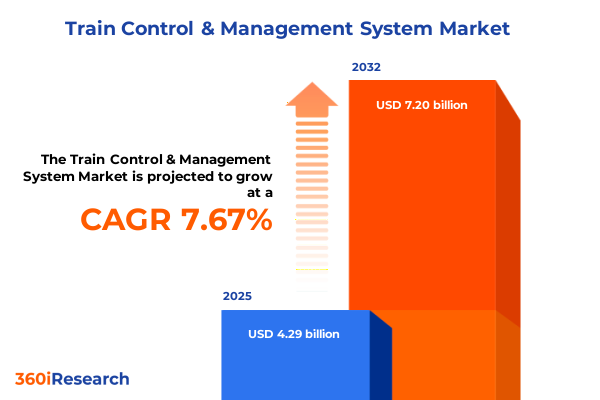

The Train Control & Management System Market size was estimated at USD 4.29 billion in 2025 and expected to reach USD 4.57 billion in 2026, at a CAGR of 7.67% to reach USD 7.20 billion by 2032.

An Illuminating Introduction Unveiling the Strategic Importance and Evolutionary Trajectory of Train Control & Management Systems

An illuminating introduction sets the stage by contextualizing the pivotal role that train control and management systems occupy within modern rail networks. Rail operators worldwide are embracing advanced technologies to bolster safety, enhance reliability, and maximize capacity. Within this dynamic environment, control systems serve as the neurological core, orchestrating the seamless integration of signaling, communications, and automated operations. This foundational overview underscores how ongoing digitalization and rigorous performance demands have elevated these systems from mere functional components to strategic assets.

Transitioning from traditional relay-based mechanisms to modular, software-driven platforms, the railway sector has witnessed a profound metamorphosis. Contemporary solutions leverage real-time data analytics, cloud infrastructure, and edge computing to deliver responsive and scalable control frameworks. This evolution responds not only to capacity constraints on congested corridors but also to the growing emphasis on passenger experience and sustainability. As a result, stakeholders across the ecosystem-from infrastructure managers to rolling stock manufacturers-are reevaluating their technology roadmaps to align with these progressive architectures.

Within this broader context, this executive summary distills the critical themes emerging across the train control and management landscape. It articulates key technological inflection points, regulatory influences, and market dynamics shaping strategic decision-making. By illuminating the interplay between component innovation, service models, and regional variances, this section lays the groundwork for a comprehensive examination of the forces driving growth and differentiation in this rapidly evolving domain.

Critical Technological and Operational Transformations Reshaping the Train Control & Management Systems Landscape for Future Rail Networks

The train control and management ecosystem is undergoing transformative shifts driven by the convergence of intelligent automation and digital connectivity. Central to this metamorphosis is the integration of advanced signaling solutions that transcend conventional trackside logic, enabling real-time decision-making and adaptive train movement. As rail operators prioritize capacity enhancement, the shift toward automated train operations has accelerated, with driver assistance and eventually unattended services becoming tangible objectives. Concurrently, the proliferation of digital twins has empowered operators to simulate network performance, identify bottlenecks, and preempt disruptions before they manifest.

Moreover, the maturation of communication technologies has underpinned a paradigm shift in how data flows between onboard systems and control centers. The adoption of cellular networks, particularly those tailored for railway-specific applications, has reinforced the reliability and security of operational communications. By contrast, fiber-optic backbones are experiencing upgrades to support the surge in bandwidth requirements for high-definition video surveillance, predictive maintenance telemetry, and cybersecurity monitoring. These complementary approaches are converging to form a hybrid architecture that balances latency, resilience, and cost-effectiveness.

