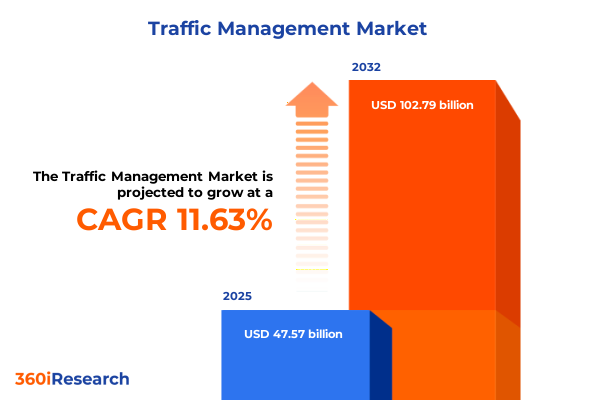

The Traffic Management Market size was estimated at USD 47.57 billion in 2025 and expected to reach USD 52.74 billion in 2026, at a CAGR of 11.63% to reach USD 102.79 billion by 2032.

Introducing the Critical Role of Intelligent Traffic Management Solutions Amid Soaring Urbanization Challenges, Accelerating Technological Breakthroughs, and Growing Demand for Sustainable Mobility

The complexity of urban mobility challenges has never been more pronounced as cities worldwide contend with growing populations, increased vehicle ownership, and evolving commuter expectations. Intelligent traffic management solutions are rising to meet these demands, leveraging a convergence of digital technologies and data-driven methodologies. The intersection of urban planning priorities and technological innovation is forging new pathways to optimize traffic flow, reduce congestion, and enhance safety across transportation networks.

As municipal authorities allocate budgets toward smarter infrastructure, the need for scalable, interoperable systems has come into sharper focus. Agencies are seeking solutions that not only address today’s bottlenecks but also anticipate tomorrow’s mobility patterns through predictive analytics and adaptive control mechanisms. At the same time, community stakeholders are demanding more sustainable approaches that balance environmental considerations with operational efficiency. This has propelled an ecosystem where hardware advancements, such as high-resolution cameras and advanced sensors, mesh seamlessly with sophisticated software platforms to deliver real-time visibility and control.

Moreover, the growing adoption of cloud and edge computing architectures is enabling agencies to harness vast volumes of traffic data without compromising on speed or reliability. With these underlying shifts, the stage is set for a new era of traffic management-one defined by proactive decision making, continuous optimization, and the promise of safer, more efficient roadways.

Uncovering the Transformative Shifts Reshaping Traffic Management From AI and IoT Integration to Cloud and Edge Computing Paradigms and Vision-Based Surveillance

Traffic management is undergoing a profound transformation driven by the integration of machine learning algorithms, pervasive connectivity, and advanced imaging techniques. Artificial intelligence and computer vision are now central to incident detection processes, enabling rapid identification of anomalies in traffic flow and swift deployment of response teams. Meanwhile, the proliferation of Internet of Things devices-from smart cameras to environmental sensors-is creating a networked fabric of real time data that supports dynamic signal timing and congestion mitigation strategies.

The shift to edge computing architectures is ensuring that critical insights are generated closer to the point of collection, reducing latency and alleviating network bandwidth constraints. This is complemented by cloud-based platforms that aggregate historical and regional data sets, facilitating deeper trend analysis and predictive modeling. As a result, traffic signal optimization now takes into account weather conditions, special events, and fluctuating travel demands, offering a level of responsiveness that was previously unattainable.

Further accelerating this paradigm is the advent of multimodal integration, where traffic management systems interface with public transportation networks, parking infrastructures, and rider information services. By delivering comprehensive situational awareness, agencies can orchestrate vehicle prioritization for emergency services and public transit while balancing the needs of private motorists, cyclists, and pedestrians. In parallel, vision-based surveillance and analytics are enhancing safety protocols by detecting unauthorized roadway incursions and facilitating enforcement of speed limits and lane usage policies. Combined, these technological shifts are setting the foundation for a truly next generation transportation ecosystem, where data drives smarter, safer, and more sustainable mobility solutions.

