new application areas, such as early-stage digestive health or low-dose gestational supplementation. At the same time, forging alliances with data analytics providers will enable real-time performance monitoring and feed formulation adjustments, increasing transparency and validating return on investment for end users.

Engagement with regulatory bodies and participation in industry consortia will keep organizations ahead of evolving inclusion limits and sustainability mandates. By contributing to standard-setting dialogues, companies can shape practical guidelines for trace mineral use and preemptively address environmental concerns. Finally, cultivating tailored market offerings-combining region-specific product portfolios with digital advisory services-will strengthen customer loyalty and unlock incremental revenue streams in an increasingly competitive landscape.

Detailing a Robust Mixed-Methods Research Framework Integrating Expert Interviews Data Analysis and Case Studies for Comprehensive Market Insights

This report synthesizes findings from a structured research framework combining primary and secondary methodologies. The secondary phase involved extensive review of trade publications, regulatory filings, technical white papers, and patent databases to map current mineral technologies and policy landscapes. Simultaneously, primary research comprised in-depth interviews with nutritionists, feed mill managers, ingredient suppliers, and regulatory experts in key markets across the Americas, Europe-Middle East & Africa, and Asia-Pacific.

Quantitative data collection incorporated distribution analyses, pricing indices, and import-export customs records to validate tariff impacts and regional adoption patterns. Qualitative insights were triangulated through multiple expert sources to ensure accuracy and mitigate bias. Case studies from representative feed integrators provided real-world context, illustrating best practices in trace mineral formulation and digital integration.

A rigorous data validation process was applied to reconcile discrepancies between public datasets and proprietary survey findings. Adherence to ethical research standards was maintained throughout, ensuring confidentiality and transparency. The result is a comprehensive, multi-dimensional perspective on trace minerals in feed, crafted to support strategic decision-making and identify emerging opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Trace Minerals in Feed market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Trace Minerals in Feed Market, by Product Type

- Trace Minerals in Feed Market, by Livestock Type

- Trace Minerals in Feed Market, by Form

- Trace Minerals in Feed Market, by Application

- Trace Minerals in Feed Market, by Distribution Channel

- Trace Minerals in Feed Market, by Region

- Trace Minerals in Feed Market, by Group

- Trace Minerals in Feed Market, by Country

- United States Trace Minerals in Feed Market

- China Trace Minerals in Feed Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Themes of Innovation Analytical Precision and Strategic Agility Shaping the Future of Trace Mineral Nutrition

Trace minerals have emerged as pivotal levers for unlocking superior livestock performance, addressing both productivity and sustainability imperatives. From organic-bound chelates to precision supplementation driven by analytics, the industry’s trajectory is characterized by rapid innovation and adaptive sourcing strategies. Regulatory shifts, notably the 2025 U.S. tariffs, have underscored the importance of supply chain resilience and have accelerated the quest for cost-effective, high-performance mineral complexes.

Segment-specific dynamics reveal that feed formulators can no longer rely on one-size-fits-all approaches; instead, they must tailor mineral portfolios by product type, livestock category, formulation form, application goal, and distribution channel to meet diverse customer demands. Regional insights further highlight how local regulations and production systems shape adoption patterns, necessitating differentiated go-to-market strategies.

As the trace mineral sphere evolves, organizations that blend integrated sourcing, targeted R&D investments, and collaborative regulatory engagement will be best positioned to capture value. By leveraging advanced delivery technologies and embracing data-enabled nutrition models, feed industry stakeholders can drive sustained growth and deliver measurable improvements in animal health and environmental outcomes. This conclusion synthesizes the core themes of innovation, agility, and strategic alignment that define the modern trace mineral landscape.

Contact Ketan Rohom to Secure Customized Trace Minerals in Feed Insights and Propel Your Organization’s Strategic Growth in Animal Nutrition

Don’t navigate the complexities of the trace minerals market alone; engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure unparalleled insights and detailed market data essential for making high-stakes decisions. Reach out to Ketan to discuss how our comprehensive report can be tailored to your organization’s strategic priorities and ensure you stay ahead in a fast-evolving feed additives landscape. Unlock exclusive client offerings and custom research add-ons by scheduling a consultation today-empower your team with the intelligence it needs to drive growth and innovation in animal nutrition.

- How big is the Trace Minerals in Feed Market?

- What is the Trace Minerals in Feed Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?