In parallel, predictive analytics and artificial intelligence algorithms are reshaping maintenance paradigms. By ingesting terabytes of sensor data, operators can transition from scheduled overhauls to condition-based servicing, mitigating downtime and reducing lifecycle costs. Edge computing further extends this capability, enabling localized data processing at field nodes to detect anomalies in near real time. Collectively, these technological inflections are forging a smarter, more responsive rail control infrastructure poised to meet the demands of tomorrow’s interconnected transport networks.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on the Train Control & Management Systems Supply Chain

United States tariff measures introduced in 2025 have exerted multifaceted pressures on the global train control and management supply chain, catalyzing both strategic realignments and cost reevaluations. The imposition of duties on key electronic components and communication modules has compelled original equipment manufacturers to reexamine sourcing strategies and localize certain production segments. As a result, many vendors are forging partnerships with North American suppliers to mitigate tariff exposure and ensure regulatory compliance while sustaining delivery schedules for flagship projects.

Simultaneously, the cumulative impact of these tariffs has reverberated across project budgets and procurement cycles. Infrastructure agencies have encountered heightened scrutiny from oversight bodies regarding value-for-money assumptions, prompting a reassessment of integration scopes and upgrade timelines. To navigate this environment, service providers have reconfigured maintenance contracts and extended warranty frameworks to absorb marginal cost fluctuations. This adaptive approach has proved essential in preserving the continuity of modernization initiatives without compromising safety or performance criteria.

Looking ahead, the export landscape for U.S.-based train control solutions may gain traction as domestic production scales up and innovative financing mechanisms emerge. Export credit facilities and bilateral trade agreements can further alleviate duty burdens for international clients, thereby enhancing the competitiveness of domestically produced systems. In this evolving scenario, stakeholders must remain vigilant to shifting policy proposals while cultivating agile supply chains capable of adjusting to successive regulatory turns.

Revealing Core Segmentation Insights to Illuminate Component, Service, Communication Technology, and Application Dynamics Within the Market

Insights drawn from market segmentation reveal nuanced patterns of adoption and investment across various dimensions. Examining component-level dynamics underscores the ascendance of automation subsystems; platforms dedicated to automatic train operation, protection, and supervision are driving modernization roadmaps, while advanced interlocking systems solidify networks’ resilience by offering fail-safe control logic and enhanced diagnostic capabilities. Alongside these hardware and software modules, the service spectrum from installation and integration to ongoing support and system modernization has emerged as a critical value driver, as operators seek comprehensive lifecycle solutions that maximize return on infrastructure investments.

Communication technology segmentation further elucidates strategic priorities across networks. While GSM-R remains entrenched in legacy corridors, a growing number of corridors are transitioning to LTE-based architectures to leverage superior throughput and network management features. Simultaneously, optical fiber deployments continue to expand, underpinning high-bandwidth requirements for surveillance and data-intensive applications. This heterogeneous environment demands interoperability and robust migration frameworks to facilitate seamless coexistence of multiple communication layers.

On the application front, segmentation highlights differential uptake patterns: freight corridors emphasize high-capacity signaling enhancements to optimize train paths and reduce dwell times, whereas high-speed lines rely on precise automatic train protection to maintain stringent safety margins at elevated operating velocities. Mainline networks balance these dual imperatives, integrating modular supervision and control elements to elevate reliability across mixed traffic flows. Urban transit systems, by contrast, prioritize automated supervision solutions to achieve rapid headways, minimize energy consumption, and enhance passenger throughput. Collectively, these segmentation insights furnish stakeholders with a granular understanding of demand drivers and technology inflection points.

This comprehensive research report categorizes the Train Control & Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Service

- Communication Technology

- Application

Dissecting Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific to Expose Distinct Opportunities and Challenges

Regional analysis exposes distinct operational priorities and investment trajectories across major territories. Within the Americas, procurement agendas reflect a dual emphasis on infrastructure renewal and network expansion. Legacy signaling installations coexist with greenfield metro projects, prompting a hybrid procurement philosophy that balances swift modernization of traditional corridors with the deployment of turnkey automated solutions for emerging urban lines. Public funding initiatives at federal and state levels have catalyzed capital expenditure cycles, while private operators pursue concession frameworks to accelerate system-wide upgrades.