Assessing the Cumulative Impact of 2025 United States Tariffs on Traffic Management Market Dynamics, Supply Chains, and Infrastructure Investments

The introduction of sweeping United States tariff measures in early 2025 has introduced a new set of challenges for traffic management solution providers and end users. Tariffs approaching a quarter of import value on critical hardware components-ranging from semiconductor chips and circuit boards to steel and aluminum for roadside equipment-have elevated the cost of cameras, traffic signal controllers, and variable message signs. Such increases are prompting public agencies to reassess procurement timelines and reevaluate capital expenditure priorities, leading to slower rollouts of planned upgrades.

Supply chain disruptions have compounded this effect, as key sensor suppliers and networking infrastructure vendors navigate customs delays and higher duties on imported goods. Organizations are exploring alternative sourcing strategies, including nearshoring and regional partnerships, but these shifts often require additional certification and testing cycles, further extending deployment schedules. As procurement costs rise, the balance between hardware investment and ongoing maintenance services tilts, driving a greater need for system integration expertise to optimize existing assets rather than acquiring new equipment.

In parallel, software and cloud service providers are recalibrating pricing models to mitigate the impact of higher underlying infrastructure costs. Edge computing nodes and data center expansions now incorporate tariff-driven surcharges, influencing total cost of ownership calculations and contract negotiations. Amid these pressures, agencies are placing greater emphasis on modular architectures and open platform standards, enabling incremental upgrades without triggering major capital outlays. This cautious approach, while prudent, has the potential to decelerate the pace of digital transformation initiatives that depend on end-to-end interoperability and real time analytics.

Despite these headwinds, some solution architects view the tariff environment as a catalyst for innovation, accelerating the adoption of local manufacturing capabilities and fostering deeper collaboration between hardware, software, and service providers. By pivoting to hybrid deployment models and leveraging strategic partnerships, stakeholders aim to maintain momentum on smart city objectives while building greater resilience against future trade policy fluctuations.

Deriving Key Insights From a Comprehensive Segmentation Framework Spanning Components, Technologies, Applications, End Users, and Deployment Models

A detailed segmentation framework reveals the multifaceted layers of the traffic management landscape, starting with components that encompass hardware, services, and software offerings. Within the hardware domain, high-definition cameras and video systems work alongside communication devices and networking infrastructure to gather critical roadway data. Advanced sensors and detectors-including inductive loop detectors, radar sensors, and magnetic sensors-deliver the sensory input that drives intelligent signal controllers and variable message signs, while specialized maintenance and system integration services ensure that complex configurations remain operational and scalable.

Moving from physical components to enabling technologies, the market is propelled by advancements in artificial intelligence and machine learning models that refine pattern recognition and predictive analytics. Cloud computing platforms unlock the potential of distributed processing for large data sets, whereas edge computing solutions prioritize low-latency decision making close to the source. Computer vision algorithms convert raw imagery into actionable insights, and the Internet of Things creates a mesh of interconnected endpoints capable of continuous communication and orchestration.

Application areas span the entire spectrum of traffic management objectives, from congestion detection and mitigation to incident response and parking optimization. Public transport priority systems interface with traffic signal management tools to grant buses and trams dedicated right of way, while traffic monitoring platforms capture historical trends for deep-dive analysis. Data collection initiatives feed into centralized analytics suites to generate performance metrics and service level evaluations, driving continuous improvements in network throughput and safety.

Finally, the segmentation extends to critical end users, including aviation authorities, municipal governments, maritime port operators, rail agencies, and road and highway maintenance entities. Each of these stakeholders navigates unique regulatory and operational contexts, with deployment models spanning cloud-based and on-premise architectures to satisfy security, latency, and scalability requirements. By understanding these intersecting segments, industry leaders can tailor their offerings to deliver precise value within a rapidly evolving ecosystem.

This comprehensive research report categorizes the Traffic Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Technology

- Applications

- End-Users

- Deployment Model

Highlighting Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific Traffic Management Ecosystems

Regionally, the Americas continue to spearhead innovation in traffic management through robust infrastructure investments and policy incentives. North American municipalities are piloting smart corridor projects that integrate adaptive signal control with connected vehicle trials, while federal funding streams support the replacement of legacy assets and the rollout of next generation roadway monitoring systems. Sustainable mobility agendas, including congestion pricing schemes and zero emission zone programs, are further fueling the deployment of data-driven traffic solutions across major urban centers.

Meanwhile, Europe, Middle East, and Africa represent a mosaic of regulatory landscapes and technological maturity levels. Western European cities are expanding intelligent transportation systems to comply with stringent emissions targets, leveraging advanced traffic cameras and dynamic signage to enforce low emission zones. In the Middle East, large-scale tolling initiatives and free zone developments harness GIS-enabled platforms to streamline vehicle access and revenue collection. Across Africa, infrastructure modernization efforts are increasingly focused on modular, cost-efficient traffic management kits that can adapt to diverse road conditions and funding constraints.

In the Asia Pacific region, rapid urbanization and population growth are driving extensive smart city programs, with China and India at the forefront of large-scale deployments. These programs often combine centralized traffic management centers with extensive sensor networks and real time analytics to optimize vehicular and pedestrian flows. Southeast Asian hubs are experimenting with AI-driven incident detection and cloud-native data platforms, while Australia and New Zealand emphasize integrated mobility strategies that align road traffic solutions with rail and public transport infrastructure. Such regional diversity underscores the importance of contextualized approaches when tailoring traffic management systems to local regulatory environments and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Traffic Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Traffic Management Vendors and Strategic Movements Driving Innovation, Collaboration, and Market Expansion

The competitive landscape is shaped by both established players and emerging disruptors collaborating across the traffic management value chain. Legacy infrastructure providers are augmenting their portfolios with cloud-native software suites and AI analytics modules designed to unify data streams from disparate sources. In parallel, technology startups are focusing on niche segments such as vision-based vehicle classification or predictive maintenance for signal controllers, injecting fresh innovation into traditional product roadmaps.

Strategic alliances between hardware manufacturers and system integrators are enabling turnkey solutions that accelerate time to deployment and reduce integration complexity. These partnerships often bundle camera arrays, sensor kits, and edge computing appliances with managed services, providing a single point of accountability for results. Additionally, mergers and acquisitions are reshaping the competitive field, as companies seek to consolidate complimentary capabilities in areas such as IoT platform management and advanced traffic analytics.

Investment in research and development remains a key differentiator, with leading vendors channeling resources into next generation sensor technologies, 5G-enabled connectivity modules, and autonomous traffic control experiments. Sustainability is also driving strategic roadmaps, as providers integrate energy efficient hardware designs and green data center practices to meet tightening environmental regulations. Through these collective efforts, top companies are not only expanding their addressable markets but also reinforcing their reputations as innovation leaders, setting new benchmarks for performance, interoperability, and resiliency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Traffic Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co., Ltd.

- Applied Information, Inc.

- Bridgestone Corporation

- Cellint Traffic Solutions Ltd.

- Chetu, Inc.

- Chevron Traffic Management Limited

- Cisco Systems, Inc.

- Cubic Corporation

- Digi International Inc.

- Environmental Systems Research Institute, Inc.

- HERE Global B.V.

- Huawei Technologies Co., Ltd.

- Indra Sistemas, S.A.

- INRIX, Inc.

- Intellias LLC

- Intelligent Traffic Control Ltd.

- International Business Machines Corporation

- Iteris, Inc.

- Kapsch TrafficCom

- Microsoft Corporation

- Miovision Technologies Incorporated

- Mitsubishi Heavy Industries, Ltd.

- MORE LION

- NoTraffic Inc.

- PTV Planung Transport Verkehr GmbH

- Q-Free ASA

- Robert Bosch GmbH

- Schneider Electric SE

- Siemens AG

- Singapore Technologies Engineering Ltd

- SWARCO AG

- Teledyne FLIR LLC by Teledyne Technologies Incorporated

- Thales Group

- TomTom N.V.

- Traffic Management, Inc.

- Viseum International

- Vivacity Labs Ltd.

- VolkerHighways Limited

- Yunex GmbH by MUNDYS SpA

- Zhejiang Dahua Technology Co., Ltd.

Actionable Strategies for Industry Leaders to Navigate Disruption, Optimize Investments, and Accelerate Adoption of Next Generation Traffic Solutions

Industry decision makers should prioritize the adoption of modular, open platform architectures that enable seamless integration of new technologies and future feature enhancements. Early engagement with end user stakeholders-including municipal planners, transportation agencies, and emergency services-will ensure that solution designs align with operational requirements and regulatory standards. By establishing pilot programs in targeted corridors, organizations can validate performance metrics, demonstrate return on investment, and refine deployment strategies before undertaking large scale rollouts.