In the Europe, Middle East, and Africa sphere, regulatory harmonization efforts such as the European Rail Traffic Management System have galvanized cross-border interoperability and accelerated the phase-out of outdated interlocking infrastructures. The Middle East is channeling considerable investment into new high-speed and urban transit projects, positioning regional operators to leapfrog intermediary stages of technological evolution. Meanwhile, African nations are embarking on targeted upgrades of critical freight and passenger corridors, frequently leveraging public–private partnerships to underwrite the deployment of modern supervision and control platforms.

Across Asia-Pacific, expanding urbanization and burgeoning freight demands have propelled aggressive network expansions, particularly in Southeast Asia and India. Chinese and Japanese manufacturers are leveraging domestic scale to export cost-competitive signaling suites, while regional operators evaluate local content requirements to balance technology access with industrial development objectives. The Asia-Pacific landscape thus embodies a spectrum of adoption velocities, from nascent commuter lines to world-class high-speed networks, each fostering unique opportunities for tailored control solutions.

This comprehensive research report examines key regions that drive the evolution of the Train Control & Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Highlight Strategic Initiatives Driving Innovation and Competitive Differentiation in Train Control & Management Systems

Leading vendors in the train control and management sector distinguish themselves through diverse strategic initiatives and innovation pathways. Established conglomerates are investing heavily in digital platform enhancements, embedding advanced analytics and cybersecurity features to differentiate their signaling and supervision offerings. Strategic alliances between technology providers and systems integrators have gained traction, forming ecosystems that streamline end-to-end deployment and support while enabling rapid customization for specific operator requirements. This collaborative approach enhances agility, reduces integration complexity, and reinforces vendor value propositions.

At the same time, emerging players are carving niches by targeting underserved segments, such as metropolitan light rail and narrow-gauge lines. These specialists offer modular control kits that accelerate upgrade cycles and reduce capital barriers for smaller operators. Several of these agile entrants are also pioneering open architecture frameworks, promoting interoperability standards that lower the risk of vendor lock-in and foster greater competitive intensity. Complementing these trends, merger and acquisition activity remains robust, with larger manufacturers acquiring niche innovators to augment product portfolios and expand geographic footprints.

Innovation leadership further manifests in the rollout of turnkey digital services for remote monitoring and predictive maintenance, enabling operators to shift toward outcome-based contracting. Companies that can integrate telemetry, mobile diagnostics, and cloud-based performance dashboards are securing long-term service agreements and deepening customer relationships. Collectively, these strategic and technological initiatives underscore the evolving competitive landscape, where differentiation increasingly hinges on delivering integrated solutions that address both operational efficiency and lifecycle optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Train Control & Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom SA

- Construcciones y Auxiliar de Ferrocarriles, S.A.

- CRRC Corporation Limited

- Hitachi Rail STS S.p.A.

- Knorr-Bremse AG

- Mitsubishi Electric Corporation

- Siemens Mobility GmbH

- Stadler Rail AG

- Thales SA

- Toshiba Corporation

- Wabtec Corporation

Delivering Actionable Strategic Recommendations to Empower Industry Leaders in Navigating Technological, Regulatory, and Competitive Challenges

Industry leaders must embrace a series of strategic imperatives to thrive amid technological complexity and regulatory flux. First, cultivating partnerships with component suppliers and communication providers will anchor supply chains and facilitate modular platform development. By collaborating early on design specifications, stakeholders can preempt integration bottlenecks and reduce engineering lead times. Moreover, investing in digital interoperability standards will promote seamless transitions between legacy and next-generation subsystems, minimizing operational disruptions during migration.

Second, organizations should channel resources into advanced analytics and artificial intelligence capabilities. Deploying predictive maintenance algorithms and real-time performance monitoring will enable condition-based servicing and optimize asset utilization. This shift from reactive maintenance models not only reduces downtime but also extends component lifecycles, driving sustainable cost efficiencies. Concurrently, augmenting cybersecurity frameworks to safeguard increasingly networked control environments is nonnegotiable, as the surface area for potential cyber threats expands with each new digital interface.