Diversifying the supply chain is critical to mitigating geopolitical and policy risks associated with tariffs and trade disruptions. Building relationships with local manufacturers and regional distributors can streamline logistics, reduce lead times, and foster collaborative innovation. Additionally, negotiating flexible service level agreements with cloud and edge computing providers will help control total cost of ownership while delivering the agility needed to adjust to evolving traffic patterns.

To capitalize on data-driven insights, stakeholders must invest in workforce training initiatives that upskill existing personnel in areas such as data analytics, cybersecurity, and system integration. Embedding change management protocols early in project lifecycles will facilitate smoother transitions and encourage adoption among field operators. Finally, measuring and reporting key performance indicators-such as average vehicle delay, incident response times, and system uptime-will drive continuous improvement cycles, reinforcing the strategic value of traffic management investments.

Detailing the Rigorous Research Methodology Integrating Primary Interviews, Secondary Data, and Triangulation for Unbiased Market Insights

Our research methodology combines a structured approach to data collection with rigorous qualitative and quantitative analysis to ensure robustness and reliability. The process begins with an exhaustive secondary research phase, reviewing publicly available industry reports, patent databases, regulatory filings, and government infrastructure plans. This establishes a foundational understanding of competitive dynamics, technology trends, and policy frameworks across key regions.

Building on this foundation, primary research activities involve in depth interviews with a cross-section of stakeholders, including senior executives at solution providers, city planners, transportation authority representatives, and technical consultants. Insights gleaned from these engagements are triangulated with market data to validate assumptions and identify emerging opportunities. A proprietary vendor mapping exercise classifies companies by capability, geographic focus, and segment specialization, providing a clear view of competitive positioning.

Quantitative analyses leverage bottom up modeling techniques to assess technology adoption curves, component cost structures, and deployment timelines. Sensitivity testing is applied to account for variables such as tariff fluctuations, regulatory changes, and macroeconomic conditions. Throughout the research cycle, iterative reviews and internal quality assurance checks are conducted to uphold objectivity and accuracy. The culmination of these efforts is a comprehensive market intelligence package that delivers actionable insights and strategic guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Traffic Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Traffic Management Market, by Components

- Traffic Management Market, by Technology

- Traffic Management Market, by Applications

- Traffic Management Market, by End-Users

- Traffic Management Market, by Deployment Model

- Traffic Management Market, by Region

- Traffic Management Market, by Group

- Traffic Management Market, by Country

- United States Traffic Management Market

- China Traffic Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights on the Future Trajectory of Traffic Management Fueled by Technology Adoption, Policy Evolution, and Sustainable Practices

The traffic management sector stands at a pivotal juncture where technology, policy, and sustainability intersect to reshape the way cities manage mobility. Innovations in artificial intelligence, edge computing, and sensor networks are unlocking new levels of situational awareness, enabling agencies to transition from reactive operations to anticipatory control. At the same time, evolving trade policies and funding landscapes are prompting organizations to adopt more resilient supply chains and flexible deployment models.

Looking ahead, the convergence of multimodal integration, green mobility initiatives, and smart city frameworks promises to deliver holistic solutions that address both congestion and environmental goals. Stakeholders who embrace open standards and collaborative ecosystems will be best positioned to deliver integrated platforms capable of harmonizing diverse transport modes. As we move into this next era of connected mobility, continuous innovation, strategic partnerships, and data-driven decision making will be the keys to unlocking more efficient, safer, and sustainable urban transportation networks.

Drive Decision Making With Expert Market Analysis and Secure Your Comprehensive Traffic Management Insights Through Direct Engagement

Engaging with an industry expert can transform your understanding of traffic management market evolution and unlock actionable insights tailored to your organization’s strategic goals. To explore the full depth of our comprehensive analysis and gain a competitive edge, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through the purchase process and answer any questions about customization and data deliverables. Secure your copy today and empower your team with an authoritative market resource that drives informed decision making and fosters sustainable growth.

- How big is the Traffic Management Market?

- What is the Traffic Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?