Finally, leaders must remain agile in navigating evolving trade policies and regional regulatory landscapes. Establishing local manufacturing or assembly hubs can mitigate tariff impacts while demonstrating commitment to domestic agendas. Coupled with proactive engagement in standardization bodies and industry consortia, this approach will position companies to influence regulatory outcomes and secure preferential procurement prospects. By aligning strategic investments with anticipated policy trajectories, industry executives can safeguard margins and capitalize on emergent growth pockets.

Explaining the Rigorous Research Methodology Employed to Ensure Data Integrity, Comprehensive Analysis, and Actionable Market Intelligence

This study employs a robust, multi-phase research methodology to ensure comprehensive and unbiased market insights. The secondary research phase encompassed an exhaustive review of regulatory filings, industry whitepapers, and technical standards to map the landscape of signaling protocols, automation architectures, and safety requirements. Concurrently, vendor collateral and patent databases were analyzed to identify emerging technology patterns and competitive positioning strategies.

Primary research complemented these findings through structured interviews with senior executives, project managers, and system engineers across leading rail operators, infrastructure agencies, and solution providers. These firsthand perspectives provided nuanced understanding of operational pain points, procurement rationales, and real-world system performance metrics. Data triangulation techniques ensured alignment between secondary sources and expert testimonies, reinforcing the validity of key insights.

Quantitative analysis harnessed proprietary databases to track deployment volumes, system lifecycle stages, and service engagement models. Although specific market sizing is beyond the scope of this summary, the underlying datasets informed segmentation frameworks and trend extrapolations. Finally, cross-validation workshops with industry stakeholders tested preliminary conclusions, refining the strategic implications and ensuring the final deliverables reflect actionable intelligence tailored for both technical and executive audiences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Train Control & Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Train Control & Management System Market, by Component

- Train Control & Management System Market, by Service

- Train Control & Management System Market, by Communication Technology

- Train Control & Management System Market, by Application

- Train Control & Management System Market, by Region

- Train Control & Management System Market, by Group

- Train Control & Management System Market, by Country

- United States Train Control & Management System Market

- China Train Control & Management System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Drawing Conclusive Insights to Integrate Findings and Outline the Strategic Imperatives Guiding Train Control & Management Systems Evolution

In conclusion, the train control and management system domain stands at a crossroads defined by digital innovation, regulatory recalibrations, and evolving operator expectations. The integration of advanced automation subsystems, bolstered by resilient communication infrastructures, is reshaping the operational fabric of rail networks. Concurrently, geopolitical developments and tariff policies have introduced new variables into cost structures and supply chain architectures, compelling stakeholders to adopt more agile strategies.

Segmentation analysis highlights divergent demands across components, services, communication technologies, and applications, underscoring the importance of tailored solutions that address specific performance and safety imperatives. Regional insights further illuminate how funding mechanisms, regulatory frameworks, and market maturity influence deployment priorities in the Americas, Europe Middle East Africa, and Asia-Pacific territories. Against this backdrop, competitive differentiation increasingly hinges on end-to-end value propositions that integrate system integration, predictive maintenance, and cybersecurity capabilities.

Ultimately, this executive summary synthesizes critical insights to guide decision-makers in shaping future investment and innovation paths. By aligning strategic initiatives with technological trends and policy dynamics, organizations can unlock new efficiencies, fortify safety standards, and deliver superior passenger and freight experiences. The findings herein provide a strategic compass for navigating the complexities of an industry in transformation.

Encouraging Engagement with Expert Associate Director Ketan Rohom to Secure Comprehensive Market Intelligence for Informed Strategic Decisions

Engage with our seasoned Associate Director of Sales & Marketing, Ketan Rohom, to unlock deeper insights and actionable intelligence that will empower your strategic planning. Initiating a dialogue with this expert will furnish you with clarity on navigating emerging technologies, regulatory shifts, and competitive pressures unique to the rail control ecosystem. By securing the full research report, you gain an authoritative roadmap that distills complex market drivers into practical guidance for driving innovation, optimizing investments, and sustaining growth. Reach out today to leverage this comprehensive analysis as a catalyst for decisive action and to ensure your organization remains at the forefront of train control and management system advancements.

- How big is the Train Control & Management System Market?

- What is the Train Control & Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?